Second Degree Price Discrimination - Examples Second Degree Price Discrimination and Ty- ing

advertisement

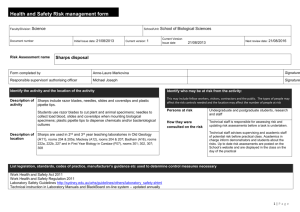

Second Degree Price Discrimination Examples1 Second Degree Price Discrimination and Tying Tying is when firms link the sale of two individual products. One classic example of tying is printers and ink refills. Companies make printers so that you can only use their brand of printer ink refills - one can’t put an ink cartridge made by firm A into a printer made by firm B. A similar result occurs with razors and refills of razor blades - if you own a particular brand of razor, only that brand’s blade refills will fit. Why do firms do tying? There are many examples presented in your textbook. This handout will focus on the price discrimination rational firms engage in tying because it allows them to extract the most consumer surplus from consumers with different levels of demand for their products. 1 Tying in the Market for Razors In order to shave, people need two products - razors and razor blades. Beardb-Gone is a monopolist in the razor market. They make razors at a marginal cost of $3 per unit. They currently make razors that will work with any razor blade refill, and razor blade refills are made in a competitive market, so consumers can obtain razor blades at marginal cost. For simplicity, we assume the marginal cost of razor blade production is zero. There are only two consumers in the market. Consumer 1 (the clean shaven one) has a high demand for razors and razor blades. Consumer 2 (the 1 Disclaimer : This handout has not been reviewed by the professor. In the case of any discrepancy between this handout and lecture material, the lecture material should be considered the correct source. Despite all efforts, typos may find their way in - please read with a wary eye. Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2008 bearded fellow) has a lower demand for the two products. Given that the price of razor blades is p (for now, it is set to zero), the two inverse demands for razor blades are p = 10 − 2r1 p = 8 − 2r2 or, in regular demand form, p 2 p r2 = 4 − 2 r1 = 5 − where r is the quantity of razor blades consumed. By law, Beard-b-Gone is not allowed to sell razors to different consumers at different prices. Consumers consume either one or zero razors, but can consume multiple razor blades. 1.1 Situation 1 - No Tying Beard-b-Gone wants to pick the price that maximizes their total profits. Since razor blades don’t cost anything, the consumer surplus (CS) that consumer 1 and consumer 2 get from consuming razors and razor blades is the entire area under their demand curves for razor blades. 1 CS1 = (10 − 0)(5) = 25 2 1 CS2 = (8 − 0)(4) = 16 2 Consumer surplus for each consumer is shown in figures 1a and 1b. Beard-bGone knows the demand functions of the two consumers, and so they know how much CS each consumer gets from using razors and razor blades to shave. When determining the price of razors, Beard-b-Gone will try and extract as much of the CS as it can. If Beard-b-Gone wants to sell to both consumers, it can’t set the price of razors any higher than $16. That is the CS of the consumer with the lowest valuation (consumer 2). If the price of razors were $17, for example, then consumer 1 will still want to buy their product (since 2 10 9 9 8 8 7 7 6 6 Price Price 10 5 4 5 4 3 3 CS1 = 25 2 2 1 1 0 0 1 2 3 4 5 0 6 Number of Razor Blades CS2 = 16 0 1 2 3 4 5 6 Number of Razor Blades (a) (b) Figure 1: Consumer surplus for consumer type 1 and consumer type 2. CS1 > 17, but consumer 2 will not, since CS2 < 17. If Beard-b-Gone is selling to both people, then they will price their razors as high as possible while still keeping both customers. That would mean a price of $16, and an overall profit of Πboth = CS2 ∗ 2 − M Crazors ∗ 2 Πboth = 16 ∗ 2 − 3 ∗ 2 = 26 What if Beard-b-Gone decided they only wanted to sell to people with the higher demand for razors?2 The maximum price they could charge would be $25, giving a profit of Πhigh only = 25 ∗ 1 − 3 ∗ 1 = 22 2 Note that we haven’t considered the option of only selling to consumer 2. This is because any rational firm would never choose that option. After all, if consumer 2 is willing to buy, consumer one, who has a higher demand than consumer two, is willing to buy as well. So if the firm is only selling to one consumer, it will be the consumer with the higher demand and thus the higher consumer surplus they can extract. 