Empirical Evaluation of Selected Hedging

advertisement

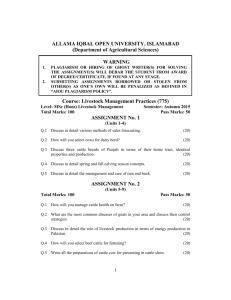

Empirical Evaluation of Selected Hedging Strategies for Cattle Feeders William D. Gorman, Thomas R. Schuneman, Lowell B. Catlett, N. Scott Urquhart, and G. Morris Southward** Several hedging strategies for fat cattle are compared using actual feedlot performance information for a period of 6.5 years and 747 pens of fat cattle. Results show that cattle feeding was not profitable (a $24.50 per head cash market loss) but a carefully chosen hedging strategy could have reduced the loss by 50 percent. This article reports the results of a study which simulated using selected hedging strategies on pens of cattle fed in a commercial feedlot over a period of approximately six and a half years. The simulation process allows estimates of profits (losses) from using the live cattle futures contracts for hedging purposes under near "real world" conditions. Producers, feedlot operators, and investormanagers have been using the futures market for hedging live cattle since its inception in November, 1964. They can use the live cattle futures for hedging in a variety of ways. Hedging all or only a portion of the cattle when they are placed on feed, hedging all or part of the cattle using a selected economic indicator, or hedging and subsequently releasing the hedge according to a specific criteria based on technical trading practices are just a few generalized examples of how cattle feeders may use the live cattle futures market for hedging purposes. These methods are typically referred to as hedging strategies. The performance of various hedging strategies involving the use of live cattle futures has been the topic of several research William D. Gorman, Thomas R. Schuneman and Lowell B. Catlett are respectively Professor, former Graduate Assistant and Associate Professor in the Department of Agricultural Economics and Agricultural Business at New Mexico State University. N. Scott Urquhart and G. Morris Southward are Professors in the Department of Experimental Statistics at New Mexico State University. reports, popular articles, and professional economic articles, [Heifner, 1973; Leuthold, 1974; McCoy and Price, 1975; Menzie and Archer, 1973; Price, 1976; Purcell, 1977; and Purcell and Riffe, 1980]. The above authors specified and evaluated selected hedging strategies. The evaluation criteria generally consisted of comparing profits (losses) and variance of profits of the specified hedging strategies with what would have happened if each of the strategies were used for hedging cattle on feed over a period of several years. Typically the strategies were compared with profits or losses that would have happened if the cattle were fed but not hedged. The strategy that resulted in the greatest average profits and/or lowest variance in profits over the period of time was judged to be the best strategy. Strategies that resulted in higher average profits or lower variance in profits (losses) than the no hedge position demonsrated the possible value of hedging by cattle feeders. All of the above studies estimated profits and or losses from feeding cattle, the no hedge position, by assuming that groups of cattle were fed for a specific number of days under average or typical conditions for a period of years. Most studies placed equal numbers of cattle on feed at regular intervals such as every week throughout the evaluation period. Actual prices occurring at the time were used to estimate the cost of the feeder cattle going into the feedlot, cost of 199 December 1982 feed, and value of fed cattle at the time they were marketed. Typical or average feed conversion ratios and standard feeding periods were also employed. The evaluation process used in these studies to measure the effectiveness of the various hedging strategies and the relationship of the strategies to the no hedge strategy by necessity, held many factors constant that could have under real world conditions affected the relative profitability of the hedging strategies. The unique feature of the research described in this article was that most of the factors controlled by assumptions in previous studies were not controlled because actual feedlot data were used. Analysis Procedure Using actual profits and losses resulting