CHAPTER 4: ACCOUNTING FOR GOVERNMENTAL OPERATING ACTIVITIES: TRANSACTION ACCOUNTING GOVERNMENT-WIDE AND FUNDS

advertisement

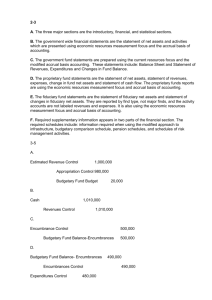

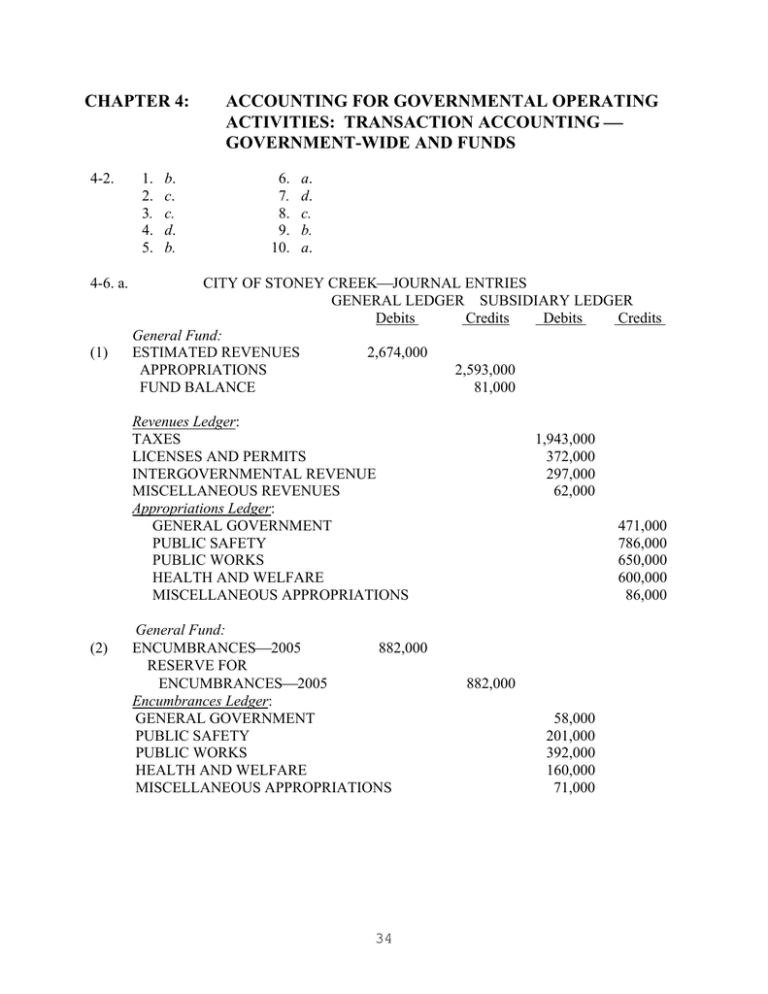

CHAPTER 4: 4-2. 4-6. a. (1) 1. 2. 3. 4. 5. b. c. c. d. b. ACCOUNTING FOR GOVERNMENTAL OPERATING ACTIVITIES: TRANSACTION ACCOUNTING ⎯ GOVERNMENT-WIDE AND FUNDS 6. 7. 8. 9. 10. a. d. c. b. a. CITY OF STONEY CREEK⎯JOURNAL ENTRIES GENERAL LEDGER SUBSIDIARY LEDGER Debits Credits Debits Credits General Fund: ESTIMATED REVENUES 2,674,000 APPROPRIATIONS 2,593,000 FUND BALANCE 81,000 Revenues Ledger: TAXES LICENSES AND PERMITS INTERGOVERNMENTAL REVENUE MISCELLANEOUS REVENUES Appropriations Ledger: GENERAL GOVERNMENT PUBLIC SAFETY PUBLIC WORKS HEALTH AND WELFARE MISCELLANEOUS APPROPRIATIONS (2) General Fund: ENCUMBRANCES⎯2005 882,000 RESERVE FOR ENCUMBRANCES⎯2005 Encumbrances Ledger: GENERAL GOVERNMENT PUBLIC SAFETY PUBLIC WORKS HEALTH AND WELFARE MISCELLANEOUS APPROPRIATIONS 34 1,943,000 372,000 297,000 62,000 471,000 786,000 650,000 600,000 86,000 882,000 58,000 201,000 392,000 160,000 71,000 GENERAL LEDGER SUBSIDIARY LEDGER Debits Credits Debits Credits (3) General Fund: TAXES RECEIVABLE⎯ CURRENT ESTIMATED UNCOLLECTIBLE CURRENT TAXES REVENUES 2,005,000 62,000 1,943,000 Revenues Ledger: TAXES 1,943,000 Governmental Activities: TAXES RECEIVABLE⎯ CURRENT ESTIMATED UNCOLLECTIBLE CURRENT TAXES GENERAL REVENUES— PROPERTY TAXES (4) 2,005,000 62,000 1,943,000 General Fund and Governmental Activities: CASH 1,591,000 TAXES RECEIVABLE⎯ DELINQUENT TAXES RECEIVABLE⎯ CURRENT 132,000 1,459,000 GENERAL LEDGER SUBSIDIARY LEDGER Debits Credits Debits Credits (5) General Fund: EXPENDITURES⎯2005 VOUCHERS PAYABLE 1,699,100 1,699,100 Expenditures Ledger: GENERAL GOVERNMENT PUBLIC SAFETY PUBLIC WORKS HEALTH AND WELFARE MISCELLANEOUS APPROPRIATIONS Governmental Activities: EXPENSES—GENERAL GOVERNMENT* EXPENSES—PUBLIC SAFETY EXPENSES—PUBLIC WORKS EXPENSES—HEALTH AND 422,100 584,000 254,000 35 411,000 584,000 254,000 439,000 11,100 WELFARE 439,000 VOUCHERS PAYABLE 1,699,100 *assuming Miscellaneous Appropriations relate to General Government (6) General Fund: At beginning of 2005 to reestablish encumbrances: ENCUMBRANCES—2004 14,000 RESERVE FOR ENCUMBRANCES—2004 Encumbrances Ledger⎯2004: PUBLIC SAFETY 14,000 14,000 GENERAL LEDGER SUBSIDIARY LEDGER Debits Credits Debits Credits RESERVE FOR ENCUMBRANCES—2004 ENCUMBRANCES—2004 Encumbrances Ledger⎯2004: PUBLIC SAFETY EXPENDITURES⎯2004 EXPENDITURES⎯2005 VOUCHERS PAYABLE 14,000 14,000 14,000 14,000 470 14,470 Expenditures Ledger⎯2005: PUBLIC SAFETY Expenditures Ledger⎯2004: PUBLIC SAFETY Governmental Activities: EXPENSES—PUBLIC SAFETY VOUCHERS PAYABLE (7) General Fund: RESERVE FOR