The New Business Venture MGT 2230 Chapter 16

advertisement

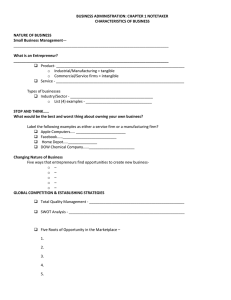

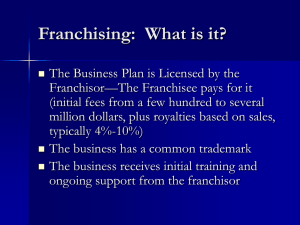

The New Business Venture MGT 2230 Chapter 16 Accessing Resources for Growth from External Sources Opening Profile: Bill Gross Franchising is an arrangement whereby a franchisor gives exclusive rights of local distribution to a franchise in return for their payment of royalties and conformance to standardized operating procedures. Advantages to the Franchisee Do not have the risks associated with creating a new business. Product acceptance is already in place. Management Expertise is provided to the franchisee. The initial capital generally reflects a fee for the franchise, construction costs, and the purchase of equipment. A financial contribution is usually based on the volume of sales. (Royalty Fee) Knowledge of the market. Operating and structural costs are functions that ensure quality as well as management controls. Advantages to the Franchisor Expansion risk is reduced allowing the venture to expand quickly using little capital. Cost advantages in the ability to buy supplies in large quantities. Ability to commit more money into advertising and customer rewards programs. Disadvantages of Franchising Problems between the franchisor and franchisee are common. Problems usually center on the franchisor not able to provide services and advertising. The franchisor could be bought out by another company. The franchisor may find it difficult in finding qualified franchisees. Poor management despite training systems can reflect negatively on the entire franchise system. Types of Franchises Good Health Time Saving or Convenience. Environmental Consciousness. The Second Baby Boom. INVESTING IN A FRANCHSIE Factors that should be addressed before making final decision; 1. Unproven vs. Proven franchise. 2. Financial Stability of Franchise. How many franchises are in the organization? How successful is each of the members of the franchise organization? Are the profits of the franchise operation from selling franchises or from royalties based on profits of franchises? Does the franchisor have management expertise in production, finance and marketing? (Background of Management Team) 3. Potential Market for new franchise still depends on the demographics and marketing research. 4. Profit Potential for a New Franchise. Information Required in Disclosure Statement, Page 549, Table 16.2 Joint Ventures 1. Two or more private sector companies combine to cut costs, share technology and research. 2. Industry – University Agreements. Purpose is in doing research. Drawbacks; A profit firms will want ownership of tangible assets such as patents, copyrights, etc. The University will want to retain proprietary rights for potential financial returns and professors wanting to publish research. 3. International Joint Ventures. Increasing due to numerous advantages. Share in earnings and growth. Low cash requirement if the patent is capitalized upon. Causes less of a drain on a company’s managerial resources. Factors in Joint Venture Success 1. The joint venture will work better of all the mangers can work well together. 2. A balance of symmetry for all parties. If one feels they put more in this can lead to bad feelings. 3. The expectations of the joint venture must be realistic. 4. The timing must be right. ACQUISITIONS This is the purchasing all or part of a company. Advantages 1. Established business creates instant cash flow and expanded customer base. 2. Location is already familiar to customers. 3. Established marketing structure so you can concentrate on growth. 4. Cost can be lower than other methods of expansion. 5. Existing employees are great asset. They have the skills, customer relationships and can re-assure everyone they know about the new ownership. 6. More opportunity to be creative because much of the start-up focus has been removed. Disadvantages 1. Marginal Success record if the purchased business was having difficulty prior to sale. 2. Overconfidence in your ability could blind you to the limitations of the firm you are purchasing. 3. Key employee loss. This is common when a business is sold that the key people also leave searching for new opportunities. 4. Over evaluation. Paying to much for the firm will be difficult to over come. Synergy The whole is greater than the sum of its parts. The acquisition must positively impact the bottom line. Synergy could be the vehicle to move forward on all goals. Lack of synergy can be one of the main reasons the acquisition fails. Structuring the Deal The structure includes the parties, the assets, the payment form, and the timing for payment. Direct purchase is acquiring the firm’s entire stock or assets. The bootstrap purchase is acquiring a small amount of the firm originally and buying the entire firm over time as cash becomes available. Locating Acquisition Candidates Brokers are people who sell companies. Accountants, attorneys, bankers, business associates and consultants. Classified section of the paper. The best method will take time and research. LEVERAGED BUYOUTS Purchasing an existing venture by an employee group. The owner is usually in a position to retire. The owner may want to divest the business of a subsidiary that no longer fits into his/her plans. The purchaser usually needs external funding due to lack of resources. The price will depend on a reasonable asking price, the firm’s debt capacity and an appropriate financial package. Negotiating for More Resources 1. Distribution task is how the benefits of the relationship will be allocated between parties. 2. Integration task is exploring possible mutual benefits from the relationship. 3. Reservation price is an amount that the entrepreneur is indifferent about whether to accept the agreement or choose the alternative. 4. Bargaining zone is the range of outcomes between the entrepreneur’s reservation price and the reservation price of the other party. Assessments 1. What will you do if an agreement is not reached? 2. What will the other party do if an agreement is not reached? 3. What are the underlying issues of the negotiation? 4. How important is the issues to you? 5. How important are the issues to the other party? Strategies for Current Negotiations 1. Build trust and share information. 2. Ask lots of questions. 3. Make multiple offers simultaneously. 4. Use differences to create trade-offs that are a source of mutually beneficial outcomes. HOMEWORK Search the internet for franchises for sale. Choose three. 1. What commonalities are the across the businesses and information provided? 2. What differences are there? 3. What would be the benefits of the franchise? 4. What would be the benefit is you started your similar type of business?