1.1 Elasticity

advertisement

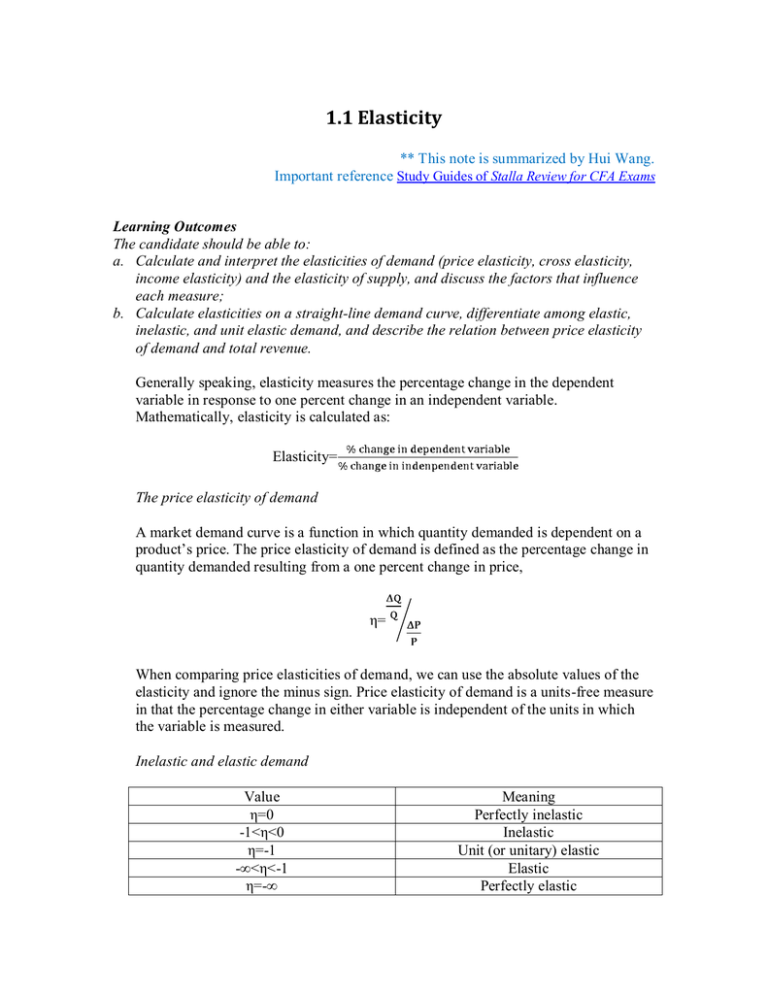

1.1 Elasticity ** This note is summarized by Hui Wang. Important reference Study Guides of Stalla Review for CFA Exams Learning Outcomes The candidate should be able to: a. Calculate and interpret the elasticities of demand (price elasticity, cross elasticity, income elasticity) and the elasticity of supply, and discuss the factors that influence each measure; b. Calculate elasticities on a straight-line demand curve, differentiate among elastic, inelastic, and unit elastic demand, and describe the relation between price elasticity of demand and total revenue. Generally speaking, elasticity measures the percentage change in the dependent variable in response to one percent change in an independent variable. Mathematically, elasticity is calculated as: Elasticity= The price elasticity of demand A market demand curve is a function in which quantity demanded is dependent on a product’s price. The price elasticity of demand is defined as the percentage change in quantity demanded resulting from a one percent change in price, η= When comparing price elasticities of demand, we can use the absolute values of the elasticity and ignore the minus sign. Price elasticity of demand is a units-free measure in that the percentage change in either variable is independent of the units in which the variable is measured. Inelastic and elastic demand Value η=0 -1<η<0 η=-1 -∞<η<-1 η=-∞ Meaning Perfectly inelastic Inelastic Unit (or unitary) elastic Elastic Perfectly elastic Elasticity along a straight-line demand curve Note that for a straight-line demand curve is the slope of the demand curve, combined with a point on the demand curve we can calculate the price elasticity of demand at that point. So when we move down the demand curve, the demand is getting more and more inelastic; when we move up the demand curve, the demand is getting more and more elastic. Point and arc elasticities If price only changes a very small amount, we can compute the point elasticity of demand: η= But when there are large changes in price, it is more appropriate to use the arc elasticity of demand: η= ÷ Total revenue and elasticity The total revenue is calculated as the price of the good multiplied by the quantity sold. The relationship between the total revenue change in response to price change and price elasticity of demand is that: Price elasticity of demand Elastic Inelastic Unit elastic Relationship between price change and total revenue a 1% price cut increases the quantity sold by more than 1% and total revenue increases a 1% price cut increases the quantity sold by less than 1% and total revenue decreases a 1% price cut increases the quantity sold by 1% and total revenue does not change We can also use this relationship to estimate the price elasticity of demand. The method used is called total revenue test: Change in TR that results from a change in the price a price cut increases total revenue a price cut decreases total revenue a price cut leaves total revenue unchanged Price elasticity of demand elastic inelastic unit elastic Similarly, the change in a consumer’s expenditure on a certain good depends on her elasticity of demand. If a consumer’s demand for a good is elastic, a price cut