ENCUMBRANCES⎯2005 ENCUMBRANCES⎯2005 EXPENDITURES⎯2005 VOUCHERS PAYABLE 470 14,000 14,470 14,470 800,000 800,000 802,100 802,100 36 GENERAL LEDGER SUBSIDIARY LEDGER Debit Credit Debit Credit Expenditures Ledger: GENERAL GOVERNMENT PUBLIC SAFETY PUBLIC WORKS HEALTH AND WELFARE MISCELLANEOUS APPROPRIATIONS Encumbrances Ledger: GENERAL GOVERNMENT PUBLIC SAFETY PUBLIC WORKS HEALTH AND WELFARE MISCELLANEOUS APPROPRIATIONS (8) 52,700 187,800 360,000 130,600 71,000 52,200 189,700 357,000 130,100 71,000 Governmental Activities: EXPENSES—GENERAL GOVERNMENT 123,700 EXPENSES—PUBLIC SAFETY 187,800 EXPENSES—PUBLIC WORKS 360,000 EXPENSES—HEALTH AND WELFARE 130,600 VOUCHERS PAYABLE 802,100 General Fund: CASH 738,000 REVENUES 738,000 Revenues Ledger: LICENSES AND PERMITS 373,000 INTERGOVERNMENTAL REVENUE 299,000 MISCELLANEOUS REVENUES 66,000 GENERAL LEDGER SUBSIDIARY LEDGER Debit Credit Debit Credit Governmental Activities: CASH 738,000 PROGRAM REVENUESGENERAL GOVERNMENTCHARGES FOR SERVICES 373,000 PROGRAM REVENUESPUBLIC SAFETYOPERATING GRANTS AND CONTRIBUTIONS 299,000 GENERAL REVENUES-MISC. 66,000 37 (9) General Fund and Governmental Activities: VOUCHERS PAYABLE 2,475,000 CASH 2,475,000 Note: The Governmental Activities ledgers are not shown here. CITY OF STONEY CREEK GENERAL FUND REVENUE LEDGER (NOT REQUIRED) ESTIMATED REVENUES REVENUES BALANCE Debit (Credit) TAXES (1) (3) (1) 1,943,000 1,943,000 LICENSES AND PERMITS 372,000 (8) (1) 373,000 INTERGOVERNMENTAL REVENUE 297,000 (8) (1) 299,000 MISCELLANEOUS REVENUES 62,000 (8) 66,000 1,943,000 -0- 372,000 (1,000) 297,000 (2,000) 62,000 (4,000) GENERAL FUND APPROPRIATIONS/EXPENDITURES LEDGER (NOT REQUIRED) AVAILABLE TRANSACTION APPROPRIATION ENCUMBRANCE EXPENDITURE BALANCE 1 2 5 7 GENERAL GOVERNMENT_______________________ 471,000 471,000 58,000 413,000 411,000 2,000 (52,200) 52,700 1,500 38 1 2 5 6 7 PUBLIC SAFETY_________________________ 786,000 786,000 201,000 585,000 584,000 1,000 (Note A) 470 530 (189,700) 187,800 2,430 1 2 5 7 PUBLIC WORKS_________________________ 650,000 392,000 258,000 254,000 4,000 (357,000) 360,000 1,000 650,000 1 2 5 7 HEALTH AND WELFARE_____________________ 600,000 600,000 160,000 440,000 439,000 1,000 (130,100) 130,600 500 1 2 5 7 MISCELLANEOUS APPROPRIATIONS______________ 86,000 86,000 71,000 15,000 11,100 3,900 (71,000) 71,000 3,900 Note A: The Public Safety account shown here is for 2005. In addition, a credit of $14,000 would be made to the Public Safety subsidiary account for 2004, at which time that account would be placed in the “deadfile” with other 2004 subsidiary accounts that had been retired at the end of that fiscal year. CITY OF STONEY CREEK b. GENERAL FUND BUDGETARY COMPARISON SCHEDULE FOR THE YEAR ENDED DECEMBER 31, 2005 VARIANCE BUDGET