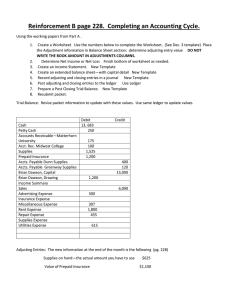

THE ACCOUNTING INFORMATION SYSTEM CHAPTER 3 OVERVIEW

advertisement