will increase the quantity she buys and thus increase her expenditure on the good and vice versa. The factors that influence the elasticity of demand: (1) Closeness of substitutes: the closer the substitutes for a good or service, the more elastic is the demand for it. (2) Product’s price relative to a consumer’s total budget: products that command a larger percentage of a consumer’s total budget tend to be more price elastic. (3) Time elapsed since price change: demand is likely to be more elastic over a long period relative to a short period. Cross elasticity of demand The cross elasticity of demand measures the responsiveness in the quantity demand of one good when a change in price takes place in another good: Cross elasticity of demand= The cross elasticity of demand for substitute goods are positive; the cross elasticity of demand for complements are negative. If the cross elasticity of demand for two goods is zero, then the two goods are not related. Income elasticity of demand The income elasticity of demand for a particular good is defined as the percentage change in quantity demanded resulting from a one percent change in consumers’ income. Mathematically, it equals: η= * For most products, the income elasticity of demand is positive. Such goods are called normal goods. For some other goods, however, the income elasticity of demand is negative. We call the goods with a negative income elasticity of demand inferior goods. Elasticity of supply The price elasticity of supply measures the rate of response of quantity supplied to a change in price. It is calculated as: Elasticity of supply= As with price elasticity of demand, when price changes are large, it is more appropriate to use arc elasticity and when price changes are very small, it is more appropriate to use point elasticity. If the quantity supplied is fixed, regardless of the price, the supply is perfectly inelastic. When the percentage change in quantity supplied is equal to the percentage change in price, the supply is unit elastic. If there is a price at which sellers are wiling to offer any quantity for sale, the supply is perfectly elastic. One special case is that for any linear supply curve that passes through origin, the elasticity of supply is 1, that is, the supply is unit elastic. Factors that influence the elasticity of supply (1) Spare production capacity: if there is plenty of spare capacity then a firm is able to increase its output without a rise in costs and therefore supply will be more elastic. (2) Ease and cost of factor substitution: if resources used to produce a good are occupationally mobile then the elasticity of supply for the good is higher than if resources cannot easily and quickly be switched. (3) Time period involved in the production process: supply is more price elastic the longer the time period that a firm is allowed to adjust its production levels. Stocks of finished products and components: if stocks of raw materials and finished products are at a high level then a firm is able to respond to a change in demand more quickly by supplying the goods in stock to the market. Exercise Problems: (provided by Stalla PassMaster for CFA Exams.) Q1. Q2. Q3. Q4. Q5. Q6. Q7. Q8. Q9. Q10. EXPLANATION Q1. Q2. Q3. Q4. Q5. Q6. Q7. Q8. Q9. Q10.