WITH FINAL (ORIGINAL BUDGET AND POSITIVE (NEGATIVE) FINAL) ACTUAL* BUDGETARY FUND BALANCE, 1/1 $ 82,900 $ 82,900 $ - 0RESOURCES (INFLOWS): TAXES 1,943,000 1,943,000 - 0LICENSES AND PERMITS 372,000 373,000 1,000 INTERGOVERNMENTAL REVENUE 297,000 299,000 2,000 66,000 4,000 MISCELLANEOUS REVENUES 62,000 AMOUNTS AVAILABLE FOR APPROPROPRIATION $2,756,900 $2,763,900 $ 7,000 39 CHARGES TO APPROPRIATIONS (OUTFLOWS): GENERAL GOVERNMENT $ 471,000 PUBLIC SAFETY 786,000 PUBLIC WORKS 650,000 HEALTH AND WELFARE 600,000 MISCELLANEOUS APPROP. 86,000 TOTAL CHARGES TO APPROPRIATIONS $2,593,000 BUDGETARY FUND BALANCE, 12/31 $ 163,900 $ 469,500 783,570 649,000 599,500 82,100 $ (1,500) (2,430) (1,000) (500) (3,900) $2,583,670 $ 180,230 $ (9,330) $ 16,330 *NOTE: THE ACTUAL EXPENDITURES IN THIS STATEMENT INCLUDE ENCUMBRANCES OF 2005 APPROPRIATIONS OUTSTANDING AT YEAR-END, BUT DO NOT INCLUDE THE EXPENDITURES OF THE 2004 APPROPRIATIONS RECORDED IN ENTRY 6. 4-7. PART A: a. ROMULUS COUNTY JOURNAL ENTRIES FY 2005 Debits (1) (2) General Fund: ESTIMATED REVENUES APPROPRIATIONS FUND BALANCE 3,170,000 3,100,000 70,000 General Fund: CASH 294,000 EXPENDITURES⎯2005 6,000 TAX ANTICIPATION NOTES PAYABLE 300,000 (COMPUTATION OF DISCOUNT: $300,000 X .06 X 1/3 YEAR = $6,000.) Governmental Activities: CASH INTEREST EXPENSE TAX ANTICIPATION NOTES PAYABLE (3) Credits 294,000 6,000 300,000 General Fund: TAXES RECEIVABLE⎯CURRENT 2,150,000 ESTIMATED UNCOLLECTIBLE CURRENT TAXES 86,000 REVENUES 2,064,000 (COMPUTATIONS: $43,000,000 ASSESSED VALUATION X $5.00 TAX RATE PER $100 = $2,150,000 GROSS LEVY; $2,150,000 GROSS LEVY X .04 = $86,000 ESTIMATED UNCOLLECTIBLE.) 40 Debits Governmental Activities: TAXES RECEIVABLE⎯CURRENT ESTIMATED UNCOLLECTIBLE CURRENT TAXES GENERAL REVENUES—PROPERTY TAXES (4) (5) General Fund: ENCUMBRANCES⎯2005 RESERVE FOR ENCUMBRANCES⎯2005 General Fund and Governmental Activities: CASH TAXES RECEIVABLE⎯CURRENT TAXES RECEIVABLE⎯DELINQUENT INTEREST AND PENALTIES RECEIVABLE 2,150,000 86,000 2,064,000 1,027,000 1,027,000 1,387,240 1,034,000 340,000 13,240 General Fund: INTEREST AND PENALTIES RECEIVABLE REVENUES 15,230 Governmental Activities: INTEREST AND PENALTIES RECEIVABLE GENERAL REVENUES – INTEREST ON TAXES 15,230 15,230 15,230 Debits (6) General Fund: EXPENDITURES⎯2005 DUE TO FEDERAL GOVERNMENT DUE TO STATE GOVERNMENT CASH Governmental Activities: EXPENSES ⎯(Itemize functions) DUE TO FEDERAL GOVERNMENT DUE TO STATE GOVERNMENT CASH (7) Credits 481,070 98,000 20,000 363,070 481,070 98,000 20,000 363,070 General Fund: EXPENDITURES⎯2005 DUE TO FEDERAL GOVERNMENT 36,800 Governmental Activities: EXPENSES⎯(Itemize functions) DUE TO FEDERAL GOVERNMENT 36,800 41 Credits 36,800 36,800 (8) General Fund: CASH REVENUES 339,000 Governmental