Support Note Catalogue Internet Support

advertisement

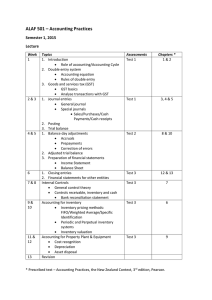

Support Note Catalogue Internet Support Support Notes are available on our web site: http://support.myob.com.au/ Certified Consultants are a collection of independent consultants available Australia-wide to provide on-site installation, setup, training and MYOB customisation. You can search for a Certified Consultant near you at: www.myob.com.au/support/ccmembers/ Training Courses are conducted by independent trainers’, in classroom settings, at selected locations. You can search for Training courses at: www.myob.com.au/support/training/ Contents Catalogue Section Page Catalogue Section Page Getting Started 2 Hot Keys 11 Simplified Tax System 2 Operating System 11 General Ledger 2 Printers 11 Banking 2 Other 11 Sales 3 Errors 12 Purchases 4 MYOB Accounting 13 Payroll 4 MYOB AssetManager 13 Inventory 6 MYOB Premier: 14 End of Period 7 General 14 M-Powered Services 8 Multicurrency 14 General: 8 MYOB AccountEdge 15 Accounting Terms 8 ODBC 15 Backing Up 8 Pocket Accounts 15 GST 9 MYOB PowerPay 15 Forms 11 MYOB & RetailManager 16 MYOB ReportWriter 16 0001 Page 1 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia Getting Started No. Name and number of pages Summary 0001 Support Note Catalogue …… ............ A list of support notes available. 0003 MYOB Electronic User Guide …………. How to access and use the MYOB User Guide electronically 0005 Addendum 105 & 45 ....................... What documentation is in the addendum and where the addendum can be found 0010 Program Specifications ....................... Recommended System Requirements to install and run MYOB 0013 QuickBooks Converter ....................... How to use the MYOB/QuickBooks converter to import into MYOB. 0015 Set up Tips ....................................... A step-by-step guide to setting up your data file for the first time. 0020 Initial Bank Rec. MYOB ...................... A step-by-step guide to entering your Unpresented cheques and uncleared deposits, and preparing your Bank account for use. 0025 Initial Bank Rec 1A ............................ A step-by-step guide to entering your MYOB Unpresented cheques and uncleared deposits as at your conversion month, and preparing your Bank account for use in FirstAccounts. 0030 Probs Installing MAC ......................... A list of common errors encountered during Macintosh installations and troubleshooting tips. 0040 Partnerships ....................................... How to set up up your Chart of Accounts for Partnerships and recording profit distribution. 0045 Pre-conversion Deposit ....................... How to enter customer deposits received prior to using MYOB. 0055 Default Credit Terms .......................... Defines Default Credit Terms. Advises where to set them up and explains the fields available that determine Credit terms that can be assigned for customers. 0070 Converting to MYOB Mid year ……….. A guide to entering data and opening balances when starting a data file mid financial year. Simplified Tax System 0200 STS Frequently Asked Questions …….. A list of Frequently asked questions about the Simplified Tax System. 0205 STS and MYOB …. .............................. Information about reporting on the Simplified Tax System and MYOB. General Ledger 0210 Statement Of Cash Flow...................... The Statement of Cash Flow report shows how your cash position has changed over a period of time. 0300 Detail Chq/CrCrd Acc ........................ How to set up cheque accounts and credit card accounts so that you can write cheques or deposit money using the chequebook module. 0305 Using Credit Cards ............................ How to set up your data file to record Credit Card transactions. 0310 EFTPOS Cust Pay ................................ How to set up and use the EFTPOS clearing account 0330 Track Profit Centres ............................ How to use Jobs to track individual profit centres. e.g Departments 0315 Exporting and Importing in MYOB ..... How to Export and Import; Chart of Accounts, Card files, Stock Items,Purchases and Sales. 0316 Xport import v105 P45 ..................... How to import and export data in v10.5 and P4.5. 0320 Entering 13th Period tran .................. What the 13th period is and how to record transactions in it. 0001 Page 2 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia Banking 0400 Bank Charges & Int ........................... How to enter Bank charges and Interest amounts into MYOB. 0405 Bounced Cheques .............................. How to record a Bounced cheque transaction, and charges. 0410 Cash flow Worksheets ........................ What a worksheet includes, excludes and how to clear and add items. 0416 Prepare a Bank Deposit slip……………. How to use the “Group with Undeposited funds” option and print the Bank Deposit Slip 0417 Using The Prepare Bank Deposit Feature. This support note deals with the using the Prepare Bank Deposit feature in Premier v8, MYOB Accounting and Accounting Plus v14. 0418 Creating Customer Payment Method.. Explains how to setup the default payment method used by customers 0420 Bank Deposit slips ............................. How to create a detailed Bank Deposit slip. 0425 Cash Drawer ...................................... How to collate deposits in an account,i.e. Cash Drawer, before transferring the total for the day/week/month into the bank. This works particularly well for high volume cash sales. 0430 Stale Cheques .................................... How to deal with a stale cheque if the cheque was written within the current financial year, or if it was written in the past financial year. 0435 Customising Forms Express Forms ...... How to Customise your data file if you have purchased Stationery cheques #05-022, 05-022D,05-023, 05-023D from Forms Express. 0440 Out of Balance in Bank Rec ................. Troubleshooting tips for finding the cause of Out of Balance amounts in Bank Reconciliations. 0445 Reconciled Transactions ..................... What you can and cannot do to reconciled transactions without your changes affecting the next Bank Reconciliation. Also describes methods you may try if you have inadvertently made a mistake. 0446 Importing Bank Statement .. ............... Outlines how to use the new Get Statement function within MYOB Accounting v12, Accounting Plus v12, Premier v6 and AccountEdge v2 0447 Incorrect Bank Statement Date............ This support note explains what to do if you have reconciled a bank account with an incorrect date. 0450 Setting up Petty Cash ........................ How to set up, pay for expenses and reimburse the Petty Cash. 0455 Using the Bank Register ...................... This support note explains how to use the Bank Register in MYOB Accounting v12, Accounting Plus v12, Premier v6 and AccountEdge v2 Sales 0500 Monthly aging in FirstAccounts .......... How to set up your Customer Terms so that you can age your receivables/payables in calendar months as opposed to 30 day blocks. 0501 Monthly Aging in MYOB .................... How to get true monthly aging in MYOB Accounting and Premier. 0505 Understanding Aging in FirstAcc ........ How Receivables and Payables are aged using the methods (1) number of Days since Invoice date (2) Days overdue using Customer terms. 0506 Understanding Aging ......................... How aging works in MYOB Accounting and Premier in Statements and Reports. 0507 Aging In February ……………….......... Tips on processing statements in February. 0508 Invoices Aging Incorrectly ................... Things to check if invoices are not aging correctly in MYOB. 0515 Prepaid hours ..................................... How to track prepaid hours of service (e.g. Internet hours) 0517 Factoring of Debtors .......................... How to handle the situation where your debtors are purchased by another entity. 0520 Cash & Credit Card Sales ................... How to set up your data file in order to cope with a high volume of Cash and Credit Card Sales. How to record reimbursements from Merchants and merchant fees. 0001 Page 3 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 0525 Contra Entries .................................... How to deal with situations were a vendor is also a customer, and you wish to reduce the value of your debt by the value of theirs. 0530 Receivables Recon .............................. What the difference is between the Aged Receivables report and the Receivables Reconciliation report. Explains how the receivables reconciliation can become Out of Balance. How to find the offending transactions causing the imbalance. And when a reported out of balance amount is actually false. 0535 Bad Debts .......................................... How to write off the debt. 0540 Credit Notes ....................................... How to issue a credit note for a refund, stock return and Discounts. 0542 Gift Vouchers ...................................... This support note provides simple steps on how to process a gift voucher as a transaction in MYOB. 0545 Commission for Emp – Template ........ How to use a Excel template to calculate commission for employees. 0555 Handling Customer Overpayments .... How to record the situation where a customer inadvertently pays you more than is outstanding. How to keep the money and apply it against a future sale, or issue a refund. 0560 Trade-ins ........................................... How to set up your Chart Of Accounts and Inventory to record Trade Ins. Also how to record a Trade In transaction. 0565 Value Adding ..................................... How to set up your Inventory to add value to Stock for expenses incurred in getting the item(s) to a saleable condition. e.g. a Used car that needs work on it prior to being sold. 0575 Transferring Credits ............................ How to transfer a credit from one customer to another. 0710 Purchases and Sales to Head Office ..... How to handle the situation where purchases or sales are made to branches or stores and these are paid by head office. Purchases 0660 Remittance Advice for Debit Stmts ...... Outlines how to produce a remittance advice with details of which bills have a debit note applied against. 0665 Payables Recon .................................. What the difference is between the Aged Payables report and the Payables Reconciliation report. How the payables reconciliation can become Out of Balance. How to find the offending transactions causing the imbalance. 0675 Reversing Deposits ............................ How to reverse a (Paid or Received) deposit on an invoice or purchase order. 0695 Hire Purch- GST accrual ...................... How to accommodate a Hire purchase agreement under an accrual basis. How to record the initial purchase and subsequent installments. 0696 Hire Purch-GST Cash ......................... How to accommodate a Hire purchase agreement under a cash basis. How to record the initial purchase and subsequent installments. 0697 Hire Purch- First Acc GST accrual ........ How to accommodate a Hire purchase agreement under an accrual basis in FirstAccounts. How to record the initial purchase and subsequent installments. 0698 Hire Purch-GST First Acc Cash ........... How to accommodate a Hire purchase agreement under a cash basis in FirstAccounts. How to record the initial purchase and subsequent installments. 0700 Printing Item Nos on Orders .............. How to customise your purchase orders to print YOUR item numbers OR the VENDORS item numbers. 0705 Vendor Cheque Remittances .............. When you need more room than is available on the cheque remittance for vendor payments, use the Card File Inquiry report. 0710 Head Office and Branches .................. When you record sales or purchases to seperate branches, but receive or pay a head office. 0001 Page 4 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia Payroll 0801 Showing Accruals as Liabilities ............ How to show Payroll Accruals such as Holiday Leave entitlements as a Liability in the Balance Sheet. 0802 Multipul Employee EFTs .................... How to pay employees pay into multiple bank accounts electronically. 0803 Employee Purchases .......................... How to handle employee purchases and then reducing their next paycheque. 0804 Reporting FBT on Payment Sum ......... Details how to report FBT on Payment Summaries 0805 Group Certificate Tips ........................ Important things to know when producing Group certificates. Explains for both Plain Paper and continuous form Group certificates. 0806 Handling Back Pay in Payroll .............. How to handle Back Pay payments to employees in Payroll. 0807 Incorrect Super Calc ........................... Troubleshooting tips, if your superannuation is not calculating correctly. 0808 Adjusting Super Rate to 9% ................ From 1/7/2000, the Super rate is 8%. This support note shows how to increase the rate and the other areas affected by the change. 0809 Multiple Branches & Payment Sum .. 0810 Section 221D Variations ..................... How to set up payroll for employees entitled to a section 221D variation. 0811 Flat Tax Deduction … ......................... Explains how to setup a flat tax rate for an employee. 0812 Adjust PAYG manually on Employee Pays . Explains how to manually adjust tax on an employee pay cheque. 0813 Entering Holiday Pay ........................... How to enter Holiday Wages in MYOB. 0814 Entering Negative Paycheques…………How to enter a paycheque for a negative amount. 