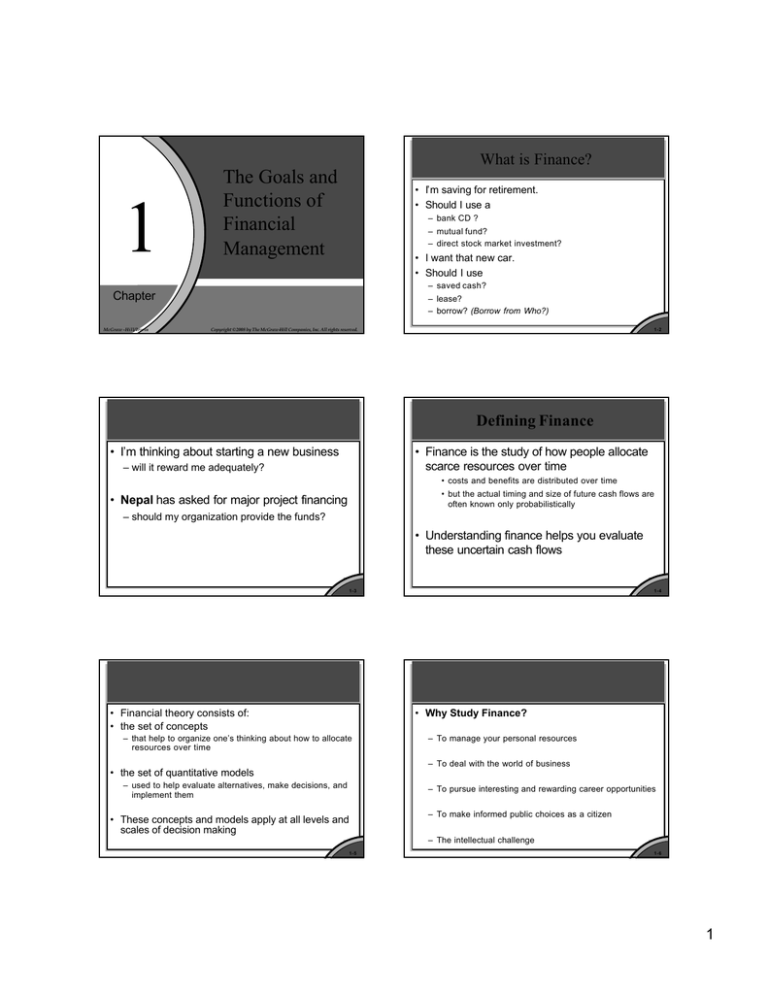

What is Finance?

1

The Goals and

Functions of

Financial

Management

• I’m saving for retirement.

• Should I use a

– bank CD ?

– mutual fund?

– direct stock market investment?

• I want that new car.

• Should I use

– saved cash?

Chapter

McGraw -Hill/Irwin

– lease?

– borrow? (Borrow from Who?)

Copyright ©2008 by The McGraw-Hill Companies, Inc. All rights reserved.

1-2

Defining Finance

• I’m thinking about starting a new business

• Finance is the study of how people allocate

scarce resources over time

– will it reward me adequately?

• costs and benefits are distributed over time

• but the actual timing and size of future cash flows are

often known only probabilistically

• Nepal has asked for major project financing

– should my organization provide the funds?

• Understanding finance helps you evaluate

these uncertain cash flows

1-3

• Financial theory consists of:

• the set of concepts

1-4

• Why Study Finance?

– that help to organize one’s thinking about how to allocate

resources over time

– To manage your personal resources

– To deal with the world of business

• the set of quantitative models

– used to help evaluate alternatives, make decisions, and

implement them

– To pursue interesting and rewarding career opportunities

• These concepts and models apply at all levels and

scales of decision making

– To make informed public choices as a citizen

– The intellectual challenge

1-5

1-6

1

Relationship between Finance,

Economics and Accounting

Financial Management

Ÿ Financial Management or business finance

is concerned with managing an entity’s

money.

Ÿ For example, a company must decide:

-

• Economics provides structure for decision

making in many important areas.

