I Measurement of Productivity Improvements: An Empirical Analysis

advertisement

I

Measurement of Productivity

Improvements: An Empirical Analysis

RAJIV D . BANKER*

SRIKANT M . DATAR*

MADHAV V. RAJ AN*

In this paper, we test for productivity gains resulting from the

introduction of a productivity-based incentive program in a large

manufacturing plant of a Fortune 500 corporation. We develop a

methodology based on a stochastic nonparametric frontier estimation technique to evaluate productivity in the postincentive plan

period relative to the pre-incentive plan period. We also test for

productivity gains using stochastic parametric frontier approaches.

The results of both the nonparametric and parametric stochastic

frontier analyses indicate that the incentive program has a positive

effect on indirect labor, manufacturing services, and materials productivity and relatively little effect on direct labor productivity.

1. Introduction

Productivity improvement and cost control have become key objectives

of U.S. corporations in recent years. As a result, many corporations have

introduced productivity improvement programs, especially productivitybased incentive payments to workers. The implementation and evaluation

of the impact of such incentive programs have placed demands on management accountants to develop reliable measures of productivity and manufacturing efficiency—an issue largely ignored in the management

accounting literature.

The agency theory literature studies the motivational effects of providing

incentives to woricers. The site at which a productivity-based scheme has

recently b ^ n introduced serves as a natural experiment for testing the effect

of an incentive contract intencted for improving labor productivity. Evaluation of its inqjact depends ontfjemettiod employed to measure productivity.

Univosity

319

320

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

We use data from the site to compare conclusions drawn by altemative

methods of measuring productivity about the impact of the incentive plan

on productivity improvements.

In our model, productivity measures the efficiency with which each of

four inputs (direct labor, materials, indirect labor, and manufacturing support

services) is consumed in producing two outputs. Accounting systems in

practice are not geared to evaluating productivity. Simple input-output quantity ratios implicitly assume constant returns to scale (CRS) and the absence

of multiple inputs and outputs. The use of input prices further obfuscates

measures of productivity. Standard usage variances ignore indirect labor

productivity and additionally assume linear and separable technologies.

Advanced management accounting textbooks, such as Kaplan (1982),

discuss ordinary least squares (OLS) approaches for estimating cost functions. This can be adapted for estimating production functions and improvements in productivity by regressing each input on the outputs produced and

testing for decreases in input consumption in the' 'event'' period—the period

after the introduction of the gain-sharing program. The specification of

stochastic disturbance terms with zero means implies Ae estimation of an

average production function. The theoretical definition of a production function expresses the minimum amount of each input to produce given outputs

with a fixed technology. An ordinary least squares analysis is therefore

inconsistent with a frontier production function that forms the core of microeconomic theory.

This has led to the development and estimation of parametric frontier

cost and production functions in the economics literature (see, for instance,

Aigner and Chu [1%8] and Aigner, Lovell, and Schmidt [1977]). A weakness of such parametric fh)ntier estimation is its inability to theoretically

substantiate or statistically test the maintained hypottiesis about the paran^tric form for the production function and the postulated distribution for

the disturbance term. Furthennore, the restrictions imposed on the production correspondence by these hypottieses are not immediately apparent. We

adopt an altemative nonparametric stochastic frontier estimation technique

called Stochastic Data Envelopment Analysis that only imposes conditions

of monotonicity and concavity on the production function, llie technique

we employ is sufficiently general to allow for multiple inputs and ou^uts

and for some of the inputs to be fixed.

We examine these altemative n^thods of evaluating productivity using

data from a large manufacturing plant that has recently establisted a productivity-based incentive compensation plan for its workers. Tlie plant manufactures traditional engineering products. It has gained a leadership position

by providing quality products at low cost. Maintaining cost advantage

I

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

321

through {M-oductivity improvements is critical in this mature, stable, competitive industry. The gain-sharing bonus scheme is an incentive to enhance

labor productivity by sharing the financial gains from improved productivity

with employees. Indirect plant labor and salaried staff are included in the

plan to provide incentives for savings in the shop floor-related portion of

indirect labor, including time spent on repairs and maintenance, equipment

handling, set-ups, and inspection of set-ups.

Strong links exist between methods discussed in this paper and those

of traditional capital markets research. Although we specify a production

economics model, as opposed to a financial economics one, we perform a

variation of residual analysis based on an estimated standard. Patel (1976),

for instance, estimates a referent market model for the relationship between

firm and market returns and uses deviations from this as a measure of

abnormal returns and thus the infonnation content of eamings forecasts.

Similarly, we estimate a referent production set for the input-output correspondence and compute deviations from it to measure improvements in

manufacturing productivity and thereby the impact of the incentive scheme.

Further, we use the 0-1 variables technique as in Schipper and Thompson

(1983) to identify productivity gains in different periods of interest relative

to a common referent correspondence. The objective of our analysis is to

describe a methodology to examine the productive impact of the gain-sharing

scheme in the setting described; additional refinements to the methodology

may be warranted based on the specific situation encountered by a researcher

and his or her observations on the production process being studied.

This paper has the following structure: In Section 2 we discuss the

empirical setting of the problem and issues involved in obtaining and handling the data. Section 3 examines the merits and demerits of various economic models used to identify stochastic input consumption frontiers in

order to measure deviations of actual input consumption from the frontier

in the event period. We consider both parametric and nonparametric estimation techniques and describe the structure imposed and the corresponding

estimation procedure employed. Section 4 discusses the results and interprets

our findings.

2. Empirical Setting

Our site is a manufacturing plant within a highly diversified Fortune

500 company. Productivity improvement is a key component of the division's comp^tive strategy. The division leads its industry in technological

advancement and market share. It has secured and retained its position by

iwoviding better quality and more reliable products at a lower cost than its

322

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

competition in a mature, no-growth industry. Productivity improvements

are critical for long-run competitive advantage. Output prices are controlled

by competitive maiket forces and reductions in input prices are generally

available to competitors as well.

Historically, the company has made great strides in productivity improvements, by producing more outputs with the same or lesser quantity of

inputs, through technological innovation, and by efficient shop floor management rather than by substituting labor for capital. This fact is stressed

by its chairman, who notes in the company's annual report that the company's strategy was to put "increased emphasis on new technology and new

engineering capacity, training, product quality, productivity and cost reduction." Among management's stated "high-priority" areas were "applying technology to new and improved products and processes" and

"improving quality, productivity and employee motivation." To continue

this trend and to maintain its cost leadership, the company has embarked

on a IKW campaign to improve productivity.

The behavioral setting of our investigation is cost minimization. Production requirements are determined by the marketing department and taken

as given by the manufacturing plant.* The plant's focus is on minimizing

resource consumption while producing the outputs required. Productivity

gains are manifested via reduced quantities of inputs required to produce

specified quantities of outputs.

Ilie particular plant we focus on is labor intensive with relatively stable

capital. As a direct consequence of this nonemphasis on capital, depreciation

accounts for only 3% of total costs and is a relatively minor item in the

plant's monthly expense summary accounts. Direct labor, on the other hand,

constitutes 20-25 percent of total expenses, and indirect labor and supervisory costs 25-30 percent. As part of its campaign to increase productivity,

a gain-sharing program^ was instituted at the plant with benefits tied predominantly to improvements in labor efficiency. Hie gain-sharing plan includes indirect plant labor and salaried staff b(»:ause these elements are a

significant percentage of t ( ^ labor costs and offer consider£d)le potential

for {Hoductivity improvement. Including indirect labor in the gain-sharing

arrangement also facilitates union negotiations because the incentive arrangement encompasses all wOTkers in tiie plant.

We describe below the basic steps of the gain-sharing computation.

Labor "pnxluctivity" in successive periods is computed relative to a base

1. If inpats and outputs are simultaneously determined, a simuhimeous equMions model must be

estimated (see Zellaor. Kmetta, uid Droe {1966}).