0815 Salary Sacrifice–Salary employees ....... How to set up payroll for Salary employees who sacrifice a portion of their salary as extra superannuation. 0816 Salary Sacrifice–Hourly employees ...... How to set up payroll for Hourly employees who sacrifice a portion of their wages as extra superannuation. 0817 Superannuation Transitional Assist....... Explains why different payroll categories appear in different windows in the Superannuation Transitional Assistant. 0818 Salary Sacrif fixed amount 7.5/13.5..... How to setup Salary Sacrifice (fixed amount) in Premier v7.5/Accounting Plus v13.5 or later. 0819 Salary Sacrif % amount 7.5/13.5 ......... How to setup Salary Sacrifice (By %) in Premier v7.5/Accounting Plus v13.5 or later. 0820 Payroll Clearing Account .................... How employers that pay wages via a direct debit system or pay cash drawing only one cheque at their bank can simplify reconciling the Bank Account by using a Payroll Clearing Account. Without a clearing account multiple paycheques will appear in the Bank Rec. in MYOB while only one aggregate figure will on the bank statement. 0821 Tracking Hours Worked in Jobs ........... Using an Excel template to track the amount of hours allocated to jobs. 0822 Changes to Superannuation reporting. Explains how to report superannuation to employees using MYOB. 0823 Changes to Super in AccountEdge ...... Explains how to report superannuation to employees in AccountEdge v3 or earlier. 0824 Multiple Superannuation Funds........... This support note outlines a method of paying Superannuation Guarantee (SGC) contributions on behalf of employees, who have multiple superannuation funds. 0001 Page 5 of 17 Updated 4/2/05 If your business has more than one branch but uses the one data file you will still be required to submit you Payment Summaries for the individual branches. This support outlines the steps involved. www.myob.com.au/support/notes/ © MYOB Australia 0825 Rostered Days Off .............................. How to set up Payroll to handle RDO for both Salary and Wages Employees. 0830 Family Tax Initiative ............................ How to record the rebate for employees entitled to it. 0835 Leave Loading .................................... How to set up Payroll to handle Leave Loading on Holiday Pay and how to record it when tax applies over the $320.00 threshold. 0840 Wage Advances and Repayments ....... How to record an advance on an employees wages and the repayments. 0845 Changing Payroll Linked ..................... How to change payroll linked accounts set up in the payroll categories. This may be necessary if amounts are to be posted to alternative accounts than those that are currently linked. 0850 Jobs in Payroll ..................................... How to record payroll expenses against job numbers when there are less than 5 jobs per pay period per employee, and more than 5 jobs per pay period per employee. 0855 Super in WorkCover ........................... How to record WorkCover calculations where WorkCover is calculated on Superannuation as well as gross wages. 0860 Terminating Employees ...................... How to record the termination of an employee. 0861 Tax on Termination Payments ............ How to calculate the tax applicable on Termination Payments 0865 Gross Wages appearing As Net ........... Why Gross Pay can appear as Net pay on Group Certificates and how to correct the problem. 0870 End of Payroll Year Guide ................... Tasks involved in balancing and closing payroll financial year. 0871 Building Industry Superannuation……... The payroll module in v14 and v8 can now be setup to automatically calculate Superannuation for the building industry. 0872 Super Guarantee Guidelines ............... A list of wage categories that should be included in the Ordinary Times Earnings Calculation for Superannuation. 0873 Allowances in MYOB Payroll ............... How to enter employee allowances on a paycheques. 0875 Calculating Accrual %s in Payroll ........ How to set up Entitlement percentages for Holiday Leave and Sick Leave accruals 0880 Starting Payroll Midyear ..................... How to set up payroll when you begin after the start of the payroll year. (July 1- June 30 is the payroll year). 0882 Setting Up Long Service Leave ............ Outlines the steps to setup Long Service Leave Accrual. 0885 Sick leave (running down) .................. How to set up your payroll if you would prefer to give an employee a certain amount of sick days for the year and then run them down, reimbursing the entitlement on their employment anniversary. 0886 Adjust Holiday/Sick Accrual hours........ How to process adjustments to the Entitlement balances for employees. 0890 PAYG Tax Tables ................................. A guide to why the PAYG amount that MYOB calculates may differ from the amount the manual tax tables provided by the ATO specify. 0895 1% Medicare surcharge levy .............. What the levy is and how it is recorded in MYOB. 0896 Payment Summary ............................. If you are using MYOB v10.5 or Premier v4.5 you will need to manually produce your Payment Summaries and will be unable to create the empdupe file for electronic submission. This support note explains how to do this procedure. 0897 One Cheque Multiple Pay Periods ...... How to make sure that all tax entitlements are correct when paying an employee for multiple pay periods on one paycheques, ie. When employee takes holiday leave. 0899 1999 Vic Payroll Tax Changes ............ How to handle the changes to Payroll Tax for employment agents in Victoria. 0001 Page 6 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia Inventory 0560 Handling Trade-Ins ............................. How to set up your Chart Of Accounts and Inventory to record Tradeins. Also how to record a Trade-In transaction. 0565 Value Adding ..................................... How to set up your Inventory to add value to Stock for expenses incurred in getting the item(s) to a saleable condition. e.g. a used car that needs work on it prior to being sold. 0585 Retentions .......................................... How to record and keep track of Retentions 0590 Dismantling Inventory ........................ How to dismantle an item into a number of items/ components 0900 Inventory Adj Summary ...................... What Inventory Adjustments are and how to use them. 0901 Inventory Adj Detail ........................... Which accounts are affected by inventory adjustments and how to check inventory adjustments 0902 Labour in Items ................................... Explains how to include labour expenses to individual inventory items. 