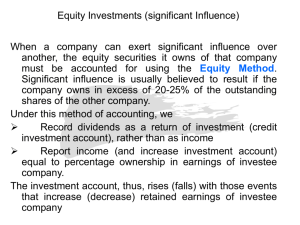

Investments in Debt & Equity Securities: Accounting Chapter

advertisement