1 THE MODIGLIANI - MILLER THEOREMS

advertisement

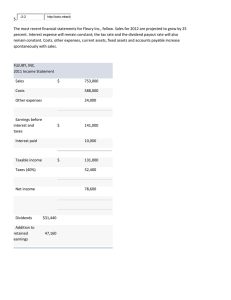

Financial Markets and Decisions II 1 BEE 3034 2010 THE MODIGLIANI - MILLER THEOREMS References Modigliani and Miller “The cost of capital and the theory of investment” American Economic Review 1958. Miller Journal of Economic Perspectives 1988, + comments. 1.1 Types of Securities Lenders Earnings 45o ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... . D Firm’s Earnings Figure 1: Returns to debt are concave in earnings. Debt and Equity Assume that a …rm has issued debt, which requires it to make repayments of value D next period. The only other security issued is equity. Equity-holders have limited liability. Shareholders will be risk loving. However bondholders will be risk-averse. Junior Debt In the case of default senior debtholders are paid …rst, Junior debt is more risky than senior debt and therefore pays a higher rate of return. 1 Equity Earnings 45o D Firm’s Earnings Figure 2: Returns to equity are a convex function of earnings. Returns to Debt 45o p D ... ... ... ... ... ... ... ... ... ... ... D+d Figure 3: Returns to junior debt 2 Preferred Stock Preferred stock receives a …xed payment. If the payment is not repaid there is no default. No dividends can be paid on equity if the payment on preferred stock is not made. Convertible Debt 1.2 Is debt, which can be exchanged for equity at a predetermined conversion rate. The Debt-Equity Ratio Theorem 1.1 1st Modigliani-Miller theorem Suppose that a …rm’s total returns X is unaffected by the …rm’s …nancial decisions and that investors can borrow on the same terms as …rms, then in equilibrium the …rm’s debt-equity ratio cannot a¤ ect its value. Proof. Consider two …rms, …rm 1 and …rm 2, both of whose earnings may be described by the same random variable X. TF =Total value of …rm F; SF =Market value of equity in …rm F; BF =Market value of bonds in …rm F: T F = SF + B F : Firm 1 is 100% equity …nanced T1 = S1 : Firm 2 is levered T2 = B2 + S2 : The total payment to shareholders in …rm 2 is X B2 r: (r = interest rate.) Suppose if possible the levered …rm has higher value T2 > T1 : Consider an investor who initially owns fraction of the equity of …rm 2. This portfolio gives returns (X B2 r) : Suppose (s)he sold this portfolio and borrowed $ B2 : (S)he could buy fraction S2S+1 B2 of the equity in …rm 1. This gives T2 returns S2S+1 B2 X B2 r = B2 r > (X B2 r) : T1 X Now suppose that T2 < T1 : Consider an investor who initially owns fraction of the equity of …rm 1. This portfolio yields returns = X and costs T1 : Suppose instead the individual purchased fraction T1 T1 T2 shares in …rm 2 and T2 B2 bonds. T1 T1 Cost = T2 S2 + T2 B2 = TT12 T2 = T1 : Returns= TT12 (X B2 r) + TT12 B2 r = TT12 X > X: Thus the investor has been able to get higher returns at the same cost. 1.3 Tax and Debt Debt interest can be deducted from corporate tax, but dividends cannot. Proposition 1.1 Under the same conditions as the Modigliani-Miller theorem. If there is a corporate income tax levied at rate t the levered …rm has greater total value by amount tB2 : Proof. Portfolio 1: shares in …rm 1 Cost = S1 ; Returns = (1 Portfolio 2: t)X: shares in …rm 2 and (1 Cost = S2 + (1 Returns = (1 t)B2 bonds. t)B2 ; t)(X rB2 ) + (1 t)rB2 = (1 t)X: Since these two portfolios yield the same returns they must have the same price. Hence S1 = S2 + (1 t)B2 , S1 = S2 + B2 therefore T1 + tB2 = T2 : The levered …rm has greater total value by amount deduction. 3 tB2 ; tB2 ; which is the capitalised value of the tax 1.4 Dividend Policy Model There are two time periods, t = 1; 2: Dt =dividend in period t: Bt =borrowing of the …rm in period t: I = investment in period 1. X1 = returns in period 1; : X2 (I) = returns in period 2: Theorem 1.2 2nd Modigliani -Miller theorem Suppose that the total returns X of a …rm are una¤ ected by …nancial decisions and investors can buy and sell securities on the same terms as the …rm. Then the …rm’s dividend policy can have no e¤ ect on its value. Proof. X1 + B1 = D1 + I; B1 = D1 + I X1 : X2 (I) = D2 + B1 (1 + r) : D2 = X2 (I) (D1 + I X1 ) (1 + r) c2 = e1 + Consider a shareholder who owns of the equity. His/her budget constraint is: c1 + 1+r e2 D2 D1 + 1+r + 1+r ; where et denotes other income in period t: Substituting from above into the budget constraint we obtain, +I X1 )(1+r) (D1 +I)(1+r) c2 e2 e2 2 (I) c1 + 1+r = e1 + D1 + 1+r + X2 (I) (D11+r = e1 + D1 + 1+r + X1+r + 1+r X1 (1+r) 1+r : Hence e2 X2 (I) c2 = e1 + + + X1 I: 1+r 1+r 1+r The shareholder’s budget constraint is independent of D1 and D2 : Consequently his/her consumption is also independent of dividend policy. c1 + Remark 1.1 The optimal level of investment is given by X20 (I) = 1 + r: 1.5 Assumptions Required for Modigliani-Miller Theorems 1. Control aspects of shares ignored. 2. Shareholders can lend and borrow at the same interest rate as …rms. 3. No bankruptcy. 4. Tax ignored 4