How to prepare

a Break Even Analysis

for your business

Michael Chase, MBA, MS Taxation

www.MChase.com

Accounting@MChase.com

Copyright 2010

Michael Chase.

All rights reserved.

Michael

Chase

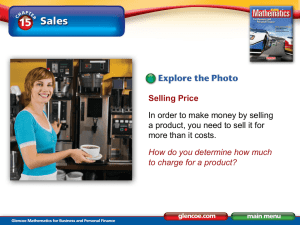

Break Even Analysis

A break even analysis is a way to figure out how much your business has to sell –

both in dollars and in units – to make money.

A business makes money when its sales are higher than break even sales.

You need to know two things to figure out your business's break even sales:

Its markup

Its fixed costs

The example on the next page shows the break even sales, in dollars and units, of a

retail business that sells widgets.

This is a simplified example because this business only has one kind of widget that it

sells for $15 each.

To apply this to a business that sells many different items at many different prices

you need to figure out:

The average selling price of each item at each price point

The average markup of each item at each price point

The percent of total sales of each item at each price point

Then aggregate the sales of each item at each price point.

This is actually easier than it sounds because you can simplify the calculation by

aggregating different items that are in about the same price range and have about

the same markup.

continued …

Break Even Analysis Example

Product: Widgets

Cost

$10

Markup

$5

Sell for

$15

Monthly Fixed Costs

Entrepreneur

Assistant

$2,500

1,250

Total payroll

3,750

Payroll taxes (10%)

Rent & Utilities

Phone & Internet

375

1,000

250

Total Monthly Fixed Costs

$5,375

Break Even Sales

Units

Unit Break Even Sales =

(Total Monthly Fixed Costs) divided by (Markup)

1,075

$5,375 / $5 =

Dollars

Dollar Break Even Sales =

(Unit Break Even Sales) times (Sell for)

1,075 x $15 =

$16,125