Table of Contents ABAXIS, INC. CONSOLIDATED BALANCE SHEETS

advertisement

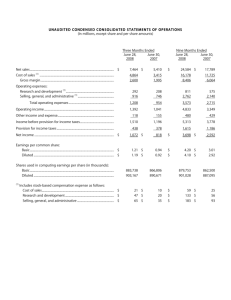

Table of Contents ABAXIS, INC. CONSOLIDATED BALANCE SHEETS March 31, 2010 2009 (In thousands, except share data) ASSETS Current assets: Cash and cash equivalents Short-term investments Receivables (net of allowances of $446 in 2010 and $388 in 2009) Inventories Prepaid expenses Net deferred tax assets, current Total current assets Long-term investments Property and equipment, net Intangible assets, net Net deferred tax assets, non-current Other assets Total assets LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities: Accounts payable Accrued payroll and related expenses Accrued taxes Other accrued liabilities Deferred revenue Warranty reserve Total current liabilities Non-current liabilities: Deferred rent Deferred revenue Warranty reserve Total non-current liabilities Commitments and contingencies (Note 9) Shareholders’ equity: Preferred stock, no par value: 5,000,000 shares authorized; no shares issued and outstanding in 2010 and 2009 Common stock, no par value: 35,000,000 shares authorized; 22,112,000 and 21,933,000 shares issued and outstanding in 2010 and 2009, respectively Retained earnings Total shareholders’ equity Total liabilities and shareholders’ equity See accompanying Notes to Consolidated Financial Statements. 56 $ 27,857 32,343 23,962 19,067 1,340 3,773 108,342 36,319 15,544 4,600 2,935 76 $167,816 $ 49,237 20,776 21,983 15,735 957 4,676 113,364 4,886 14,798 5,175 2,464 24 $140,711 $ $ 9,404 5,615 400 1,256 1,157 1,183 19,015 3,963 3,698 34 1,116 1,024 1,714 11,549 163 1,359 160 1,682 137 1,550 583 2,270 — — 125,050 22,069 147,119 $167,816 117,846 9,046 126,892 $140,711 Table of Contents ABAXIS, INC. CONSOLIDATED STATEMENTS OF INCOME Year Ended March 31, 2010 2009 2008 (In thousands, except per share data) Revenues Cost of revenues Gross profit Operating expenses: Research and development Sales and marketing General and administrative Total operating expenses Income from operations Interest and other income (expense), net Income before income tax provision Income tax provision Net income Net income per share: Basic net income per share Diluted net income per share Shares used in the calculation of net income per share: Weighted average common shares outstanding — basic Weighted average common shares outstanding — diluted $124,557 52,435 72,122 $105,562 46,937 58,625 $100,551 45,507 55,044 10,688 30,138 10,521 51,347 20,775 630 21,405 8,382 $ 13,023 8,361 24,712 7,757 40,830 17,795 1,271 19,066 7,053 $ 12,013 6,966 23,689 6,681 37,336 17,708 2,096 19,804 7,301 $ 12,503 $ $ $ $ $ $ 0.59 0.58 22,021 22,606 See accompanying Notes to Consolidated Financial Statements. 57 0.55 0.54 21,826 22,324 0.58 0.56 21,499 22,261 Table of Contents ABAXIS, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME Common Stock Shares Amount Balances at March 31, 2007 Common stock issued under stock option exercises Common stock issued in settlement of restricted stock units, net of shares withheld for employee taxes Share-based compensation Excess tax benefits from share-based awards Components of comprehensive income: Net income Change in unrealized gain (loss) on investments, net of tax Comprehensive income Balances at March 31, 2008 Common stock issued under stock option exercises Common stock issued in settlement of restricted stock units, net of shares withheld for employee taxes Share-based compensation Excess tax benefits from share-based awards Components of comprehensive income: Net income Change in unrealized gain (loss) on investments, net of tax Comprehensive income Balances at March 31, 2009 Common stock issued under