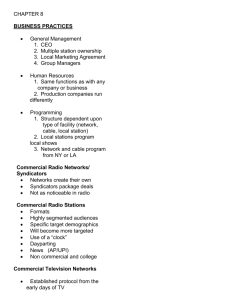

Media Convergence- Part 1 MEDIA CONVERGENCE CPS 181s Nov 20, 2001

advertisement

Media Convergence- Part 1 CPS 181s Nov 20, 2001 MEDIA CONVERGENCE Media convergence and its synergistic benefits are key drivers behind mega-mergers in media companies America Online (AOL) and Time-Warner Viacom and CBS The Walt Disney Company and Capital Cities/ABC Increased possibility to increase access convenience and new innovative services Fragmented media usage in households Changes in federal communication laws Advances in digital technology 1 MEDIA CONVERGENCE ….. CONVERGENCE….. Media content refers to the content of the communication, not their infrastructure Media convergence occurs when different types of media content found across types of media form will be accessible in digital form in digital devices Content includes: text, audio, and video Devices include: wireless telephones, personal computers, PDAs, and interactive television desktops This chapter reviews the implications of that convergence for the old and new economy, on various media platforms, and public policy issues QUESTIONS c What is media convergence? d What conditions make media convergence possible? e How do new media companies leverage off traditions media channels? f What are the reasons for media megamergers? g What public policy issues must be addressed with digital convergence and media convergence? 2 WHAT CONDITIONS MAKE MEDIA CONVERGENCE POSSIBLE? The use of a CO-der-DECoder (codec) enabling analog signals and digital signals to be converted Continued Advances and Decreasing Cost of Digital Technology Most media content originate sin digital form Digital is easily manipulated, stored, combined, and transmitted Low-Cost Digital Network Infrastructure Use if the non-proprietary network protocol (IP), transfer protocol (HTTO), and hypertext language (HTML) allows an unencumbered environment The World Wide Web became a low-cost digital network infrastructure that experienced an explosive growth in users and sites Media Proliferation From newspapers at the turn of 1900 to cable in the 1980s and satellite reception in the 1990s, the number of media choices continue to grow WHAT CONDITIONS MAKE MEDIA CONVERGENCE POSSIBLE?... Media Usage Fragmentation in American Households Increased fragmentation of media shows a decline in traditional television news viewing in America The dwindling television news audience was greatest among younger people who spent more time with their computers Broadcast and entertainment showed a steady decline as well, as basic cable subscriptions increased The percentage of households with alternative forms of media entertainment and information increased 3 A Technographic’ ’s View of New Consumer Internet Adoption Technographic Technographic’s Mainstream Number of new on-line customers Early Adopters Laggards Time Source: Mary Modahl, “Now or Never: How Companies Must Change Today to Win the Battle for Internet Customers” Harper Business, 2000 Primetime Viewing Shares of Free and Cable Television Networks -1985 to 1998 1 Year Network Affiliates Ad-Supported Basic Cable All Other Television 1985 - 1986 69.3% 7.5% 23.2% 1989 - 1990 58.1% 16.4% 25.5% 1990 - 1991 55.1% 19.3% 25.6% 1991 - 1992 54.9% 19.8% 25.3% 1992 - 1993 52.9% 21.1% 26.0% 1993 - 1994 52.4% 21.3% 26.3% 1994 - 1995 48.7% 24.3% 27.0% 1995 - 1996 46.0% 26.7% 27.3% 1996 - 1997 42.1% 29.7% 28.2% 1997 - 1998 39.6% 32.5% 27.9% For all television viewing Monday-Sunday, 8-11pm EST. Due to multiset use and independent roundings, totals add up to more than 100. 1Includes the FOX network, UPN, WB, other independent stations, pay cable and public television Source: Cable Advertising Bureau, Cable TV Facts (1999) Note: 4 Primetime Viewing Shares of Free and Cable Television Networks Primetime Viewing Shares of Free and Cable TV Networks 1985-1998 100% 90% 80% 70% 60% All Other Basic Cable Network Affiliates 50% 40% 30% 20% 10% 0% 1985 1990 1991 1992 1993 1994 1995 1996 1997 1998 Note: For all television viewing Monday-Sunday, 8-11pm EST. Due to multiset use and independent roundings, totals add up to more than 100. All Other includes the FOX network, UPN, WB, other independent stations, pay cable and public television Source: Cable Advertising Bureau, Cable TV Facts (1999) Children Were Found to be Immersed in Media Usage Television Music Reading Watching Using videos a computer 5 Statistics From Kaiser Foundation Report Kids and Media Results of a study measuring how much media children are exposed to . Times are in hours and minutes. Amount of time kids spend each day on average: Watching TV 2:46 Listening to music 1:27 Reading for fun :44 Watching videos :39 Using a computer for fun :21 Playing video games :20 Online :08 Percent of kids who have a TV in their room: All kids 2-18 53% 2-7 year olds 32% 8 and older 65% Percent of kids who have a computer in the home: All kids 2-18 69% 2-7 year olds 62% 8 and older 73% Lower income 49% Upper