History of Political Economy Thomas C. Leonard Dept. of Economics Fisher Hall

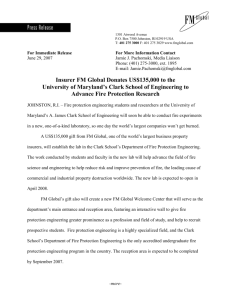

advertisement