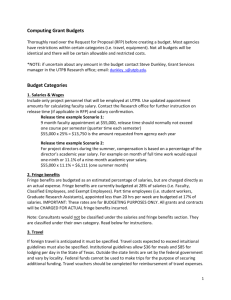

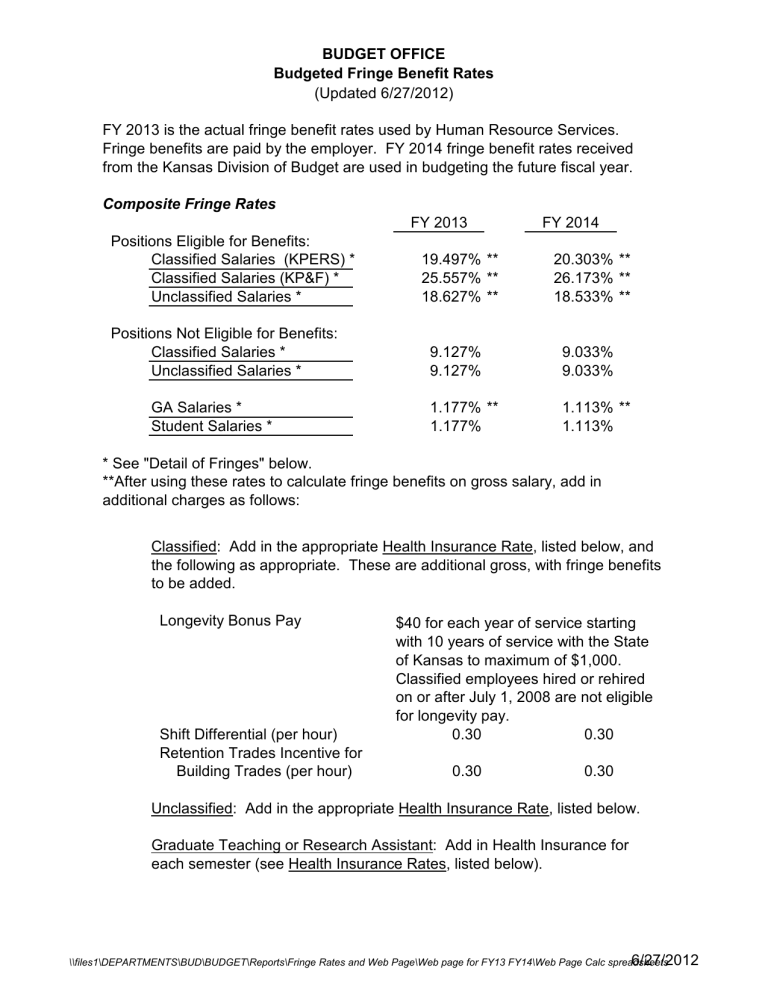

(Updated 6/27/2012) BUDGET OFFICE

BUDGET OFFICE

Budgeted Fringe Benefit Rates

(Updated 6/27/2012)

FY 2013 is the actual fringe benefit rates used by Human Resource Services.

Fringe benefits are paid by the employer. FY 2014 fringe benefit rates received from the Kansas Division of Budget are used in budgeting the future fiscal year.

Composite Fringe Rates

FY 2013 FY 2014

Positions Eligible for Benefits:

Classified Salaries (KPERS) *

Classified Salaries (KP&F) *

Unclassified Salaries *

19.497% **

25.557% **

18.627% **

20.303% **

26.173% **

18.533% **

Positions Not Eligible for Benefits:

Classified Salaries *

Unclassified Salaries *

GA Salaries *

Student Salaries *

9.127%

9.127%

1.177% **

1.177%

9.033%

9.033%

1.113% **

1.113%

* See "Detail of Fringes" below.

**After using these rates to calculate fringe benefits on gross salary, add in additional charges as follows:

Classified: Add in the appropriate Health Insurance Rate, listed below, and the following as appropriate. These are additional gross, with fringe benefits to be added.

Longevity Bonus Pay $40 for each year of service starting with 10 years of service with the State of Kansas to maximum of $1,000.

Classified employees hired or rehired on or after July 1, 2008 are not eligible for longevity pay.

0.30

0.30

Shift Differential (per hour)

Retention Trades Incentive for

Building Trades (per hour) 0.30

0.30

Unclassified: Add in the appropriate Health Insurance Rate, listed below.

Graduate Teaching or Research Assistant: Add in Health Insurance for each semester (see Health Insurance Rates, listed below).

Extra Duty Compensation Rates (excludes health insurance paid through regular salary)

FY 2013 FY 2014

Classified Salaries

Unclassified Salaries

19.497%

18.627%

20.303%

18.533%

Detail of Fringes

Positions Eligible for Benefits:

Classified (KPERS)

Retirement:

KPERS

Death & Disability

FICA

Workmen's Compensation

Unemployment Compensation

Leave Pay

TOTAL

Classified (KP&F)

Retirement:

KP&F

FICA

Workmen's Compensation

Unemployment Compensation

Leave Pay

TOTAL

FY 2013

9.370%

1.000% ***

7.650%

0.557%

0.300%

0.620%

19.497%

FY 2013

16.430%

7.650%

0.557%

0.300%

0.620%

25.557%

Unclassified

Retirement:

TIAA

Death & Disability

FICA

Workmen's Compensation

Unemployment Compensation

Leave Pay

TOTAL

FY 2013

8.500%

1.000% ***

7.650%

0.557%

0.300%

0.620%

18.627%

FY 2014

8.500%

1.000%

7.650%

0.573%

0.270%

0.540%

18.533%

***There will be a moratorium of Death & Disability for 3 months. This will be for the paydates in April, May and June, 2013. Budget is using .769% for

Death & Disablity for FY 2013.

FY 2014

10.270%

1.000%

7.650%

0.573%

0.270%

0.540%

20.303%

FY 2014

17.140%

7.650%

0.573%

0.270%

0.540%

26.173%

Positions Not Eligible for Benefits

Classified & Unclassified

FICA

Workmen's Compensation

Unemployment Compensation

Leave Pay

TOTAL

Graduate Assistants

Workmen's Compensation

Leave Pay

TOTAL

FY 2013

7.650%

0.557%

0.300%

0.620%

9.127%

FY 2013

0.557%

0.620%

1.177%

FY 2014

7.650%

0.573%

0.270%

0.540%

9.033%

FY 2014

0.573%

0.540%

1.113%

Students

Workmen's Compensation

Leave Pay

TOTAL

FY 2013

0.557%

0.620%

1.177%

FY 2014

0.573%

0.540%

1.113%

For Students and Graduate Assistants:

(Add FICA for a salaries paid when classes are not in session)

(Add UCI for salaries paid when not enrolled in classes.)

Health Insurance Rates for Classified & Unclassified (use Dependent Coverage)

Full-Time Employee

Single Coverage

Dependent Coverage

Fall / Spring Semester Rates

Summer Semester Rate

FY 2013

$6,995.04

$10,232.64

Part-Time Employee

Single Coverage

Dependent Coverage

$5,571.84

$8,132.16

$5,571.84

$8,132.16

Health Insurance Rates for Graduate Teaching and Research Assistants

8/1/11-7/31/12

$338.00

$135.00

FY 2014

$6,995.04

$10,232.64