from pens of cattle fed in a commercial feedlot for a period of years as a basis for measuring the effectiveness of selected hedging strategies rather than profits or losses under assumed feeding conditions allowed variation resulting from the following situations to enter into the evaluation process: 1. The pens of cattle, under actual feeding conditions, rarely match up exactly with the total weight of multiples of 40,000 pounds (the amount of one live cattle futures contract); hence, it is not possible to completely hedge the pens of cattle. Each pen was either overhedged or under-hedged depending upon the relationship of the estimated total pounds of fed cattle to be marketed from each pen and the number of futures contracts that would result in the closest number of total pounds. For example, a pen containing 100 head of steers that are expected to weigh 1,050 pounds on the average when sold results in 105,000 pounds of live cattle. The nearest total weight of futures contracts that could be obtained was three contracts weighing a total of 120,000 pounds. This results in having 15,000 more pounds in futures than live cattle, hence even though futures and live cat200 Western Journal of Agricultural Economics tie prices move together, the feeder has an "at risk" position of 15,000 pounds. Should prices of fed cattle and live cattle futures increase by $5.00 per hundredweight, the increased revenue from the sale of the fed cattle in the cash market would not be sufficient to offset the decline in revenue from having to purchase the three futures contracts at the higher price in order to close out the futures. The resulting loss attributable in this situation to not being able to place a perfect hedge in terms of matching total pounds of live cattle with futures contracts would be $750. If the prices of the cash and futures markets had declined by $5.00 per hundredweight there would have been a corresponding profit of $750. The total weight of cattle marketed exactly matched the total weight of futures contracts in previous studies using feeding data controlled by assumptions, i.e. 120 head of 1,000 pound steers marketed totaling 120,000 pounds and three futures contracts totaling 120,000 pounds. 2. Under feeding conditions controlled by assumptions, costs of gains are similar from pen to pen because common feed prices and feed conversion ratios are used for all pens of cattle of the same type. Under actual feeding conditions, feed prices and conversion ratios often vary widely from one pen of cattle to another. It is not uncommon to hedge into a loss situation on a particular pen of cattle even though it was thought to be profitable at the time the hedge was placed, because of substantially underestimating costs of gains. The impact of under or over-estimating costs of gains varies by type of hedging strategy, but it is particularly troublesome with strategies using profit targets based on breakeven costs to initiate and/or release hedges. Using actual feedlot data in the evaluation process allowed the impact of variation in feeding costs and Gorman, Schuneman, Catlett, Urquhart and Southward subsequent errors of estimating breakeven costs to enter into the process. 3. Using actual feedlot data allowed measurement of the impact of feeding various weights, grades, and sex of cattle. The futures contract is based on Choice grade steer cattle, but possibly as many as 40 percent of all fed cattle grade lower than Choice and approximately 40 percent are heifers. The cash market price spreads between Choice and Good or other grades, between steers and heifers, and between various weight classes of market animals, can change during the feeding period and thus influence profits. Source of Feedlot Data A commercial feedlot with a one time capacity of approximately 15,000 head made all of its records available to the researchers from the time it opened in June of 1971. The cooperating lot feeds cattle on a custom basis for ranchers and others interested in feeding cattle. The owners of the feedlot also owned about 15 percent of the cattle fed in the feedlot during the period studied. For accounting purposes however, the ownership of cattle on feed and ownership and operation of the feedlot were treated as separate entities. Cattle fed by the owners of the