OLS AND FRONTIER FUNCTION ESTIMATES ... AVERAGE COST FOR TENNESSEE LIVESTOCK ...

advertisement

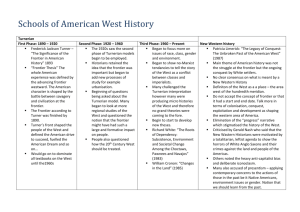

SOUTHERN JOURNAL OF AGRICULTURAL ECONOMICS DECEMBER, 1983 OLS AND FRONTIER FUNCTION ESTIMATES OF LONG-RUN AVERAGE COST FOR TENNESSEE LIVESTOCK AUCTION MARKETS Dan L. McLemore, Glen Whipple and Kimberly Spielman Considerable research has been conducted to explore economies of size in the livestock auction market industry. Since auction market cost functions are expected to conform to microeconomic theory, conclusions regarding industry economies of size are often derived from estimated long-run average total cost (LRATC) functions (French; Stoddard). The LRATC function suggests the least-cost firm size, as well as the structure of size economies for the industry. Previous economies-of-size research has generally used the least squares method or the economic-engineering method to estimate LRATC functions (French; Bressler; Polishuk and Buccola; and Johnson). The frontier function method has been suggested as an alternative to these methods (Bressler; Miller and Nauhein; Seitz). Even though use of a frontier function is theoretically appealing in some cases, its application in economies-ofsize research has not been widespread (Bressler; French; Farrell and Fieldhouse; Lesser and Greene). The purpose of this paper is to evaluate the frontier function method of estimating an LRATC function in contrast to the ordinary least squares (OLS) method. Both methods will be applied to evaluate size economies in the Tennessee livestock auction market industry. METHODOLOGY Typically, the OLS method uses cross-section data in a regression of average total cost against output volume to estimate an LRATC function. Recent studies utilizing OLS have confirmed that cost economies do exist in auction markets (Wootan and McNeely; Grinnell and Shuffett; Grimes and Cramer; Wilson and Kuehn). A frontier function estimate of LRATC is an envelope curve fitted to the bottom of the point scatter of average cost plotted against volume. A frontier function may be estimated by several methods (Farrell and Fieldhouse; Aigner and Chu; Timmer; Hazell). This study incorporates the minimum absolute deviations (MAD) method developed by Hazell. The MAD estimate of LRATC at a given output minimizes the sum of the deviations of estimated average total cost from the observed average total cost, assuming that the estimated average total cost is less than or equal to observed average total cost. Although the frontier function has not been widely used by researchers to estimate industry cost functions, this approach may yield a more appealing estimate of the LRATC function than the OLS method. Observations of average cost probably represent firms operating at various points along numerous short-run average total cost (SRATC) curves. It is unlikely that each firm would be operating at the tangency between its SRATC and the industry LRATC during a given time period. Each observation on SRATC will either be on or above the LRATC, and it is probable that most of the observations will be above the LRATC. Thus, cross-section data for an industry would include firms operating not only with a variety of plant capacities but also at a variety of volumes for a particular plant capacity. Although many factors may influence average total cost in the short run, the LRATC function defines the relationship between cost and volume only. Since annual plant volume from a cross section of firms would reflect both short- and long-run factors, one would expect a range of average total costs to be observed at each plant volume. OLS estimation of LRATC produces a function which lies as near the mean of the average total costs for a certain size firm as allowed by the particular functional form used. The OLS estimate is a useful predictor of short-run average cost for a range of plant sizes, but would overestimate LRATC at a particular output volume. It is clear from economic theory that, at any given volume, the firm operating at a lower SRATC is operating nearer the LRATC. Thus, a frontier function fitted to the lower extreme of the scatter