Dr. M.D. Chase Long Beach State University

advertisement

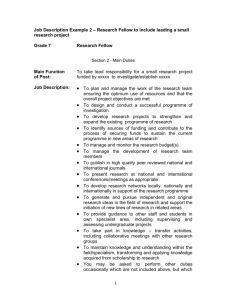

Dr. M.D. Chase Advanced Accounting 815-61B Long Beach State University INDIRECT AND MUTUAL HOLDINGS Page 1 INDIRECT AND MUTUAL HOLDINGS I. Indirect holdings: A. Indirect Vertical Holdings exist when "P" owns part of "S1" which in turn owns part of "S2". In this case "P" has a direct holding in "S1" (level 1 holding) and an indirect holding is "S2" (level 2 holding). B. Indirect Horizontal Holdings ("Connecting Affiliates") exist when "P" has direct holdings in both "S1" and "S2" and one of the subs also has a direct holding in one or more of the other subs. In other words, "P" has both a direct and an indirect holding in one or more of the subs. C. Procedure: 1. Use normal elimination procedures for each subsidiary that meets consolidation requirements; 2. Treat each subsidiary as a separate investment and insure that each sub has included the equity in net income from lower level subs in which either equity method (APB-18) or consolidation (APB-16) rules apply. 3. These same rules apply irrespective to which level holding was acquired first. The key point is to insure that all intercompany items are accounted for and eliminated at each level. No new procedures are necessary, but the normal procedures must be carefully applied at each level from the bottom up. II. Mutual (Reciprocal) Holdings: A. A mutual or reciprocal holding exists when a subsidiary owns any part of a parents stock. "P" stock owned by "S" is not outstanding from the consolidated perspective (ARB-51) and must be eliminated from (not reported on) the consolidated balance sheet. B. Two methods of eliminating "S" ownership of "P" are presently GAAP (the TREASURY STOCK and RECIPROCAL methods), but result in different consolidated financial statements with respect to consolidated retained earnings and minority interests. 1. Treasury stock method:All shares are considered "off the market" with no claim to income; the treasury stock method is considered to be theoretically superior to the "reciprocal" method for this reason. a. Investment in "P" is considered temporary: 1. The investment account on the books of "S" is eliminated against Treasury stock recorded at cost; 2. When the investment is sold, the sale is treated as a reissuance of treasury stock and normal treasury stock rules apply (no gains or losses are recognized (APB-9); balancing credits to PIC-T/S; balancing debits to PIC-T/S or, if none exists, RE. eliminate the investment: Treasury stock (at cost)......................... xxxxx Investment in parent........................ xxxxx sell the investment at a gain: Cash............................................. xxxxx Treasury stock (at cost).................... xxxxx PIC-T/S..................................... xxxxx sell the investment at a loss: Cash............................................. xxxxx PIC-T/S (if any exist; RE if none exists)........ xxxxx Treasury stock (at cost).................... xxxxx B. Investment in "P" is considered permanent: 1. The treasury stock is considered to be "retired"; this entails converting from cost to par method of accounting for treasury stock; this means that "P" PIC in excess of par must be eliminated ratably based on its ratio prior to the acquisition of the T/S. eliminate the investment: Treasury stock (at cost)......................... xxxxx Investment in parent........................ xxxxx retire the treasury stock: "P" C/S (at par)................................. xxxxx PIC-T/S (or RE if cost > par).................... xxxxx Treasury stock (at cost).................... xxxxx PIC-T/S [(PIC/C/S)(PIC)(%retired)].......... xxxxx 2. Reciprocal method: allocates a percentage of "P" income to "S" under normal equity method rules; requires the use of simultaneous equations and becomes very complex in situations in which excesses of cost over book value and intercompany transactions exist; Note: This method is not consistent with ARB-51, paragraph 13 which posits that "P" stock held by "S" is not outstanding from the consolidated viewpoint.