stock option exercises Common stock issued in settlement of restricted stock units, net of shares withheld for employee taxes Share-based compensation Excess tax benefits from share-based awards and other tax adjustments Components of comprehensive income: Net income Change in unrealized gain (loss) on investments, net of tax Comprehensive income Balances at March 31, 2010 Retained Accumulated Earnings Other Total (Accumulated Comprehensive Shareholders’ Comprehensive Deficit) Income (Loss) Equity Income (In thousands, except share data) 21,207,000 $103,282 $ 483,000 3,128 16,000 — — (110) 1,122 1,609 — — — — 21,706,000 194,000 — — 109,031 636 33,000 — — (281) 1,749 6,711 (15,470) $ — — $ — 87,812 3,128 — — — — — — (110) 1,122 1,609 12,503 — 12,503 $ 12,503 (1,415) — $ 104,649 636 (1,415) 11,088 — — (2,967) — (1,415) — (1,415) — — — — — — — (281) 1,749 6,711 — — 12,013 — 12,013 $ 12,013 — — 21,933,000 128,000 — — 117,846 915 — — 9,046 — 1,415 — — — 1,415 — $ 126,892 915 1,415 13,428 (446) 5,398 — — — — (446) 5,398 — 1,337 — — 1,337 — — 13,023 — 13,023 $ 13,023 — — 22,069 $ — — — — $ — $ 147,119 — 13,023 51,000 — — — — — 22,112,000 $125,050 $ See accompanying Notes to Consolidated Financial Statements. 58 Table of Contents ABAXIS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended March 31, 2010 2009 2008 (In thousands) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Investment premium amortization Loss on disposals of property and equipment Loss on foreign exchange translation Share-based compensation expense Excess tax benefits from share-based awards Provision for deferred income taxes Changes in assets and liabilities: Receivables, net Inventories Prepaid expenses Other assets Accounts payable Accrued payroll and related expenses Accrued taxes Other accrued liabilities Deferred rent Deferred revenue Warranty reserve Net cash provided by operating activities Cash flows from investing activities: Purchases of available-for-sale investments Purchases of held-to-maturity investments Proceeds from redemptions of available-for-sale investments Proceeds from maturities and redemptions of held-to-maturity investments Purchases of property and equipment Proceeds from disposals of property and equipment Purchase of intangible assets Net cash (used in) provided by investing activities Cash flows from financing activities: Proceeds from issuance of common stock under stock plans, net Excess tax benefits from share-based awards Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year $ 13,023 $ 12,013 $ 12,503 4,935 211 104 60 5,337 (2,096) 1,245 4,492 — 16 137 1,743 (6,711) 4,813 3,497 — 2 — 1,108 (1,609) 6,400 (2,035) (5,068) (383) (52) 5,436 1,917 884 140 26 (58) (954) 22,672 (1,221) 1,051 (295) (21) (2,440) (576) 30 479 (149) 621 349 14,331 (3,944) (5,572) 894 33 (84) 447 — 503 (105) (208) 1,101 14,966 (3,030) (70,562) 3,000 27,381 (3,413) — — (46,624) — (32,950) 36,975 14,279 (2,651) 20 (5,000) 10,673 (20,575) (21,167) — 32,804 (3,619) — — (12,557) 469 2,096 2,565 7 (21,380) 49,237 $ 27,857 $ 355 6,711 7,066 (52) 32,018 17,219 49,237 $ Supplemental disclosure of cash flow information: Cash paid for income taxes, net of refunds $ 6,349 $ 1,491 $ Supplemental disclosure of non-cash flow information: Change in unrealized gain (loss) on investments, net of tax $ 3,018 1,609 4,627 — 7,036 10,183 17,219 319 — $ 1,415 $ (1,415) Transfers of equipment between inventory and property and equipment, net $ 1,797 $ 1,877 $ 1,742 Net change in capitalized share-based compensation $ 61 $ 6 $ 14 Common stock withheld for employee taxes in connection with share-based compensation $ 446 $ 281 $ 110 See accompanying Notes to Consolidated Financial Statements. 59