of average cost-output volume observations would more closely approach the theoretical notion of a LRATC function which is envelope to the industry's SRATC curves. Even though the frontier function more accurately resembles the theoretical LRATC curve, if none of the observed firms were operating on the LRATC curve, the estimated frontier function would overestimate the actual LRATC curve. Even so, the overestimation bias would likely be less than that of the OLS estimate. Data measurement error could affect the frontier function estimate more than the OLS estimate. The location of the frontier function is most dependent on the observations with lower SRATC for any given volume. Thus, errors in measurement in these few observations may disproportionately affect the estimated function. Dan McLemore is a Professor, Glen Whipple an Assistant Professor, and Kimberly Spielman a Graduate Research Assistant, Department of Agricultural Economics and Rural Sociology, University of Tennessee. 79 With large measurement error, the frontier function estimate could be below the actual LRATC. Since observations on average total cost and volume are not expected to be normally distributed about the estimated frontier function, statistical measures of fit or significance do not exist. The sum of the absolute deviations of the estimated average total cost from observed averge total cost provides a measure of fit for the frontier estimate. This measure is useful for comparisons of alternative frontier estimates. The sum of the absolute deviations does not, however, provide an absolute measure of fit or significance, nor is it useful for comparison of the frontier function with estimates utilizing other techniques, such as OLS. For expositional purposes, assume an LRATC function of the form: Yi = a + (1) n . Yi maximizes A frontier function of form (1) may be estimated by restricting: E (a + 3X). Thus, y, may be eliminated and the optimizing criterion restated: n (5) maximize: E (o + 3Xi), i= subject to the restrictions that: (4) ot + 3X,1 Yl + p3Xn Yn. This problem can be solved using linear programming. To allow ox and 3 to assume negative as well as positive values, the intercept and Xi terms must be included twice-once with negative and once with positive signs. The linear programming problem becomes: n (6) Maximize: O i n (li) + n Pi E (Xi) + i= (7) Subject to: (-l) 2 + i=l n ,32 E (-Xi) i= cl (1) + o2 (-1) + Pi(XI) + cx(l) + C-2(-1) (xl,,a2, , 2 : 0) 13(-XI) ; Y P2(-Xn) Yn ~ + PI(X) + a + 15x1 Y,'whichever The maximizing criterion will force either atl or o 2 in equation (6) to be zero; the nonzero ot I oro 2 is an estimate of a in equation (1). Likewise, either 13 or 12, is nonzero, is an estimate of 3 in equation (x + Y2 ( Restriction (2) can be described as: X2 •..... ~...• ax + p3Xn . •• •.. Y,. Since yi is constant for any given observation, minimizing 80 3Xi) oL + 3Xi X for each observation i. (This is the same as restricting E, > 0 for all i.) Only the most efficient of the observed firms will satisfy the equality since the remainder of firms will produce at a cost above the frontier function. An infinite set of a ox and 3 will satisfy restriction (2). Thus, to estimate a unique frontier function, an optimizing criterion is needed. The MAD method minimizes the absolute value of the deviations of the estimated average total cost from the observed average total cost. This is the same as minimizing the linear sum of errors (Ei) and causes the estimated function to lie as near the center of the average cost-volume point scatter as possible, subject to restriction (2). Summing over observations (i) and rearranging equation 1, the optimizing criterion may be mathematically described as: n n n (o + 3Xi). (3) minimize: E E i = E Yii=l i=l i=l (4) + ,Xi + Ei Yi = the actual total cost for market i Xi = the volume (output) handled by market i Ei = random error. Yi (l i= where: (2) n APPLICATION TO THE TENNESSEE .LIVESTOCK AUCTION MARKET INDUSTRY LRATC functions for the Tennessee livestock auction market industry were estimated using both OLS and frontier function methods. Accounting records were obtained from the Packers