feedlot were treated identical to and were charged the same rates as customer fed cattle. Although approximately 1,000 pens of cattle were fed in the feedlot, information from only 747 pens was included in the study. Pens of cattle on backgrounding programs for short periods of time before going to pasture were eliminatd from the study as were pens consisting of cows, bulls, and mixed steers and heifers. In addition some 100 pens of cattle on experimental feeding programs were also eliminated.' The 747 pens of cattle (58 percent steers 1The Agricultural Experiment Station of New Mexico, Arizona and Utah had cattle on experimental trials in the feedlot during the time period covered in the study. Hedging Fat Cattle and 42 percent heifers) varied in number, conversion rates, in-weights, out-weights, breeds, and length of time on feed. Feedlot Information Collected Feedlot "summary sheets", which showed actual costs, prices, and profits for individual pens of fed cattle were obtained for each of the 747 pens of cattle. The summary sheets also reported the sex, weights, numbers, and dates the cattle were placed on feed and marketed; costs of the feeder animals, feed, and medical treatment; and feed conversion rates and costs per pound of gain. The feed cost category on the summary sheet included the cost of the feed ingredients plus a charge ranging from $12 to $17 per ton of feed fed for the use of the facilities (actual custom feeding charges over the study period), utilities, labor, management and a contribution to profit to the feedlot owners. Tabulations of the profits (losses) realized for each pen on the summary sheets provided the information for the "no hedge" strategy, i.e. feeding cattle with no regard to futures. In the same manner, information on average profits from feeding steers versus heifers during the period was obtained by sorting by sex before tabulaton. Futures Information For the study, daily futures prices were adjusted for the difference between the reported Omaha cash price and the Texas/New Mexico cash price for Choice grade fed steers, and for the spread between prices for steers and for heifers in order to arrive at appropriate "Localized" futures prices. Brokerage fees for buying and selling futures contracts, which increased during the period, were charged against hedging strategies at the rate of $36, $40, or $50 per roundturn for each contract hedged, depending on the year and the month cattle were placed on feed. Interest on margin deposits for futures contracts was calculated daily using a 10 percent annual rate. Hedging calculations included sales of contracts when cattle were expected to be fin201 December 1982 ished or the closest month beyond, if a contract was not available in the expected delivery month. Daily closing prices on the first day following a purchase or sale in the cash market were used as the futures market trading prices. Since contracts are usually traded only in 40,000 pound units (a standard contract), it was necessary to establish the decision rule of one futures contract for each 40,000 pounds of expected delivery weight, or the weight closest to it. For example, one contract was considered sold if expected delivery weight was 40,000 to 64,000 pounds; and two contracts if 65,000 to 104,000 pounds. The Simulation Process The simulation process involved using information from the feedlot records to predict the quantity of feed needed and the length of time the animals would be on feed for various in-weights and sex of cattle. An estimate of the quantity of feed needed was necessary to estimate feeding costs, and days on feed was needed to estimate interest expense and the date the cattle would be ready for slaughter. Both of these items of information were needed for implementing the hedging strategies. The expected market weight of each pen fed and the projected days on feed were specified as functions of in-weight and sex of the cattle, and the season of the year. The function was estimated by applying least squares regression to the historical feedlot data. The complete historical record on each pen of cattle fed was available to the researchers, but the simulation procedure involved using only that part of the information that was available at the time the pens of cattle were placed on