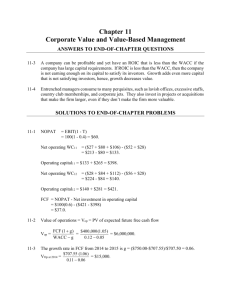

The Relation Between the Cost of Capital and Economic Profit

advertisement