1 INSTRUCTOR: David Pritchard

advertisement

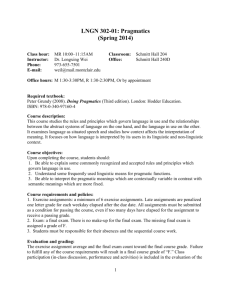

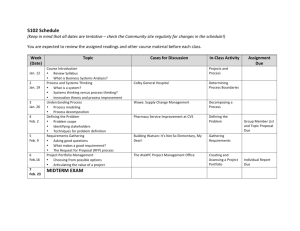

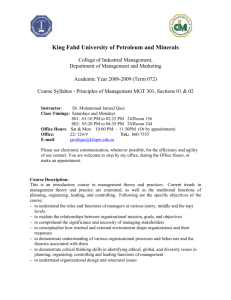

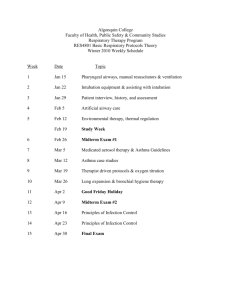

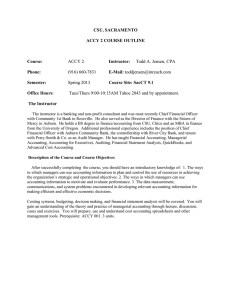

1 FLORIDA ATLANTIC UNIVERSITY COLLEGE OF BUSINESS SCHOOL OF ACCOUNTING Cost Accounting ACG3341 Spring 2011 INSTRUCTOR: David Pritchard OFFICE: LA 429 OFFICE HOURS: Tuesday 6:00 - 7:00 PM Wednesday 6:00 - 7:00 PM Thursday 6:00 - 7:00 PM Other times by appointment PHONE: TBA EMAIL: dpritcha@fau.edu CLASS: Thursday 7:10 – 10:00 PM Room: LA 331 Credit: 3 Hours PREREQUISITES: Excel ACG 2071,Junior standing, and working knowledge of Word and COURSE DESCRIPTION Designed to establish a working knowledge of three areas: 1) Cost accounting techniques, including job costing, process costing, cost analysis, cost volume profit analysis, cost allocation, activity-based costing, budgeting, variance analysis, and transfer pricing 2) Application of costing techniques to management decision making. 3) Decision making and the integration of decisions into the organization’s structure strategies and objectives. Applications include issues in decentralized organizations, cost behavior, budgeting, cost estimates, product costing, and performance motivations and assessment. COURSE OBJECTIVES Students will demonstrate knowledge of basic concepts in managerial accounting and cost accounting (cost behavior and relationships, product costing, budget concepts). Students will demonstrate their ability to think critically about accounting problems and issues. Students will demonstrate their ability to communicate effectively on accounting issues and problems. 2 Students will be assessed via quizzes, exams, essay questions, and problems utilizing spreadsheet and word processing skills in conjunction with accumulated accounting knowledge. A student who receives less than 72% for these objectives must retake the course. Understand and be able to work effectively with the following concepts, using excel when appropriate; definitions of cost, cost behaviors, cost-volume-profit analysis, job costing, activity based costing, and budgeting. REQUIRED TEXT AND SUPPPLEMENTAL MATERIALS Cost Accounting: Horngren, Datar, et. al., 13th Ed. ISBN-13: 978-0-13-813045-9 Effective Writing: A Handbook for Accountants: May and May, 8th Edition, Prentice Hall, 2009. (This text is not expected to be used specifically in this course but is a requirement for all FAU accounting courses). COURSE REQUIREMENTS AND POLICIES Class format will consist of lecture, class discussion and problem solving. Videos and assigned outside reading will also be utilized. Student performance is assessed through homework assignments, exams and other activities. End of chapter problems assigned will be discussed in class as time permits. Assigned end of chapter materials should be attempted before coming to class the day they will be discussed. Attendance is not specifically graded although it may affect scores in other areas if exams and quizzes are missed. Attendance and effort may be considered in grade determination for borderline cases. Homework and Class Preparation Even if you can work the assigned problems correctly without reference to the chapter, you need to think about how each chapter’s material relates to prior material and accounting. You should work additional problems to see a wider variety of circumstances (which will make the tests less surprising). The grade you will receive will depend on your effort, completeness, answer, and neatness. Chapter Problems Students working in teams of 3 or 4 will complete six Chapter Problems. All teammates will receive the same score for each assignment. All Problems must be prepared using Excel or Word as appropriate and submitted to the instructor no later than the night of the class it is due (handwritten assignments will not be accepted). Students will be assessed based upon presentation and correctness of solution. Late assignments will be penalized 10% each day late (strictly enforced). Solutions will be posted shortly after assignments are submitted. Once the solutions are posted, assignments will no longer be accepted for any reason. 