0903 Inventory less than zero ...................... This support note explains what to do if you receive the message “This will result in your inventory item showing less than zero”. 0905 Inv Linked Accounts ........................... What Linked Accounts are, and how they apply to Inventory. 0907 Inventory Value Reconciliation Report . How to reconcile inventory using the Inventory Value Reconciliation Report. 0908 How Reconcile Inventory Works .......... Explains the differences to balancing inventory in Premier v7/Accounting, Accounting Plus v13 to earlier versions of MYOB. 0909 Inventory Autobuild ............................ How to setup and use inventory autobuilds. 0910 Periodic Inventory .............................. What Periodic Inventory is. How to set up your inventory to use this method, and how to record end of period adjustments required for accurate reporting. 0911 Items Register Report .......................... Premier v7/Accounting, Accounting Plus v13 and later versions now have an additional feature of an Items Register. This support note gives an outline of this new feature. 0912 Items List Report ................................. How to reconcile inventory using the Items List Summary Report (this method is used in Premier v6, Accounting/Accounting Plus v12 and earlier versions). 0915 Inventory Change Overs ..................... How to record a changeover where an old part is handed over to a vendor in exchange for a new or reconditioned part and the old part is then reconditioned to sell. 0920 Consignor .......................................... How to set up your inventory to handle stock sent out to your customers on consignment. How to track who has your stock and the quantities and how to record sales when they happen. 0921 Consignee .......................................... How to handle inventory where you are the Consignee. 0922 Consignor – 2003 ............................... How to set up your inventory to handle stock sent out to your customers on consignment. How to track who has your stock and the quantities and how to record sales when they happen – Accounting/Accounting Plus v13, Premier v7 and AccountEdge v3. 0930 I buy, I sell, I Inv ................................. A guide to selecting the right combination of I BUY, I SELL, & I INVENTORY in your Items list. If the items are not set up correctly, it can cause possible future problems that are difficult to amend. 0935 Tracking Stock Sent Off Site ............... How to track inventory off-site and which may return in another form. 0955 Markup Sell Prices Tax Excl Cost ......... How to upgrade item prices via Excel. 0001 Page 7 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia End Of Period 0040 Partnerships ....................................... How to set up up your Chart of Accounts for Partnerships and recording profit distribution. 0320 Enter Transactions in 13th Period ....... What the 13th is period and how to record transactions in it. 0530 Receivables Reconciliation .................. What the difference is between the Aged Receivables report and the Receivables Reconciliation report. Explains how the receivables reconciliation can become Out of Balance. How to find the offending transactions causing the imbalance. 0665 Payables Reconciliation ....................... What the difference is between the Aged Payables report and the Payables Reconciliation report. How the payables reconciliation can become Out of Balance. 0805 Group Certificate Tips ........................ Important things to know when producing Group certificates. Plain Paper Group certificates and continuous form Group certificates. 1000 End of Year Guide .............................. Tasks involved in closing the Financial and Payroll Years. 1005 Changing the Last Month …………….. Explains how to change the last month of a financial year in a data file of the Financial Year. 1105 Distrib Trusts Profit ............................. How to modify Chart of Accounts for distributions to beneficiaries. How to distribute the Income to the beneficiaries. 1110 Posting Depreciation .......................... How to post end of year provisions for depreciation. 1115 Export files for Solution 6 ................... How to Export information from your data file to send to your accountant to use in Solution 6. 1120 Using Acc Code Conv ........................ For Accountants using Solution 6: this utility converts MYOB export information for easy import into Solution 6. 1125 MYOB Help for Acc ............................ Information on MYOB for accountants. 1130 Consol MYOB Reports ........................ How to create a Balance Sheet or Profit & Loss report for a consolidated entity where there are multiple data files. M-Powered Services 1201 The Box File. ....................................... Details about the Box File automatically created with every Company File in Premier v7.5 and Accounting Plus v13.5 1202 Backup/Restore M-Powered Service Users – Explains how the backup / restore function is affected for MPowered customers. 1203 Synchronisation Error .......................... Explains what to do if you received a Synchronisation Error. 1204 M-Powered DF cannot be found ........ This support note will explain what this error message is and the options that are available to resolve it. 1205 Removing old Superannaution Amts ... Once activating the MYOB M-Powered superannuation Service, the MPowered Service Centre will display all previously unprocessed superannuation amounts, this support note explains how to remove them. General - Accounting Terms 1793 Simplified Accounting ......................... Handling the Simplified Accounting Method – Backing Up 1300 Backup Principles ............................... Why backups are so important and setting up a cycle of backups. 0001 Page 8 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 1305 Backup and Restore Win ..................... How to backup and restore data files on a PC. 1308 Backup and Restore AccountEdge ....... How to backup and restore using MYOB AccountEdge. 1309 Restoring a Repaired DF ...................... Explains how to restore a data file repaired from the MYOB datafile repair team. 1310 Backup & Restore - Mac ..................... How to backup and restore data files on a Macintosh. 1315 Taking Files Home ............................... How to transfer a data file from your office computer to your home computer. 1318 Restore Errors – Dynazip...................... Explains some errors that could occur when restoring. 1321 File Corruptions and Integrity test ...... How to perform a data file integrity test on a version of MYOB that does not have the 'Verify Data' command 1515 MYOB Folders .................................... What the folders installed with the program contain and the importance of backing up these folders. - GST 1701 MYOB and the BAS ............................ An overview of the link between MYOB and the reporting requirements ATO's the ATO's Business Activity Statement. 1702 Cash and Accrual GST ......................... Explains both types of GST reporting 1703 BAS Derive from Acc .......................... How to use the Partial or Derived from Accounts method of filling out the BAS 1704 Manual BAS Transaction ..................... Explains what information is needed to enter ATO payments or credits 1707 GST Installments Paid ………………….. Explains the three Options for reporting the BAS and also outlines the procedure for Option 3. 1708 FirstAcc and Private Usage .................. How to make an end of period GST adjustment for private usage and consumption of goods. 1709 Installing the Readyreckoner................ How to install the Readyreckoner 1710 Update Card File Tax Codes ............... How to use EXCEL to update customer and vendor tax codes 1711 FA3.5 Manual BAS - GST .................... How to use the GST/Sales Tax reports to fill out the BAS 1712 FA3.5 Manual BAS - PAYG ................. How to use the GST/Sales Tax reports to enter PAYG withholding amounts on the BAS 1713 Tax Codes in GJs ................................ How to use tax codes in the General Journal Entry window 1714 GST & private use .............................. How to record purchases that include a creditable and non-creditable component 1715 Update Item Tax/Prices ....................... How to use EXCEL to update tax codes and prices 1716 N-T & FRE .......................................... The difference between N-T and FRE tax codes 1717 Alter GNR tax code ............................ How to alter the GNR tax code 1718 Alter GN2 tax code ............................ How to alter the GN2/NOA tax code 1719 GST Private use 2003 Releases............. How to enter private use GST amounts in Premier v7 / Accounting/Plus v13 (& later versions). 1720 WET, GST and MYOB ......................... How to record the WET amounts 1725 GST Adjustments & Disc .................... How to make adjustment notes for credits, refunds and settlement discounts with GST 1726 Discounts and GST.............................. How to process discounts in Premier v7, Accounting / Plus v13 (and later versions). 1730 PAYG Withholdings v9/p3 .................. How to create a report which shows both the gross amount of the purchases and the amount withheld 0001 Page 9 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 1731 PAYG Withholdings v10/P4 ................ What are voluntary withholding agreements and how to use the voluntary withholding tax code 1732 PAYG Withholding in FAv3.1 .............. How to create a report which shows both the gross amount of the purchases and the amount withheld 1733 Payroll PAYG in FA3.5 ......................... How to report payroll wages and PAYG withholdings inthe FirstAccounts BASlink 1735 Input Taxed Trans .............................. Which tax codes to use for input-taxed transactions 1736 Withholdings in FA35 ......................... What are voluntary withholding agreements and how to use the voluntary withholding tax code. 1740 GST Cellar Door Wine Sales ................ Set up tax rates for WET and GST where the wine sales have been made at the cellar door 1741 Wine - Promotional Use ...................... How to account for WET on Wine for Promotional Use 1743 Wine Producer Rebate & Wholesale….How to set up and record the Wine Producer Rebate on Wholesale sales. 1745 Lay-Bys with GST ................................ How to account for lay-bys 1746 Insurance Settlements & GST .............. This support note deals with accounting for insurance settlement amounts. 1750 Line Tax on GST Invoices .................... How to customise your forms to include the line tax field and other new GST fields 1751 Long Term Accom .............................. How to account for long-term accommodation transactions 1755 Updating Selling Matrix ..................... How to update the selling matrix where you use one or more price levels 1760 Luxury Car Tax and MYOB Acc ........... How to enter a sale involving luxury car tax 1762 Second Hand Goods & GST ............... Outlines the issues and procedures to handle second-hand goods under the new tax system 1765 Empl'ee Reimburse with GST .............. Outlines a procedure to track GST input credits when reimbursing employees 1766 Employee Purchases & GST ................ Explains how to account for situations where employees purchase goods or services from the business 1770 Import Purchase & GST ...................... How to record overseas purchases treating import costs as expense items or part of the inventory value 1771 Deferred GST on Import ..................... How to defer GST payment on international purchases 1772 Split Purch with GST/Free ................... How to split tax between taxable and non-taxable supplies 1773 Tax Information Reconciliation ………. An overview of this report is provided, which will assist you to identify any reported out of balances. 1774 Invoices with GST Only ...................... How to account for invoices with GST amounts only relating to a previous purchase 1775 Neg amounts on Trans ....................... How to create transactions that include both income and expense accounts 1776 Merchant Fees & GST ........................ How to account for GST on Credit card merchant fees 1780 GST On workcover Accrual ................. How to account for GST on Workcover – Accrual Basis 1781 GST on Workcover Cash ..................... How to account for GST on Workcover – Cash Basis 1782 GST on Workcover (SA) Accrual........... How to claim the GST included in Workcover premiums as an input tax credit – Accrual Basis 1783 GST on Worcover (SA) Cash ................ How to claim the GST included in Workcover premiums as an input tax credit – Cash Basis 0001 Page 10 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 1784 3rd Party Insurance ............................ How to enter compulsory third party insurance premiums 1785 Yellow Pages & GST ............................ How to process transaction to Yellow pages and pay GST amount up front. 1787 BAS Templates ................................... How to save and edit your BAS setup. 1788 Reconciling the BAS ........................... Explains how to reconcile the BAS. 1789 Additional Tax Codes .......................... Explains how to track unique transactions in the BAS. 1790 BAS Reform Guide............................... Overview of changes to BAS 1791 Accrual to Cash Basis … ...................... Explains steps involved when converting from Accrual to Cash Basis on the BAS Statement. 