THE UNIVERSITY OF ST. THOMAS SCHOOL OF LAW Spring 2011 Business Planning

advertisement

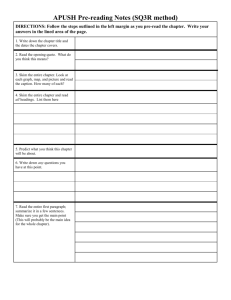

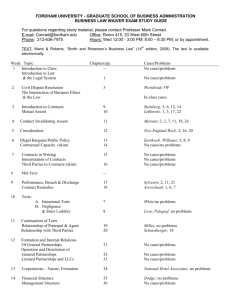

THE UNIVERSITY OF ST. THOMAS SCHOOL OF LAW Spring 2011 Business Planning Course 809 Prof. Duncan J. McCampbell 651 403 9895 Email: duncanmccampbell@comcast.net 1. Texts: F. Gevurtz, Business Planning (“G”) (4th edition, Foundation Press); Texts and materials retained from prerequisite courses on Federal Income Taxation and Business Associations: Corporations and Other Business Association Statutes, Rules and Forms, (“CP”) (West); Selected Federal Taxation Statutes and Regulations (“FT”) (West); and miscellaneous handouts. 2. Day/Time/Place: Tuesdays & Thursdays, 9:00-10:25 a.m., MSL 324 3. Requirements: Students are expected to attend scheduled classes. Students should be prepared to discuss assigned materials and problems. Students will also be expected to timely submit individual writing assignments and participate effectively and collaboratively in a group project. All reading assignments should be fully and carefully read prior to class. Assigned reading materials not covered in a class session automatically become part of the next class assignment. 4. Grades: Grades will be based on a scale of 1000 points possible: Two (2) individual document drafting assignments (together comprising 300 points possible); A group project that includes a document and a presentation (200 points possible); Class attendance and participation (200 points possible); A final examination (300 points possible). This course is intended to function as a capstone experience for students exploring the world of business law. The course touches upon the legal and commercial issues encountered in forming, operating, disposing of, and (to an extent appropriate in a law course) managing a businesses. It builds upon the foundations laid in the two prerequisites to this course: Business Associations and Federal Income Taxation. Using readings, real-world fact patterns and problem sets, class discussions, sample agreements, statutes, and regulations, students will explore the factors involved in starting a business entity and recommending a choice of entity. Students will examine issues related to the buying and selling of businesses and draft documents relevant to these transactions. Description of the Learning The Document Drafting Assignments (Two Assignments for 300 Points Total) The Document Drafting Assignments are done by students working alone and will generally coincide with the timing and content of lecture and text readings. A basic fact pattern, problem statement and, in some cases, sample documents will be provided by the professor. Students will be given a sufficient period of time to prepare the documents, which will be graded on their clarity, elegance, sophistication and legal effectiveness. The first individual document drafting assignment is Problem I, which will be handed in without presentation. [Problem III will be discussed in class, but there will be no written assignment arising from it]. The second document drafting assignment (Problem IV) will be presented to the class by individual student. The Group Project (200 Points) This project is set up around Problem II. It is intended to approximate the team structure typically set up in a law firm to perform of a substantial piece of legal work for a business client. For the group project, the class will be divided into groups of 4 students that are selected at random by the professor. Each group will be comprised of a group-appointed (whether by vote or other agreed means) Partner and three Specialist Associates (i.e. corporation, tax, securities). The group will be given an interesting and complex problem to solve for a major business client. The group will co-produce a document and present their recommendations jointly to the class. Each contributor will be graded entirely on the basis of her/his individual performance. Bear in mind, however, that 60 of the 200 points possible will be awarded within the group—to each group member by the other three members of the group on the basis of the member’s teaming performance. The points will be awarded confidentially. [Note: This course feature is meant to address a key skill in complex corporate practice: teaming. For those nervous about placing their fate in the hands of colleagues, the professor will supply detailed, obvious and easy-to-follow metrics for what constitutes outstanding individual and teaming efforts.] Class Attendance and Participation (200 Points) This course touches upon many