2.0

Chapter

2.1

Key Concepts and Skills

2

z Know

the difference between book value and

market value

z Know the difference between accounting

income and cash flow

z Know the difference between average and

marginal tax rates

z Know how to determine a firm’s cash flow

from its financial statements

Financial

Statements,

Taxes and

Cash Flow

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

2.2

2.3

Chapter Outline

Balance Sheet

z The

z The

Balance Sheet

z The Income Statement

z Taxes

z Cash Flow

balance sheet is a snapshot of the firm’s

assets and liabilities at a given point in time

z Assets are listed in order of liquidity

z

z

Ease of conversion to cash

Without significant loss of value

z Balance

z

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

Sheet Identity

Assets = Liabilities + Stockholders’ Equity

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

2.4

The Balance Sheet

Figure 2.1

Total Value of Assets

Current Assets

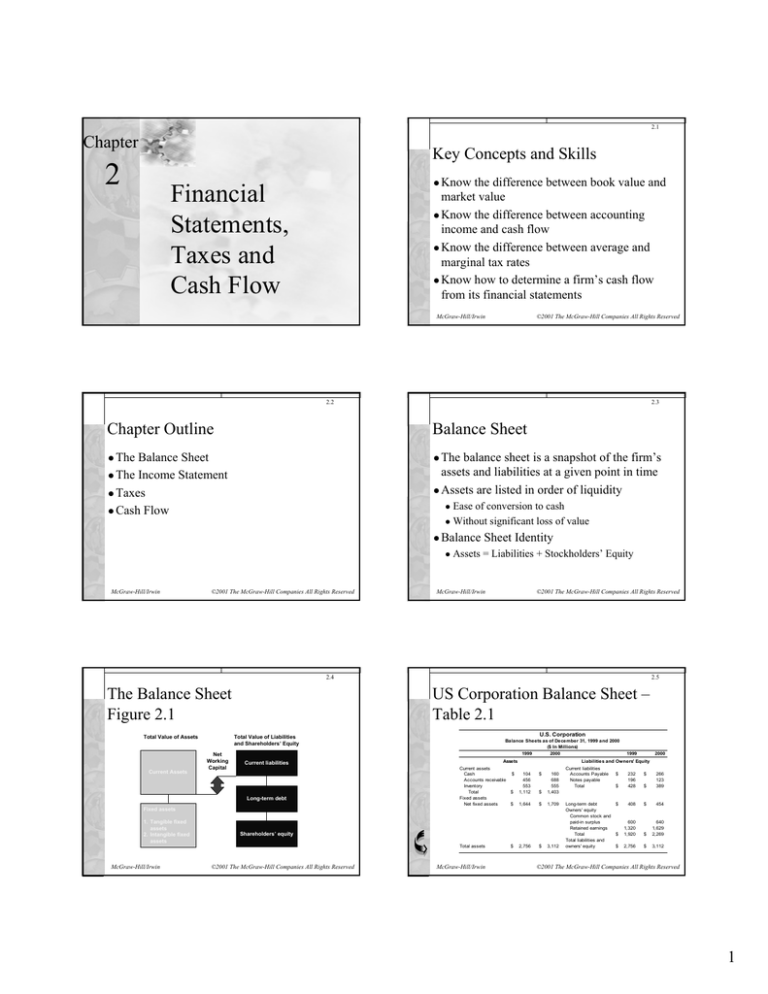

US Corporation Balance Sheet –

Table 2.1

Net

Working

Capital

Current liabilities

Long-term debt

McGraw-Hill/Irwin

U.S. Corporation

Total Value of Liabilities

and Shareholders’ Equity

Fixed assets

1. Tangible fixed

assets

2. Intangible fixed

assets

2.5

Balance Sheets as of December 31, 1999 and 2000

($ In Millions)