1792 Cash to Accrual Basis … ...................... Explains steps involved when converting from Cash to Accrual Basis on the BAS Statement. 1800 GST general faqs ................................ Frequently asked questions relating to GST 1801 BAS general faqs ................................ Frequently asked questions relating to the BAS 1802 BASlink general faqs ........................... Frequently asked questions relating to BASlink 1803 New BASlink ....................................... Frequently asked questions relating to the integrated BASlink application 1804 Old BASlink ........................................ Frequently asked questions relating to Excel BASlink version 1805 FAQs 2nd Edition ................................. How to check to see if you are running the latest version of BAS, what BAS/GST reports are available in the latest version, and tasks to be completed before and after completing the BAS. 1806 th th 4 Quarter BAS FAQ ............................ Frequently asked questions relating to running the 4 Quarter BAS. – Forms 1400 Copy Customised Forms … ................. How to copy individual customised forms 1401 Copy Customised Forms Folder .......... How to copy your entire customised forms folder 1455 Graphics in Forms .............................. How to use graphics in your forms. i.e. invoices purchase orders etc. 1470 Customising Forms ............................ An introduction to customising invoices, cheques and other forms. 1481 Customising Forms ............................. How to customise forms in Premier v8, Accounting v14, Accounting Plus v14 and AccountEdge v4. 2680 Customising in forms in Just Invoices…How to customize forms in Just Invoices. – Hot Keys 1420 BusinessBasics Hot Keys....................... Keyboard shortcut keys to functions with BusinessBasics 1425 FirstAccounts Hot keys-Win ................ Keyboard shortcut keys to functions within FirstAccounts. Win only 1430 FirstAccounts Hot keys - Mac .............. Keyboard shortcut keys to functions within FirstAccounts. Mac only 1435 MYOB Hot keys-Mac .......................... Keyboard shortcut keys to functions within MYOB Mac only 1440 MYOB Hot keys-Win ........................... Keyboard shortcut keys to functions within MYOB Win only – Operating Systems 1325 Date Formats ..................................... How to change the Date Format in MYOB for PCs and Macintosh. 1326 Display Settings for Windows .............. Recommended window display settings for viewing MYOB 1330 MYOB Shortcuts Win 95/8 ................. How to create/edit Icons to open your data file directly in Windows 95. 0001 Page 11 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 1350 Macintosh Memory ............................ Information regarding Macintosh Memory. How to allocate RAM. 1655 Windows Explorer ............................... Gives brief overview of Windows Explorer. – Printers 1390 Printing Probs Win 95, 98, 2000 ........ Printing problems are not normally questions handled by the support team however we have put together a troubleshooting document to help you should you encounter printing difficulties in Win95. 1395 Printer Error Defin .............................. What Printer Errors between -5 and 5 mean, other printer-generated error messages and how to resolve them. 1397 Reinstall a Printer Driver in Win .......... How to reinstall a printer driver in Windows 95. Always try reinstalling the printer driver if you are having problems printing! – Other 0150 Confirming your Company Files……….Details on confirming your company files. 1312 Upgr First Acc to v11 or P5 Wind ........ Details how to upgrade from FirstAccounts to MYOB Accounting v11 or Premier v5 on Windows. 1313 Upgr First Acc to v11 or P5 Mac.......... Details how to upgrade from FirstAccounts to MYOB Accounting v11 or Premier v5 on Macintosh. 1370 MA/MP on the same machine………….Explains how to install MYOB Accounting and Accounting Plus on the same machine. 1398 Uninstalling/Reinstall MYOB .. ............. This support note explains how to uninstall and reinstall MYOB programs. 1445 PPCD Content .................................... For PAC and CC members only. A list of what is contained on the Professional Partners CD 1480 Installing QuickTime …. ...................... Details how to install QuickTime. 1490 Deleting Transactions … ..................... Explains how to delete or reverse Transactions. 1491 Deleting General Ledger Accounts ...... Explains how to delete General Ledger Accounts from the Accounts List. 1492 Deleting Cards .................................... Explains how to delete Cards. 1500 Exporting Reports ............................... How to export a report out of MYOB so that it can be reformatted. (See 1505 for exporting reports using OfficeLink). 1530 Electronic Payments ........................... How to creatre an ABA file to be transmitted to the bank for processing. This support notes relates to MYOB Accounting 8 & 9 and MYOB Premier 2. 1531 Electronic Payments v12 / p5 .............. How to creatre an ABA file to be transmitted to the bank for processing. This support notes relates to MYOB Accounting / Plus v12, Premier 6 and AccountEdge v2. 1532 Rejected Electronic Payments .............. How to process a rejected payment included in the Electronic Payments process. 1540 Share Portfolio ................................... How to handle share portfolio in MYOB, updated for GST 1545 Share Dividends ................................. How to handle share dividends and dividend reinvestment plans. 1560 Downloading from Mymyob …. ......... Explains how to download from the my myob web site. 1560 Windows Explorer …........................... Outlines use of Windows Explorer 1555 User ID & Password............................. Explains new User ID & Password setup in the 2004 releases of MYOB. 1675 Not an MYOB Datafile......................... What to do if you receive the error Not an MYOB Datafile. 0001 Page 12 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 1680 Moving Datafiles b/w platforms ......... Different methods of transferring data between Macintosh and PC and vice versa 1900 Categories........................................... How to setup and use the Categories feature within MYOB. (Premier v7, Accounting/Plus v13 & later). Errors 1320 Error 20 of 39 …………………………….Details what to do if the verification process detects this particular message. 1322 Critical Error in BASLink ....................... What the error means and steps to take afterwards. 1396 RPC Stub Error .................................... Explains what this error means and steps to take afterwards. 1399 Install Shield Errors .............................. What to do if you receive an Installshield error message. 1485 Email Troubleshooting ........................ For those having difficulty using the email option within MYOB. 1504 Officelink Connection Alerts……………A listing of errors and solutions for officelink errors. 1605 Bus Errors Macintosh .......................... A description of Bus Error 1 on a Mac and Troubleshooting tips. 1610 Cash and Dict File .............................. What the 'Cash file is full' and 'Dictionary file is full' error messages mean and steps you must take. 1615 Fatal Error 1106 ................................. What the error means and steps you must take afterwards. 1620 Fatal Error 114x .................................. What the error means and steps you must take afterwards. The 'x' stands for any errors beginning with 114, x could be 1 - 9. 1625 Fatal Error 1199 ................................. What the error means and steps you must take afterwards. 1630 Mac Unexpectedly quit ...................... What the error means and steps you must take afterwards 1635 Gen Protection Faults ......................... What a General protection fault is and broad troubleshooting tips. 1645 Macintosh System Errors .................... A list of Macintosh System errors. 1650 Windows System Errors ...................... A list of Windows System errors. 1660 Install Trblshooting ............................. For those who are having difficulty installing the program - some alternative procedures are provided. 1670 Lock Files............................................. Explains what the Lock File error means and what to do to overcome the error. 1671 Lock Files 2003 releases....................... Explains what the Lock File error means and how to overcome this error when using Premier v7 (& later versions) and Accounting Plus v13 (& later versions). 1689 Data File Corruption............................ Outlines how a data file corruption may occur and the various errors you may receive to indicate a corruption. 1826 OffLink Run Time ............................... How to deal with the Runtime Error that may occur when using OfficeLink with Word 97. 2099 Termination Code 1250 ….................. Explains what to do if you receive Termination Code 1250. 2106 Errors in MYOB data file .. ................... Explains details about data file corruption errors. MYOB Accounting 1505 OfficeLink and MYOB (Excel) .............. How to use MYOB OfficeLink with Excel. Windows only. 1506 OfficeLink and MYOB (Word/WP) ....... How to use MYOB OfficeLink with Microsoft Word and Corel WordPerfect. 1507 Uninstalling Office 97 ......................... How to completly remove Office 97 from you computer. 0001 Page 13 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 1515 MYOB Folders .................................... What the folders installed with the program contain and the importance of backing up these folders. 1550 Changing the default user ID ............. How the change the default user ID. MYOB AssetManager Pro 2000 Overview of UCA & STS ...................... An overview of the ‘Uniform Capital Allowances System’ and the ‘Simplified Tax System’. 2010 AM and End of Fiscal Year .................. How to start a New Fiscal Year in AssetManager Pro and what happens when the new year is commenced. 2020 Closed Dataset error ........................... Possible causes for this error and how to resolve it. 2025 Importing and Exporting for v3 .......... How to Import and Export data in AssetManager Pro version 3. 2030 New datafile errors in AM v1.5 ............ Possible causes of this error in AssetManager version 1.5 and how to resolve it. 2035 Exporting v1.5 / import v2 … ............. Explains how to export assets from Asset Manager v1.5 and import them into Asset Manager v2.0 2045 Useful Tax Reports for AM Pro ............. Details suitable reports within AssetManager pro to obtain tax figures. 2050 Using the Asset Count module in AM.. How to use the Asset Count module in AssetManager Pro. 2055 Changing Effective Life........................ How to change the effective life for an asset. 2060 Private Use & AM Pro .......................... How to process private use transactions in AssetManager Pro 2065 Luxury Car Tax and AM Pro ................ How to process Luxury Car Tax. 2070 Revaluing Assets in AM Pro.................. How to revalue assets in AssetManager Pro. 2075 Second Elements of Cost in AM Pro..... Details the process of entering first and second element costs. 2080 Adjustments in AM Pro........................ How to process adjustments in AssetManager Pro 2085 Software Development Pools in AM .... Explains how to setup Software Development Pools in AssetManager Pro. 2090 Exporting Reports from AM Pro........... How to export reports from AssetManager Pro. 2095 Disposal of STS Pool assets ..………Explains the steps required when disposal of an STS Pool asset greater than the STS pool balance MYOB Premier -General 1515 MYOB Folders .................................... What the folders installed with the program contain and the importance of backing up these folders. 1550 Changing the default user ID ............. How to change the default user ID. 2100 Setting up Premier on Win95/98 ........ How to set up Premier on a Windows 95 or 98 network. 2101 Setting up Premier on Macintosh ....... How to set up Premier on a Macintosh network. 2102 Setting up TCP/IP ............................... Tips on how to set up TCP/IP to run Premier 3, it you choose to use this transport protocol. 2103 Setting up Premier W2K ...................... Setting up Premier on Windows 2000/ME Network 2105 Premier Performance .......................... How to get the most out of Premier and your network. 2107 Premier Single User Locking ............... A list of administrative areas that can be accessed when there is only one person in Premier. 0001 Page 14 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 2108 Extensions from DAT to PRM …………. This support note will provide the outline in changing the file extension for MYOB data files. 2109 Premier protocol ................................ How to install a network adapter. 2110 Network errors - Premier 3 ................. What happens if you recieve a network error message in Premier 3, and how to prevent these errors. 2111 Network Termination Code 1250 ....... How to resolve Termination Code 1250 in MYOB Premier 2112 MYOB Premier and Error Codes .......... A list of Premier Error Codes, their meaning and how to resolve them. 2120 Windows 98 prob's and Realtek........... If you are experiencing problems with Premier in Windows 98, check to see if you have a Realtek driver installed. 2121 Setting up Premier on Wind XP … ...... How to setup your Premier network on a Windows XP environment. 2122 Adding Additional Workstations …...... Explains how to enter additional workstations to Premier. 