Import Tariffs and Export Subsidies: General Equilibrium Analysis

advertisement

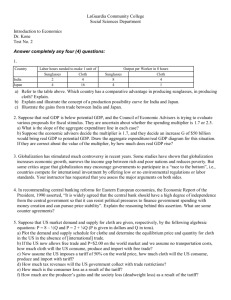

Econ 354, revised 11/19/02, page 1 Import Tariffs and Export Subsidies: General Equilibrium Analysis Introduction We assume two countries, each of which can produce cloth and food. Home is assumed to have a comparative advantage in cloth, and Foreign is assumed to have a comparative advantage in food. It is also assumed that increases in production of one good entail rising opportunity cost in terms of the other good, so that each country's production possibility frontier (PPF) is concave to the origin, as in the Heckscher-Ohlin model. The graphs passed out in class depict PPFs for the two countries that satisfy the given assumptions. We also assume that the welfare of each country can be indicated with community indifference curves. Import tariffs As a benchmark, the analysis begins with the equilibrium situation under free trade. The terms of trade (TOT) for the price of cloth relative to food has been established in the market such that Home's desired cloth exports equal Foreign's desired cloth imports, and Home's desired food imports equal Foreign's desired food exports. Each country produces at point PF on its PPF, where the marginal rate of transformation equals the world TOT, given by the slope of the tangents or “isovalue” lines at the PF points on the PPFs. Each country consumes at its point CF, given by the tangency of its isovalue line to one of its community indifference curves. For each country the difference between the production and consumption points generates a “trade triangle,” where the hypotenuse is the isovalue line, and dashed lines give the base and height. For Home, the triangle’s base measures its cloth exports, and the triangle’s height measures its food imports. For Foreign, the triangle’s base measures its cloth imports, and the triangle’s height measures its food exports. Trade allows each country to move to an indifference curve higher than any attainable under autarky, showing the gains from trade. Economic efficiency in the allocation of resources exists because the marginal rate of substitution in consumption equals the marginal rate of transformation in production. That is, the value to consumers of a unit of cloth in terms of food (the slope of the indifference curve) equals the opportunity cost of producing that unit of cloth (the slope of the PPF). Now suppose Home imposes a tariff on the import of food from Foreign. Home consumers must now pay a higher price for imported food than received by the Foreign exporters of food. Competition insures that all food must sell for the same price in Home, and so in Home the price of Home-produced food rises as well. Thus, the relative price of food to cloth rises in Home compared to in Foreign. This encourages the expansion of the Home food industry, and the contraction of its cloth industry. The production point at Home moves to PT1, where the slope of the tangent is less, directly measuring the lower relative price of cloth to food (the slope’s inverse, which has risen, measures the higher price of food to cloth). Home can now supply more of its food requirements, and so it desires to import less food. And with less cloth production, after satisfying its own demand there is less cloth to export. These two effects lead to a rise in the relative price of cloth on the world market, assuming Home is a major player in Econ 354, revised 11/19/02, page 2 the world market (the “large-country” assumption). Consequently, Home’s terms of trade have improved, and the isovalue line emanating from point PT1 is steeper than at PF. Two possibilities are shown for the consumption point: CT1 or C′T1. Point CT1 shows an equilibrium where Home is on a higher indifference curve than with free trade. The inefficiencies of the tariff have been more than offset by the improvement in Home’s TOT. Point C′T1 shows an alternative outcome where Home is not on a higher indifference curve than with free trade. In either case, if the Stolper-Samuelson assumptions hold, the factor used intensively in the food production will enjoy higher real income, while the factor used intensively in the cloth industry will suffer lower real income. Also note that while both possible consumption points lie along the isovalue line showing Home’s improved TOT, the indifference curves themselves are tangent to a line with a lower slope, representing the lower relative price of cloth inside Home. This is because Home’s consumers must pay the Home relative price, not the world (Foreign) relative price. For both producers and consumers, there is graphically a “wedge” between the slopes measuring the home and foreign relative prices. Foreign is also affected by the tariff. It sees the TOT from its point of view decline because the price of its export good (food) falls, and the price of its import good (cloth) rises. Its welfare definitely falls, because the indifference curve at CT1 (or C′T1 to match the case where Home’s welfare is not improved) must be lower than at CF. Since the tariff causes relative prices to move in the opposite direction in Foreign compared to Home, the factor used intensively in food suffers lower real income in Foreign, while the factor used intensively in cloth enjoys higher real income. However, Foreign’s overall welfare is lower, as measured by the indifference curves. Thus, the possible improvement of Home’s welfare already described has come at the expense of Foreign, and the tariff is therefore called a “beggar-thy-neighbor” policy. The inefficiency of the tariff in Home is that the marginal rate of substitution in consumption of food to cloth at Home (equal to the marginal rate of transformation in production there) is less than the marginal rate of transformation in Foreign. If the Home MRS is 1/2 but the Foreign MRT is 2/1, it means that at Home prices, consumers are indifferent to giving up two cloth units for one food unit. But if they could trade at the Foreign price, they could get four food units by giving up two cloth units. Food is relatively too costly at Home, because too many resources are devoted to the food industry with the tariff. The effect of this inefficiency on welfare can be most clearly seen by assuming that Home cannot influence the world relative price (Home is a small country). In this case the relative price of food at home must rise by the full amount of the tariff (the relative price of cloth must fall by the full amount). Home’s production point would be PT2, and its consumption point CT2. Home’s welfare definitely falls because no indifference curve along the isovalue