2. The design <^ this gain-diaring program is discussed in detail in Baidta- and Datar (1987b).

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

323

period benchmaii^. The first step entails a computation of the standard direct

labor hours in die base period (denoted by s^,) obtained by multiplying the

standard direct labor hours per unit for each product (based on industrial

engineering estimates) by the quantity of each product produced in the base

period. The actual total labor hours (denoted by a^) including direct labor,

indirect plant labor, and salaried staff hours are also computed for the

base period. The ratio of actual direct and indirect labor hours to standard

direct labor hours in the base period determines a base ratio (denoted by

Tb — Ot/st,). In each subsequent nranth t, the ratio r, of actual total labor

hours a, to the standard direct labor hours Sf (based on the direct labor content

of products produced in period t) is computed. The gain-sharing fraction g,

for period t is calculated as -^ = ~^.

r,

Values of ^, greater than one indicate

a,l Sy

"productivity" gains; values of g, less than one signal "productivity"

declines.

The gain-sharing agreement calls for woricers to be paid at base-period

wage rates if g, in a period is less than one. When g, is greater than one,

half of the "productivity" gains are paid to workers. For example if g, =

1.14, which signals a 14 percent increase in "productivity," each worker

receives a bonus of 7 percent over the base wage or salary.

Our objective is to identify increases in productivity in each of the four

inputs in the 15 months following the program's introduction relative to the

33 months preceding it. Monthly data were available for a 48-month period

labeled 1 through 48, with the gain-sharing program taking effect in month

34. Monthly data on the physical quantities of the two products produced

were obtained firom plant production reports. The summary of manufacturing

costs provided details of the actual number of direct and indirect labor hours

employed each period. Gains in labor productivity are measured via reductions in hours worked. This provides a good measure of productivity because

the mix of workers at various skill levels and pay levels has remained

constant over the entire period of study. Productivity gains as reflected in

a reduction of labor hours is achieved by employing fewer temporary

laborers.

Tht two [Hoducts manufacbired in the plant use a common metal which

accounts for 90 percent of total raw material cost (which constitutes about

15-20 percent of total cost). We deflate material cost of production by the

increase in material prices each period to obtain a constant-cost estimate of

material consunqition. For miscellaneous manufacturing oveiiieads, we

group several relatively minor costs such as power (about 3 pereent of t c ^

cost), gas (1-2 percent), perish^le tools and jigs (4 percent), and janitorial

324

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

services (1-2 percent) that represent important support services for the operation of the plant, under the single category of manufacturing support

services (25-30 percent of full cost). We deflate the cost each period by

appropriate indices, based on plant records and suppliers' bills, to obtain a

constant-cost estimate of consumption of manufacturing services.

The financial reporting focus of the accounting system required significant assumptions to be made in our analysis. The only information available

with respect to material cost was the material cost of goods sold for each

product. The material cost of production for each product is calculated by

multiplying the (deflated) material cost of goods sold by the ratio of goods

produced to goods shipped for each individual product. The total material

cost of production is derived by aggregating material costs over all products.

The material consumption data are thus noisy and approximate and our

results with respect to material costs must be interpreted cautiously.

There are four cost components: direct labor, materials, indirect labor,

and manufacturing services. The stability and relative maturity of the manufacturing process limits the potential for improvement in materials and

direct labor productivity. The input-output relationships including the noise

and stochasticity in these relationships are well known, and management

can control these costs on the basis of inputs consumed and outputs produced.

Indirect labor and manufacturing services inputs, on the other hand, are

discretionary in nature with no identified direct relationship between inputs

and outputs. Consequently, these costs cannot be controlled by monitoring

outputs and inputs. Instead, incentives need to be provided to influence the

behavior and effort of workers. The labor-based gain-sharing program is an

example of such an incentive. Consequently, we expect the gain-sharing

program to result in improvements in indirect labor and possibly manufacturing services. The impact on manufacturing services is likely to be smaller

because the program does not directly provide incentives to improve manufacturing services productivity. Nevertheless, the general focus on improving labor productivity may positively influence manufacturing services

pnxluctivity as well.

3. Methodfrilogy for Testing the Impact of Productivity

Improvement Programs

In describing the methodology, we (tenote die' two out{Hits produced as

yi and yz written in vector form as y = (yttyz)- The {^ysical inputs Xi, X2,

X3, and X4 are denoted by the vector x = (jt,,X2,JC3,jC4) where JC, represents

direct laixx, x^ indirect hSofX, x-^ materials consumption, aiMi X4 consumption

of manufacturing wrvices. ITie [Htxluction technology at the pknt permits

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

325

little substitution among inputs. Because the plant is labor intensive, the

capital employed is small and relatively constant over the period of our

analysis. Similarly, material consumption cannot be reduced by substituting

other inputs for materials.

Our analysis of the production process indicated that the consumption

of each input depends on only the quantity of outputs y, and )'2 produced

and in particular is independent of the level of consumption of the other

inputs. That is,

Xi = fi(y,,y2) for all i = 1,2,3,4.

Our objective is to evaluate if, after controlling for the outputs produced,

input consumption in the post-gain-sharing period is less than the input

consumption in the pre-gain-sharing period.

The usual approach for testing for efficiency gains in the post-gainsharing period relative to the pre-gain-sharing period is to use a least squares

regression by fitting prespecified functional forms for the correspondence

between outputs and each input. Following the methodology of Schipper

and Thompson (1983), dummy (0-1) variables representing the pre- and

post—gain-sharing periods could be introduced to capture shifts in the relationships across these periods. For instance, specifying a loglinear relationship between each input and output y, and ^2 yields the following

estimation model:

[A] log Xi, = aoi + a,i log yi, -t- a2i log y^, + b A + ^a

Vi=l,...4, t=l,...48

where D, = 0 for t = 1 , . . . 3 3

= 1 for t = 3 4 , . . . 48

The eleiments of Ci are assumed to be distributed i.i.d. N(O,CT^) and

uncorrelated withji andy2- Significantly negative values ofbi indicate lower

input costs Xi (and productivity gains with respect to input i) in the postgain-sharing period.

Hiere are two important limitations in applying least squares techniques

to estimate the input consumption relationship between each input Xi and

the output prcKluced y = (y^ya). First, tiie regression-based approach estimates ibe average amount of input consumed to produce given levels of

ouQmts, whereas the theoretical definition of a production function expresses

the minimum amount of input for given levels of outputs. Moreover, from

a managennnt ccmtrol perspo^ve, comparing future period input consunq)tion with theregressicm-basedestimated consumption indicates whether

input consumption in tiie post-gain-sharing period has been less tiian av-

326

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

erage, rather than whether input consumption is lower than the best diat

was achieved in die pre-gain-sharing period. Furthermore, least squares

regression estimates assume that the disturbance term arises from an i.i.d.

stochastic process so that deviations of actual observations from the estimated function are a s s u n ^ to result fiom random deviations. In reality,

these deviations result from extemal random factors as well as inefficiencies

of plant workers. Indeed, the productivity-based incentive plan is aimed at

motivating workers to put in greater effort to reduce inefficiency and improve

productivity. Second, regression-based parametric methods assumed a particular and often arbitrary functional form on die input-output correspondence. This problem is partly mitigated by assuming a flexible parametric

relationship between inputs and outputs such as a translog or loglinear

functional form. In die next section we provide a methodology to test for

productivity gains assuming a loglinear stochastic production technology.

3.1. Parametric Stociiastic Frratier Estimatitm

Estimating a frontier production function involves the specification of

the error term as being made up of two components, one normal and die

other from a one-sided distribution. That is, the error structure is given by:

e,, = Vi, -f- Uu V i = 1 , . . . 4 and t = 1 , . . . 48.

TTie error component Ui, represents a symmetric disturbance, where for each

I, {UjJ are assumed to be independendy and identically distributed as

N(O,(ji.). The error component Vj, is assumed to be distributed independently

of «i, satisfying Vj, S: 0. In particular, {vJ are a s s u n ^ to be independently

and identically distributed from a half-normal distribution Ar^(0,o^) trunc a t e below at zero.

