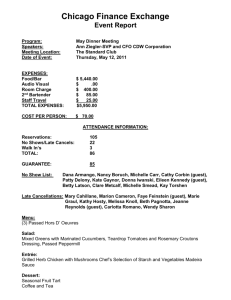

Claremont Graduate University MGT 328: Finance & Accounting for Non-Profits

advertisement

Claremont Graduate University Peter F. Drucker and Masatoshi Ito Graduate School of Management MGT 328: Finance & Accounting for Non-Profits Spring 2010 Faculty: Faith Raiguel Contact Information: Phones: Home 323-662-5722; LA Opera 213-972-3676 E-mail: fairai@yahoo.com Objectives of the Course: • • • • • Expand awareness of the similarities and differences between financial management of profit-seeking firms and not-for profit firms. Understand the scope and importance of financial management responsibilities within an arts organization. Understand the techniques of day-to-day financial management, with particular emphasis on budgeting, financial statements, internal controls and decision making. Develop a thorough understanding of funds accounting and of financial analysis. Provide a useful set of tools for an emerging arts manager, regardless of art form or professional specialty. Texts: • • • “Not-for-Profit Accounting Made Easy,” Ruppel, John Riley & Sons (Abbreviation “NFP”) “Good to Great and the Social Sectors,” Collins, Jim Collins (Abbreviation “Good to Great”) “Sarbanes-Oxley for Nonprofits,” Jackson and Fogarty, John Riley & Sons (Abbreviation “SOX”) Additional materials/activities: • Case Studies in arts or arts related fields. • Guest speakers in budgeting, planning, artistic decision making, bond financing, audit function, governance, among others. • Internet research in arts and government websites. • ArtsOrg Project • Additional readings and assignments TBD ArtsOrg Project 1 Drucker School - Syllabus, Spring 2010 - Arts Management- Accounting & Finance 328 You will be asked to select an arts organization, anywhere in the country that is of interest to you. Pick a back-up organization. Throughout the course, you will be asked to analyze, discuss or otherwise use materials provided by your organization as they relate to other class materials and exercises. 1. Visit their website. Find their mission statement on the website. Be prepared to discuss it in class and analyze it. 2. Establish contact with their CFO or Business Manager a. Conduct an interview to collect and discuss items below 3. Obtain - Materials a. Most recent audited statement, last three years b. Monthly Financial Statement – any one will do, even without numbers i. Refer to it for its structure (sometimes they will not share) c. Current Annual Budget (usually they will provide) d. Most recent 990 (available on Guidestar) e. Current promotional material f. Organization chart (if possible) g. Other material TBD – if possible i. Articles of incorporation ii. Bylaws iii. Tax exemption letter 4. Articulate a. Product array i. Be able to articulate what they sell ii. Detailed list of “other earned revenue sources” b. External Environment, their stakeholders c. Internal Environment, organization structure d. SWOT Analysis, 1-2 items in each category e. Comparative financial statements, 3 years i. Income statements ii. Balance sheets f. Ratio analysis and discussion of key ratios. g. Largest Challenge they face in the next five years i. What steps are they taking to address it? ii. Are they using a Strategic (Long Range) Planning process? iii. Is there a Strategic Plan in place? h. Your assessment of fiscal health and two or three key aspects of the organization that resonate with you on a fiscal basis. 