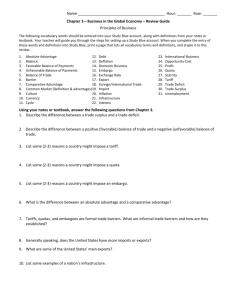

Study Questions for Week 5

advertisement

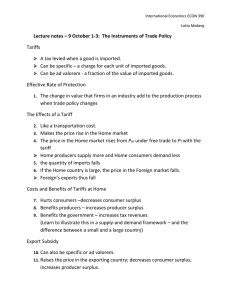

Study Questions for Week 5 1. What is the “small country” assumption? What is the “large country” assumption? Is the US a small country in the international oil market? In the international tea market? In the international rice market? Wheat market? 2. Examine Figure 5.1. Is the text using the small country model? Explain the interpretation of each of the areas a, b, c, and d in this figure. 3. The text notes different mechanisms for allocating import licenses under an import quota system. Which one raises the most money for the government? Which one is the least efficient? 4. Examine Figure 5.2. With reference to Figure 5.2 explain the statement: “in a growing market an import tariff is less restrictive than an equivalent import quota.” 5. Consider the domestic market for good X described in the figure above. Fill out the table below for the following 2 cases. A. $1 Import tariff for a small country. The world price is $6 World Price $6 Domestic Price Quantity Consumed Domestically Quantity Produced Domestically Quantity Imported Consumer Surplus (domestic) Producer Surplus (domestic) Production Effect Consumption Effect Government Tariff Revenue Net National Gain B. Import quota = 2 units. The world price is $6. The import licenses are auctioned to the highest bidder. World Price $6 Domestic Price Quantity Consumed Domestically Quantity Produced Domestically Quantity Imported 2 units Consumer Surplus (domestic) Producer Surplus (domestic) Production Effect Consumption Effect Government Auction Revenue Net National Gain C. Suppose due to increased world supply, the world price fell to $4. How would this change your answers in 5A and 5B? 6. Consider the domestic market for good X described in the figure above. (a larger copy of this figure is included at the end of this study guide for your convenience). Fill out the table below for the following 2 cases. A. $2 Import tariff for a large country. The import tariff causes the world price to fall from $6 to $5 World Price $5 Domestic Price Quantity Consumed Domestically Quantity Produced Domestically Quantity Imported Consumer Surplus (domestic) Producer Surplus (domestic) Production Effect Consumption Effect Government Tariff Revenue Net National Gain B. 2 unit Import quota for a large country. The import quota causes the world price to fall from $6 to $5. The import licenses are auctioned to the highest bidder. World Price Domestic Price Quantity Consumed Domestically Quantity Produced Domestically Quantity Imported Consumer Surplus (domestic) Producer Surplus (domestic) Production Effect Consumption Effect Government Auction Revenue Net National Gain $5 2 units 9. What are domestic content requirements? Suppose Washington State had a “domestic content” rule that WSU could only hire faculty with PhD’s from universities within Washington State. How would this affect WSU faculty wages? Costs per student? Output (# of students served), Quality? 10. Subsidy for domestic producers: Examine Figure 5.4, panel (a). How much does this subsidy cost? How much does this subsidy benefit domestic producers? How much does this subsidy cost the government? How large is the production inefficiency? 11. Subsidy for domestic exporters: Examine Figure 5.4, panel (b). Is the text using the small country model or the large country model? How much does this subsidy cost? How much does this subsidy benefit domestic producers? How large is the production inefficiency? 12. What is “dumping”? Compare two different definitions of dumping; the price-based and cost-based. Suppose country A produced good X with MC=$10, ATC=$16, and AVC=$9. It exported and sold good X to country B (a high income country) at $18. It exported and sold good X to country C (a low income country) at $10. Can country B claim that country A is dumping according to the price-based definition? the cost-based definition? 13. Use the case study on the sugar import quota to estimate The loss in consumer surplus The gain in producer surplus The production effect The consumption effect How are these import quotas allocated? Should we consider the value of these import quotas as a loss to the US? 14. The US is a large country in the world oil market. The table below shows quantities of oil (in millions of barrels per day) for different prices. Currently the price of oil is $100 per barrel. If the US places a $40 per barrel import tariff on oil, studies show that the world price will decrease to $90, the US price would be $130 and the US would import 13 rather than 14 million barrels per day. Use these data with the large country model of an import tariff to estimate the following tariff effects. Area a: transfer of consumer surplus from consumers to domestic producers Area b: production inefficiency of the tariff Area c + e: government tariff revenue Area d: consumption inefficiency Area e: terms of trade effect Does the US as a whole benefit or lose from this tariff? Price Q supplied US Q demanded US Q Imported US $100 6 20 14 $130 6 19 13 14. According to the reading on the US ethanol tariff, does the US seem to have a comparative advantage in ethanol production? Who benefits the most from the US ethanol tariff? 15. Refer to the figure below (extras provided to show your work) showing the domestic market for good X in the small country, Zimbania. The world price is $5. a. Determine Zimbania’s own production, imports, quantity demanded, consumer surplus, and producer surplus for the case of free trade. b. Determine Zimbania’s own production, imports, quantity demanded, consumer surplus, producer surplus, government revenue, production inefficiency and consumption inefficiency for the case of a $2 per unit import tariff. c. Determine Zimbania’s own production, imports, quantity demanded, consumer surplus, producer surplus, government revenue, production inefficiency and consumption inefficiency for the case of an import quota of 2 units. d. Determine Zimbania’s own production, imports, quantity demanded, consumer surplus, producer surplus, government revenue, production inefficiency and consumption inefficiency for the case of a domestic production subsidy of $2 per unit produced by domestic suppliers. e. Note that all three policies (tariff, quota, and subsidy) expand domestic production to 3 units and increase producer surplus to $4.5. Which policy is the most efficient? Why?