CHAPTER 3 The Accounting Information System 3-1

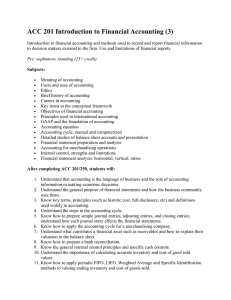

advertisement

CHAPTER 3 The Accounting Information System 3-1 LECTURE OUTLINE Chapter 3 provides a review of accounting procedures throughout the accounting cycle. Depending on time constraints and students’ accounting course background, Chapter 3 can be approached in several different ways: (1) Spend 2-3 class sessions reviewing the chapter and Appendices 3-A and 3-B. (2) Spend 1-2 class sessions reviewing selected portions of the chapter and Appendix 3-A. (3) Omit the chapter entirely. It is assumed that all students have completed at least one course in elementary accounting principles. Therefore students should already be familiar with the mechanics of journalizing, posting, and preparing adjusting entries and financial statements, etc. An important objective of a review of these procedural details is to prepare students: (1) to progress from mere memorization of required journal entries to an understanding of entries’ impact on the financial statements, and (2) to visualize the effect of errors (both the failure to record transactions and the improper recording of transactions) on the financial statements. The following topics covered in Chapter 3 may warrant special emphasis because students’ grasp of them may be weak and because an understanding of these areas is helpful in mastering later chapters of the text: (1) Transactions affecting owners’ equity—helpful in understanding prior period adjustments and the retained earnings statement of Chapter 4, and in understanding transactions described in Chapters 15 and 16. (2) Year-end procedure for inventory and related accounts—helpful in understanding the effect of inventory errors in Chapter 8. (3) Reversing entries—an understanding of reversing entries is assumed in Chapters 14 and 18 when accounting for accrued bond interest is discussed. (4) Conversion of cash basis to accrual basis (Appendix 3-A)—helpful for preparing the statement of cash flows in Chapter 24. The following lecture outline can be expanded upon or reduced to suit the needs of your class. 3-2 A. Basic Terminology. Review the 11 terms defined on text pages 70 and 71. B. Double-Entry Accounting. 1. Review the mechanics of debits and credits. TEACHING TIP Use Illustration 3-1 in reviewing double-entry rules for increasing and decreasing accounts. Debits increase assets and expenses while credit increase liabilities, owners’ equity, and revenues. The normal balance of an account is the same as the increase side. Use Illustration 3-2 to discuss and provide examples of transactions affecting the equity accounts. Emphasize the difference between nominal and real accounts. C. The Accounting Cycle. TEACHING TIP Present an overview of the accounting cycle by using Illustration 3-3. 1. Journalization. 2. Posting to the Ledger. 3. Trial Balance. 4. Adjusting Entries. 3-3 TEACHING TIP Use Illustration 3-4 in discussing adjusting entries. Provide examples of each type and discuss the effect on the financial statements of failure to make each type of entry. The ability to classify adjusting entries into one of these five categories is necessary to an understanding of reversing entries. 5. a. Prepaid expenses. b. Unearned revenues. c. Accrued liabilities (expenses). d. Accrued assets (revenues). e. Estimated items. Year-End Procedure for Inventory and Related Accounts. TEACHING TIP Review the adjusting and closing process for inventory and related accounts by using Illustration 3-5. The direction of the error in beginning inventory and the temporary accounts with debit balances will cause an error in net income in the opposite direction; e.g., if beginning inventory is overstated, net income will be understood. The direction of the error in ending inventory and the temporary accounts with credit balances will cause an error in net income in the same direction; e.g., if ending inventory is overstated, net income will be overstated. 6. The Closing Process and Preparation of a Post-Closing Trial Balance. 7. Reversing Entries. 3-4 TEACHING TIP Use Illustration 3-6 to demonstrate the journal entries to be made when reversing entries are not made and when reversing entries are used. Emphasize that reversing entries are optional and that the financial statement amounts are identical whether or not reversing entries are used. a. Use of reversing entries is optional. b. In an accounting system which uses reversing entries, the following types of adjusting entries should be reversed: (1) adjusting entries for unearned and prepaid items where the original amount was entered in a revenue or expense account. (2) adjusting entries for all accrued items. 8. Use of a Work Sheet to Prepare Financial Statements. a. Use of a work sheet is optional. Work sheet format varies. The format used in the text may be different from the one students used in elementary accounting. b. See Mann, bibliography reference 2, for illustration of an alternate work sheet format. D. APPENDIX 3-A. Cash basis versus accrual basis accounting. 1. Strict cash basis. Recognize revenue when cash is received and expenses when cash is paid. a. Used by small businesses and individual tax payers. b. Not acceptable under GAAP. 3-5 2. Modified cash basis. Recognize revenue when cash is received. Depreciable assets are capitalized and depreciated; prepaid assets are capitalized and expensed as used; and all other expenses are recognized as paid. a. Used by service organizations (CPA’s, lawyers, doctors, and architects). b. Not accpetable under GAAP if inventory is significant or if average annual gross receipts are at least $5 million. 3. Accrural basis. Revenues are recognized when earned and expenses when incurred. 4. Conversion from cash to accrural basis. TEACHING TIP Use Illustration 3-7 to discuss the conversion of the cash basis to the accrural basis. E. APPENDIX 3-B. Specialized journals and methods of processing accounting data. 1. Special journals are used to expedite the journalizing and posting of frequently occurring transactions. TEACHING TIP Use Illustration 3-8 to discuss the special journals. 2. Subsidiary ledgers are used to facilitate the recording process by freeing the general ledger from the details of individual balances. a. Examples include: accounts payable. accounts receivable, inventory, equipment, and 3-6