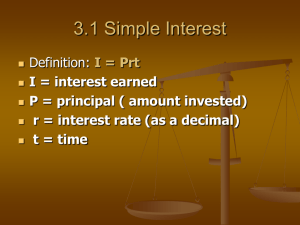

Section 3-1, Simple Interest I = Prt present value

advertisement

Section 3-1, Simple Interest The formula for simple interest is I = Prt where P = principal, or present value r = annual simple interest rate (written as a decimal) t = time in years (assume a 360-day year) If a principal P is borrowed or invested at a rate r, then after t years the borrower will owe, or the investor will have earned, an amount A called the future value of the loan or investment. A= principal + interest or A=P+I A = P + Prt or A = P(1 + rt) Note that this formula is linear, i.e, its graph is a straight line. Q1. (a) (#14, page 132). Use the simple interest formula to calculate r if I = $28, P = $700, t = 13 weeks. (b) Use the simple interest formula to calculate P if A = $8,000; r = 12%; t = 7 months. Q2 (#36, page 133). A department store charges an 18% annual rate for overdue accounts. How much interest will be owed on an $835 account that is 2 months overdue? Section 3-1, p. 1 Q3. (#52, page 134). The buying and selling commission schedule shown below is from a well-known online discount brokerage firm. Transaction Size Commission Rate $0 - $2,500 $22 + 1.4% of principal $2,501 - $6,000 $38 + 0.45% of principal $6,001 - $22,000 $55 + 0.23% of principal $22,001 - $50,000 $79 + 0.15% of principal $50,001 - $500,000 $119 + 0.07% of principal $500,001 + $169 + 0.06% of principal An investor purchases 450 shares at $64.84 a share, holds the stock for 26 weeks, and then sells the stock for $72.08 a share. Find the interest earned by the investment. Section 3-1, p. 2