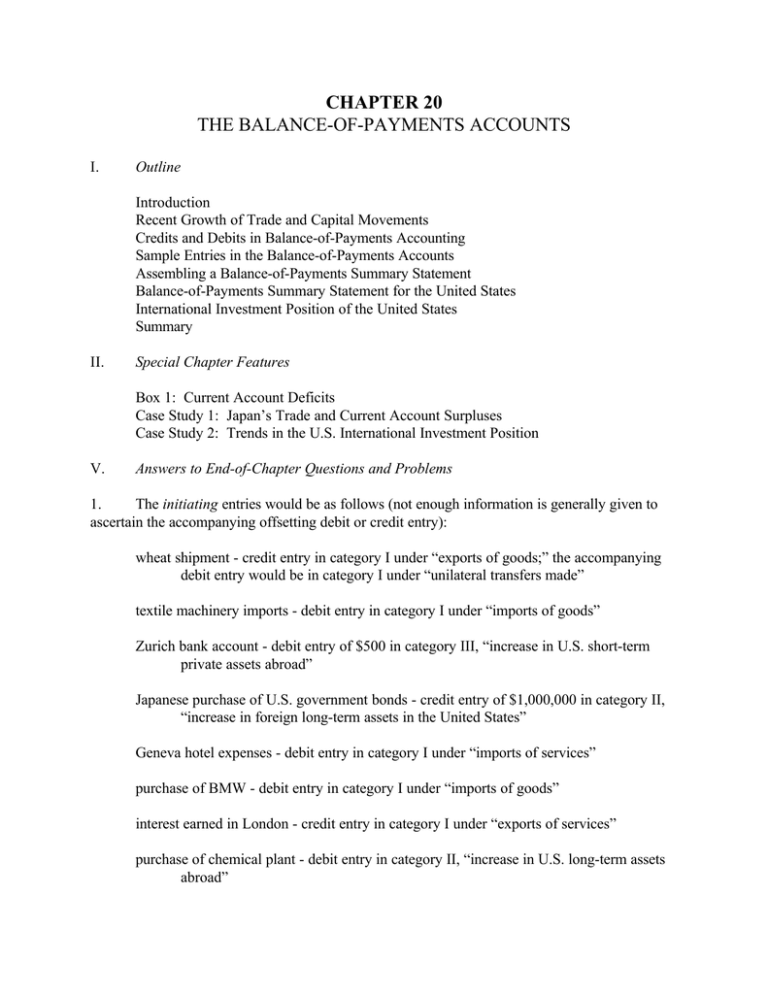

CHAPTER 20 THE BALANCE-OF-PAYMENTS ACCOUNTS

advertisement

CHAPTER 20 THE BALANCE-OF-PAYMENTS ACCOUNTS I. Outline Introduction Recent Growth of Trade and Capital Movements Credits and Debits in Balance-of-Payments Accounting Sample Entries in the Balance-of-Payments Accounts Assembling a Balance-of-Payments Summary Statement Balance-of-Payments Summary Statement for the United States International Investment Position of the United States Summary II. Special Chapter Features Box 1: Current Account Deficits Case Study 1: Japan’s Trade and Current Account Surpluses Case Study 2: Trends in the U.S. International Investment Position V. Answers to End-of-Chapter Questions and Problems 1. The initiating entries would be as follows (not enough information is generally given to ascertain the accompanying offsetting debit or credit entry): wheat shipment - credit entry in category I under “exports of goods;” the accompanying debit entry would be in category I under “unilateral transfers made” textile machinery imports - debit entry in category I under “imports of goods” Zurich bank account - debit entry of $500 in category III, “increase in U.S. short-term private assets abroad” Japanese purchase of U.S. government bonds - credit entry of $1,000,000 in category II, “increase in foreign long-term assets in the United States” Geneva hotel expenses - debit entry in category I under “imports of services” purchase of BMW - debit entry in category I under “imports of goods” interest earned in London - credit entry in category I under “exports of services” purchase of chemical plant - debit entry in category II, “increase in U.S. long-term assets abroad” lumber sales to Japan - credit entry in category I under “exports of goods” shipment of Fords from Mexico - debit entry in category I under “imports of goods;” profits earned in the Mexican plant - credit entry in category I, “exports of services” 2. The capital account in the balance of payments indicates the net asset transfers between the home country and foreign countries during the time period under consideration. A net debit balance (capital account deficit or net capital outflow) indicates that home country wealthholders increased their holdings of foreign assets relative to foreign wealthholders’ ownership of home country assets. A net credit balance (capital account surplus or net capital inflow) indicates the opposite. The current account reflects the net effect with respect to foreign countries of the sources and uses of home country current income during the time period. A net debit balance (current account deficit) indicates that current income used to purchase imports of goods and services and to make unilateral transfers abroad exceeded current income generated by exports of goods and services and the receipt of unilateral transfers from abroad. A net credit balance (current account surplus) reflects the opposite. 3. The “net international investment position” shows the total existing stock of foreign assets (physical and financial) owned by U.S. citizens and government minus the total existing stock of U.S. assets (physical and financial) owned by foreign citizens and governments. If the United States experienced a current account surplus, the U.S. net international investment position would increase. Foreign payments to the United States for exports of goods and services and for unilateral transfers would exceed U.S. payments for imports of goods and services and unilateral transfers. This would result in a net buildup of U.S. ownership of foreign assets relative to foreign ownership of U.S. assets. 