feed. Information on total gain, date marketed out of the feedlot, profit or loss, and other facts that are not known until the cattle are marketed and the pen is closed out was not used in the simulation process prior to the time the information would be available. Information on these items which were needed in the hedging strategies were estimated in order to simu202 Western Journalof Agricultural Economics late, as near as possible realistic conditions. A simplified description of the sequential steps of the simulation process is as follows: 1. Information was obtained on sex, average in-weight, date, and number of animals in the pen from the feedlot records as each pen was placed on feed. 2. Total feedlot gain, feeding cost, interest expense, and days on feed for each pen were estimated using the regression equations developed from the historical data. 3. The date the animals would be ready for market and the total market weight of the pen were estimated. 4. The breakeven price for each of the pens was estimated. Prices for corn and alfalfa hay (f.o.b. the feedlot) prevailing at the time the pen was placed on feed were used to estimate the feeding costs. This assumption was realistic since the feedlot allows feeder customers to lock in feed ingredient prices through prepayments. 5. Decisions on hedging were made according to the rules for each hedging strategy (discussed in a subsequent part of this article). 6. Actual information on feeding costs, breakeven price, total feedlot gain, date marketed and profit or loss for each pen was obtained after the cattle were marketed and -the pen closeout records were prepared. 7. Profits or losses from the futures transactions for each pen were tabulated. 8. The cash market and futures market profits or losses were summed across all pens for each hedging strategy. The first pen used in the simulation process was placed on feed June 1, 1971 and the last pen of cattle was placed in feed January 3, 1977. Hedging Strategies Six hedging strategies were tested (table 1). Strategy 1 was a simple "no hedge" while Gorman, Schuneman, Catlett, Urquhart and Southward c CZ U1) V0 C: () -o u) Al > CL a> ,,, c CZ d) C 0 -a CU ) 0 CZ 0 U ) 0) U) I a) Q) cr CI 0 _0 CU co a) a Hedging Fat Cattle 0 z > DL a CZ 0 0 _0 L a. 3CCZU2 Ž > Q_ a) a) a) 4-, 0 Z U a) P'c CU CU CU CZ n A F-) L-~ CZ-C Ea , c a) L 0 LL 0 CZ N Mc~ CZ ~- - CZ 0 CV CO CZ C: a) U) a) a) U) .r- -C CZ CZ a) a)aU) U) o 0 0) C ._ C U)a)C -" V C: CU U) 0 o0 CZ C o 0 a) C CZU+ a)0 I U) a) CL ICZ E 0 CU n cm cn a) >-Z C a)C U) a) I e U) _ L- I a0) a) .) I-c o- z (JU U)a a) a) > = > a)0 0, U) V - ~~~~ PaU) Lo > 5 o -) (D : o, a) CZ C U-LL V, , 0 c a ~~~0 0 O& CO%C v U) - .2 CZ-t n > 0a )0) a)C- u_ CU V, U) 0 -o-c, o 0) cCU C C > U)~ q F U) , 0 a) I Q) co _0 - co a) - C 0 V) 0) 0 C c -C 0) 0 U) 0) 0 L _-a ~~ ~ O ~~ ~~ U CUUJCUCU Z Jca U) 0a0 ima 0 m -a)C C U) )U) U) LJ C a) co Z a) a) a) U U) U) a) a) a)) (D U) a) a) co ' c: 0CUW~~.I.CU I- Z 0 CU CU u CU - CZ c e-0 5) 0 U a) a) -a co .0 a) coa. CU c _ 0 C U a) : Co a) - C a) Ca a) a) I - a) 0CZi lo a CZU CCC $ cz CZ L - Ia a)~ aa) 0 cC: aa~ EL CL a)ed a~~~~~~~~~~~~~ac aco C>C CUa)a) CZ CLCC aa) CZ ~ a U) a U) c O () C\ a) d) 0) _ .=- C L C' E E CU 0) CZ> >E ~ d a) -6 a) 00 a) z cr U) TC co CO I'l- C\ I U) c a - a)a V) a) " "o C U .2 I ,n I 0- L() O > C CO a) ,_ mIL a) o t0 Co coQ)0 :;-- - -0a)> 0) cn \ CU a) cn -W co II1 > m -i ~cn3 CUN c a)w a a) 0 -r- a) O co UJ1.1_ LU I O 0 aa. Wm- 203 December 1982 strategy 2 was a "routine hedge" such that each pen of cattle was hedged at the beginning of the feeding period and the hedge held until the cattle were sold. These two strategies were included as benchmarks or reference points for other strategies. Strategies 3-6 are a combination of profit targets, moving averages, regression equations and selective profitability measures. Strategy 3 uses the estimated breakeven cost equations and profit targets. The estimated breakeven cost of each pen was calculated and compared to the localized futures price and various profit targets ($1.50-3.00 per hundredweight). If the various profit targets were met, then the cattle were hedged and the hedge retained until the cattle were sold; otherwise the cattle remained unhedged. Strategy 4 used both the 3 and 10 and 4 and 18 day moving averages