Activities: CASH REVENUES⎯(itemize sources) 339,000 339,000 Debits (9) General Fund and Governmental Activities: DUE TO FEDERAL GOVERNMENT DUE TO STATE GOVERNMENT VOUCHERS PAYABLE General Fund: (10) RESERVE FOR ENCUMBRANCES⎯2005 ENCUMBRANCES⎯2005 EXPENDITURES⎯2005 VOUCHERS PAYABLE Governmental Activities: EXPENSES⎯(itemize functions) VOUCHERS PAYABLE 339,000 Credits 194,290 20,000 214,290 890,800 890,800 894,900 894,900 894,900 894,900 General Fund: (11) VOUCHERS PAYABLE CASH EXPENDITURES⎯2005 Governmental Activities: VOUCHERS PAYABLE CASH EXPENSES⎯(itemize functions) 1,107,090 1,099,060 8,030 1,107,090 1,099,060 8,030 General Fund and Governmental Activities: (12) TAX ANTICIPATION NOTES PAYABLE CASH 42 300,000 300,000 b. ROMULUS C0UNTY GENERAL FUND INTERIM BALANCE SHEET, OCTOBER 31, 2004 ASSETS AND RESOURCES CASH TAXES RECEIVABLE⎯CURRENT LESS: ESTIMATED UNCOLLECTIBLE TAXES RECEIVABLE⎯DELINQUENT LESS: ESTIMATED UNCOLLECTIBLE INTEREST AND PENALTIES RECEIVABLE LESS: ESTIMATED UNCOLLECTIBLE INVENTORY OF SUPPLIES TOTAL ASSETS ESTIMATED REVENUES LESS: REVENUES TOTAL ASSETS AND RESOURCES $ 351,110 $1,116,000 86,000 243,000 189,000 28,270 11,160 3,170,000 2,418,230 1,030,000 54,000 17,110 16,100 1,468,320 751,770 $2,220,090 LIABILITIES AND FUND EQUITY LIABILITIES: VOUCHERS PAYABLE FUND EQUITY: APPROPRIATIONS LESS: EXPENDITURES $1,410,740 ENCUMBRANCES 136,200 AVAILABLE APPROPRIATIONS RESERVE FOR ENCUMBRANCES 136,200 RESERVE FOR INVENTORY OF SUPPLIES 16,100 TOTAL RESERVED FUND EQUITY FUND BALANCE TOTAL FUND EQUITY TOTAL LIABILITIES AND FUND EQUITY $ 150,600 $3,100,000 1,546,940 1,553,060 152,300 364,130 2,069,490 $ 2,220,090 Debits Credits 4-7. PART B: a. General Fund: (1) FUND BALANCE 100,000 ESTIMATED REVENUES 100,000 (THIS ADJUSTS THE ORIGINAL BUDGETARY INCREASE OF $70,000 IN FUND BALANCE TO A NET DECREASE OF $30,000.) (2) General Fund: ENCUMBRANCES⎯2005 RESERVE FOR ENCUMBRANCES⎯2005 43 1,032,000 1,032,000 (3) General Fund and Governmental Activities: TAXES RECEIVABLE-DELINQUENT 6,500 INTEREST AND PENALTIES RECEIVABLE 1,340 ESTIMATED UNCOLLECTIBLE TAXES⎯ DELINQUENT 6,500 ESTIMATED UNCOLLECTIBLE INTEREST AND PENALTIES 1,340 (THIS ENTRY REVERSES THE WRITE-OFF ENTRY AND PLACES THE RECEIVABLES UNDER ACCOUNTING CONTROL AGAIN.) INTEREST AND PENALTIES RECEIVABLE 270 REVENUES (General Revenues in Governmental Activities) 270 (TO RECORD INTEREST AND PENALTIES ACCRUED AND COLLECTED.) CASH TAXES RECEIVABLE⎯DELINQUENT INTEREST AND PENALTIES RECEIVABLE (4) General Fund: EXPENDITURES⎯2005 DUE TO FEDERAL GOVERNMENT DUE TO STATE GOVERNMENT CASH Governmental Activities: EXPENSES-VARIOUS DUE TO FEDERAL GOVERNMENT DUE TO STATE GOVERNMENT CASH (5) (6) 8,110 6,500 1,610 338,420 68,400 14,400 255,620 338,420 68,400 14,400 255,620 