and Stockyards Administration Form 130 for 1978 and 1980.1 A total of 101 observations were available (Table 1). Market output was measured according to volume of livestock handled, gauged in "Animal Marketing Units" (AMU). An AMU has been defined by the USDA as one cow, one calf, three hogs, four sheep or goats, ori one horse or mule (Stoddard). Data from both 1978 and 1980 were combined to estimate the LRATC function. Costs for 1980 were deflated to 1978 dollars by the Index of Prices Paid by Farmers. Economic theory suggests use of an average cost function that would decrease at a decreasing rate over the small firm sizes and may or may not turn up for large sizes. Four functional forms were hypothesized as theoretically appropriate for the Tennessee auction market LRATC: (I) Y -x = (8) Maximize: an(l) + 32. n E + 3X +yX -1 n 1 + Y1 - 1-I3 + =1 X 2 + -1 (9) Subjectto: (,(l) + + Pi a 2 (-1) + X -2 ^ ,1 . Y2. 1 2 1 + t2n(-1) al(1) + Y = oa + P (II) As an example, the linear programming problem for Model IV was: ^ O2(-1) + + P1+ Xn +Y2Y ^ ^ X] ^ X2 ^~~~~XI X (III) lnY = ex + plnX (IV) Y = a + pL -lI 2 X + Y X2 1 -n 2 YX2n Appropriate linear programming formulations were used to estimate frontier functions for the other three functional forms. where: Y = Total cost per animal marketing unit (AMU) X = Number of AMU's handled per year RESULTS Each of these models was used in an OLS regression of average total cost against AMU's. 2 Frontier functions were estimated using the same functional forms. Table 1. Number and Average Volume of Livestock Auction Markets by Size Group, Tennessee, 1978 and 1980 ~VoluhanNumber of Volume handled per year (AMU) Less than 9,000 markets 1978 1980 Average volume Number of Average volume handled (AMU) markets handled (AMU) 7 5,814 14 5,840 9,000 - 17,999 15 13,810 14 13,115 18,000 - 26,999 13 21,648 5 20,892 27,000 - 35,999 4 31,244 6 32,276 36,000 - 44,999 5 39,455 2 40,711 45,000 - 53,999 7 51,453 3 46,046 54,000 or more 4 75,412 2 69,702 55 46 Estimates of the Tennessee auction market industry LRATC function are given in Table 2. The OLS estimates yielded relatively small R 2 's, which seems consistent with the notion that a large part of the variation in observed average total cost is not related to volume in the long run. The wide range of average total costs for a given volume apparent in Figure 1 suggests that large R2 's are unlikely. Model IV was considered to be the best OLS estimator of LRATC based upon R2. 3 Model IV was also considered to be the best frontier function estimate based upon the sum of absolute deviations (1AD). Both OLS and frontier function estimates of Model IV are shown in Figure 1. Results from both the OLS and frontier function estimates indicate that economies of size existed in the industry. However, the two functions differ in the range of volumes over which economies of size appear to be important. The OLS functions for Model IV indicates that the average market must handle almost 60,000 AMU's to achieve 90 percent of the available econ- I The design capacity of auction market facilities cannot be determined from the Packers and Stockyards Administration data. Thus, one cannot determine how near the firms were operating to their short-run minimum cost volumes. The phase of the cattle cycle probably affects volume moving through livestock auction markets in Tennessee. While 1978 represented an intermediate year, cattle numbers were near the low point of the cycle in 1980. This data may contain other flaws common to accounting data. The real costs of auction market operation may not be accurately represented because the accountant's view of costs, reflected in the firm's records, differs from the economist's view. 2 Alternatively, each model was specified to include a binary variable to capture the effect of year (1 if 1978, 0 if 1980) on average total cost. Regression results indicated that the impact of a year on average total costs was an statistically significant at the o = 0.10 level. 