The logic untterlying this specification is that die production process is

subject to two disturbances. Hie irannegative disturbance Vj, refl«;ts the

condition that for each input the input consumption level must lie above the

fircmtier (a minimum omsumption level) over all time periods. These deviations are attributable to factcvs umler the worker's control such as iiwfficiencies, wastage, die effort provicted by employees, and the extent of

reworked, ctefective, and dmnaged products. For each i, die random disturbance term Ujt reixeseirts die stochastic nature of die frontier itself over

time, v ^ much like d n random disdirbance term in a least square regression model. Hie Uj, t^m is the result of favtHabie as well as unfavtnable

raiuknn extemal events not controllable at ihe plant level, such as rand(»n

p^cnmance, iiKMtel specificioicm, and cm»s of ob%rvati<»i and

MEASUREMENT OF PRODUCnVlTY IMPROVEMENTS

INPUT

OUTPUT

Figure 1

of Composed Error Specification

n:^asurement. Figure 1 distinguishes between average and frontier relationships and illustrates the notion of composed errors in the single-input and

single-output case.

The point M represents an ou^ut level of OL and input consumption

of LM. Under ttie composed error model, the input consumption frontier

level is estimated to be LN. The total deviation MN comprises the inefficiency

component NP and a random effect PM which exceeds the level of

inefficiency.

The stochastic input p(»sibility frontier expresses the Pareto efficient

input combinations necessary to {Hoduce specified vectors of outputs given

die existing technology. Input consumption in excess of frontier levels is a

reflectk»i of ii^fficiency in implementing production. Reducing the degree

of inefficiency in production is an inqxntant motivation for the introduction

of a gain-sharing {nt^ram. It could alternatively be argued that incentives

328

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

{»x)vided by the gain-sharing agreement induce new ways of organizing

production and result in shifts in the input possibility frontier. We take the

position that the input possibility frontier is not shifting (note that capital

investment in technology is also relatively stable over the period of our

fuialysis) and test whether the probability distribution generating the inefficiency terms decreases with the introduction of the gain-sharing program.

Our objective is to examine if productivity in the 15 months following

the gain-sharing program increases relative to the 33 months preceding it.

Production inefficiencies are measured by the nonnegative disturbance term

Vj, and represent deviations firom the frontier attributable to factors under

the workers' control. Note that since for each i, Vj, is assumed to be independently and identically distributed from a half-normal distribution

N^{O,ail,) truncated below at zero, any increase in productivity will decrease

both the mean and the variance of the distribution of Vu (because the mean

and variance of a half-normal distribution are not independent). One way

to examine this is to test if v,, is distributed as half-normal A^^(O,CTVJ) for

the 33-nionth pre-gain-sharing period and as N^(O,(TI — 80 for the 15month post-gain-sharing period.

Assuming a loglinear relationship (or, alternatively, a translog function),

we could proceed by estimating the following model:

[B] log Xj, = aoi + au log y,, + azi log yz, + Cj,, i = 1 , . . . 4, t = 1 , . . . ,48

where €(, = Ui, -I- Vj,

and Ui, ~ N(O,a^.)

Vi, ~ N " ( 0 , a J . ) f o r t = l , . . . , 3 3

Vi, ~ N^(O,aJ. - 8i) for t = 3 4 , . . . ,48.

Henceforth, cFy. is used to denote (TI. for observations 1—33 andCTJ.~ Si for

observations 34—48.

An approach to estimating the stochastic frontier production function

models as in [B] discussed by Aigner, Lovell, and Schmidt (ALS) (1977)

and Olson, Schmidt, and Waldman (OSW) (1980) is a maximum likelihood

estimator (MLE). Following Weinstein (1964), the density function of €i

for each i = 1 , . . . 4 is given by:

wtere of = o^. + o^., Xj =CTv/o^Bjand f*() and F*(-) are tfie standard

nonnal (tensity and distdbutiiHi functicms, reflectively.

We tl^refore have:

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

329

that is.

Ln fied = Ln - ^ -ITT

The relevant loglikelihood function for all 48 observations is given by:

Therefore,

L ( ) = 48Ln

IT

CT

48

Ln[F*

+ tE

= 34

33

V .

2

48

- 1

Ji - 8,

where €i, = ln Xjt — doi — «» In ^u ~ fl2i In )'2f The loglikelihood function

can then be maximized with respect to the unknown parameters Ooi, au, 021,

(TIJ (TI. and 8i using a nonlinear search algorithm (such as Fletcher-Powell).

A test of the null hypothesis of 8; = 0 would then provide evidence on

productivity gains and reduction in inefficiency with respect to input i in

the post-gain-sharing period. The maximum likelihood estimator of 6i is

consistent and asymptotically efficient, but its finite sample distribution is

not known.

An alternative approach maintains somewhat different assumptions and

it models the input-ou^t relationship as:

[C] log Xi, = aa + au log y,, + a2i log y2, + €;,

w t e r e €i, = Uj, -I- Vj,

and

uu ~ N(0,cr2.)

fOT t = 1 , . . . ,33 wtere Vj, = vi -I- b,

for t = 3 4 , . . . ,48.

330

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

Note that in model [B], the inefficiency terms V;,, both pre- and post-gain

sharing, are drawn from a half nonnal distribution that ranges over [0,<»),

with the post-gain-sharing distribution hypothesized to have a lower mean

and, accordingly, a lower variance. In contrast, in model [C], pre- and

post-gain-sharing inefficiencies are drawn from distributions with the same

variance, but ranging over [8i,oo) and [0,«>),respectively,with 8; hypothesised (in the altemate hypothesis) to be positive. A positive value of Sj in

model [C] indeed implies tiiat mean inefficiency is greater pre-gain sharing,

but it also implies that, in every instance of the pre-gain-sharing period,

there is inefficiency in input consumption, relative to frontier levels, of at

least e^i. This is apparently a restrictive feature of this model.

Model [C] is also consistent with an altemative set of maintained assumptions, namely, a neutral shift in the frontier unaccompanied by any

shifts in the probability distribution from which the inefficiency terms arise.

Of cotirse, this does imply that this model cannot be employed to distinguish

between the two altemative sets of assumptions. Conversely, if tiiere is no

a priori evidence to maintain one set of assumptions rather than the other,

model [C] provides a robust formulation.

The model in [C] can be estimated as:

[C]

log X,, = aoj + a,i log y,, + a2i log y2, - B A + Uj, -I- \„

where Uj, ~

V, ~ N"(O,aJ.)

D, = O f o r t = l , . . . , 3 3

= 1 fort = 34, . . . , 4 8 .

Hie maximum likelihood estimation technique discussed earlier can be

employed to test the null hypothesis of Sj = 0 versus the altemative that 8^

>0.

Stochastic frontier production function models as in [C] can also be

estimated as discussed by ALS (1977) and OSW (1980) using a corrected

ordinary least squares (denoted by CDLS) estimator. Hie COLS coefficients

are obtained by estimating an ordinary least squares (OLS) regression for

the composed error model in [ C ] . Except for the constant term, the OLS

estimator is unbiased and consistent. Tlie bias of the constant term is the

mean of €i = + \/2hT (Tyj. Consistent estimates of the variances

l

^i can be obtained by:

4)il3i]^ and ^

= A-^i

IT

where |j4i and |i4i are the second and third monwnts of the OLS residuals.

MEASUREMENT OF reODUCnVITY IMPROVEMENTS

331

A consistent COLS estimate of the constant term is obtained by subtracting

\/5/iir dvi ftom the OLS estimate of the constant term. This COLS estimate,

however, is not asymjHotically efficient and its finite sample distribution is

unknown.

In a Monte Carlo experiment designed to compare the COLS and MLE

estimators mentioned above, OSW (1980) find diat die COLS estimator is

more n»an square error (MSE) efficient for sample sizes 200 and below.

At sample sizes of 400 and 800, die MLE is MSE efficient for estimating

al., (TI., and a? but COLS is stUl superior for d,i and dj,. OSW (1980) could

not reject the null hypothesis diat there is no difference in variance between

MLE and COLS parameter estimates for any parameter for sample sizes

greater dian 25. OSW (1980) conclude diat COLS and MLE techniques are

both ai^licable in estimating parameters ofthe equation in [B] in moderately

sized samples.

The above discussion also suggests that the computationally simple

COLS estimators are preferred to the MLE estimators in smaller samples.

There is, however, one important problem widi the COLS estimator in diat

the estimator may not exist (in a meaningful form) in some samples. This

may happen in one of two ways. A "Type I " failure occurs if dv. is negative.