income 81% Percent of kids who have a computer in their bedroom: All kids 2-18 16% 2-7 year olds 6% 8 and older 21% Parental oversight - Percent of kids… With no rules about TV 49% In homes where TV is usually on during meals 58% Percent of time parents watch TV with their kids: 2-7 year olds 19% 8-18 year olds 5% Source: Kaiser Family Foundation Forecasted Continued Media Proliferation and Media Usage Fragmentation Experts predict that over the next ten years technological advances in wireless, digital compression, two-way networks, the Internet, and high-definition television (HDTV) will present even more choices 6 Media Fragmentation, 1960 ’s 1960’s to 2010 ’s 2010’s TV TV faces faces the the worst worst audience audience fragmentation fragmentation of of all. all. Here, Here, News News Corp. Corp. tracks tracks and and forecasts forecasts the the explosion of TVexplosion of TVviewing viewing choices choices available available in in any any given given hour. hour. Once there were Once there were three three options; options; soon soon there there will will be be1,000 1,000 1960s Most Americans watch the Big Three Networks every night Source: 1970s UHF Stations bring more choices, and the fledging cable industry intoduces a few new channels like HBO and Turner’s TBS Superstation Business Week, February 16,1998 1980s The VCR becomes commonplace, letting consumers watch recorded shows and movies whenever they want. Cable explodes, with new networks like CNN and MTV. 1990s Direct-broadcast satellites are introduced offering hundreds of channels. Cable systems are slowly upgraded with more channels 2000s Digital compression and two-way networks allow cable companies to offer even more channels and services. DBS services grow more entrenched. As TVs are linked to the Internet, new programming delivered via the Internet takes hold. Result: 300 choices at any moment. 2010s Broadcasters may use high-definitionTV spectrum to launch more channels. Internet chat evolves into networked virtual reality games, interactive movies, and other activities being hatched by MITs media lab and others. News Corp. forecasts 1,000 channels, now called “context windows”. 13 How Offline Media Drives Online Media 7 How Do New Media Companies Leverage Off Traditional Media Channels? The New Economy is quite depend upon the traditional new outlets of the Old economy Online presence is using traditional media to build an audience for the new media In 1999, an estimated 28 percent of all American households were online, a threefold increase from almost 9 percent just four years earlier Build brand awareness among Internet users, dot com companies spent an estimated $3 to $4 billion in advertising in 1999 Media Companies 90 percent of those dollars were on traditional media outlets Online news users say they still read newspapers and listen to radio news about the same or at a higher rate than online The Internet has emerged as a mechanism for supplementing, not replacing traditional media sources 8 Dot-Com Spending in Traditional Media Dot-com and online services spending in traditional media ($ in thousands) 1/99 – 6/99 %Chg YoY Network TV 129,218 910% Cable TV 83,105 323% Magazine 81,233 206% Spot TV 63,828 136% National Newspaper 56,835 180% Spot Radio 50,149 318% Local Newspaper 24,066 238% Network Radio 18,348 71% Outdoor 5,865 521% Sunday Magazine 1,662 375% 642 22% 514,951 273% Syndicated TV Total Source: Advertising Age Top Dot-Com and Online Service Advertisers Top Dot-com and online services spending in local and national newspapers 1. Value America 1/99 – 6/99 1/98-6/98 19,778 5,499 2. E*Trade 9,053 4,218 3. Dow Jones (Online OPS) 7,648 6,438 4. Cheaptickets.com 4,147 2,112 5. Priceline.com 3,153 1,006 6. Charles Schwab (online) 2,887 0 7. AltaVista 2,281 0 8. Lowestfare.com 2,261 0 9. BankOne (online) 1,648 0 10. Amazon.com 1,333 0 54,190 19,273 Total Source: Advertising Age 9 U.S. Advertising Expenditure, All Media Top 100 Daily Newspapers in the United States by Circulation, 1998 2 1997 (Millions) Percent of Total 1998 (Millions) Percent of Total Percent Change $41,341 22.1 $43,925 21.8 6.3 5,322 2.8 5,721 2.8 7.5 • Retail 19,257 10.3 20,331 10.1 5.6 • Classified 16,762 8.9 17,873 8.9 6.6 9,821 5.2 10,518 5.2 7.1 36,893 19.7 39,173 19.4 6.2 7,237 3.9 8,301 4.1 14.7 1 Daily newspapers total • National Magazines Broadcast television Cable television Radio 13,491 7.2 15,073 7.5 11.7 Direct mail 36,890 19.7 39,620 19.7 7.4 Yellow pages 11,423 6.1 11,990 5.9 5.0 23,940 12.8 25,769 12.8 7.6 Business papers 4,109 2.2 4,232 2.1 3.0 Outdoor 1,455 0.8 1,576 0.8 8.3 Internet 600 0.3 1,050 0.5 15.0 Total – National 110,538 59.00 119,285 59.3 7.9 Total – Local 76,662 41.0 81,942 40.7 6.9 $187,200 100.0 $201,227 100.0 7.5 Miscellaneous 3 Total – All media * America Online Welcome Screen 10 Case Example: America Online Founded by Steve Case in Northern Virginia, America Online (AOL) first sought partnerships with established media brands (Apple, MTV, San