- Provides a broad picture of economic

environment.

• Accounting provides financial data in various

forms.

where to invest its money.

whether or not to replace an old asset.

when to issue new stocks and bonds.

whether or not to pay dividends.

– Income statements, balance sheets, and

statement of cashflows.

• Finance links economic theory with the

numbers of accounting.

1-7

Recent Issues in Finance

1-8

Recent Issues in Finance (cont’d)

• Recent focus has been on:

• The following are significant to financial

managers during decision making:

– Risk-return relationships.

– Maximization of returns for a given level of risk.

– Portfolio management.

– Capital structure theory.

– Effects of inflation and disinflation on financial

forecasting.

– Required rates of return for capital budgeting

decisions.

– Cost of capital.

• New financial products with a focus on

hedging are being widely used.

1-9

Functions of the Financial Manager

1-10

Risk-Return Trade-Off

• Influences operational side (capital versus

labor/ Product A versus Product B)

• Influences financial mix (stocks versus

bonds versus retained earnings)

- Stocks are more profitable but riskier.

- Savings accounts are less profitable and less

risky (or safer)

• Financial manager must choose appropriate

combinations

1-11

1-12

2

Sole Proprietorship

Partnership

• Represents single-person ownership

• Advantages:

• Similar to sole proprietorship except there

are two or more owners.

– Articles of partnership: Specifies ownership

interest, the methods for distributing profits, and

the means of withdrawing from the partnership.

– Limited partnership: One or more partners are

designated as general partners and have

unlimited liability of the debts of the firm; other

partners designated limited partners and are

liable only for their initial contribution.

– Simplicity of decision-making.

– Low organizational and operational costs.

• Drawback

– Unlimited liability to the owner.

– Profits and losses are taxed as though they

belong to the individual owner.

1-13

Corporation

1-14

Corporation (cont’d)

• Corporation

• Disadvantage:

- Articles of incorporation: Specify the rights and

limitations of the entity.

- Its owned by shareholders who enjoy the

privilege of limited liability.

- Has a continual life.

– The potential of double taxation of earnings.

• Subchapter S corporation: Income is taxed as a direct

income to stockholders and thus is taxed only once

as normal income.

- Key feature is the easy divisibility of

ownership interest by issuing shares of

stock.

1-15

1-16

conflict of interest

Goals of Financial Management

•

There may be some conflict of interest between managers and the

owners.

•

Suppose you have to decide between two alternative investments:

Safe ( With lower expected return)

or

Risky ( with higher expected return)?

• Valuation Approach

• Maximizing shareholder wealth (shareholder

wealth maximization)

• Management and stockholder wealth

•

Which one to go for?

- Retention of position of power in long run is by

becoming sensitized to shareholder concerns.

- Sufficient stock option incentives to motivate

achievement of market value maximization.

- Powerful institutional investors are increasing

management more responsive to shareholders.

– Some owners may want safe, but if they want safe, they can pull out their

shares and put in safe assets.

– If risky investment makes to increase the market value of the fi rm, you

should go for the risky one.

•

Would you do it? Conflict of interest may come to play.

1-17

1-18

3

Profit maximization OR Wealth

maximization?

Management rule:

• Maximize the wealth of current shareholders

– Rule depends only upon production technology,

market interest rates, market risk premiums, and

security prices

– Alternative rules stated in terms of “profit

maximization” are fraught with unresolved

issues, and are better avoided

• Case I:

• Suppose initial outlay for two projects is $ 1 Million.

•

Return from

Year 1

Year 2

Profit

•

Project A

$1.05 Million

—

Project B

$ 1.1 Million

$0.05 Million

= $ 50,000

$ 0.1 Million

= $ 100,000

How do you apply profit maximization rule?

1-19

1-20

Profit maximization OR Wealth

maximization?

The agency problem

• CASE II: (Uncertain environment)

•

Return from

Year 1

Profit

Project A

$1.05 Million

$0.05 Million

= $ 50,000

(With certainty)

Project B

$ 1.2 Million OR $ 0.9 Million

with prob. 0.5 each

•

Managers wont work for the owners unless it is in their best interest (From

Harvard Business review)

•

Shareholders rely on CEOs to adopt policies that maximize the value of their

shares.