in conjunction with estimated breakeven costs and profit targets. The strategy allowed for the hedge to be lifted and placed several times during the feeding period. A regression equation was used for strategy 5 to calculate a tolerance interval. The interval predicts where the next day's futures price will be, within specified limits, using the previous eight days' prices. This strategy, like strategy 4, allowed for hedges to be lifted and placed during the feeding period. The last strategy, strategy 6, was designed to allow for not placing cattle on feed if the profit target was not met. If the profit target was met then the cattle were placed on feed, hedged, and the hedge kept throughout the feeding period. Analysis of Results The period studied was separated into two phases, for analysis: the period from June 1, 1971 to August 13, 1973 when prices were generally increasing, and from August 14, 1973 to January 3, 1977 when there were large fluctuations in cash market prices along with a slight downward trend in overall prices. All 747 pens of cattle were used to test strategies 1 through 5 and 242 pens were used for strategy 6. Because of the difference 204 Western Journalof Agricultural Economics in concept and resulting number of pens in the analysis, results of strategy 6 are discussed separately and are not reported in the tables with the other strategies. Strategy 1 - No-Hedge The average cash market loss was - $24.50 per head over the 6.5 years (Table 2). Not all the pens lost money; feeding was profitable with approximately a third of them. Feeding steers gave higher frequencies of large profits and large losses, but the mean loss per head was only slightly greater for steers (- $25.10) than for heifers (-$23.60). The mean loss was higher with steer pens than with heifer pens during the period when live cattle cash market prices were fluctuating or decreasing (Table 3). During the period of increasing prices steer pens yielded a smaller average loss than heifer pens, -$11.70 per head for steers and -$26.60 per head for heifers. Strategy 2 - Routine Hedge The routine hedge would have yielded a mean futures market profit of $4.30 per head for the entire time (Table 2). This offset 18 percent of the - $24.50 per head average loss in the cash market and reduced the combined loss to -$21.20 per head. Slightly more than 50 percent of the pens of cattle would have been hedged profitably, but not profitably enough to offset the unprofitable hedges and losses in the cash market. Hedging the 433 pens of steers would have resulted in an average loss of $1.40 per head in the futures market; where as hedging the 314 pens of heifers would have yielded an average profit of $12.20 per head in the futures market. Strategy 3 - Selective Hedge The selective hedge with a $3 profit target would have yielded a mean futures market profit of $11.50 per head but this was not sufficient to offset the average cash market loss of -$24.50 per head. This strategy, however, would have reduced the cash loss by almost 50 percent, for Gorman, Schuneman, Catlett, Urquhart and Southward 0 a) r^ a) a) o L. 0 o cO ICM I I Hedging Fat Cattle 0000 O)0) C O c I- - I- - I I I I O 000 0 0 co C- cc cI C\ 0 O IC) IC I I I I U) 0 a, U, I E_ a,) 0 (n 00000000000 CN\ -- 0 ci T-co vr- I- w- v-- < Z CO 00 0) N 00 cc\i 0 C CO6 vvT- v- Ir 0) CZ .) 0 co I E E1 6 o. n U) a, a, LO I 0 0 000 0 '' 0 O 000 0 LO 00 00 O C 't co cO C) CO LI CD CD I c) C) LO cTvI I I I I I I I I I oz cn 0. cn ra 0 " < z O - 00000 CO o: o I- -TvZ. 00 - 0 0 r cO O co 1-C o vO - v--w-- '-- oc0 L_ 0 000 O 0 CM a> a, o(1I E CI 0 0 I cM I I o 000 (D Ci ci 4 I LO 't 0 O C\i C6 C' I I 0 r- I I I I cn 0, . 0 mO( a, 00000 < COLO o CO Z 0 oC -- 0 000 Co o0 o0- o-o od CM --- 0 0 0 C - C C6 cZ a) E I- E' a) .r U) a, 4) E IL : 0 00 0C ON 0 LO Co CM c 0 000 0 0 0 CO CMCM vCO O c cO CZ co c- o co 0 000 1) ox Lc t* CO) CM 0 0 Ol o o CO co 0 C-) CZ -c a) U) C6 LO a) O Wh co 0 cc ~Ca, 0~ Ca,u 0) O cs a, (D 0) -o a, a, n a) ,0 a, a ) CD 0 cn 0 a) CM N CY) a, GO CO) v-c a, -o 0) Y a(c3 6 C, _0 Cb co '0 0C c,t c a, En E -o (D cn 0 0 co c- C. a, Cc 4 C) L) co. Ln 205 Western Journalof Agricultural Economics December 1982 CO 0 Co Z 0 0 q o oC L- aC Z I 0 0 I_ C 03 (1) I-cn Q0 a 0 (1 I C\ U) n D O , I c O CZ CZ CM O C (0 00 00 CO CO CO CO 00 C 00 C Z O a O I--, CM Co (O (D CD CO (O Z C> C0 CO 0 (6 D O6 (6 O6 o CO CM C Co CD CM Ct I I I CM O CM I. L C:)I 6g 4) I I I I o o C(D CO CM CM 0 CO I o CD CM Cm a) ) 0) a) a I _ ra CO CM ( 0 c 0s I I I 00000 I- ._ CM CM CM oO 0c z I I Z 0') CO *t 0 a) O0I d) 0o)o) LCO 0000 cn CD (1 W- Co CO CO o CM CM 00 C CO E .