3 Since Πhigh only < Πboth , Beard-b-Gone will choose to sell to both individuals. The total surplus will be the sum of the firm profits and the consumer surplus of any consumers that buy razors and razor blades. Note that since the price of razors is set to extract all the surplus from consumer 2, despite buying razors and razor blades they end up with no consumer surplus. 1 1 T Sno tying = CS1 + CS2 + Πboth = (10)(5) − 16 + (8)(4) − 16 + 22 = 31 2 2 1.2 Situation 2 - Tying Having taken economics as an undergraduate, the CEO of Beard-b-Gone decides she wants to try tying - Beard-B-Gone will make their own razor blades. To make sure that people buy their brand and not anyone else’s, they modify their razors so that they will only work with official Beard-bGone razors blades. They sell their official razor blades at a price of p. If Beard-b-Gone wants to sell to both consumers, then the maximum price P they can charge for their razors is the CS consumer 2 (the low demand consumer) has left after buying razor blades.3 We now allow Beard-b-Gone to sell razor blades at a price above 0. By doing so, they’re taking away some consumer surplus from anyone that buys razor blades. We can redefine the CS for consumer 2 after buying razor blades as 1 CS2 = (8 − p)(quantity of razor blades demanded at p) 2 1 p = (8 − p)(4 − ) 2 2 (1) After buying official Beard-b-Gone razor blades, consumer 2 has (1) left over in consumer surplus. That means that Beard-b-Gone can charge P = CS2 = (1) and still get consumer 2 (and consumer 1) to buy both their razors and their razor blades. If they follow this strategy, Beard-b-Gone will sell two razors at a price of P = 21 (8 − p)(4 − p2 ), r1 = 5 − p2 razor blades to consumer 1 at price p, and r2 = 4 − p2 razor blades to consumer 2 at price p. With zero 3 Actually, this was always how we calculated P , but before we had set p = 0. 4 marginal cost of producing razor blades, total profits will be Πboth tying = 2 ∗ (CS2 left after buying razor blades at price p) + (price of razor blades) ∗ [consumer 1’s demand for razor blades + consumer 2’s demand for razor blades] − 2 ∗ (marginal cost of producing razors) or h p p pi 1 −2∗3 = 2 (8 − p)(4 − ) + p 5 − + 4 − 2 2 2 2 p = (8 − p)(4 − ) + p [9 − p] − 6 2 p2 = 32 − 8p + + 9p − p2 − 6 2 p2 = 26 + p − 2 Πboth tying We have now made profits a function of only p, and we can take first order conditions with respect to p to find the optimal price of razor blades. Π0both tying = 1 − p = 0 → p = 1 If p = 1, then P = 21 (8 − 1)(4 − 12 ) = 12.25. Total profits for the firm are now Πboth tying = 2 ∗ 12.25 + 1(4.5 + 3.5) − 6 = 26.5 Beard-b-Gone can make more money if they are able to tie in the sale of their razors with the sale of their razor blades. In doing so, they are able to sell razors at a price low enough to get both consumers, and make up for the lower price of razors by selling razor blades. So Beard-b-Gone has higher profits - what about consumers? The consumer surplus situation with tying is shown in figures 2a and 2b. With tying, both people get razors. Consumer 2 still doesn’t get any surplus - they have to pay for the razor blades (blue region), and whatever willingness to pay they have left is eaten up by the cost of the razor (purple region) - the price 5 10 9 9 8 8 7 7 6 6 Price Price 10 5 5 4 4 3 3 2 2 1 1 0 0 1 2 3 4 5 0 6 0 Number of Razor Blades 1 2 3 4 5 6 Number of Razor Blades (a) (b) Figure 2: Firm profits and consumer surplus under tying. of razors is exactly equal to CS2 (after buying razor blades). Consumer 1, on the other hand, gets the red region in CS. 1 1 (10 − 1)(5 − ) − 12.25 = 8 2 2 Consumer 2’s situation hasn’t changed - they