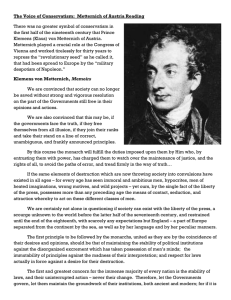

Accounting Conservatism and Private Debt Contracting Jingjing Zhang Kellogg School of Management

advertisement