2124 Adding Additional Workstations .......... Explains how to enter additional workstations to Premier v8 and later. 2125 Virtual Redirector in Windows 95B ..... If you are using Windows 95B and are experiencing network problems with Premier, you should read this information. 2130 MYOB Premier 3 Upgrade Checklist ... What you need to know and do to upgrade to Premier 3. 2205 Time Billing Work in Progress ............. How to reflect the Work in Progress for services provided in the Financial Statements 2210 Time Billing Rounding ........................ Overcoming the possible rounding issues on Time Billing Invoices 2215 Activities and Items on Invoices .......... How to invoice Items and Services on Time Billing Invoices. -Multi Currency 2300 Exchange Rates .................................. How to calculate exchange rates. 2310 Multiple Control Account ................... How to setup Multiple Control Accounts 2320 T/fer from 1 currency A/C to another .. Outlines steps to transfer funds from one foreign currency to another. 2330 Multi currency Contra ......................... How to process contra transactions when using multi currency. MYOB AccountEdge 2123 AccountEdge 3 and OS X Network...... Details how to setup AccountEdge 3 on a OS X network. Pocket Accounts 2405 Hot Sync Speed................................... Explains how to increase the speed of a Hot Sync MYOB PowerPay 2500 PowerPay Set Up Tips ......................... What you need to know to get your PowerPay data file set up! 2501 Imprt Card Details PP6 ....................... How to import Employee information into PowerPay. 2505 Including Super in WorkCover. ........... How to include Super in the Workers Compensation calculation. 2510 PowerPay-End Of Year Routine ........... Steps to take at the end of a Payroll Year in Power Pay 2512 Carrying over RDO Accrual ….. ........... Explains how to carry over RDO Accruals. 2515 Tracking Rostered Days Off ................ How to track Rostered Days off in MYOB PowerPay 2520 Importing Pay Details into PP ............. How to import pay information into MYOB PowerPay. 0001 Page 15 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 2530 Dealing With PPS and Tax Rates ......... How to handle contractors who pay PPS tax or employees using different rates of tax eg flat 15%. 2535 Upgrading to Version 4 (MAC) ........... How to upgrade to Version 4.0 of PowerPay on the Macintosh. 2536 Upgrade to v5 from v3 (WIN) ............ How to upgrade to v5 of PowerPay from v3 or PayCheque Pro in Windows. 2540 Backup/Restore, Compact (Mac) ........ Backup/Restore and Compacting procedures for Mac. 2541 Backup/Restore, Compact (Win) ........ Backup/Restore and Compacting procedures for Windows. 2545 Employee Purchases in PowerPay ....... How to handle purchases made by your employees and deducting them from their next paycheque. 2550 Employee Reimbursements ................ How to reimburse employees in their paycheque 2555 Setting up Salary Sacrifice .................. How to set up Salary Sacrifice Superannuation in MYOB PowerPay 2560 Paying Employees by Bank Transfer .... How to setup PowerPay to handle Direct Credits to the employee's bank account. 2565 Splitting Employee's Pay ..................... How to pay employees in more than one bank account, or both cash and cheque. 2570 Export Files at Finalise Pay .................. How to create the Export files, eg Bank Transfer file, when finalising the pay run. 2575 Terminating Employees ...................... How to terminate employees in PowerPay 2580 Holiday Pay and Tax ........................... How to pay Holiday Pay in advance for a number of periods in one pay and calculating the correct tax in PowerPay. 2585 Adjustment Pay Runs .......................... How to create and use Adjustment and Additional Pay Runs. 2591 PPay Leave Adjustments ...................... How to adjust an employees leave balance. 2595 Tax adjustments in PowerPay .............. How to adjust the amount for tax deducted in MYOB PowerPay. 2600 PP tax tables update ........................... Update tax tables and how to add a tax scale 2605 PPay transfer to MYOB ....................... Creating a transfer file that can be imported into MYOB accounting software 2610 PPay 4D Tools Check Fix ..................... How to run the 4D Tools program to fax errors within PPay 2611 PPay – 4D Compact Wind/Mac ........... Explains how to compact the PPay datafile. 2615 PAYG in PPay on BAS .......................... How to retrieve the information from PPay required for reporting on the BAS. 2620 PPay Adjusting Super to 9% … ........... Explains how to increase your superannuation % in PPay. 2622 PPay PubHol in Adv v6 ….................... Details paying public Holiday’s in advance. 2625 NEX Tax Scale ..................................... Explains how to alter the NEX tax scale so that the PAYG is withheld correctly. 2626 Changes to Super Reporting ............... Explains the changes to reporting Superannuation and explains how this can be completed in PowerPay. Support Notes relevant for RetailManager & MYOB Accounting 2730 Accounting Export ……………………. How to setup RetailManager to export your sales/purchases information to MYOB Accounting software. 2731 Accounting Export Troubleshooting .. How to overcome problems that may occur when exporting accounting information from Retail Manager and when importing into MYOB Accounting Software. 2738 Updating Accounting Export Update… How to change auto import details in RM if MYOB Accounting is upgraded. 0001 Page 16 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia 2744 Importing Stock into RM from MYOB… Instructions on how to import inventory items from MYOB Accounting to RetailManager 2745 Importing Cards into RM from MYOB. Instructions on how to import supplier, customer and staff cards from MYOB Accounting to RetailManager ReportWriter 2450 ReportWriter Support Options............. This support note provides information on the support MYOB is able to offer & provides information on alternative means of support for issues MYOB Technical Support cannot assist with. 2452 ReportWriter Table Structures.............. Provides information on MYOB Table Structures. 2453 ReportWriter Performance ................... Shows you some areas of ReportWriter which allows you can maximise the performance of the program. 2454 ReportWriter Sending Reports ............. Explains how to send reports from ReportWriter 2458 ReportWriter Connections ................... Explains how to utilise an existing ODBC connection to an MYOB data file and provides an overview on connecting to a different MYOB database/data source. 0001 Page 17 of 17 Updated 4/2/05 www.myob.com.au/support/notes/ © MYOB Australia