The problem occurs when X; = a^./CTu^ is small. A "Type H" failure occurs

when d^ < 0 and corresponds to die situation when X is large. This problem

does not' exist in the case of MLE estimators because the MLE procedure

simply maximizes the loglikelihood function widi respect to X and as reported

by OSW (1980) provides unbiased estimates of a^, au, and Oii- Indeed, as

the variance of o^. of the one-sided efficiency term increases, die MLE

estimators dominate because die MLE mediodology takes die exact nature

of the asymmetry of the distribution of the disturbance into account.

Because we encounter situations in which the COLS estimators do not

exist, we report the results of both die COLS and MLE estimations of each

input on the ou^uts i»oduced.

3.2 N<Mq>anunrtric Stochietk Frontkr Estimation

Although die paranwtric stochastic estimation of production frontiers

described in Section 3.1 overcomes tte conceptual difficulties of estimating

an averse relationship between inputs and outputs inherent in the usual

regression analysis, it does assume a particular functional form for the

production cOTtespomience airi the error stmcture. TTw statistical distributitms of the i»rameters are based on ttese assumed functional forms. Inferences based on die statistical tests are consequently conditional on die

specification of tbe nKxlel ctwiectly reflecting the un(teriying

332

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

production relation (see Hildenbrand [1981], Varian [1984], and Banker

and Maindiratta [1987]). But the choice of a particular functional form is

difficult to justify on a priori grounds. This problem can be partially mitigated

by using fiexible functional forms such as the translog that can be used to

approximate various production functions. Unfortunately, these forms require the estimation of a large number of parameters relative to the 48

available observations. Furthennore, the underlying regularity conditions of

monotonicity and strict quasi-concavity are violated at many points of most

data sets, thus biasing inference; for a theoretical analysis of regularity

conditions see Caves and Christensen (1980) and Bamett and Lee (1985).

The problems inherent in parametric estimation can be overcome by

estimating a nonparametric stochastic frontier using the approach of Stochastic Data Envelopment Analysis (SDEA) (see Banker [1986a]). This

technique is an extension of Data Envelopment Analysis (DEA), which was

introduced by Chames, Cooper, and Rhodes (1978). DEA is a nonparametric

method for evaluating productivity which assumes only the regularity conditions of monotonicity ofthe prodtiction function and convexity ofthe input

possibility frontier; it imposes no additional stmcttire on the specified functional form. Banker, Chames, and Cooper (1984) show its flexibility in

modeling production operations in the presence of multiple outputs.

The DEA approach has been used in a variety of empirical settings.

Examples include program evaluation (Chames, Cooper, and Rhodes

[1981]), evaluation of school district efficiencies (Bessent et al. [1983]),

productivity measurement for manufacturing operations (Banker [1985];

Banker and Maindiratta [1986]), and tiie estimation of hospital production

fimctions (Banker, Conrad, and Strauss [1986]). Some other settings in

which the DEA technique has been employed are steam-electric power

generation (Banker [1984]), coal mines (Bymes, Fare, and Grosskopf

[1984]), pharmacy stores (Banker and Morey [1986a]) and fast-food restaurants (Banker and Morey [1986b]).

DEA's limitation lies in the fact that it does not allow for the possibility

of extemal random errors impacting the production process. Any difference

between the actual input consumption and the estimated frontier level is

therefore attributed to inefficiency. TTie SDEA model, on the otiier hand,

allows for the possibility of random errors in model specification or measurement via a symmetric random error component, in addition to the onesicted deviations attributable to inefficiency in the use of input resources.

TMs formulfttion for the error term resembles tte composed error specifications of the mo(tels of Aigner, Lovell, and Schmidt (1977) ar^ Meeusen

and van det Broeck (1977) discussed in Secticm 3.1.

The nonlinear maximum likelilKxxl estimation models require an a pricm

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

333

(and often arbitrary) specification of the parametric distributions of the two

error terms. On the other hand, the linear programming-based formulation

of SDEA requires the relative weights for the two types of deviations (or

error terms) to be specified in the objective function. By varying the relative

weights, we examine the sensitivity ofthe estimation results to the postulated

importance of deviations due to inefficiency or external random factors. In

fact, for specific extreme values of these weights, the model includes the

traditional nonstochastic DEA model (in which all variations of actual values

from the predicted frontier are attributed to inefficiency) and also the minimum absolute deviations (MAD) regression model (in which all variations

of actual values from the predicted values are attributed to external random

factors).

Since the consumption of each input is independent of the consumption

of other inputs, we employ the SDEA model to estimate a separate stochastic

production frontier for each input i, that is, x, = f{y) relating the input

consumed x, to the output vector y, with f:Y-^R

where Y is the convex

hull of y. We do not impose any parametric form on / and only assume

that/i is monotonic and convex.

We model the technological specification and the input possibility frontier for all inputs to be the same in the pre- and post-gain-sharing periods.

Our objective is to examine if productivity of input consumption is greater

in the post-gain-sharing period than in the pre-gain-sharing period. To do

so, we split the data comprising 33 observations in the pre-gain-sharing

period and 15 observations in the post-gain-sharing period into two sets of

24 observations each. The first set comprises all odd-numbered observations

and includes 17 observations from the pre-gain-sharing period and 7 observations from the post-gain-sharing period. We refer to this sample as the

estimation sample because this sample is used to actually estimate the stochastic nonparametric frontier for each input i.^ We then computed the

efficiency scores for all observations in the second sample, referred to as

the test sample, by comparing the estimated minimum input consumption

with the actual input consumption. These efficiency scores are used to test

whether productivity in the post-gain-sharing period is significantly greater

than pnxiuctivity in the pre-gain-sharing period. The frontier values ii, =

fi(yu, y^) are estimated by specifying the structure imposed on the deviations

of ;Ci, from 4 . As in Section 3.1, the deviation Xn - 4 is expressed as the

3. We also re-eaimated tf» fhwlier using a random sample of 17 observations from the 33 pregain-sharing observations and 7 (*servati<»is ftran the 15 pmt-gain-shahng observations. The results

were sinilm' to Ibose repcxted in detail hoe.

334

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

sum of two components; Vj, represents the excess of input i consumed in

period t due to inefficiency and u,, represents the effect of random factors

including specification and measurement errors. That is,

Xi, -

X,, =

Vi, -I- Ui,.

(1)

Because Vj, measures input inefficiency relative to the input consumption

frontier, Vi, is nonnegative and the symmetric term u,, is unconstrained in

sign. Unlike the parametric stochastic frontier estimation of Section 3.1; no

particular parametric form is assume for Uj and Vi. As in goal programming

formulations, the symmetric error Un is expressed as:

u., = Uit -

UiT widi Ui^; Ui7 > 0,

andSr=,Ui: = 2r.,Ui7

(2)

(3)

Therefore,

Vi Xi, = Xi, = Vi, + Urt -

Ui7 with Ui^. Ui7 > 0 ,

The stochastic, nonparametric input consumption frontier values Hi, =

fi(y,,,y2,) are estimated by minimizing a weighted sum of different components of deviations subject to die monotonicity and convexity constraints.

The monotonicity and convexity conditions for ii, = ^(y,) can be represented

by inequality (4) as follows:

For each t, i^i, — ii, S: Wi,(ys — yj for all s = 1,—n

(4)

where Wa is a nonnegative vector (see, for instance, Bazaraa and Shetty

[1979] and Banker [1986a]). The intuition for (4) follows fitom die fact diat

all points of a monotonic and convex function lie above die tangent hyperplane at any point t. Substituting (1) and (2) into (4) yields:

x« - Xi, 2: Wi,(y, - yd + (Vis - Vj,) -I- (Ui^ ~ u^ - \i^ + u^)

foralls=l,...,n.

(5)

For each input i, i= 1 , . . . ,4, the linear program to be solved is given

by:

[D]

Minimize 2 ^ , (u^ -I- u^ subject to

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

[D.I]

[D.2]

[D.3]

335

for e a c h t = l , . . . , 2 4 .

x« - Xi. > Wi,(y, - y.) + (vu - v,,)

-I- (Uit - Ui7 - u.t + Ui7) for all s = 1 , . . . ,24, s 7^ t

2 , ^ , (u,r - Ui7) = 0

Wi, > 0 , Vi,, Ui:,Ui, > 0 .