5. Organize a. All your material in a 3 ring binder b. Prepare Executive Summary – style of “4. Articulate” above c. Prepare a 5-6 page Highlights, Power point presentation 2 Management 328 F. Raiguel GRADING Second Semester • HOMEWORK 40% Grading will be weighted for o EFFORT o CLARITY o IMAGINATION o COMPLETENESS o TIMELINESS • CLASS PARTICIPATION 30% o Including preparation and involvement • ARTSORG PROJECT 15% o This will be the foundation for homework as well. • FINAL EXAM 15% While each segment does not carry equal weight, it is expected that each student will complete each segment satisfactorily for full credit in the course. 3 Drucker School - Syllabus, Spring 2009 - Arts Management- Accounting & Finance Speakers: The following speakers are among those to be integrated into the course, subject to final scheduling and availability. It is expected that students will research these individuals and their affiliated organizations prior to their appearances to enhance dialogue. Tom Clough, Horizon Partners, Economist/Consultant Long Range Planning, challenges of the current environment. Richard Jones, Partner, Nixon Peabody, Attorneys at Law Bond Financing, role and requirements in financing activity in non-profit organizations. www.nixonpeabody.com Christopher Koelsch, Vice President for Artistic Planning, LAOpera Balancing Artistic Vision with Fiscal Reality www.laopera.com Bill Lowman, President, Idyllwild Arts Foundation 2/18, 2/25 Budgeting, reporting and the pitfalls of internal controls www.idyllwildarts.org Nancy Shelmon, Partner, PriceWaterhouse, Co-Author, ”Financial and Accounting Guide for Not-For-Profit Organizations” Organizational Accountability: auditing, 990, SOX, internal controls www.pwc.com Ed Rada, President, Music Center Foundation Endowments, investment and distribution policies Christopher Walker, Chair, Finance Committee, LAOpera; Trustee, LA County Museum of Art; Trustee, KCET. Governance: the Role of the Finance Committee, Stewarding an Organization’s Resources www.laopera.com www.kcet.org www.lacma.org 4 Drucker School - Syllabus, Spring 2009 - Arts Management- Accounting & Finance Faith Raiguel 14-session course outline Session & Date 1 Jan. 20 SESSION THEME, CONTENT AND PREPARATION Introductions and Orientation to the Field PREPARATION Read: “Good to Great” Prepare for class: Articulate for discussion in class three points of particular interest in “Good to Great”, agree or disagree with the thesis. Elements of Financial Management system • Organization’s Annual “Life Cycle” • Principles, Systems, People • Complete Books and Records Role of the Finance Office Discuss ArtsOrg Project 2 Jan. 27 Complete Books And Records #1 Elements of “The Books” • Journals, record of transactions • General Ledger, closing “the books” • Financial Statements, month-end reporting ANNUAL OPERATING BUDGET PREPARATION. Read: “NFP” Ch 2 portion on Statement of Activities pp 46-56 “SOX” Appendix A “Governance & Artistic Product” Opera America Article, Winter 2008 Prepare: Contact information for Arts Org Project Prepare brief answers to the following questions on The Operating Budget: • What is a budget? • Why budget? • Who cares? • Who is involved? • When do you do it? • How do you use it? In Class Exercise: Budget Poker 5 3 Feb. 3 Budgeting and Introduction to Cash Flow GUEST, Christopher Koelsch, LA Opera, VP of Artistic Planning PREPARATION Prepare: CASE #1 Cool Theater The role of financial planning in artistic decision making. Using the Operating Budget as keystone for other tools: • Planning for Cash Flow • Planning for the Future Key concepts: Fixed & Variable Costs 4 Feb 10 CASH FLOW FUNDS ACCOUNTING & FINANCIAL STATEMENTS #1 GUEST: Bill Lowman, Idyllwild Arts, President PREPARATION Read: NFP Chapters, 1,2 Prepare: CASE #2 Shoreline Symphony Part 1 Key Concepts – It’s ACCRUAL World. Accrual Accounting • “Cash