General Fund: EXPENDITURES⎯2005 DUE TO FEDERAL GOVERNMENT 25,890 Governmental Activities: EXPENSES-VARIOUS DUE TO FEDERAL GOVERNMENT 25,890 25,890 General Fund and Governmental Activities: TAXES RECEIVABLE⎯CURRENT 25,000 REVENUES (General Revenues at Governmental Activities) ($500,000 X $5.00 PER $100) 44 25,890 25,000 (7) (8) (9) General Fund and Governmental Activities: CASH TAXES RECEIVABLE⎯CURRENT TAXES RECEIVABLE⎯DELINQUENT INTEREST AND PENALTIES RECEIVABLE REVENUES (VARIOUS AT G-W LEVEL) 593,700 6,960 16,240 General Fund and Governmental Activities: TAXES RECEIVABLE⎯DELINQUENT 214,000 EST. UNCOLLECTIBLE TAXES⎯CURRENT86,000 TAXES RECEIVABLE⎯CURRENT ESTIMATED UNCOLLECTIBLE TAXES⎯ DELINQUENT General Fund: RESERVE FOR ENCUMBRANCES⎯2005 EXPENDITURES⎯2005 ENCUMBRANCES⎯2005 VOUCHERS PAYABLE Governmental Activities: EXPENSES (VARIOUS) VOUCHERS PAYABLE (12) 927,000 43,270 7,330 General Fund and Governmental Activities: INTEREST AND PENALTIES RECEIVABLE23,200 ESTIMATED UNCOLLECTIBLE INTEREST AND PENALTIES REVENUES (GENERAL REV. AT G-W LEVEL) General Fund and Governmental Activities: (10) DUE TO FEDERAL GOVERNMENT DUE TO STATE GOVERNMENT VOUCHERS PAYABLE (11) 1,571,300 214,000 86,000 94,290 14,400 108,690 1,097,240 1,092,670 1,097,240 1,092,670 1,092,670 1,092,670 General Fund and Governmental Activities: ESTIMATED UNCOLLECTIBLE TAXES⎯ DELINQUENT ESTIMATED UNCOLLECTIBLE INTEREST AND PENALTIES TAXES RECEIVABLE⎯DELINQUENT INTEREST AND PENALTIES RECEIVABLE 45 39,940 4,180 39,940 4,180 General Fund: (13) INVENTORY OF SUPPLIES 3,000 FUND BALANCE 3,000 EXPENDITURES⎯2005 3,000 RESERVE FOR INVENTORY OF SUPPLIES 3,000 ($19,100 PHYSICAL INVENTORY - $16,100 ALREADY RECORDED = $3,000 INCREASE DUE TO SUPPLIES PURCHASED DURING THE YEAR.) Governmental Activities: INVENTORY OF SUPPLIES EXPENSES (VARIOUS) (14) b. 3,000 3,000 General Fund and Governmental Activities: VOUCHERS PAYABLE CASH 1,202,600 1,202,600 CLOSING ENTRIES, APRIL 30, 2005 General Fund: REVENUES APPROPRIATIONS ENCUMBRANCES⎯2005 ESTIMATED REVENUES EXPENDITURES⎯2005 FUND BALANCE 3,053,440 3,100,000 70,960 3,070,000 2,864,720 147,760 Governmental Activities: REVENUES (VARIOUS) EXPENSES (VARIOUS) UNRESTRICTED NET ASSETS 3,053,440 2,864,720 188,720 c. ROMULUS COUNTY GENERAL FUND BALANCE SHEET AS OF APRIL 30, 2005 ASSETS CASH TAXES RECEIVABLE⎯DELINQUENT LESS: ESTIMATED UNCOLLECTIBLE TAXES⎯DELINQUENT INTEREST AND PENALTIES RECEIVABLE LESS: ESTIMATED UNCOLLECTIBLE INTEREST AND PENALTIES MATERIAL AND SUPPLIES INVENTORY TOTAL ASSETS 46 $ 472,300 $373,790 241,560 39,960 132,230 15,280 24,680 19,100 $ 648,310 LIABILITIES AND FUND EQUITY LIABILITIES: VOUCHERS PAYABLE FUND EQUITY: RESERVES: RESERVE FOR INVENTORY OF SUPPLIES $ 19,100 RESERVE FOR ENCUMBRANCES⎯2005 70,960 TOTAL