TTie weight Cj > 0 in the objective function is a prespecified constant.

Varying the value of c, gives different estimates of the production frontier

values. Small values of Ci corresponds to greater weight being placed on

the inefficiency term Vi, and for c, < - leads to the conventional DEA

n

formulation in which all variation is attributable to inefficiency. Increasing

Ci increases the amount of variation attributed to the random factors reflected

in the «i, terms and for Ci > 2 corresponds to MAD regression. By estimating

the model for various values of c,, we are able to assess the sensitivity of

the estimation to assumptions about the relative weights assigned to the

different sources of deviations of actual values from estimated frontier

values.

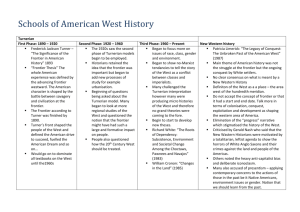

In Figure 2, we illustrate the estimation of the production frontier corresponding to different values of c for the case of a single input and a single

output. Here, for small values of Cj (< 0.2) we obtain tiie DEA estimates,

which assume no random specification or measurement errors and the linear

program estimates the minimum amount of input consumption for a given

level of output assuming monotonicity and convexity. The frontier is computed based on available observations and without recourse to any a priori

assumptions about the specific underlying functional form ofthe input-output

correspondence. For each input, the input productivity measure in any period

t is the ratio of the minimum amount of input for the level of output produced

as determined by tiie estimated fr^ontier, and the actual input consumption

in that period. Thus, for period 4 the productivity equals ABIAC. This DEA

measure of productivity is a relative measure because it evaluates the productivity of any period relative to available observations subject to tiie

conditions of monotonicity, convexity, and minimum extrapolation.

For Ci = 0.8, the input consumption frontier is pulled upward because

some of tte deviation of actual input consumption from estimated values is

attributed to random stochastic factors rather than inefficiency alone. The

inefficiency scores for various observations is, in general, lower. For still

larger values of c,(Ci = 1.2), variations of actual from estimated values are

entirely ^tributed to random factc»s and yield the MAD regression equation.

TMs has tte effect of fiirtter pushing up tiie estimated input consumption

function and reducing tite iirefficiency scores. Note, however, that the MAD

336

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

INPUT

OUTPUT

FIGURE 2

Estimation <tf Sto<^astic, Ntrnpanunetrk Input Consumption Function

regression is a flexible, nonparametric formulation for estimating monotonic

and convex functional correspondence of outputs and inputs and does not

impose any parametric form for the production relationship.

A stochastic, nonparan^tric frontier is e^imat^ for each input i and

for each value Cj basc^ on the 24 observations in die estimation sample.

Tliese yield estimates of d^ minimum amount of input consunq^cm ij, for

given levels of o u ^ t s {yu,y-hi assuming a one-sided (feviation due to inefficiency Vjt imd a symmetric two-sided emn* conqx)nent u^ attributable to

random factors including model specificaticm and nwasurement errors. E>ifferent values of Cj provide different weights on Vjt and u^.

MEASUREMENT OF PRODUCnVITY IMPROVEMENTS

337

Productivity (efficiency) scores are then computed for each of the 24

observations in the test sample for each input i and for all values c, as the

rado of the estimated consumption ii, and the actual consumption Xi,. The

Mann-Whitney (1947), Welch (1937), and Kolmogorov-Smimoff (Conover

[1980]) tests are used to examine if the average productivity of the 8 observations in the post-gain-sharing period is significandy greater than the

average productivity of the 16 observations in the pre-gain-sharing period.

The tests are run for all inputs i, / = 1 , . . . ,4 and all values of Ci. This

enables a determinadon of the sensitivity of our conclusions to changes in

the relative weights attributable to the random and inefficiency factors.

Comparing the results ofthe nonparametric and parametric stochastic frontier

analysis provides some insight into the robustness of our conclusions about

the impact of the gain-sharing program at the particular site.

In addition to estimating productivity measures for each of the inputs,

we compute an overall measure of productivity for each period using a

generalization ofthe Davis (1955) method. The overall productivity measure

aggregates the individual input productivities in each period using the actual

cost shares of the inputs in that period as weights."* The productivity of each

input may be analyzed in terms of productivity variances analogous to direct

material and direct labor usage variances in cost accounting.' The aggregation described above is equivalent to computing total variance for a period

as the weighted sum of the individual input variances. If inputs are not

separable, cost savings can be realized by subsdtuting one input for another

in die event of changes in the relative prices of inputs. As in Banker (1985),

we can compute two separate variances: an allocative variance that evaluates

die ratio at which inputs are employed relative to their prices and a technical

variance that examii^s the physical consumption of inputs reladve to the

estimated firontier consumption for the given mix of inputs. The product of

the two variances represents the aggregate variance. In the next section, we

discuss and interpret our findings based on both a nonparametric and a

parametric analysis of stochastic input consumption functions.

4. Results and Interpretatioiis

Given the methodological advantages of nonparametric stochasdc fronder estimadon, we start by discussing the results of Stochasdc Data En4. WeiiJiting each input productivity by the share of tfiat input in total cost emphasizes gains in

the most significimt ekments (tf total cost in the computation of total productivity.

5. Ualike vaHances, the n ^ measures described in this paper control for volume changes and

laoss periods.

I

338

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

velopment Analysis. Tables 1 through 5 contain the results of tests for

differences in productivity scores in the pre- and post-gain-sharing periods

for direct labor, indirect labor, materials, manufacturing services, and aggregate inputs. The one-sided Welch two-means test makes inferences on

the relative magnitude of means in the two periods. The one-sided MannWhitney test measures die presence of significant differences in the locations

of the underlying distributions in the pre- and post-gain-shMing periods.

The Kolmogorov-Smimoff test evaluates a more general form of differences

among productivity scores in the two periods. The alternative hypothesis is

that productivity scores in periods after gain sharing "tend to be higher"

than those before its introduction.

Table 1 presents the results for direct labor productivity for various

estimates of c that increases the weight on random deviations relative to the

inefficiency component. The table indicates that direct labor productivity is

not significantly different in the post-gain-sharing period relative to tiie pregajn-sharing period for all values of c. A likely explanation is the limited

potential for improvement in direct labor productivity for a mature technology. The input-output relationship for direct labor is well documented

and can be effectively monitored via engineering standards. Besides, improvements in direct labor productivity may be constrained by machineoperating constraints and strict quality-control standards in place at the plant.

Results on the impact of the gain-sharing program on indirect labor

productivity are presented in Table 2. Welch's two-means test, the MannWhitney test, and the Kolmogorov-Smimoff test indicate tiiat indirect labor

productivity is significantly greater (at the 10 percent level) in the postgain-sharing period than in the pre-gain-sharing period. This basic conclusion is relatively st^le across all values of c. These results are consistent

with our hypothesis that providing gain-sharing incentives influences workers' behavior and motivates tiiem to determine ways to increase productivity

of indirect labor. The input-output relationship in Has. case of indirect labor

is not directly identified, so that unlike direct labor, monitoring indirect

labor productivity via engineering standards is considerably more difficult.

Table 3 describes tiie results for materials productivity and indicates

significant gains in materials productivity in the post-gain-sharing period.