4. Japan’s current account surplus has been smaller than its trade surplus because Japan is a net importer of services, including transportation services and travel expenditures abroad by Japanese citizens. The official reserve transactions balance has been close to zero because Japanese monetary authorities have not been intervening in foreign exchange markets and hence government transactions in category IV have been minimal. 5. Keeping track of the capital account provides information on the specific nature of developments in the relative holdings of foreign assets by domestic citizens and government and home country assets held by foreign citizens and government. For example, the analyst can examine the extent to which the asset changes have been concentrated in short-term assets, longterm assets (and direct versus portfolio assets), private assets, or official assets. Developments in these various asset categories have different implications as to the speed with which the capital account can change in the future and for the size of investment income flows that will occur in the future. In addition, since the capital account estimates never match the current account figures in practice, examination of the magnitude of the resulting statistical discrepancy can be useful for assessing the size and nature of the gaps that exist in the data-collection network. 6. Since Y = C + I + G + (X - M), the current account balance can be defined as (X - M) = Y - (C + I + G). With a current account deficit, (X - M) < 0 or, therefore, Y < (C + I + G). Because Y indicates production in the economy and (C + I + G) indicates total spending by the country’s residents (or the use of goods and services), the fact that Y < (C + I + G) means that the country’s use of goods and services is greater than the country’s production. 7. When the initial investment is made, say the purchase of a foreign production facility by a Country A firm, there is a debit in the long-term capital account of country A (“increase in longterm assets abroad”) and a credit in A’s short-term capital account (either an “increase in foreign short-term assets in country A” if the foreign firm selling the facility is given a bank account in country A, or a “decrease in A’s short-term assets abroad” if payment is made from the A firm’s bank balance abroad). Over time, A’s current account can be affected in a variety of ways - for example, exports from A of components to the new facility can take place, final goods imports into A from the facility can occur, and profits may be repatriated to A. Of course, if A’s currency depreciates because of the initial capital outflow, this can alter A’s current account immediately. 8. In balance-of-payments accounting, the transactions would be recorded for country A as follows: ITEM (1): Credit: Category I, Exports of goods, + $1,000 Debit: Category IV, Increase in short-term assets abroad, - $1,000 ITEM (2): Debit: Category I, Unilateral transfers made, - $500 Credit: Category IV, Increase in foreign short-term assets in A, + $500 The merchandise trade balance improves by $1,000 (the credit entry for exports); the current account balance improves by $500 (the sum of the $1,000 export credit entry and the - $500 unilateral transfers entry); the official reserve transactions balance has a net effect of zero [the $500 improvement in the current account is matched by the - $500 change (- $1,000 + $500) in the short-term private assets account. 9. There is validity to this point because of the identity (X - M) = S + (T - G) - I. A reduction in the U.S. federal government budget deficit, assuming other right-hand-side variables are constant, would reduce (T - G) and therefore decrease (X - M).