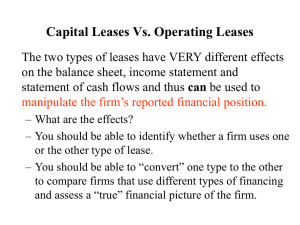

Operating Leases and Credit Assessments The Ohio State University Purdue University

advertisement