Although these gains could be attributed to reduced scrap, wastage, and

reworic, the labor-tosed gain-sharing program does not directly motivate

efforts to improve materials productivity. Morraver, mataials {ooductivity

is more effectively controlled via evaluating materials consunoption requirements of the ou^uts produc»l. As indicate in Section 2, data on ti^ {riiysical

units of materials consumed each period were •aot available and our results

may be an artifact of the noise in our estimates (rf material

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

339

TABLE lA

Welch's Two-Means Test on Direct Labor Productivity

c=0.04 (DEA)

0 = 0.2

c = 0.4

0 = 0.6

0 = 0.8

0=1.0 (MAD)

95% Conf. Interval

for Difference in

Average Productivity

r (Test

Statistic)

Degrees of

Freedom

Level of

Significance

(-0.109,0.088)

(-0.109,0.088)

(-0.109,0.088)

(-0.116,0.108)

(-0.112,0.109)

(-0.119,0.122)

-0.22

-0.22

-0.22

-0.08

-0.02

+ 0.02

15.2

15.2

15.2

14.6

14.4

14.0

0.59

0.59

0.59

0.53

0.51

0.49

TABLE IB

Mann-Whitney Test on Direct Labor Productivity

95.4%

Cor^idence

Interval

Point Estimate

for Difference in

Average Prodttctivity

-0.0093

-0.0093

-0.0093

0

0

-0.0017

o o o o o o

o o o o o o

1 1 1 1 1 1

c = 0.04 (DEA)

0=0.2

0 = 0.4

0=0.6

0 = 0.8

0=1.0 (MAD)

W (Test

Statistic)

Level of

Significance

96

100

100

99

0.5

0.5

TABLE IC

K<dmogorov-Snilm(^ Test tor Direct Labor Productivity

T,* (Test Statistic)

Level of Significance

c = 0.04

(DEA)

c=0.2

c = 0.4

c = 0.6

0.125

>0.10

0.125

>0.10

0.125

>0.10

0.187

>0.10

-0.8

0.187

>0.10

c=I.O

(MAD)

0.187

>0.10

The difference in manufacturing services productivity in the pre- and

post-gain-sharing period shown in Table 4 demonstrates some, though not

significant, improvement in productivity. Manufacturing services productivity is di£ficult to monitor based on tiie quantity of services consumed and

tHi^Hits produced, and providing incentives to influence behavior may be

useful in motivating incieased efficiency. Ontiieother hand, the gain-sharing

{Hognun focuses on labor productivity aloiK rather than total input productivity, and consequently provides no direct incentives for improving manufacturing services jwoductivity. Thus, although some improvement in

jHoductivity is realized, tiiese gains are not significant.

Tidde 5 describes changes in tiie overall jMtxiuctivity in the two periods

based on an aggregation of individual input productivities. The table signals

I

340

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

TABLE 2A

Welch's Two-Means Test on Indirect Labor Productivity

c = 0.04 (DEA)

c = 0.2

c = 0.4

c = 0.6

c = 0.8

c=I.O

c = 1.2 (MAD)

95% Conf. Interval

for Difference in

Average Productivity

T (Test

Statistic)

Degrees of

Freedom

Level of

Significance

(-0.1,0.438)

(-0.1,0.438)

(-0.11,0.444)

(-0.11, 0.451)

(-0.12,0.467)

(-0.12,0.48)

(-0.12,0.493)

1.48

1.48

1.46

1.44

1.38

1.40

1.42

7.5

7.5

7.5

7.5

7.6

7.6

7.8

0.091

0.091

0.094

0.097

0.11

0.10

0.099

TABLE 2B

Mann-Whitney Test on Indirect Labor Productivity

Point Estimate

for Difference in

Average Productivity

95.4%

Confidence

Interval

W (Test

Statistic)

Level of

Significance

0.0753

0.0753

0.0859

0.0849

0.086

0.0834

0.0932

(0, 0.21)

(0, 0.21)

(0, 0.21)

(-0.02,0.21)

(-0.03,0.22)

(-0.02,0.25)

(-0.02,0.26)

130.5

130.5

131.5

128.5

119.5

123.5

125.5

0.0331

0.0331

0.0288

0.0432

0.1223

0.0795

0.0629

c = 0.04 (DEA)

c = 0.2

c = 0.4

c = 0.6

c = 0.8

c=1.0

c = 1.2 (MAD)

TABLE 2C

Kolmogorov-SmimofF Test for Indirect Labor Productivity

c = 0.04 c=0.2

(DEA)

Tl (Test Statistic)

Level of Significance

0.5

0.05

0.5

0.05

c = 0.4

c = 0.6

c=0.8

c = 1.

(MAD)

0.5

0.05

0.437

0.10

0.375 0.437

>0.10

0.10

0.437

0.10

gains in aggregate productivity since introduction of the gain-sharing program. This reflects the weights assigned to individual input productivities

(based on the actual cost shares of various inputs) in computing aggregate

productivity as well as the productivity gains experienced by indirect labor,

materials, and to a lesser extent manufacturing services.

We next compare the results of the nonparametric analysis with the

conclusions based on a parametric estitimticm of the input consumption

function. Using mo<tel [C], tl^ latter requires a jKinuneiric specification of

the functional relationship between iapats and o u ^ t s as well as distiibutional assumptions about the random error term and inefficiency conqtoi^nts.

341

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

TABLE 3A

Welch's Two-Means Test on Materials Productivity

c = 0.04(DEA)

c = 0.2

c = 0.4

c=0.6

c = 0.8

c=1.0

c= 1.2 (MAD)

95% Conf. Interval

for Difference in

Average Productivity

T (Test

Statistic)

Degrees of

Freedom

Level of

Significance

(0.032, 0.245)

(0.032. 0.245)

(0.022. 0.248)

(0.022.0.251)

(0.015. 0.264)

(0.011.0.301)

(0.010. 0.305)

2.71

2.71

2.49

2.48

2.34

2.29

2.27

22 0

22.0

21.7

21.3

19.5

16.2

16.0

0.0065

0.0065

0.011

0.011

0.015

0.018

0.019

TABLE 3B

Mann-Whitney Test on Materials Productivity

Point Estimate

for Difference in

Average Productivity

95.4%

Confidence

Interval

W (Test

Statistic)

Level of

Significance

0.163

0.163

0.1591

0.1566

0.1395

0.1694

0.1686

( 0.001.0.25)

( 0.001.0.25)

(-0.002. 0.276)

(-0.002,0.280)

(0. 0.3)

(0.002. 0.331)

(0. 0.322)

133

133

131

129

133

134

133

0.0233

0.0233

0.0309

0.0405

0.0233

0.0201

0.0233

c = 0.04(DEA)

c = 0.2

c = 0.4

c = 0.6

c = 0.8

c=1.0

c= 1.2 (MAD)

TABLE 3C

Kolmogorov-SmirnofF Test for Materials Productivity

c = 0.04 c = 0.2

(DEA)

T,* (Test Statistic)

Level of Significance

0.562

0.025

0.562

0.025

= 0.4

c = 0.6

c = 0.8

c=1.0 c=1.2

(MAD)

0.5

0.05

0.5

0.05

0.5

.05

0.562

0.025

0.437

0.10

In Tables 6A and 6B we describe the COLS and MLE estimates assuming

a translog production function that includes as special cases the CobbDouglas and CES functional forms.

Table 6A indicates productivity gains significant (at the 5% level) in

indirect lahor, materials, and manufacturing services (see estimates of 5,).

The asymptotic f-statistics should be interpreted cautiously because the sample size is 48 and small sample distributions of COLS are not known. Many

of the coefficients on ttie loglinear and logquadratic (translog) terms are not

significant, arguably due to multicollinearity among the independent variables. Furttermore, as discussed by Caves and Christensen (1980) and

342

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

TABLE 4A

Wekh'!s Two-Means Test cta Maniifactoring Services ProdiKtivity

0 = 0.04 (DEA)

0 = 0.2

0 = 0.4

0 = 0.6

0 = 0.8

0 = 1 . 0 (MAD)

95% Conf. Interval

for Difference in

Average Productivity'

TfTest

Statistic)

Degrees of

Freedom

Level cf

Significance

(-0.15,0.376)

(-0.15,0.376)

(-0.15,0.380)

(-0.15,0.381)

(-0.16,0.387)

(-0.16,0.414)

0.%

0.96

0.96

0.95

0.96

0.97

10.1

10.1

9.8

9.7

9.6

lO.l

0.18

018

0.18

0.18

0.18

0.18

TABLE 4B

Mann-Whitney Test on 1Vfanufacturing Services Productivity

Point Estimate

for Difference in

Average Productivity

95.4%

Cor^idence

Interval

W (Test

Statistic)

Level of

Significance

0.0712

0.0172

0.0807

0.0766

0.0766

0.0957

(-0.06,0.21)

(-0.06,0.21)

(-0.05,0.23)

(-0.05,0.23)

(-0.05,0.22)

(-0.07,0.29)

119.5

119.5

117.5

116.5

115.5

116.5

0.1223

0.1223

0.1489

0.1636

0.1792

0.1636

0 = 0.04 (DEA)

0 = 0.2

0 = 0.4

0 = 0.6

0 = 0.8

0 = 1 . 0 (MAD)

TABLE 4C

Kolmogorov-Smimoff Test for Manufacturing Services Productivity

T,* (Test Statistio)

Level of Signifioanoe

0 = 0.04

(DEA)

0 = 0.2

0 = 0.4

0=0.6

0.313

>0.10

0.313

>0.10

0.313

>0.10

0.313

>0.10

0 = 0.8

0.313

>0.10

0=1.0

(MAD)

0.375

>0.10

Bamett and Lee (1985), the regularity conditions of monotonicity and strict

quasi-concavity are often violated at many points of data sets. Etesides, the

translog form requires the estimaticHi of a large number of parameters relative

to the 48 available observsrtions.