- CY co \ CO C< C06 LDBY cn n CO 0000 CO CO O I < CO Co o ? I i _§ 00000 .r, a)Ct$ O6 Z 1- I- C O T- - C\l Co CZ aC it LO O Z I -o Z CM _ I 6q I CO a) Q- I .0? = CL a) . 0 4a) C4) CO CM CM CM CM 3 (0 a: _ :3 -- ) Q E z E z co r CO CO c r ( 3 co CO S 00 Or . . 0000 cn a& CZ1: CO Cd )<S| I O Co C6C 3 I, E 0 O o 0 O 0 O O = c c 0 co co co co 0 - co L6 a/) a) a Q-CZ cn 206 o I a) I Q -0 LO LO o 'n an * 3 Q) Co C . co cn Tco C § CZ ~coTrCD xI a) C .O 0) D' * a) Q a '-Q 0o 0 0 0 0 o0 O 0 < : a a) Q3 4 CMC CMCM I a) o - C i & M co C kE- a)O a a t 'L n Hedging Fat Cattle Gorman, Schuneman, Catlett, Urquhart and Southward During the increasing price phase, Strategy 4 would have yielded an average futures market profit of $15.80 per head. Because the steer pens in that time experienced a relatively small mean cash market loss, - 11.70 per head, a mean profit of $3.30 per head would have resulted. For the decreasing price phase, approximately equal average futures market profits would have resulted for both steers and heifers, $10.60 per head and $10.80 per head, respectively. During this period, however, the average cash market losses were much greater for steers than for heifers. a mean combined net loss of -$13.00 per head fed. Over two-thirds of the pens would have been hedged sometime during the feeding period with selective hedging (Table 4). On the average, hedging with this strategy would have been profitable (futures market only) for both steers and heifers, and also for both the increasing and decreasing price phases of the cattle cycle. Strategy 4 - Moving Averages Strategy 4 (with the $5 and $3 futures profit limits for lifting the hedge) would have resulted in the highest average futures market profit of all the strategies tested, $12.30 per head (Table 2). The average combined loss would have been -$12.20 per head (Table 3). Fifty-eight percent of the pens fed were hedged with 59 percent of the hedges being profitable (Table 5). Strategy 5 - Tolerance Intervals The tolerance interval strategy was not as accurate a predictor of price trends in the futures market as was the moving average technique. A mean futures market profit of TABLE 4. Number of Roundturns for Individual Pens of Cattle for Specified Hedging Strategies.a Strategy 1 No Hedge 2 Routine Hedge 3 Selective Hedge 4 Moving Averages 5 Tolerance Intervals Profit Target Limits ($/cwt.) 0 1 2 3 4 --- 747 0 NA 747 NA NA NA NA NA NA 3 5 and 3 5 and 3 217 313 262 530 429 269 NA 5 163 NA 0 38 NA 0 15 Number of Roundturns aA roundturn is defined as selling a futures contract and subsequently buying an offsetting contract. TABLE 5. Frequency of Pens Traded (Hedged) Versus Profitable Trades for Specified Hedging Strategies. Strategy Profit Target Limits ----- $/cwt.) ----- 1 No-Hedge 2 Routine Hedge 3 Selective Hedge 4 Moving Averages 5 Tolerance Intervals Pens Tradeda Profitable Tradesb ------------------(percent) ------------------- --- 0 100 0 56 3.00 5.00 and 3.00 5.00 and 3.00 71 58 65 57 59 64 aPens traded in the futures market as a percent of all pens fed. bProfitable trades in the futures as a percent of pens traded. 207 Western Journalof Agricultural Economics December 1982 $7.20 per head for the tolerance interval strategy would have reduced the mean cash loss by 30 percent to - $17.30 per head. This strategy was not successful during the increasing price phase of the cattle cycle resulting in an average loss in the futures market of -$1.40 per head. The decreasing price phase produced a mean futures market profit of $11.20 per head. Strategy 6 - Investor-Feeder Strategy Only 242 of the possible pens of cattle met the strategy conditions and hence would have been placed on feed and hedged with this strategy. An average futures market profit of $18.10 per head would have resulted on the 242 pens. This profit in the futures would have offset the average cash market loss of - $4.81 per head to produce an average combined (cash and futures market) profit of $13.25 per head over the