RESERVES FUND BALANCE TOTAL FUND EQUITY TOTAL LIABILITIES AND FUND EQUITY d. $149,360 $ 90,060 408,890 498,950 $ 648,310 ROMULUS COUNTY GENERAL FUND STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE FOR THE YEAR ENDED APRIL 30, 2005 REVENUES TAXES INTEREST AND PENALTIES ON TAXES OTHER SOURCES TOTAL REVENUES EXPENDITURES SALARIES AND WAGES CONTRIBUTIONS TO RETIREMENT FUNDS INTEREST ON NOTE PAYABLE OTHER TOTAL EXPENDITURES EXCESS OF REVENUES OVER EXPENDITURES LESS CHANGE IN RESERVES DURING 2005: ENCUMBRANCES INVENTORY OF SUPPLIES INCREASE IN FUND BALANCE FOR THE YEAR FUND BALANCE, MAY 1, 2004 FUND BALANCE, APRIL 30, 2005 $2,089,000 31,740 932,700 3,053,440 819,490 62,690 6,000 1,976,540 2,864,720 188,720 $70,960 3,000 73,960 114,760 294,130 $ 408,890 Computations: Taxes = [4-7A(3) 2,064,000 + 4-7B(6) 25,000] Interest and Penalties on Taxes = [4-7A(5) 15,230 + 4-7B(3) 270 + 4-7B(8) 16,240] Other Sources = [4-7A(8) 339,000 + 4-7B(7) 593,700] Salaries and Wages = [4-7A(6) 481,070 + 4-7B(4) 338,420) Contributions to Retirement Funds = [4-7B(7) 36,800 + 4-7B(5) 25,890] 47 Interest on Notes Payable = [4-7A(2) $6,000] Other = [4-7A(10) 894,900 - 4-7A(11) 8030 + 4-7B(11) 1,092,670 - 4-7B(13) 3,000] NOTE: The Governmental Activities ledger is not shown here. ROMULUS COUNTY General Fund General Ledger (Not Required) Cash ____ 5-1-2004 Bal. 93,000 4-7A(2) 294,000 4-7A(5) 1,387,240 4-7A(8) 339,000 4-7B(3) 8,110 4-7B(7) 1,571,300 4-7A(3) 4-7B(6) 4-7B(9) Interest and Penalties Rec.__ 4-7A(6) 363,070 4-7A(11) 1,099,060 4-7A(12) 300,000 4-7B(4) 255,620 4-7B(14) 1,202,600 Taxes Receivable⎯Current 2,150,000 4-7A(5) 1,034,000 25,000 4-7B(7) 927,000 4-7B(9) 214,000 Est. Uncollectible Current Taxes 86,000 4-7A(3) 86,000 5/1/2004 Bal.26,280 4-7A(5) 15,230 4-7B(3) 1,340 4-7B(3) 270 4-7B(8) 23,200 4-7A(5) 13,240 4-7B(3) 1,610 4-7B(7) 7,330 4-7B(12) 4,180 Est. Uncollectible Interest & Penalties _ 4-7B(12) 4,180 5/1/2004 Bal. 11,160 4-7B(3) 1,340 4-7B(8) 6,960 Inventory of Supplies_________ 5/1/2004 Bal.16,100 4-7B(13) 3,000 Taxes Receivable⎯Delinquent 5/1/2004 Bal. 583,000 4-7A(5) 340,000 4-7B(3) 6,500 4-7B(3) 6,500 4-7B(9) 214,000 4-7B(7) 43,270 4-7B(12) 39,940 Reserve for Inventory of Supplies___ 5/1/2004 Bal. 16,100 4-7B(13) 3,000 Est. Uncollectible Delinquent Taxes 4-7B(12) 39,940 5/1/2004 Bal.189,000 4-7B(3) 6,500 4-7B(9) 86,000 Vouchers Payable___________ 4-7A(11) 1,107,090 5/1/2004 Bal 148,500 4-7B(14) 1,202,600 4-7A(9) 214,290 4-7A(10) 894,900 4-7B(10) 108,690 4-7B(11) 1,092,670 NOTE: An underline under a number in a T-account indicates a point at which the account has a zero balance. 