Jose Mercury News, and NBC) Newspapers had retreated from electronic media back to print and allowed third-party online services to emerge as an uncontested market By 1995, America Online would surpass Prodigy and CompuServe as the largest online service company in the United States America Online achieved a market value of over $138 billion and would also acquire CompuServe, Netscape, and TimeWarner Monster.com Home Page 11 Case Example: Monster.com Founded by Jeff Taylor in Massachusetts, Monster.com was reaching 3.5 million unique users as of January 2000 By January 2000, Monster.com build brand awareness largely through the combined use of broadcast television commercials Monster.com created a pre-emptive lead against its competitors and an effective barrier to entry Monster.com User Statistics Monster.com Key Metrics — December 1998 to January 2000 U.S. Internet Users visiting Monster.com Direct Traffic (non-alliance) December 1998 March 1999 June 1999 September 1999 January 2000 1.4% 3.4% 4.2% 4.1% 5.3% 81.0% 90.0% 94.0% 95.0% NA Page Views 48 Million 82 Million 122 Million 146 Million 158 Million Paid Job Listings 186,000 204,000 252,000 255,000 315,000* Resume Database 1.0 Million 1.3 Million 1.6 Million 2.0 Million 3.0 Million NA 2.5 Million 3.6 Million 4.2 Million 6 Million Registered Members Note: *As of December 1999 Source: Bean Murray Institutional Research, Monster.com, Media Metrix 12 CBS Marketwatch Home Page Driving Traffic CBS Evening News Driving Traffic CBS Marketwatch Weekend Case Example: CBS Marketwatch Founded by Larry Kramer, the San Francisco-based financial news vertical, utilizes the resources of CBDS, its minority equity owner and broadcast partner to build brand awareness nationwide As of March 2000, the site had become the fortieth most visited site n the web with 5.5 million unique users By utilizing its content on broadcast news, there is reference to the site daily Rather than using the Web to enhance their core business, CBS Marketwatch has as it focused purpose to build a great website 13 What are the Reasons for Media Megamergers? Media companies have been using mergers to develop vertical integration for content and distribution across all media: print, video, and audio Media merges have increased with the increase of broadband List of Recent Mega-Mergers 1995 Disney and Capital Cities / ABC 1995 Time-Warner and Turner Broadcasting 1995 Westinghouse and CBS Inc. 1996 SBC and Pacific Telesis 1996 NYNEX and Bell Atlantic 1996 US West and Continental Cable 1996 Thomson and West Publishing 1998 America Online and Netscape 1999 AT&T and Comcast 1999 Viacom and CBS Inc. 2000 America Online and Time-Warner 2000 Tribune Company and Times Mirror Company 14 Top Multiple Systems Operators Top 10 Multiple System Operators, Data in Millions, 1997 Rank System operator Number of Subscribers Pay-cable units Homes passed by cable 1 Tele-Communications Inc. 14.4 14.3 23.8 2 Time Warner Cable 12.3 8.2 19.0 3 US West Media Group 4.9 3.8 8.3 4 Comcast Cable Communications Inc. 4.3 3.7 6.9 5 Cox Communications Inc. 3.3 2.0 5.1 6 Cablevision Systems Corp. 2.9 4.8 4.4 7 Adelphia Communications Corp. 1.8 0.8 2.6 8 Jones Intercable Inc. 1.5 1.2 2.3 9 Century Communications Corp. 1.3 0.5 2.1 Marcus Cable 1.2 0.7 1.9 10 Source: TV Digest, May 12, 1997 by permission from Warren Publishing Point - Counterpoint on Cross Media Ownership Relax/Eliminate Relax/Eliminate Media Media Ownership Ownership Rules Rules zzExisting Existing Federal Federal laws laws prohibiting prohibiting crosscross- ownership ownership of of aa television television station station and and aa newspaper newspaper in in the the same same market market or or limiting limiting the the number number of of television television or or radio radio stations stations that that aa single single media media company company can can are are outdated. outdated. zzWith With the the individuals individuals having having increased increased access access to to other other sources sources of of media, media, such such as as cable cable channels channels and and Internet Internet sites, sites, concentration concentration of of media media in in single single market market cannot cannot be be achieved. achieved. Media Media usage usage is is much much more fragmented today than ever more fragmented today than ever before before Maintain Maintain Media Media Ownership Ownership Rules Rules zzExisting Existing Federal Federal Laws Laws need need to to be be maintain maintain to to ensure ensure the the public’s public’s interest interest and and to to keep keep competition competition zzLocal Local newspapers newspapers and and television television stations stations continue continue to to dominate dominate the the media media in in local local markets. markets. Allowing Allowing cross-ownership cross-ownership will will reduce the number of choices for viewers, reduce the number of choices for viewers, readers and advertisers. readers and advertisers. 15