distinct legal specialties, which is one reason many people find a practice of this type so interesting. Successful company/corporate practitioners are able to see a virtual constellation of commercial possibilities and legal issues surrounding every business client and fact pattern. The student is expected to attend class and actively participate in the exploration, discovery and collegial discussion of that constellation. Thus, all students begin the course with a 200 point presumption of perfect attendance and sterling participation. Some-hopefully all--will finish the course having attended all scheduled class sessions, having demonstrated sufficient participation, and having all 200 points intact. The Final Examination (300 Points) The Final Examination has two parts. The first part is the student’s Client and Legal Issues Checklist (CLIC), which the student will (a) develop independently throughout the course; (b) turn in on the last day of class in pursuit of 100 points possible; (c) use for issue-spotting on the open-CLIC final examination; and (d) hopefully have close at hand when they start their first legal job. More than an outline, the CLIC is the student’s permanent business law issue spotting and client/matter management system. When properly structured and maintained, the CLIC captures the learned nuances of each new commercial representational experience, and makes a young lawyer more prepared and experienced than others might expect her/him to be. 2 The CLIC will be graded on the basis of its organization, completeness and legal sophistication. It should be obvious that, since the CLIC is the only document that students will be permitted to take into the Final Examination, a properly constructed and populated CLIC will have a substantial impact on a student’s exam preparation and ultimate performance. The second part of the Final Examination is the written exam itself (200 points), which will be a client fact pattern requiring the student’s analysis and recommendations. All assignments are due before the start of class on the dates noted below. Session Topic Assignment Choice of Entity 1/18 Introduction to Business Planning Read (G) pp. 1-57; 1149-1152 Read article posted to Blackboard 1/20 Choice of Business Entity Read (G) pp. 58-100; Review Reg. Sec. 3017701-3(FT) and briefly review IRC Sections 465 & 469 (FT) 1/25 Choice of Business Entity Read (G) pp 100-12 1/25 Partnerships, Limited Partnerships and Limited Liability Companies (Funding) G pp. 113-168; skim UPA & RUPA (CP) 1/27 Partnerships, Limited Partnerships and Limited Liability Companies (Profit and loss) G pp. 168-196; skim 196-199; read pp.199-233; skim RULPA (CP). 2/1 Partnerships, Limited Partnerships and Limited Liability Companies (Profit and loss, mgmt. & ownership changes) G pp. 233-285 2/3 Partnerships, Limited Partnerships and Limited Liability Companies (Dissolution & ownership changes) G pp. 285-358; skim Del. LLC Act (CP) 2/8 Problem I Wrap-Up CLIC Roundup Problem I written materials due (LLC Operating Agreement) Corporate Formation 2/10 Introduction to Problem II (Group) Read Problem II, G pp. 1152-1161 & G. pp. 359-408 and IRC §§ 351, 357 357, 358, 362 & 368 2/15 Forming a Corporation (Contributions & Dividends) G. pp. 408-466; skim CP-Del. Corp Law 3 2/17 Forming a Corporation (Dividend Alternatives & Mgmt. G. pp. 466-514 “ “ 2/22 Forming a Corporation (Mgmt. & Dissolution) G. pp. 514-575 2/24 Problem II Incorporation Discussion Problem II Group First Drafts Due Financing 3/1 Financing the Business Venture Federal & State Securities Laws G. pp. 576-583; skim pp. & 583-617; read pp. 617- 628; skim G. pp. 628-647. 3/3 Federal & State Securities Laws G. pp. 647-656; skim 656-664; r read pp. 664-699. 3/8 Group Presentations of Problem II Problem II written materials due 3/10 Problem III Review and Discussion CLIC Review G. pp. read 721-767; 1161-1163 3/15 Restructuring G. read pp. 767-805 3/17 Restructuring G. read pp. 806-854 3/17 Restructuring G. read pp 854-889 Articles posted to Blackboard 3/22 and 3/24 No class, Spring Break 3/29 Purchase and Sale of a Business Introduction to Problem IV G. read pp 890-918; 1163-1172 3/31 Purchase and Sale of a Business Takeover Defenses, Antitrust and Share Classes G. 919-935 4/5 Purchase and Sale of a Business Management Buy-Outs G. 935-951 4/7 Structuring the Deal G. 1006-1023 4/12 Apportioning Assets and Liabilities G. 1023-1052 4/14 Securities and Tax Issues G. 1052-1064; 1064-1108 4/19 Problem IV Presentations CLIC Roundup Problem IV Assignments Due 4/21 Problem IV Presentations Final Exam Review CLIC’s Due 4/26 No Class 4