48 4-7A(9) 4-7B(10) 4-7A(9) 4-7A(10) 47B(1) 4-7B(13) 4-7A(1) 4-7B(b) Due to Federal Government 194,290 5/1/2004 Bal. 59,490 4-7A(6) 98,000 94,290 4-7A(7) 36,800 4-7B(4) 68,400 4-7B(5) 25,890 Revenues____________ 4-7B(b) 3,053,440 4-7A(3) 2,064,000 4-7A(5) 15,230 4-7A(8) 339,000 4-7B(3) 270 4-7B(6) 25,000 4-7B(7) 593,700 4-7B(8) 16,240 Due to State Government 20,000 4-7A(6) 20,000 14,400 4-7B(4) 14,400 Expenditures⎯2005_________ 4-7A(2) 6,000 4-7A(11) 8,030 4-7A(6) 481,070 4-7B(13) 3,000 4-7A(7) 36,800 4-7B(b) 2,864,720 4-7A(10) 894,900 4-7B(4) 338,420 4-7B(5) 25,890 4-7B(11) 1,092,670 Fund Balance 100,000 5/1/2004 Bal. 294,130 3,000 4-7A(1) 70,000 4-7B(b) 147,760 Tax Anticipation Notes Payable_____ 4-7A(12) 300,000 4-7A(2) 300,000 Estimated Revenues 4-7B(1) 100,000 3,170,000 4-7B(b) 3,070,000 ____ Encumbrances⎯2005__________ 4-7A(4) 1,027,000 4-7A(10) 890,800 4-7B(2) 1,032,000 4-7B(11) 1,097,240 4-7B(b) 70,960 Appropriations 4-7A(1) 3,100,000 3,100,000 Reserve for Encumbrances⎯2005___ 4-7A(10) 890,800 4-7A(4) 1,027,000 4-7B(11) 1,097,240 4-7B(2) 1,032,000 4-8. A. TOWN OF BENTON ALEX BENTON PARK ENDOWMENT FUND GENERAL JOURNAL FOR YEAR ENDED JUNE 30, 2005 Debits 1. DECEMBER 31, 2004: CASH 500,000 REVENUES—CONTRIBUTIONS FOR FOR ENDOWMENT 49 Credits 500,000 2. DECEMBER 31, 2004: INVESTMENT IN BONDS ACCRUED INTEREST RECEIVABLE CERTIFICATE OF DEPOSIT CASH 406,300 6,000 70,000 482,300 3. JANUARY 2, 2005: NO ENTRY REQUIRED IN THE ENDOWMENT FUND. 4. MARCH 31, 2005: A. CASH REVENUES—INVESTMENT EARNINGS B. INTERFUND TRANSFERS OUT CASH 5. APRIL 1, 2005: A. CASH ACCRUED INTEREST RECEIVABLE REVENUES—INVESTMENT EARNINGS B. INTERFUND TRANSFERS OUT CASH 6. JUNE 30, 2005: A. CASH REVENUES—INVESTMENT EARNINGS Ch. 4, Solutions, 4-8 (Cont’d) B. INTERFUND TRANSFERS OUT CASH 700 700 700 700 12,000 6,000 6,000 6,000 6,000 700 700 700 700 7. JUNE 30, 2005: NO ENTRY REQUIRED IN THE ENDOWMENT FUND. 8. JUNE 30, 2005: Note: Entries A and B below are adjusting entries made to all bonds before 25% of them are sold. A. ACCRUED INTEREST RECEIVABLE (ALL BONDS) REVENUES—INVESTMENT EARNINGS ($400,000 x .06 x 3/12) 6,000 B. INVESTMENT IN BONDS REVENUES—CHANGE IN FAIR VALUE OF INVESTMENTS [($400,000 X 1.02) - $406,300] = $1,700 1,700 50 6,000 1,700 CASH INVESTMENT IN BONDS ($400,000 x 1.02 x 25%) ACCRUED INTEREST RECEIVABLE (25%) (TO RECORD SALE OF BONDS) C. STOCKS CASH (TO RECORD PURCHASE OF STOCKS) 103,500 102,000 1,500 104,000 D. INTERFUND TRANSFERS OUT CASH (OR DUE TO MAINTENANCE FUND) (NOTE: CHANGE IN FAIR VALUE NOT INCLUDED IN EARNINGS FOR TRANSFER PURPOSES) 104,000 6,000 6,000 Closing entry: A. REVENUES—CONTRIBUTIONS FOR ENDOWMENT 500,000 REVENUES—INVESTMENT EARNINGS 13,400 REVENUES—CHANGE IN FAIR VALUE OF INVESTMENTS 1,700 OPERATING TRANSFERS OUT FUND BALANCE—RESERVED FOR ENDOWMENT (TO CLOSE TEMPORARY ACCOUNTS) 13,400 501,700 B. TOWN OF BENTON ALEX BENTON PARK