– Like other human beings, however, CEOs tend to engage in activit ies that increase

their own well being.

$ 0.2 Million OR $0.9 Million

= $ 200,000 OR a loss of $100,000

( With 50% Chance of each)

• What is the meaning of choosing investment that

maximizes profit?

• Why managers have to act for the interest of

shareholders?

•

One of the most critical roles of the board of directors is to create incentives that

make it in the CEO’s best interests. Conceptually this is not a difficult

challenge.

•

Some combination of three basic policies will create the right monetary

incentives for CEOs to maximize the values of their companies:

– Boards can require that CEOs become substantial owners of company stock.

– Salaries, bonuses, and stock options can be structured so as to provide big rewards

for superior performance and big penalties for poor performance.

– The threat of dismissal for poor performance can be made real

1-21

Social Responsibility

1-22

Ethical Behavior

• Adoption of policies that maximize values in

the market attracts capital, provides

employment and offers benefits to the

society.

• Certain cost-increasing activities may have

to be mandatory rather than voluntary

initially, to ensure burden falls equally over

all business firms.

1-23

• Ethical behavior creates invaluable

reputation.

• Insider trading

• Protected against by the Securities and

Exchange Commission (SEC).

1-24

4

Is ethics really relevant?

The Role of Financial Markets

• This is a good question to answer.

– First, although business errors can be forgiven,

ethical errors tend to end careers and terminate

future opportunities. Why? Because unethical

behavior eliminates trust, and without trust

businesses cannot interact.

– Second, the most damaging event a business

can experience is a loss of public’s confidence in

its ethical standards.

• Financial markets are indicators of

maximization of shareholder value and the

ethical or the unethical behavior that may

influence the value of the company.

• Participants in the financial market range

over the public, private and government

institutions.

– Public financial markets

– Corporate financial markets

1-25

Structure and Functions of the Financial

Markets

1-26

Stocks versus Bonds

• Stock = ownership or equity

• Money markets

- Securities in this market include commercial

paper sold by corporations to finance their daily

operations or certificates of deposit with

maturities of less than 12 months sold by banks.

• Capital markets

- Stockholders own the company

• Bond = debt or IOU

- Bondholders are owed $ by company

- Long-term markets

- Securities include common stock, preferred

stock and corporate and government bonds.

1-27

1-28

Return Maximization and Risk

Minimization

Allocation of Capital

• Primary market

– When a corporation uses the financial markets

to raise new funds, the sale of securities is made

by way of a new issue.

• Secondary market

– When the securities are sold to the public

(institutions and individuals).

– Financial managers are given a feedback about

their firms ’ performance.

1-29

• Investors can choose risk level that meets

their objective and maximizes return for that

given level of risk.

• Companies that are rewarded with highpriced securities can raise new funds in the

money and capital markets at a lower cost

compared to competitors.

• Firms pay a penalty for failing to perform

competitively.

1-30

5

Internationalization of Financial Markets

Restructuring

• Restructuring can result in:

• Allocation of capital and the search for low

cost sources of financing on the rise in

global market.

• The impact of international affairs and

technology has resulted in the need for

future financial managers to understand

– Changes in the capital structure (liabilities and

equity on the balance sheet).

– Selling of low -profit-margin divisions with the

proceeds of the sale reinvested in better

investment opportunities.

– Removal or large reductions in the of current

management team.

- International capital flows.

- Computerized electronic funds transfer systems.

- Foreign currency hedging strategies.

• It has resulted in acquisitions and mergers.

1-31

1-32

Technological Impact on Capital Market

• Consolidation among major stock markets

and mergers of brokerage firms with

domestic and international partners.

• Electronic markets have gained popularity as

against traditional organized exchanges and

NASDAQ.

• Resulted in the merger of NYSE with

Archipelago and NASDAQ bought out

Insinet from Reuters.

1-33

6