In addition, the COLS estimation suffers from "Type I" failure for

direct labor, indirect labor, and materials as discu^ed by Olson, Schmidt,

and Waidman (1980), because tl^ third mrni^ot of the OLS residuals is

positive, implying tiiat a , is negative. Hie bias of 0.073 in die i n t e n d

term in the case of manufacturing %rvices is cfHiected using tiie n^tiKxloIogy

described in Section 3.

In order to overconw tiie "Type I" failure in the COiJS estimatkm, we

also estimate the translog infmt consuroiHion function using Maximum Like-

NfEASUREMENT OF PRODUCnVlTY IMPROVEMENTS

343

TABLE SA

Welch's Two-Means Test on OveraO Productivity

95% Conf. Interval

for Difference in

c = 0.04 (DEA)

c=0.2

c=0.4

0=0.6

c = 0.8

c=1.0

c= 1.2 (MAD)

Average Productivity

T(Test

Statistic)

Degrees of

Freedom

Level of

Significance

(-0.064,0.293)

(-0.064,0.293)

(-0.068,0.297)

(-0.072,0.304)

(-0.077,0.316)

(-0.078,0.336)

(-0.078,0.341)

.45

.45

.42

.40

.37

.41

.42

9.5

9.5

9.3

9.3

9.1

9.2

9.2

0.091

0.091

.094

0.097

0.10

0.096

.095

TABLE SB

Mann-Whitney Test on Overall Productivity

Point Estimate

Average Productivity

95.4%

Confidence

Interval

W (Test

Statistic)

Level of

Significance

0.0904

0.0904

0.0928

0.0852

0.0799

0.0894

0.0914

(-0.012,0.191)

(-0.012, 0.191)

(-0.015,0.194)

(-0.022,0.204)

(-0.024,0.222)

(-0.012,0.242)

(-0.020 0.242)

126.5

126.5

129.5

128.5

126.5

129.5

129.5

0.0557

0.0557

0.0379

0.0432

0.0557

0.0379

0.0379

for Difference in

c = 0.04 (DEA)

c = 0.2

c=0.4

c = 0.6

c=0.8

c=1.0

c= 1.2 (MAD)

TABLE SC

for Overail Productivity

= 0.2

c = 0.4

c = 0.6

c = 0.8

c= I

(DEA)

T|* (Test Statistic)

Level of Significance

0.437

0.10

(MAD)

0.437

0.10

0.437

0.10

0.437

0.10

0.437

0.10

0.437

0.10

0.50

0.05

lihood Estimation (MLE). This is done using the program LIMDEP (see

Greene [1985]). The results reported in Table 6B are very similar to the

COLS estimation with consumption of indirect labor, materials, and manufacturing services significantly lower in the post-gain-sharing period (see

estinuttes of 5) resulting in greater productivity and efficiency. It is interesting to note that the MLE estimate of <Ty, turns out to equal zero in the

case of direct labor, indirect l^x>r, and materials. Consequently, for these

inqputs, tte COLS estimates are maximum likelihood resulting in identical

panaaster estimates in T^les 6A and 6B.

results of the translog model are difficult to interpret in a straight-

344

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

TABLE 6A

Estimates of the Translog COLS Model

log X, = ao, + a,i log y,, + a^, log y,, + a,, (log y,,)'

+ a* (log ya)' + %, (log y,,) (log y^) - 8,D, + e,

where i = l , . . . , 4 ; t = l

48,

and €„ = !!„ + v«. u. ~ N(0, o i ) , v, ~ N*(0, aid

Estimates

ao

a,

aj

a3

a,

as

8

Estimate of Bias

in

Intercept

Direct

Labor

Indirect

Labor

Materials

Cost

Manitfacturing

Services

16.697

(1.98)

-2.891

(-1.37)

-0.102

(-0.12)

0.305(2.07)

0.057

(1.77)

-0.067

(-0.63)

-0.013

(-0.61)

33.990~

(3.24)

-7.072~

(-2.69)

-0.529

(-0.50)

O.537~

(2.93)

0.031

(0.76)

0.037

(0.28)

-7.793

(3.02)

-13.980

(-0.72)

3.747

(0.77)

1.201

(0.61)

-0.271

(-0.79)

-0.139

(-1.86)

0.107

(0.43)

0.162~

(3.24)

1.182

(0.40)

1.900

(1.59)

0.170

(0.82)

0.081

(1.80)

-0.406~

(-2.73)

0.065~

( 2.16)

—

—

—

0.073

0.08r

Figures in parentheses indioate t-statistios.

The superscript ~ indicates a ooeffioient signifioant at the 5% level.

TABLE 6B

Estimates of the Translog MLE Model

log X, = aa + a,, log y,, + aj. log y^ + a,, (log y,,)'

+ a4, (log ya)' + a,, (log y,,) (log y j - 8,D, + e,,

where i = l , . . . , 4 ; t = l , . . . , 4 8 ,

and €, = u,, + V,. u, ~ N(0, ai), v, ~ N*(0, al,)

Estimates

Direct

Labor

Indirect

Labor

Materials

Cost

Mantrfacturing

Services

16.697

(1.98)

-2.891

(-1.37)

-0.102

(-0.12)

0.305(2.07)

0.057

(1.77)

-0.067

(-0.63)

-0.013

(-0.61)

33.t«6~

(3!24)

-7.072~

(-2.69)

-0.529

(-0.50)

O.537~

(2.93)

0.031

(0.76)

0.037

(0.28)

0.081(3.02)

-13.975

(-O.72)

3.747

(0.77)

1.201

(0.61)

-0.271

(-0.79)

-0.139

(-1.86)

O.tO7

(0.43).

0.162"

(3.24)

-5.S76

(-0.32)

1.075

(0.22)

1.552

(1.21)

0.137

(0.42)

0.067

(I.M)

-0.331(-2.06)

0.047~

(1.96)

Figures in {HuentlKses indioate t-statistios.

The superscript — indicates a ooefficwnt significant at the 5% tevel.

MEASUREMENT OF PRODUCTIVITY IMPROVEMENTS

345

TABLE 7A

Estimates of the LogUnear COLS Model

log X, = aa -I- a,, log y,, -I- aj, log y^ - 8 A + e,,

where i = l , . . . ,4; t = l , . . . ,48,

and e. = u, + v,. u, ~ N(0, a^), v« ~ N*(0, al,)

Estimates

Direct

Labor

Indirect

LtUmr

Materials

Cost

Manufacturing

Services

3.638"

(10.97)

0.725"

(16.34)

0.213"

(8.47)

-0.008

(-0.36)

6.988"

(16.76)

0.352"

(6.32)

0.135"

(4.28)

0.093"

(3.35)

-0.449

(-0.61)

0.842"

(8.56)

0.0514

(0.92)

0.164~

(3.36)

-0.024

Estimate of Bias

in Intercept

0.641"

(9.99)

0.237"

(6.54)

0.073"

(2.27)

0.105

Figures in parentheses indicate t-statisdcs.

The superscript ~ indicates a coefficient significant at the 5% level.