period. Although this strategy was profitable for an investor-feeder, it was not as profitable as it appeared at the time the 242 pens were placed on feed. If a perfect hedge had been realized each time, the investor-feeder would have made a combined cash and futures market profit of approximately $3 per hundredweight, corresponding to his profit target, or about $27 to $30 per head, depending upon the market weight of the cattle. Average profit would actually have been only approximately half of the amount estimated, indicating that there were problems. The cause of the lower profits was one or a combination of the following factors: 1) accuracy of estimating breakeven costs; 2) changes occurred in the basis during the feeding period (local and futures prices); 3) the gross weight of cattle marketed was not equal to the gross weight of the futures contract (error in estimating total gains); 4) the cash market prices and the futures market prices (adjusted for location bases) did not coincide when the cattle were marketed; or 5) a combination of the above. 208 Remarks On the average, feeding cattle in the study feedlot was not profitable during the 6.5 years studied. The average cash market loss was -$24.50 per head. A carefully chosen hedging strategy, however, could have reduced the average loss on the 747 pens studied by nearly 50 percent. Because both cash and futures market profits varied greatly over time and by sex of animal fed, certain hedging strategies proved highly profitable under particular circumstances. But none of the strategies designed for the operator interested in keeping his feedlot full would have resulted in an average futures market profit greater than the average cash market loss. The investor-feeder could have profitably fed cattle so long as he fed only those pens that could be profitably hedged in the futures market when they were placed on feed, at a price of at least $3 above estimated breakeven costs. These results compare favorably with other studies. Menzie and Archer concluded in their study that not all pens of cattle should necessarily be hedged and that feeding and hedging only when "projected returns" exceeded estimated costs of feeding involves almost no risk at all. These results verified that not all pens of cattle should be necessarily hedged but showed that some risk remained even when estimated breakeven costs techniques were used. This study reinforces Purcell's finding that moving average strategies consistently produce superior results over other strategies and that some selective hedging program is needed in lieu of either a "no hedge" or "routine hedge" program. The period of the study was characterized by wide fluctuations in prices for cattle and feed grains. In addition, the study period included only part of a cattle price cycle. A longer period might produce different results. Gorman, Schuneman, Catlett, Urquhart and Southward References Gorman, William D. et al. Evaluation of Selected Hedging Strategies for Cattle Feeders. New Mexico State University Agricultural Experiment Station Research Report 396, November 1979. Heifner, Richard G. Hedging Potentialin Grain Storage and Livestock Feeding. Washington, D.C.: U.S. Department of Agriculture, Agricultural Economics Report No. 238, January 1973. Leuthold, Raymond, "Price Performance on Futures Market of a Non-Storable Commodity: Live Beef Cattle." American Journal of Agricultural Economics, 56(1974):271-79. Hedging Fat Cattle Menzie, Elmer L. and Thomas F. Archer. Hedging as a Marketing Tool for Western Cattle Feeders. The University of Arizona Agricultural Experiment Station Technical Bulletin No. 203, May 1973. Price, Robert V. "The Effects of Traditional and Managed Hedging Strategies for Cattle Feeders." Unpublished M.S. thesis, Department of Agricultural Economics, Kansas State University, 1976. Purcell, Wayne D. "Effective Hedging of Live Cattle." Commodities. July 1977. Purcell, Wayne D. and D. Riffe. "The Impact of Selected Hedging on the Cash Flow Position of Cattle Feeders." Southern JournalAgricultural Economics, 12(1980):85-94. McCoy, John H. and Robert V. Price. Cattle Hedging Strategies. Kansas State University Agricultural Experiment Station Bulletin No. 591, August 1975. 209 December 1982 210 Western Journal of Agricultural Economics