3 Solutions that are directly copied from a solutions manual will be considered plagiarized and will be assigned a grade of zero (0). Failure to attend class will not be considered an excused reason for late submissions. Chapter Problem Schedule Problem # Due Date Feb 17 4-41 Mar 3 5-31 Mar 24 6-35 Mar 31 7-43 Apr 7 15-35 Apr 14 16-27 Excel Assignments Students will individually complete three assignments utilizing Excel. All Excel assignments must be submitted to the assignment drop box no later than the night of the class it is due (handwritten assignments will not be accepted). Students will be accessed based upon their solution and use of Excel techniques. Late assignments will be penalized 10% each day late (strictly enforced). Solutions will be posted shortly after assignments are submitted. Once the solutions are posted, assignments will no longer be accepted for any reason. Solutions that are directly copied from a solutions manual will be considered plagiarized and will be assigned a grade of zero (0). Failure to attend class will not be considered an excused reason for late submissions. Excel Schedule Problem Due Date Feb 3 3-38 Feb 24 17-27 Apr 21 11-23 Examinations There will be four examinations during the term. These exams will consist of essay and problems as appropriate. Make-up exams are offered only under extraordinary circumstances that are beyond the student’s control. The instructor must be informed before the exam and reserves the right to accept/reject the student’s explanation. Verifiable documentation will be required. Preplanned activities such as vacation will not be accepted as an extraordinary circumstance. 4 Exam Schedule Test Date Feb 3 1 Mar 3 2 Mar 31 3 Apr 28 4 Web Site Visit Students, individually, will visit the web site of the Institute of Management Accountants and answer questions provided by the instructor. Reports will be submitted via assignment drop box. Students will be assessed based upon the solution presented. Case Study Students working in groups of 3 or 4 will complete one Case Study. All teammates will receive the same score for each assignment. The Case Study must be prepared using Excel or Word as appropriate and submitted to the instructor no later than the night of the class it is due (handwritten assignments will not be accepted). Students will be assessed based on presentation and quality of solution. Solutions will be discussed the night of the due date. Once the solution has been discussed, assignments will no longer be accepted for any reason. Solutions that are directly copied from a solutions manual will be considered plagiarized and will be assigned a grade of zero (0) Quizzes There will be 10 online quizzes during the semester. Quizzes will be available from Thursday through Wednesday of the week and will reflect material from the week’s lecture and readings. Quizzes will be No make-up quizzes are offered. Quiz Schedule Week Jan 20 – Jan 26 Jan 27 – Feb 2 Feb 10 – Feb 16 Feb 17 – Feb 23 Feb 24 – Mar 2 Mar 17 – Mar 23 Mar 24 – Mar 30 Apr 7 – Apr 13 Apr 14 – Apr 20 Apr 21 – Apr 27 Quiz Chapter(s) covered by quiz 1 2 & 10 2 3 3 4 4 17 5 5 6 6 7 7&8 8 15 9 16 10 11 5 Peer Assessment Students will be working in groups. Once in a group, a student will not be allowed to move to another group or quit a group. At the end of the term, students will evaluate members of their group. The score for this assessment will represent an average of scores for each student. CHANGES IN COURSE REQUIREMENTS The instructor reserves the right to make changes to the class requirements as he determines necessary. ACADEMIC HONESTY Academic Honesty A fundamental principle of