perfect competition monopolistic competition monopoly STRUCTURE

advertisement

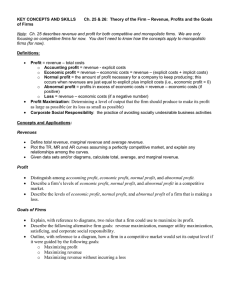

perfect competition monopolistic competition monopoly (simple) monopoly (perf. discriminating) number of firms many several one one type of output homogeneous heterogeneous not applicable (but consider substitutes in related markets) not applicable (but consider substitutes in related markets) entry/exit free free barriers to entry barriers to entry information full and symmetric full and symmetric full and symmetric full and symmetric firm’s demand price taker - horizontal price maker - downward sloping price maker - downward sloping price maker - downward sloping market demand downward sloping don’t really draw one firm is same as market firm is same as market profit maximizing firms mr = mc at x profit max profit maximizing firms mr = mc at x profit max profit maximizing firms mr = mc at x profit max profit maximizing firms mr = mc at x profit max short-run profit could be +/0/- could be +/0/- could be +/0/- could be +/0/- long-run profit 0 0 + or 0 + or 0 allocative efficiency? (NSS maximized?) yes no no yes productive efficiency? (firm at min of lratc?) yes no probably not but perhaps probably not but perhaps p=mc at x profit max p>mc at x profit max p>mc at x profit max p=mc at x profit max remember to think of both the market and firm when doing analysis in perfect comp. hard to decide on definition of market/product group, so really only look at the firm picture remember to consider dead weight loss from the monopolist’s behavior each unit is sold at its demand price, so the entire area of NSS goes to the monopolist as PS and CS=0! no notion of supply CURVE no supply CURVE no notion of supply CURVE STRUCTURE CONDUCT behavioral assumption and implication PERFORMANCE p vs. mc COMMENTS oligopoly STRUCTURE number of firms few type of output homogeneous or heterogeneous entry/exit often there are some barriers to entry usually strategically created information full and symmetric firm’s demand (δ) price maker - downward sloping market demand (D) downward sloping CONDUCT behavioral assumption and implication profit maximizing firms mr = mc at x profit max short-run profit could be +/0/- long-run profit + or 0 with Cournot 0 with Bertrand + or 0 with Chamberlin PERFORMANCE allocative efficiency? (NSS maximized?) no with Cournot yes with Bertrand no with Chamberlin productive efficiency? (firm at min of lratc?) probably not but perhaps Is p =? >? <? mc p>mc at x profit max - Cournot p=mc at x profit max - Bertrand p>mc x profit max - Chamberlin COMMENTS keep in mind game theory and cartels