2 2 3 Adjusted R's (R) for Models I, II, III, and IV were .132, .205, .180, and .254, respectively. R2 values were derived from R2 values shown in Table 2. R2 for Model III was calculated as indicated in Table 2, footnote b. 81 Table 2. Long-Run Average Total Cost Functions for Tennessee Livestock Auction Markets, 1978 and 1980 Ordinary Least Squares Model 2 Y = a + 8X +YX (I) (II) Y = a + 1~X (III) (IV) + Y- Y = a+ 1-X X MADEstimate of Frontier Function 2 a § Y 5.828 -0.00008643 (0.00002590) 0.0000000008083 (0.0000000003380) R a Y 8 .149 2.454 -0.00001875 7988.542 ~~(1544.801) .213 2.054 2040.385 2.993 -0.15793 (0.03486) .188 3.299 18655.230 (4152.953) ~ 3.826 lnY = a + BlnX a -22806680.290 (8283490.842) b 1.506 .269 CADC 0.0000000002201 229.31 -0.07416 2.103 231.23 233.17 590.455 8154126.868 223.39 a Numbers in parentheses below coefficients are standard errors of estimate. 2 b The R value for Model III was computed by evaluating the estimated equation for predicted average cost in logarithms at each observed volume, obtaining the antilogs of the predicted average costs, computing the deviations of the resulting predicted average costs from the original observed average costs, computing the sum of squares [J(y - 9)2], and using: 2 R = 1_ (y - )2 ;(y- y)2. c SAD represents the sum of the absolute deviations of the observed average costs from the frontier function. d The sum of absolute deviations for Model III was calculated from the observed average costs and the antilogs of predicted average costs. Table 3. Comparison of Long-Run Average Total Cost Functions Derived from Minimum Absolute Deviation Estimation of a Frontier Function and from Ordinary Least Squares for Model 4 12 Li ,, ^ 9~~~~~~~~~S * ~~Average .· 8. So '^' 4a)% . 5,000 6.118 -.312 8.4 2.547 -.302 86.0 7,500 5.381 -.312 32.3 2.327 -.158 92.9 10,000 4.936 -.286 46.8 2.244 -.099 95.6 15,000 4.441 -.234 62.9 2.179 -.051 97.6 20,000 4.175 -.196 71.5 2.153 -.033 98.4 30,000 3.896 -.147 80.6 2.132 -.018 99.1 40,000 3.751 -.117 85.3 2.123 -.012 99.4 50,000 3.663 -.097 88.2 2.118 -.009 99.5 60,000 3.604 -.083 90.1 2.115 -.007 99.6 70,000 3.561 -.072 91.5 2.113 -.006 99.7 90,000 3.503 -.058 93.4 2.111 -.004 99.7 ~' . Ordinary astSquares ' ' ' — *.ar_ ________10 Frontier Function %cost Average Cost %cost economieg total function economieg realized cost elasticity realized (1) (() ($) Volume •(AMU) 5 * <. .' ' • ' ~»~_ ' ____________ _ OLS OLS Cost function elasticity total cost ($) 3 Frontier Function 10 20 30 40 50 60 MU) Volun in Thousands (A. 70 80 90 Figure 1. Long-Run Average Total Cost Functions for the Tennessee Livestock Auction Market Industry Using Ordinary Least Squares and Frontier Function Using ,r.iary Least SqA a And Fro0n tier F unt Methods for Model 41 (1978 and 1980 Data Combined) omies of size (Table 3).4 On the OLS function, elas- ticity of cost with respect to volume declines (sign ignored) at a decreasing rate, but remains at - .058 for 90,000 AMU's. 5 That is, the OLS function declines substantially up to maximum observed volumes. The frontier function estimate for Model IV indicates that auction markets achieve 90 percent of the available economies of size at an output of less than 7500 AMU's. Of available economies, 99 percent are achieved at 30,000 AMU's. For the frontier function, the elasticity of cost with respect to volume reaches -. 051 at 15,000 AMU's, while the OLS function required 90,000 AMU's to reach an elasticity of - .058. Elasticity of average total cost with respect to volume was determined according to: Elasticity = dATC . Vol dVol ATC b Percent cost economies realized was defined as the difference between predicted average total cost (ATC) at the minimum observed volume and predicted ATC at the volume under consideration, divided by the difference between predicted ATC at the minimum oba served volume and predicted ATC at the asymptotic minimum of the function ATCin. vo.- ATCv,0 i LATCin ATCasympt. mi The frontier function estimate indicates that economies of sizes are practically exhausted at relatively small levels of output. CONCLUSIONS The appropriateness of the OLS or the frontier function as an estimator of LRATC depends on the goals 4 Percent cost economies realized was defined as the difference between predicted average total cost (ATC) at the minimum observed volume and predicted ATC at the volume under consideration, divided by the difference between predicted ATC at the minimum observed volume and predicted ATC at the asymptotic minimum of the function. ATCin..vol.