academic, business and community life is honesty. Violation of this ethical concept will result in penalties ranging from a grade of “F” in the course to dismissal from the University. In all penalties, a letter of fact will be included in the student’s file. Academic Irregularities Students are referred to CH.6C5.4.01 of the student handbook entitled Academic Irregularities. It is the policy of the faculty of the School of Accounting at FAU to adhere to the provisions of this section and to take action to secure the maximum penalty in the event of a violation of CH.6C5.4.01 of the rules of the Department of Education of the State of Florida. The Internet is a powerful tool providing access to a wealth of information. Students are reminded that plagiarism guidelines that apply to printed materials also apply to materials accessed via the Internet at http://business.fau.edu/index.php?src=gendocs&ref=uniformpolicies&category=Accounti ng&submenu=departments_Accounting. Uniform School of Accounting Policies The School of Accounting (SOA) has adopted a set of uniform policies for all courses offered by the School. These policies are considered a part of this syllabus. For example, SOA students are required to maintain an e-mail address and to subscribe to the SOA discussion list. Instructions on how to get an e-mail address and how to subscribe can be found, along with a full explanation of all policies at http://business.fau.edu/index.php?submenu=departments_Accounting&submenu=depart ments_accounting&src=gendocs&ref=studentinfo&category=Accounting. 6 GRADING CRITERIA The final course grade is dependent on the following requirements: Requirement Points 400 Tests (4 @ 100 points each) 10 Web Site Visit 90 Collaborative Learning Problems (6 @15 pts each) 150 Quizzes (10 @ 15 pts each) 25 Case Study 45 Excel Problems (3 @ 15 pts each) 20 Peer Assessment Total 740 GRADING SCHEME Percentage and Grade 92-100 A 72-76 C 90-91 A70-71 C- 87-89 B+ 67 – 69 D+ 84-86 B 64-66 D 80-83 B60-63 D- 77-79 C+ 0 – 59 F Grades will be computed on the basis of assigned work, quizzes and the exam scores. The final course grade is based upon the percentage of points earned to total points possible. . Grades are computed to the nearest 1/10th percentage point. Students must attain the next higher percentage in order to receive the respective grade: Example: 92.0 = A 91.9 = AStudents with an average score below 72% for the 4 exams must repeat the course. Students who receive an average score of 72% for all work attempted must repeat the course. Grades, once assigned, cannot be changed except in case of administrative errors in grading. Students have 48 hours from which they receive a grade (in person) to dispute it. After 48 hours, students forfeit their right to dispute any class grade received. Extra credit work is not offered as a means to improve your grade. 7 TENTATIVE SCHEDULE Week 1 Class Date Jan 13 2 Jan 20 Class Introductory/The Management Accountant’s Role in the Organization Cost Terms & Cost Behavior 3 4 5 6 7 Jan 27 Feb 3 Feb 10 Feb 17 Feb 24 CVP Test 1 Job Costing Process Costing ABC 8 9 Mar 3 Mar 10 Test 2 Spring Break 10 11 Mar 17 Mar 24 Budgeting Direct cost variances Overhead variances 12 Mar 31 Test 3 13 14 15 Apr 7 Apr 14 Apr 21 Allocation of Support Department Costs Joint costs Relevant costing Spoilage, rework, scrap 16 Apr 28 Test 4; 7 – 9:30 PM May 9 Grades Due Assignment Reading Chapter 1 Quiz 1 Chapters 2,10 Quiz 2 3-38 (Excel) Quiz 3 Quiz 4: CLP 4-41 Quiz 5;17-27 (Excel) CLP 5-35 Chapter 3 1,2,10,3 Chapter 4 Chapter 17 Chapter 5 Quiz 6 Quiz 7;CLP 6-35 Chapter 6 Chapters 7& 8 CLP 7-43; Web Site Visit 6,7,8 Quiz 8;CLP 15-35 Quiz 9;CLP 16-27 Quiz 10; 11-23 (Excel) ; Case Study 4,17,5 Chapter 15 Chapter 16 Chapters 11 & 18 Common questions, 15,16,11,18

![BIOS430 Evolution, Spring Semester 2016 Syllabus [v1.0]](http://s3.studylib.net/store/data/008212911_1-eda4846995a3f3a1f17c130a72ee789b-300x300.png)