Basis Bookkeeping” • “Simplified Accrual Basis Bookkeeping” • “Full Accrual-Basis Bookkeeping” Basic Financial Statements • STATEMENT OF FINANCIAL POSITION: Balance Sheet • STATEMENT OF ACTIVITIES: Income Statement • STATEMENT OF CHANGES IN NET ASSETS: Statement of Changes of Financial Position • STATEMENT OF CASH FLOWS • NOTES TO FINANCIAL STATEMENTS 5 Feb.17 FUNDS ACCOUNTING & FINANCIAL STATEMENTS #2 STRATEGIC PLANNING AND FINANCIAL MODELING GUEST: Tom Clough, Horizon Associates PREPARATION Read: NFP Chapters 3,5,7 Prepare: CASE #2 Shoreline Symphony Part 2 EFFECTIVE COMMUNICATION: Board Brief, Executive Summary UNDERSTANDING THE BALANCE SHEET Key Concepts: Liquidity, Short Term, Long Term, P’s & Q’s 6 6 Feb. 24 FINANCING A NON-PROFIT: LEVERAGING RESOURCES PREPARATION • Create Executive Summary for West Northridge Academy (2-3 pages max) • Create Board Brief for Case of your choice (1 page) Read NFP Chapters 4, 6, 8, 9, 10, enough to provide “write-up” below" Write-up FOR EACH CHAPTER ABOVE IN NFP: • Define the concept in each chapter • Is it an asset or liability • Does it generate income or expense • Comment on why it is important. 7 Mar. 3 Leveraging Resources: 1.Operations: Creating Revenue Opportunities • Earned, programmatic, pricing issues • Earned, ancillary, Role of UBI • Contributed, realistic goals and strategies 2,Endowments 3.Debt EVALUATION TOOLS + EFFECTIVE COMMUNICATION FINANCING CAPITAL PROJECTS: Role of Bond Financing GUEST: Rick Jones, Nixon Peabody PREPARATION Read: NFP Chapter 11; SOX Chapter 3 Prepare (one copy to turn in): Set up 3 years of Balance Sheets & Income Statements of your ArtsOrg REVIEW OF THE BALANCE SHEET…again Ratio analysis, introduction and overview INTRODUCTION TO BOOKKEEPING JOURNALS, GENERAL LEDGER, TRIAL BALANCES, JOURNAL ENTRIES Key concept: DEBITS AND CREDITS 8 Mar. 10 THE BASICS, BOOKKEEPING Prepare: DEBIT AND CREDIT EXERCISE CASE #2 Shoreline Symphony Part 3 - bookkeeping REVIEW DEBIT AND CREDIT EXERCIZE for work over the break. Mar 17 SPRING BREAK 7 9 Mar. 24 OPERATING STANDARDS & ROLE OF ENDOWMENTS GUEST: Ed Rada, Music Center Foundation, President PREPARATION Calculate 3 years of ratios for your ArtsOrg DEBIT AND CREDIT EXERCISE, write up journal entries Read: NFP Chapter 6; SOX Chapter 1 Endowments reading maerials 10 Mar. 31 Key Concept: BALANCE SHEET RATIOS POWER OF DEBITS & CREDITS AUDIT ENVIRONMENT AND GOVERNMENT REPORTING GUEST: Nancy E. Shelmon, Partner, Price Waterhouse PREPARATION Read: NFP 12; SOX 2, 4, 5 Download: California Nonprofit Integrity Act not just the legislation but a discussion Download: New Form 990 Bring Form 990 from your ArtsOrg Prepare: Inquiry of ArtsOrg on Compliance with SOX & Cal Integrity Act DEBIT AND CREDIT EXERCISE, prepare trial balance & financial statements 11 Ap.7 The increasing demand for accountability. The changing oversight landscape. The Audit function INTERNAL CONTROLS + INTRODUCTION TO GOVERNANCE Guest, Christopher V. Walker, Chair, Finance Committee, LA Opera Trustee, LA County Museum of Art, KCET PREPARATION Read: SOX Chapter 6,7, 8 Read: LATimes “Bigger, Bolder + Poorer” E-mail to me three questions for Chris Walker by Saturday night, April 3 The changing economic climate. Organizational stewardship and governance issues. Key Roles, Challenges and Rewards. Complete Books and Records, again • What to keep and what to throw away. Key Internal Controls • People • Systems & Reports • Physical tools Effective Communication 8 12 Ap. 14 13 Ap. 21 14 Ap. 28 GOVERNANCE & INTERNAL CONTROLS CONTINUED REVIEW – Semester recap PREPARATION Read: SOX 9,10 Appendices: E, F, G FINAL MEETING Presentation of Class Projects FINAL EXAM 9