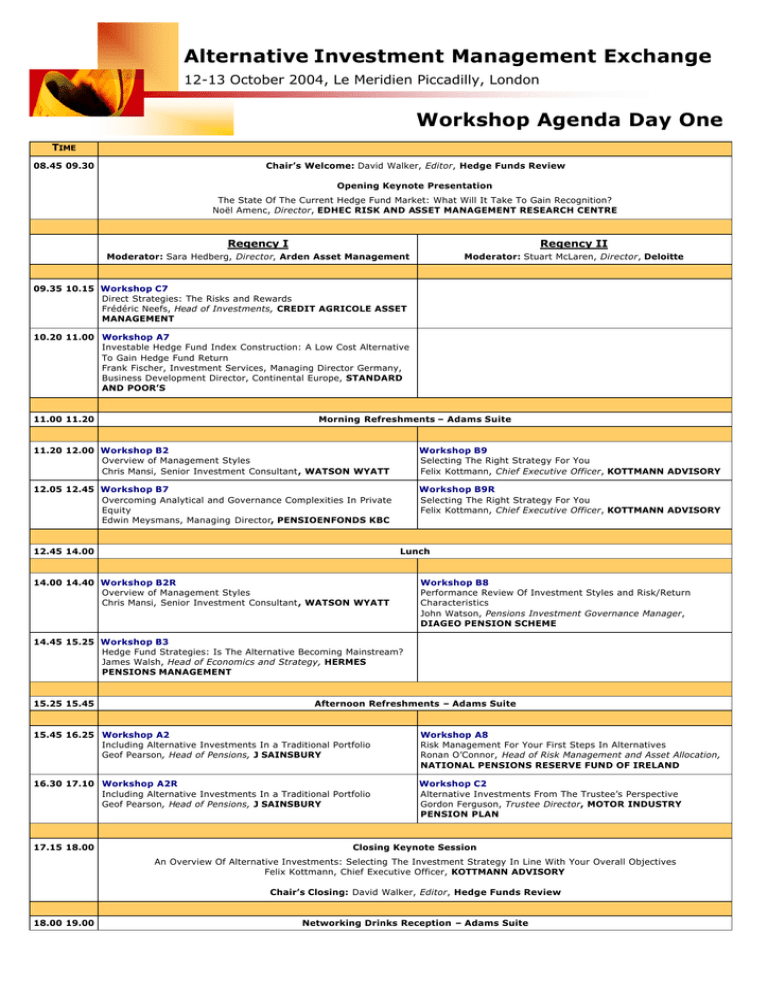

Regency I Regency II

advertisement

Alternative Investment Management Exchange 12-13 October 2004, Le Meridien Piccadilly, London Workshop Agenda Day One TIME 08.45 09.30 Chair’s Welcome: David Walker, Editor, Hedge Funds Review Opening Keynote Presentation The State Of The Current Hedge Fund Market: What Will It Take To Gain Recognition? Noël Amenc, Director, EDHEC RISK AND ASSET MANAGEMENT RESEARCH CENTRE Regency I Regency II Moderator: Sara Hedberg, Director, Arden Asset Management Moderator: Stuart McLaren, Director, Deloitte 09.35 10.15 Workshop C7 Direct Strategies: The Risks and Rewards Frédéric Neefs, Head of Investments, CREDIT AGRICOLE ASSET MANAGEMENT 10.20 11.00 Workshop A7 Investable Hedge Fund Index Construction: A Low Cost Alternative To Gain Hedge Fund Return Frank Fischer, Investment Services, Managing Director Germany, Business Development Director, Continental Europe, STANDARD AND POOR’S 11.00 11.20 Morning Refreshments – Adams Suite 11.20 12.00 Workshop B2 Overview of Management Styles Chris Mansi, Senior Investment Consultant, WATSON WYATT Workshop B9 Selecting The Right Strategy For You Felix Kottmann, Chief Executive Officer, KOTTMANN ADVISORY 12.05 12.45 Workshop B7 Overcoming Analytical and Governance Complexities In Private Equity Edwin Meysmans, Managing Director, PENSIOENFONDS KBC Workshop B9R Selecting The Right Strategy For You Felix Kottmann, Chief Executive Officer, KOTTMANN ADVISORY 12.45 14.00 Lunch 14.00 14.40 Workshop B2R Overview of Management Styles Chris Mansi, Senior Investment Consultant, WATSON WYATT Workshop B8 Performance Review Of Investment Styles and Risk/Return Characteristics John Watson, Pensions Investment Governance Manager, DIAGEO PENSION SCHEME 14.45 15.25 Workshop B3 Hedge Fund Strategies: Is The Alternative Becoming Mainstream? James Walsh, Head of Economics and Strategy, HERMES PENSIONS MANAGEMENT 15.25 15.45 Afternoon Refreshments – Adams Suite 15.45 16.25 Workshop A2 Including Alternative Investments In a Traditional Portfolio Geof Pearson, Head of Pensions, J SAINSBURY Workshop A8 Risk Management For Your First Steps In Alternatives Ronan O’Connor, Head of Risk Management and Asset Allocation, NATIONAL PENSIONS RESERVE FUND OF IRELAND 16.30 17.10 Workshop A2R Including Alternative Investments In a Traditional Portfolio Geof Pearson, Head of Pensions, J SAINSBURY Workshop C2 Alternative Investments From The Trustee’s Perspective Gordon Ferguson, Trustee Director, MOTOR INDUSTRY PENSION PLAN 17.15 18.00 Closing Keynote Session An Overview Of Alternative Investments: Selecting The Investment Strategy In Line With Your Overall Objectives Felix Kottmann, Chief Executive Officer, KOTTMANN ADVISORY Chair’s Closing: David Walker, Editor, Hedge Funds Review 18.00 19.00 Networking Drinks Reception – Adams Suite Alternative Investment Management Exchange 12-13 October 2004, Le Meridien Piccadilly, London Workshop Agenda Day Two TIME 08.45 09.30 Chair’s Welcome And Re -Cap: David Walker, Editor, Hedge Funds Review Opening Panel Discussion Institutional Investors Lessons Learned: The Benefits And Disadvantages Of Allocating Funds In Alternative Investments Panellists: Leif Hasager, Executive Vice President, BANKPENSION Ronan O’Connor, Head of Risk Management and Asset Allocation, NATIONAL PENSIONS RESEERVE FUND OF IRELAND Robbert Coomans, Manager of Alternative Investments, ABP Magnus Backstrom, Chief Investment Officer, OP Bank Group Pension Fund Regency I Regency II Moderator: Sara Hedberg, Director, Arden Asset Management Moderator: Stuart McLaren, Director, Deloitte 09.35 10.15 Workshop C3 Managing Alternative Investment Strategies Alongside Traditional Investments Nicholas Verwilghen, Partner Head of Quantitative Research, EIM (UNITED KINGDOM) LTD Workshop A4 Using Risk Budgeting To Determine Asset Allocation Kerrin Rosenberg, Associate, HEWITT BACON & WOODROW 10.20 11.00 Workshop C3R Managing Alternative Investment Strategies Alongside Traditional Investments Nicholas Verwilghen, Partner Head of Quantitative Research, EIM (UNITED KINGDOM) LTD 11.00 11.20 Morning Refreshments – Adams Suite 11.20 12.00 Workshop A6 Difficulties In Assessing Risk Exposure And Manager Performance Adri de Ridder, Chief Investment Officer, SKANDIA LIV Workshop C1 Defining and Delivering on Internal Research Targets Dave Bamber, Assistant County Treasurer, Technical and Pensions, FLINTSHIRE COUNTY COUNCIL PENSION FUND 12.05 12.45 Workshop A6R Difficulties In Assessing Risk Exposure And Manager Performance Adri de Ridder, Chief Investment Officer, SKANDIA LIV Workshop C6 Using Fund of Fund Managers for Diversification of Investment Strategies Alexandar Pechovitch, Head, Hedge Funds & Convertible Bonds Investments, TRACTEBEL 12.45 14.00 Lunch 14.00 14.40 Workshop C5 Fund of Fund Managers: The First Step in Alternatives Michael Rosenthal, Investment Analyst, CREDIT AGRICOLE ASSET MANAGEMENT 14.45 15.25 Workshop A3 Leveraging An Asset Liability Framework Approach To Achieve An Optimised Portfolio Robbert Coomans, Manager of Alternative Investments, ABP INVESTMENTS 15.30 16.10 Workshop B1 Investment Strategy Selection To Match Expectations And Risk Appetite Leif Hasager, Executive Vice President, BANKPENSION 16.15 16.30 Workshop C8 Direct Hedge Fund Exposure: Concentration Of Risk Or Cost Effective Solution? Magnus Backström, Chief Investment Officer, OP BANK GROUP PENSION FUND Chair’s Summary And Closing Address: David Walker, Editor, Hedge Funds Review