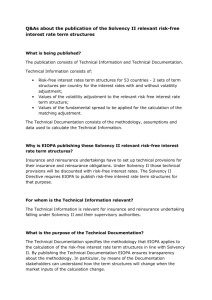

Solvency II Revealed October 2011

advertisement