Part 6: Valuing Operating Leases F402/F560 O

advertisement

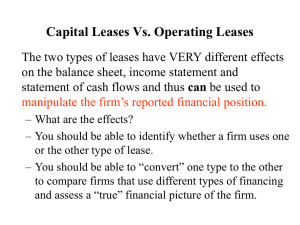

F402/F560 Corporate Valuation and Strategy Part 6: Valuing Operating Leases OFF-BALANCE SHEET LEASES The issue: Many companies lease important equipment or buildings. They often structure these leases so they qualify as “operating” leases, not “capital” leases. Operating leases do not have to be included on the balance sheet. Companies use this device to reduce the amount of debt on their statements, which makes their debt-to-equity ratio look healthier. However: The equipment is, in fact, part of the invested capital employed in the business. And these lease payments are contractual commitments, just like loan payments. A list of expected future lease payments is included in the auditors’ footnotes. The recommended treatment of operating leases: The basic intent: o Include the leased equipment as part of invested capital. It’s as if it were PP&E. o Include the amount owed on the leased equipment as longterm debt, in an amount equal to what was added to PP&E. o Reverse the implied interest expense which is a portion of the lease payments. It’s as if they were loan payments. o Forecast the value of these operating leases as a percent of sales. It’s as if they were part of PP&E. Here’s how: F402/560 Page 1 of 4 1. Adjust both the operating and financial calculations of invested capital. Compute the present value of the lease commitments, as disclosed in the notes to the financial statements. Use cost of debt as the discount rate. Add the present value of the leases as an “operating leases” adjustment to operating invested capital. Add the present value of the leases as additional “operating leases” debt to financial invested capital. 2. Adjust NOPAT for the amount of implied interest paid on the leases. Compute the implied interest expense as a percent of the present value of the leases. Use cost of debt as the interest rate. Add the implied interest expense – after tax – to NOPAT. Alternatively, adjust cash taxes for the tax shield created by this added interest expense. 3. Adjust weighted average cost of capital. Include the present value of the operating leases as a debt. Use interest rate on long-term debt as cost of debt on the leases. 4. Deduct the present value of operating leases as an interest-bearing liability or commitment in the final equity value calculation. Note that these changes can have a dramatic effect on ROIC and FCF! F402/560 Page 2 of 4 Operating Leases Example Value of Leasable Assets = 8,000 Interest rate on debt = 7% Interest rate on leases = Own the Assets Lease the Assets Year 1 Revenue Year 2 Year 1 12,000 COGS (10,760) Lease payment @ 8% 0 Interest expense @ 7% (560) Income before tax 680 Provision for tax (272) Net income 408 Year 2 Revenue 12,000 COGS (10,760) Lease payment @ 8% (640) Interest expense @ 7% 0 Income before tax 600 Provision for tax (240) Net income 360 Current oper assets 2,000 Current oper assets 2,000 PP&E 9,000 PP&E 1,000 Total assets 3,000 1,000 Total assets 11,000 Current oper liabilities 1,000 Current oper liabilities Debt 8,000 Debt Equity 2,000 Equity 2,000 Total liab & equity 3,000 Total liab & equity 11,000 Net income 408 Net income Interest after tax 336 Interest after tax NOPAT 744 NOPAT Invested capital ROIC 8% 10,000 Invested capital 7.44% 0 360 0 360 2,000 ROIC PV of oper leases Adj inv cap 18.00% 8,000 10,000 NOPAT 360 Implied interest 640 Tax on implied interest (256) Adj NOPAT 744 Adjusted ROIC F402/560 7.44% Page 3 of 4 The equations are: Value of leased equipment = Present Value of noncancelable lease payment obligations, as disclosed in footnote to audited statements in 10-K report. = Each future lease payment discounted to present value, using interest rate on long-term debt as discount rate. Also: where last amount listed as “Thereafter” is discounted as one value for the next number of periods (e.g., if there are five years of lease payments plus a total for “thereafter,” then the thereafter total is discounted six periods). = Value of assumed debt associated with the leased equipment. Operating invested capital (after adjustment for operating leases) = Operating invested capital (unadjusted) + PV of operating leases Financial invested capital (after adjustment for operating leases) = Financial invested capital (unadjusted) + PV of operating leases NOPAT (after adjustment for operating leases) = NOPAT (unadjusted) + implied interest, after tax, on PV of leases where implied interest on leases = PV of leases × interest rate on long-term debt and implied interest after tax = Implied interest × 0.6 Therefore: NOPAT (after adjustment for operating leases) = NOPAT (unadjusted) + (PV of leases × cost of debt × .6) F402/560 Page 4 of 4