MAINTENANCE FUND GENERAL JOURNAL FOR YEAR ENDED JUNE 30, 2005 1. DECEMBER 31, 2004: NO ENTRY REQUIRED IN EXPENDABLE TRUST FUND. 2. DECEMBER 31, 2004: NO ENTRY REQUIRED IN EXPENDABLE TRUST FUND. 3. JANUARY 2, 2005: ESTIMATED OTHER FINANCING SOURCES— INTERFUND TRANSFERS IN APPROPRIATIONS FUND BALANCE 4. MARCH 31, 2005: CASH INTERFUND TRANSFERS IN 13,400 13,000 400 700 700 51 5. APRIL 1, 2005: CASH INTERFUND TRANSFERS IN 6,000 6. JUNE 30, 2005: CASH INTERFUND TRANSFERS IN 700 6,000 700 7. JUNE 30, 2005: EXPENDITURES--MATERIALS AND CONTRACTUAL SERVICES EXPENDITURES--WAGES AND SALARIES CASH ACCOUNTS PAYABLE 2,700 10,150 12,420 430 8. JUNE 30, 2005: A. CASH (OR DUE FROM ENDOWMENT FUND) INTERFUND TRANSFERS IN B. OPERATING TRANSFERS IN APPROPRIATIONS EXPENDITURES--MATERIALS AND CONTRACTUAL SERVICES EXPENDITURES--WAGES AND SALARIES ESTIMATED OTHER FINANCING SOURCES FUND BALANCE C. (1). 6,000 6,000 13,400 13,000 2,700 10,150 13,400 150 TOWN OF BENTON ALEX BENTON PARK ENDOWMENT FUND BALANCE SHEET AS OF JUNE 30, 2005 ASSETS CURRENT ASSETS: CASH ACCRUED INTEREST RECEIVABLE TOTAL CURRENT ASSETS INVESTMENTS: BONDS, AT PAR STOCKS CERTIFICATE OF DEPOSIT TOTAL INVESTMENTS TOTAL ASSETS $ 17,200 4,500 21,700 306,000 104,000 70,000 480,000 $501,700 52 LIABILITIES AND FUND EQUITY LIABILITIES FUND EQUITY: FUND BALANCE—RESERVED FOR ENDOWMENT TOTAL LIABILITIES AND FUND EQUITY (2). -0501,700 $501,700 TOWN OF BENTON ALEX BENTON PARK ENDOWMENT FUND STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE FOR YEAR ENDED JUNE 30, 2005 REVENUES RECEIVED FOR CONTRIBUTION TO ENDOWMENT REVENUES EARNED FOR TRANSFER TO EXPENDABLE TRUST FUND: INTEREST ON BONDS INTEREST ON CERTIFICATE OF DEPOSIT TOTAL REVENUE EARNED FOR TRANSFER REVENUES FROM CHANGE IN FAIR VALUE OF INVESTMENTS TOTAL REVENUES $500,000 12,000 1,400 13,400 OTHER FINANCING USES: OPERATING TRANSFERS TO ALEX BENTON PARK MAINTENANCE FUND EXCESS OF REVENUE OVER OTHER FINANCING USES FUND BALANCE, JULY 1, 2004 FUND BALANCE, JUNE 30, 2005 C. (1). 1,700 515,100 13,400 501,700 -0$501,700 TOWN OF BENTON ALEX BENTON PARK MAINTENANCE FUND BALANCE SHEET AS OF JUNE 30, 2005 ASSETS CASH TOTAL ASSETS $ 980 $ 980 53 LIABILITIES AND FUND EQUITY LIABILITIES: ACCOUNTS PAYABLE TOTAL LIABILITIES FUND EQUITY: FUND BALANCE TOTAL LIABILITIES AND FUND EQUITY (2). $ 430 430 $ 550 980 TOWN OF BENTON ALEX BENTON PARK MAINTENANCE FUND STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE FOR YEAR ENDED JUNE 30, 2005 REVENUES EXPENDITURES: MATERIALS AND CONTRACTUAL SERVICES WAGES AND SALARIES EXCESS OF EXPENSES OVER REVENUES OTHER FINANCING SOURCES: OPERATING TRANSFERS IN INCREASE IN FUND BALANCE FUND BALANCE, JULY 1, 2004 FUND BALANCE, JUNE 30, 2005 54 $ -0$ 2,700 10,150 12,850 (12,850) 13,400 550 -0$ 550