- ATCvol.i LATC n vol. -ATCasympt. mn. 5 Elasticity of average total cost with respect to volume was determined according to: Elasticity = dATC . dVol 82 Vol ATC of the researcher. The OLS approach estimates the expected short-run average cost conditions and yields statistical estimates of significance. The frontier function approach provides a more theoretically appealing estimate of LRATC since it is analogous to the envelope concept, although measurement error in a few observations may be more likely to result in misestimation of the LRATC. The OLS estimate indicates that auctions in Tennessee may experience substantial cost economies by increasing volume up to relatively large output levels. Along the frontier function estimate, economies of size are important only at relatively small output levels. Thus, the OLS estimate indicates that economies of size are possible over a wider range of volume in the long run than with the frontier function. In 1978 and 1980 combined, 50 percent of the livestock auctions in Tennessee operated at volumes less than 18,000 AMU's. These data indicate that a large portion of auction market firms operated at volumes that leave substantial cost economies uncaptured, assuming the OLS function to be the appropriate estimate of LRATC. This suggests that the frontier function estimate more accurately reflects observed firm behavior with regard to volume and thus may be the more appropriate estimator of LRATC. REFERENCES Aigner, D., and S. Chu. "On Estimating the Industry Production Function." Amer. Econ. Rev. 58(1968):826-39. Bressler, R. G., Jr. "Research Determination of Economies of Scale." J. Farm Econ. No. 3, 27(1945):526-39. Farrell, M. J., and M. Fieldhouse. "Estimating Efficient Production Functions Under Increasing Returns to Scale." J. Royal Stat. Soc. 125(1962):252-67. French, B. C. "The Analysis of Productive Efficiency in Agricultural Marketing: Models, Methods, and Progress. " In A Survey ofAgricultural Economics Literature, Vol. 1, by Lee R. Martin, pp. 93-206. University of Minnesota Press, 1977. Grimes, Glen, and Charles Cramer. Missouri Livestock Auction Market Operating Costs and Returns. Columbia: University of Missouri Extension Division, C-83212, 1966. Grinnell, G. E., and D. M. Shuffett. An Economic Analysis of Kentucky's Livestock Auction Markets. Kentucky Agr. Exp. Sta. Res. Rep. 22, September 1979. Hazell, P. B. R. "A Linear Alternative to Quadratic and Semivariance Programming for Farm Planning Under Uncertainty." Amer. J. Agr. Econ. 53(1971):53-62. Johnson, P. R. "Some Aspects of Estimating Statistical Cost Functions." J. Farm Econ. 46(1964):179-87. Lesser, W. H., and W. H. Greene. "Economies of Size and Operating Efficiency of Livestock Markets: A Frontier Function Approach." J. NortheasternAgr. Econ. Council No. 1, 9(1980):37-40. Miller, Thomas, and Charles Nauhein. "Linear Programming Applied to Cost Minimizing Farm Management Strategies." J. Farm Econ. 46(1964):556-566. Polishuk, L. M., and S. T. Buccola. Operating Costs of Virginia Livestock Auction Markets: Statistical and Synthetic Methods Analyses. Virginia Polytechnic Institute and State University, Res. Div., Bull. 138, December 1978. Seitz, Wesley. "The Measurement of Efficiency Relative to a Frontier Production Function. " Amer. J. Agr. Econ. 52(1970):505-511. Stoddard, E. D. "An Economic Analysis of Cost of Service and Value of Service Tariffs in the Livestock Auction Industry." Ph.D. dissertation, University of Maryland, Dep. of Agr. and Resource Econ. 1975. Timmer, C. P. "Using a Probabilistic Frontier Production Function to Measure Technical Efficiency." J. Polit. Econ. 79(1971):776-94. Wilson, E. M., and J. P. Kuehn. A Cost Analysis of the Livestock Auction Markets in West Virginia. Agr. Exp. Sta., Bull. 600 T, April 1971. Wooten, C. V., and J. G. McNeely. FactorsAffecting Auction Marketing Opening Costs. Tex. Agr. Exp. Sta., Texas A&M University, Bull. 1056, October 1966. 83