TABLE 7B

Estimates of the LogUnear MLE Modei

log x, = ao, + a,, log y,, + a,, log y^ - 8 A + e,

where i = l

4; t = l

48,

and e. = u. -H V. u. ~ N(0, ai), v» ~ N*(0, aid

Estimates

Direct

Labor

Indirect

Labor

Materials

Cost

Manitfacturing

Services

3.638"

(10.97)

0.725"

(16.34)

0.213~

(8.47)

6.988"

(16.76)

0.352"

(6.32)

0.135"

(4.28)

0.093"

(3.35)

-0.449

(-0.61)

0.842"

(8.56)

0.051

(0.92)

0.164"

(3.36)

0.412

(0.75)

0.644"

(10.27)

0.201"

(5.32)

0.062"

(2.12)

(-0.36)

Figures in {xirentheses indicate t-statisdcs.

The superscript ~ indicates a coefficient significant at the 5% level.

forward manner because of the presence of second-order terms. Further, as

noted earlier, the results are adversely affected by multicollinearity among

the indepen^nt variables and the large number of parameters estimated

relative to available oteervations. To provide a partial resolution to these

issues, we estim^e a restiicted form of the translog, the logline^ functional

form. TTie results, described in Tables 7A and 7B, sue very similar to those

obtaiiKd in tiw more general translog model. The gain-sharing agreement

346

JOURNAL OF ACCOUNTING, AUDITING AND FINANCE

has a positive impact on productivity of indirect labor, materials, and manufacturing services. Once again the COLS estimations presented in Table

7A suffer from "Type I " failure due to negative estimates for av. The

loglinear form is re-estimated using MLE (see Table 7b) and yields estimates

very similar to those obtained using COLS. In the cases of' 'Type I'' failures,

MLE estimates av to equal zero.

The results of the nonparametric and parametric stochastic frontier analyses are remaricably similar. They suggest that the gain-sharing progr^n

has a positive effect on indirect labor, manufacturing services, and materials

productivity and relatively little effect on direct labor. Our conclusions

appear to be robust to the assumed functional forms ofthe input consumption

functions although we are somewhat skeptical about the reliability of the

materials consumption data. Nevertheless, the consistency ofthe parametric

analysis with the stochastic nonparametric estimation increases the degree

of confidence in our analysis.

REFERENCES

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

Aigner. D. J.. C.A.K. Lovell, and P. J. Schmidt. "Formulation and Estimation of Stochastic

Frontier Production Models." Journal of Econometrics (19T7). pp. 21-37.

Aigner. D. J.. and S. F. Chu, "On Estimating the Industry Production Function," American

Economic Review (1968). pp. 826-839.

Banker. R. D.. "Estimating Most Productive Scale Size Using Data Envelopment Analysis."

European Journal of Operational Research (July 1984). pp. 35-44.

Banker. R. D.. "Productivity Measurement and Management Control," in The Management of

Productivity and Technology in Mamrfacturing. P. Kleindorfer (ed.) (New Yoric: Plenum, 1985).

Banker, R. D.. "Stochastic Data Envelc^ment Analysis," Camegie Mellon University, mimeo

(1986a).

Banker. R. D.. "Maximum Likelihood. Consistency and Data Bivelopment Analysis." Carnegie

Mellon University, mimeo (1986b).

Banker. R. D., A. Chames, and W. W. Co<^r, "Models for the Estimation of Technical and

Scale Inefficiencies in Data Envelopment Analysis." Management Science (September 1984),

pp. 1078-1092.

Banker. R. D., and A. Maindiratta. "Piecewise Loglinear Estimation of Efficient Production

Surfaces." Management Science (January 1986), pp. 126-135.

Banker. R. D.. and A. Maindiratta. "Nonparametric Analysis of Technical and Allocative Efficiencies in Production," Econometrica, in press (1987).

Banker. R. D., and R. C. Morey. "Efficiency Analysis for Exogenousiy Fixed Inputs and

Outputs." Operations Research (1986a), pp. 513-521.

Banker, R. D., and R. C. Morey, "Data Enveic^Mnent Analysis with OtfegcHica] Inputs and

Outputs." Management Science (December 1986b), i^. 1615-1627.

Banker. R. D., R. F. Conrad, and R. P Strauss, "A Cm^karative Af^licalion of DEA and

Translog Methods: An Illustrative Study of Hospital Production," Management Science (January

1986), pp. 30-44.

Banker, R. D., and S. M. DaJar, ProductivityAccomtingfiirMimt^tmingOperations,

research

monograph commissioned by the American Accounting Association, in ptcss (1987a).

Banker, R. D., and S. M. Datar, "Accounting fm Ldx>r Productivity in Manufacturing Operalmas: An Apfdicitfiai," in Field Studies in Management AcoomUing and ConOxA, W. Brans

and R. Ka|4an (eds.), (Cambrid^, Mass.: Harvad Business School Press, forthcoming [1987b]).

Bamett, W. A., and Y. W. Lee, "The Global Prcqxsrties of the Minflex Laurent, Genoalized

Lemtief and Traiisl<^ FlexiMe Functicnal Fffltns," Ectmometrica (1985), RI. 1421-1437.

MEASUREMENT OF HiODUCTIVITY IMPROVEMENTS

16.

347

Bazaraa, M. S., and C. M. Shetty, Nonlinear Programming: Theory and Applications (New

Yoric: Wiley, 1979).

17. Bessent, A., W. Bessent, J. Kennington, and B. Reagan, "An An>lication of Mathematical

Programming to Assess Productivity in the Houston Independent School District," Management

Science (December 19S2), pp. 1355-1367.

18. Byrnes, P., R. Fare, and S. Grosski^f, "Measuring Productivity Efficiency: An Application to

Illinois Strip Mines," Management Science (June 1984), pp. 671-681.

19. Caves, D. W., and L. R. Christensen, "Global Properties of Flexible Functional Forms," American Economic Review (1980), K>. 422-432.

20. Chmnes, A., W. W. Cooper, and E. Rhodes, "Measuring the Efficiency of Decision-Making

Units," European Journal of Operational Research (1978), pp. 429-444.

21. Chames, A., W. W. Cooper, and E. Rho(fes, "Evaluating Program and Managerial Efficiency,"

Management Science (June 1981), pp. 668-697.

22. Conover, W. J., Practical Nonparametric Statistics (New Yoilc: Wiley, 1980).

23. Davis, H. S., Productivity Accounting, The Wharton School of the University of Pennsylvania,

Industrial Research Unit (1955). (Reprint 1978.)

24. Gieene, W. H., "LIMDEP" (New York, 1985).

25. Hildenlwand, W.,"Short-run Production Functions Based on Micro-data," Econometrica (September 1981), pp. 1095-1125.

26. K^lan, R. S., Advanced Management Accounting (Ea^viooACX\fk, N.J.: Prentice-Hall, 1982).

27. Mann,M. B.,andD. R. Whitney, "On a Test of Whether One or Two Variables is Stochastically

Larger Than the Other," Annals of Mathematical Statistics (1947).

28. Meeusoi, W., and J. van der Broeck, "Efficiency Estimation from Cobb-Douglas Production

FuncdcMis with Composed Error," Intemational Economic Review (1977), |^. 435-444.

29. Olson, J. A., P. J. Schmidt, and D. M. Waldman, "A Monte Carlo Simuladon of Esdmators of

Stochastic Frontier Producdon Funcdons," Journal cf Econometrics (1980), pp. 67-82.

30. Patell, J. M., "Corporate Fmecasts of Eamings per Share and Stock Price Behavior," Journal

of Accounting Research (1976), pp. 246-276.

31. Richmond, J., "EstimatingtheEfiiciencyofProducdon,"/n/erna(iona/£cono/Ric/?evi>H'(l974),

K>. 515-521.

32. Schii^jer, K., and R. Thompson,' 'The Impact of Merger-Related Reguladons on the Shareholders

of Acquiring Firms," Journal of Accounting Research (1983), pp. 184-221.

33. Varian, H., "The Nonparametric Af^noach to Production Analysis," Econometrica (1984),

I^. 579-597.

34. Weinsein, M. A., '"Vas Sum of Values fh>m a Normal and a Truncated Nonnal Distribution,"

Technometrics (1964), {^. 104-105.

35. Welch, B. L., "Tte Significance of the Difference between Two Means When the Population

Variances Are Unequal," Biometrika (1937), pp. 350-62.

36. Zellner, A., J. Kmento, and J. Dreze, "Specificadon and Esdmadon of Cobb-Douglas Production

FuDcdon Moifels," Econometrica (1966), pp. 784-795.