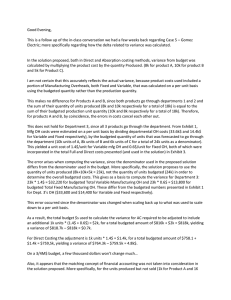

Evaluating Operating Results operation. Variance

advertisement

Evaluating Operating Results • Effectiveness – attaining the goal set for the operation. • Efficiency – wasting no resources. Variance Difference between operating result and the budgeted or standard amount. • • Favorable variance (F) - increases operating income relative to the budgeted or standard amount. Unfavorable variance (U) - decreases operating income relative to the budgeted or standard amount. Operating Income Variance – A measure of effectiveness Difference in operating income between the amount earned and the amount in the master budget. Operating Income Earned Master Budget Operating Income Operating Income Variance Standard Cost A measure of how much it should cost to manufacture a product or provide a service. Types of Standards • Ideal standard – A standard that demands perfect implementation and maximum efficiency in every aspect of the operation and is not easily attainable. • Currently attainable standard – A standard that workers with proper training and experience can attain most of the time without extraordinary effort. Sources of Standards • • • • • Activity Analysis Historical Data Benchmarking Market Expectations Strategic Decision Handout Standard Cost Sheet Product: Widget-A Direct materials Direct labor Variable overhead Fixed overhead Standard cost per unit Unit: 2 lbs. @ 0.5 hrs. @ 0.5 hrs. @ 0.5 hrs. @ $ 4.00 $20.00 $ 3.00 $25.00 Additional data: Variable selling, general, and administration Fixed selling, general, and administration 1 $ 8.00 10.00 1.50 12.50 $32.00 $3.00 $2.00 Operating Data Budgeted units of production and sales Actual units manufactured and sold Selling price per unit (budgeted and actual) Direct materials purchased and used Direct labor Variable overhead Fixed overhead Total manufacturing cost Variable SG&A Fixed SG&A Total SG&A 10,000 8,000 $60 per unit 18,000 lbs. @ $4.50 3,800 hrs. @$22.00 $81,000 83,600 11,800 128,000 $304,400 $ 24,000 16,000 $ 40,000 Example 1 Assume that McMillan manufactures and sells computer cases. Budgeted variable costs per suit are as follows: Direct materials cost Direct manufacturing labor Variable manufacturing overhead Total variable costs $ 10 6 8 $ 24 • Budgeted selling price is $40 per unit. • Fixed manufacturing costs are expected to be $52,000. • Budgeted selling costs are $5 per unit (variable) and $10,000 per month (fixed). • The Master budget for July is based on selling 10,000 units. Actual Results: Units Revenues Variable Costs Direct Materials Direct Labor Variable Overhead Variable Selling Total Variable Costs Contribution Margin Fixed Costs Fixed Overhead Fixed Selling Total Fixed Costs Operating Income 11,000 $423,500 108,000 70,000 81,000 65,000 324,000 99,500 53,000 9,500 62,500 37,000 The budgeted breakdown of manufacturing costs per unit is as follows: Direct Materials Direct Labor Variable OH 2 Lb @ .25 Hrs @ 2 Lb @ $5.00 $24.00 $4.00 $10.00 $6.00 $8.00 For the production (and sale) of 11,000 units, McMillan required 24,000 Lb of Direct Materials costing $4.50 per Lb (a total of $108,000). McMillan required 2,800 Direct Labor Hours costing $25.00 per DLH (a total of $70,000). Variable OH is driven by the materials usage. Example 2 (working backwards) Nelson Company uses a standard cost system. During the past month, the manufacturing operation had the following direct labor variances: Direct labor rate variance Direct labor efficiency variance $11,600 F $24,000 U The firm allows 2 standard direct labor hours per unit 2 standard direct labor-hours per unit Its standard direct labor-hour rate is $30 per hour During the month, Nelson spent 16 percent more in direct laborhours than the total standard hours for the units manufactured. Determine the following for Nelson Company: 1. The total standard hours allowed for the units manufactured. 2. The total direct labor-hours worked. 3. The actual direct labor wage rate per hour. 4. The number of units manufactured. Background Pokeman Bunch, Inc., manufactures PokeMonster figures and has the following data from its operation for the year just completed: Problem Information Actual Result Units Revenues Flexible Budget Variance Flexible Budget Master Budget 1,200 1,000 $69,600 $60,000 Variable costs 40,000 Contribution margin $11,200 Fixed costs Operating income Sales Volume Variance U 5,000 $5,800