1999

2000

Assets

Current assets

Cash

Accounts receivable

Inventory

Total

Fixed assets

Net fixed assets

$

$

$

104

456

553

1,112

$

160

688

555

1,403

$

1,644

$

1,709

Shareholders’ equity

Total assets

©2001 The McGraw-Hill Companies All Rights Reserved

McGraw-Hill/Irwin

$

1999

2000

Liabilities and Owners' Equity

2,756

$

3,112

Current liabilities

Accounts Payable

Notes payable

Total

Long-term debt

Owners' equity

Common stock and

paid-in surplus

Retained earnings

Total

Total liabilities and

owners' equity

$

232

196

428

$

$

$

266

123

389

$

408

$

454

$

600

1,320

1,920

$

640

1,629

2,269

$

2,756

$

3,112

©2001 The McGraw-Hill Companies All Rights Reserved

1

2.6

Market Vs. Book Value

2.7

Example 2.2 Klingon Corporation

z The

balance sheet provides the book value of

the assets, liabilities and equity.

z Market value is the price at which the assets,

liabilities or equity can actually be bought or

sold.

z Market value and book value are often very

different. Why?

z Which is more important to the decisionmaking process?

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

NWC

NFA

KLINGON CORPORATION

Balance Sheets

Market Value versus Book Value

Book Market

Book Market

Assets

Liabilities and

Shareholders’ Equity

$ 400 $ 600 LTD

$ 500 $ 500

700 1,000 SE

600 1,100

1,100 1,600

1,100 1,600

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

2.8

2.9

US Corporation Income Statement –

Table 2.2

Income Statement

z The

income statement is more like a video of

the firm’s operations for a specified period of

time.

z You generally report revenues first and then

deduct any expenses for the period

z Matching principle – GAAP say to show

revenue when it accrues and match the

expenses required to generate the revenue

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

U.S. CORPORATION

1998 Income Statement

($ In Millions)

Net sales

$ 1,509

Cost of goods sold

750

Depreciation

65

Earnings before interest and taxes

$

694

$

624

$

412

Interest paid

70

Taxable income

Taxes

212

Net income

Dividends

$

Addition to retained earnings

McGraw-Hill/Irwin

103

309

©2001 The McGraw-Hill Companies All Rights Reserved

2.10

2.11

Taxes

Example: Marginal Vs. Average

Rates

z The

z Suppose

one thing we can rely on with taxes is that

they are always changing

z Marginal vs. average tax rates

Marginal – the percentage paid on the next dollar

earned

z Average – the tax bill / taxable income

z

z Other

taxes

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

income.

your firm earns $4 million in taxable

What is the firm’s tax liability?

What is the average tax rate?

z What is the marginal tax rate?

z

z

z If

you are considering a project that will

increase the firm’s taxable income by $1

million, what tax rate should you use in your

analysis?

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

2

2.12

2.13

The Concept of Cash Flow

Cash Flow From Assets

z Cash

z Cash

flow is one of the most important pieces

of information that a financial manager can

derive from financial statements

z The statement of cash flows does not provide

us with the same information that we are

looking at here

z We will look at how cash is generated from

utilizing assets and how it is paid to those that

finance the purchase of the assets

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

Flow From Assets (CFFA) = Cash Flow

to Creditors + Cash Flow to Stockholders

z Cash Flow From Assets = Operating Cash

Flow – Net Capital Spending – Changes in

NWC

McGraw-Hill/Irwin

2.14

Cash Flow Summary

Table 2.5

I. The cash flow identity

Cash flow from assets = Cash flow to creditors (bondholders)

+ Cash flow to stockholders (owners)

II. Cash flow from assets

Cash flow from assets = Operating cash flow

- Net capital spending

- Change in net working capital (NWC)

where

Operating cash flow = Earnings before interest and taxes (EBIT)

+ Depreciation - Taxes

Net capital spending = Ending net fixed assets - Beginning net fixed assets

+ Depreciation

Change in NWC = Ending NWC - Beginning NWC

III. Cash flow to creditors (bondholders)

Cash flow to creditors = Interest paid - Net new borrowing

IV. Cash flow to stockholders (owners)

Cash flow to stockholders = Dividends paid - Net new equity raised

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

©2001 The McGraw-Hill Companies All Rights Reserved

2.15

Quick Quiz

What is the difference between book value and

market value? Which should we use for decision

making purposes?

z What is the difference between accounting income

and cash flow? Which do we need to use when

making decisions?

z What is the difference between average and

marginal tax rates? Which should we use when

making financial decisions?

z How do we determine a firm’s cash flows? What

are the equations and where do we find the

information?

z

McGraw-Hill/Irwin

©2001 The McGraw-Hill Companies All Rights Reserved

3