didn’t have any surplus before, and they don’t have any now. Consumer 1 is now worse off than they used to be. Before, they had to pay $16 for razors and were able to get razor blades for zero cost. Now, the cost of razors has gone down to $12.25, but they have to pay $1 for razor blades. With a demand for 4.5 blades, that means they’re paying $12.25 + $4.50 = $16.75. There’s also some additional consumer surplus that’s gone away that hasn’t turned into firm revenues. See that little non-shaded region in the bottom right of figure 2a? That was consumer surplus under the no tying situation. Now, it’s not going to anyone. 6 2 Tying in the Market for Disposable Mops Moppin’-Glo makes mop handles at a marginal cost of $2 per unit. They have no fixed costs. The mop handles attach to disposable mop heads, which are made in a competitive market and sell at a price of $1 per mop head. There are two consumers in the market, with the following inverse demand functions p 4 p p = 20 − 2m2 → m2 = 10 − 2 p = 20 − 4m1 → m1 = 5 − where m is the number of mop heads. Each consumer purchases either one or zero mops. 2.1 Situation 1 - No Tying Say the firm does not engage in tying. Then they choose between selling to the high demand consumer or both consumers. Since the marginal cost of mop heads isn’t zero (recall that p = M Cmop heads = 1), calculating CS under no tying is a little more complicated than it was in the last example. 1 1 CS1 = (20 − 1)(5 − ) = 45.125 2 4 1 1 CS2 = (20 − 1)(10 − ) = 90.25 2 2 By logic similar to example 1 Πboth = 2 ∗ 45.125 − 4 = 86.25 Πhigh only = 90.25 − 2 = 88.25 The firm will choose to sell only to the high demand individual. Total surplus is then T Shigh only = 88.25 since neither consumer gets any surplus at all (consumer 1 doesn’t buy, and consumer 2 has to pay all their surplus as the cost of a mop). 7 22 Price 16 12 8 Cost of Mops 4 0 Cost of Mop Heads 0 2 4 6 8 11 Number of Mop Heads Figure 3: Cost of mops and mop heads for consumer 2 (not to scale). 2.2 Situation 2 - Tying Under tying, Moppin’-Glo starts making their own disposable mop heads. They will choose the price for mop heads p and the price of mops P that maximizes overall profits in selling to both consumers. First, we need to write out the profit function in terms of only p. If consumer 1, with the low demand, buys mops at price p, their consumer surplus will be 1 p CS1 = (20 − p)(5 − ) 2 4 (2) Moppin’-Glo will then set the price of mops equal to (2), since they want to extract all the possible surplus from the low demand consumer. Profits will then be Πboth tying = 2 ∗ P + (p − M Cmop heads )(m1 + m2 ) − 2 ∗ M Cmops p p p = (20 − p)(5 − ) + (p − 1)(5 − + 10 − ) − 4 4 4 2 2 p 3p = 100 − 5p − 5p + + (p − 1)(15 − ) − 4 4 4 p2 3p2 3p = 100 − 10p + + 15p − − 15 + −4 4 4 4 p2 = 81 + 5.75p − 2 8 Taking first derivatives Π0both tying = 5.75 − p = 0 → p = 5.75 That means 1 5.75 P = (20 − 5.75)(5 − ) = 25.38 2 4 m = m1 + m2 = 3.56 + 7.13 = 10.69 Πboth tying = 2 ∗ 25.38 + (5.75 − 1)(10.69) − 2 ∗ 2 = 97.54 Profits are higher under tying, so that’s what Moppin’-Glo will do. As for consumers, CS1 = 0 and CS2 = 25.38. Consumer surplus overall has gone 22 22 16 16 12 12 Price Price up, as have profits, so total surplus is higher under tying in this market. Cost of Mops 8 4 0 4 Cost of Mop Heads 0 2 Cost of Mops 8 4 6 8 0 11 Number of Mop Heads CS Cost of Mop Heads 0 2 4 6 8 11 Number of Mop Heads (a) (b) Figure 4: Consumer surplus, cost of mops, and cost of mop heads for consumers 1 and 2 (not to scale). 3 Some Quick Notes In the first case, consumer surplus went down under tying. In the second case, consumer surplus went up under tying. Unfortunately, there’s rarely a quick 9 and easy way to know if CS will go up or down. The one guaranteed rule is that if the non-tying situation involves selling to both consumers (as it did in our example with razors and razor blades), CS will go down under tying. Both consumers are still consuming the goods, but under tying consumers have to pay a marked up cost for what they used to get at marginal cost. 10