line emanating from PT2 could be higher than the one at CF. (In the large-country case, this inefficiency still exists, but may be offset by the improved TOT at the expense of the other country.) Now let us return to the large-country case where Home’s tariff-induced changes in export supply and import demand can change the TOT. Suppose that in response to its fall in welfare, Foreign imposes its own import tariff. If Home can influence the TOT, so can Foreign. Thus Foreign’s tariff can reverse the decline in Foreign’s TOT and improvement in Home’s TOT. Foreign’s equilibrium production and consumption points become PT2 and CT2. Foreign’s Econ 354, revised 11/19/02, page 3 welfare at CT2 might be higher than at CT1, as pictured, but it is unlikely to restore welfare to the tariff-free equilibrium at CF. Furthermore, CT2 might not be higher than CT1 (not pictured), and so Foreign’s retaliatory tariff might be worse than no retaliation. Either way, with Foreign’s retaliation Home will now be in same position as graphed for the case where it cannot influence the terms of trade. Continued rounds of higher tariffs and retaliations could eliminate world trade, and so tariffs do not seem like a promising avenue to raise world welfare. Export Subsidies We now consider the effects of subsidies in the export industry. Once again, we start with the benchmark free-trade case, with consumption and production points at PF and CF for Home and Foreign. Now suppose that Home implements a subsidy to the export industry. From the Home cloth industry’s point of view, the price it receives including the subsidy has risen beyond that paid in the market. Thus, to Home producers the relative price of cloth to food rises, and the cloth industry expands and the food industry contracts. The expanded output of cloth at Home generates more export supply, while the contraction of the Home food industry generates a greater Home demand for food imports. If Home is a large enough country, these effects will be great enough to reduce the world relative price of cloth, resulting in a decline in Home’s TOT. Equilibrium production and consumption points will be at PS1 and CS1 for both countries. Note that this definitely involves a loss of welfare for Home. It suffers from both a declining TOT and economic inefficiency. Foreign, however, is made better off, as the TOT from its point of view (the relative price of food) has risen, and it suffers no economic inefficiency. In contrast, if there were no TOT effect because Home was small, the production and consumption points would be PS2 and CS2. There could, of course, be Stolper-Samuelson effects. At Home where the relative price of cloth is higher, the factor used intensively in cloth enjoys a rise in real income, and that used intensively in food suffers a decline in real income. In Foreign, where the relative price of cloth is lower, the converse is true. Thus, in Foreign, the factor used intensively in cloth might lobby for retaliation of some sort in response to the cheap cloth from Home. The precise effect of the subsidy on Home consumers depends on the nature of the subsidy. The textbook case and the one depicted by the graph is the true export subsidy, where the subsidy is only paid if the unit of output is actually exported. In this case, Home consumers must pay a higher relative price equal to the relative price received by the producer, including the subsidy, for exports. The higher price paid by the consumer compensates for the fact that no subsidy is paid to the producer for any sales at Home. In this case, points CS1 and CS2 on Home’s export subsidy graph would lie along the iso-value line emanating from the relevant production point, but would be on indifference curves tangent to steeper lines consistent with Home relative price higher than Foreign relative price, which is given by the slope of the TOT line. An alternative case discussed in class is a subsidy to the industry involved in exports, whether or not a given unit of output is exported. In this case, Home consumers will pay the same as Foreigners, because Home producers get the same subsidy no matter who buys their output. Econ 354, revised 11/19/02, page 4 Thus, Home producers will receive a higher relative price than Home consumers and Foreign consumers and producers. The equilibrium points are not shown on the graph, but the Home consumption point will in this case be at point of tangency of a community indifference curve to the TOT line. This case involves a smaller welfare loss to Home than the pure export subsidy, because the terms of trade effect is smaller and because Home consumers do not face the distortion of paying a different relative price than the foreign one. This situation could apply to Canada’s exports of lumber to the U.S., where Canada is Home and the export is lumber instead of cloth. Some analysts believe that low stumpage fees for cutting trees on crown land in Canada act as a subsidy to that industry. The Americans as a whole benefit from Canada’s consequently cheaper lumber and Canadians as a whole are hurt. Meanwhile, special interests in the American lumber industry (the factors used intensively in lumber) are harmed, and thus they have lobbied for retaliation in the form of am import tariff. The factors used intensively in the Home export industry are better off from the subsidy, and will be naturally opposed to its elimination. Because Home’s export subsidy raises the welfare of Foreign, it seems odd that Foreign might retaliate, but, as noted above, special interests would be in favor of it. The class graph depicts the case where Foreign institutes its own export subsidy. This will reverse the TOT effect, and the graph shows the case where the TOT returns to its free trade value. This is the only thing, however, that returns to its free trade value. Foreign’s equilibrium points move to PS2 and CS2, showing that Foreign more than reverses its gain from Home’s subsidy, becoming worse off than under free trade. (You can infer from our tariff analysis that a tariff would be preferable to this for Foreign, unless there are even more rounds of retaliation.) The effect on Home from Foreign’s retaliatory subsidy is that Home may be partly rescued from its own folly! Production and consumption points PS2 and CS2 are now achieved, and CS2 involves higher welfare than CS1 (it would be possible to draw a situation where this was not so). Points PS2 and CS2 would also be the result for Home if it imposed a subsidy and were not a large country. This definitely involves lower welfare than under free trade, and represents in Home the economic inefficiency of the subsidy.