Top Incomes in the Long Run of History

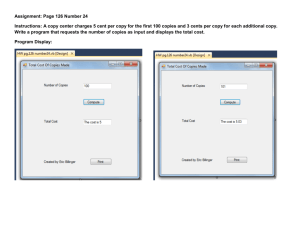

advertisement