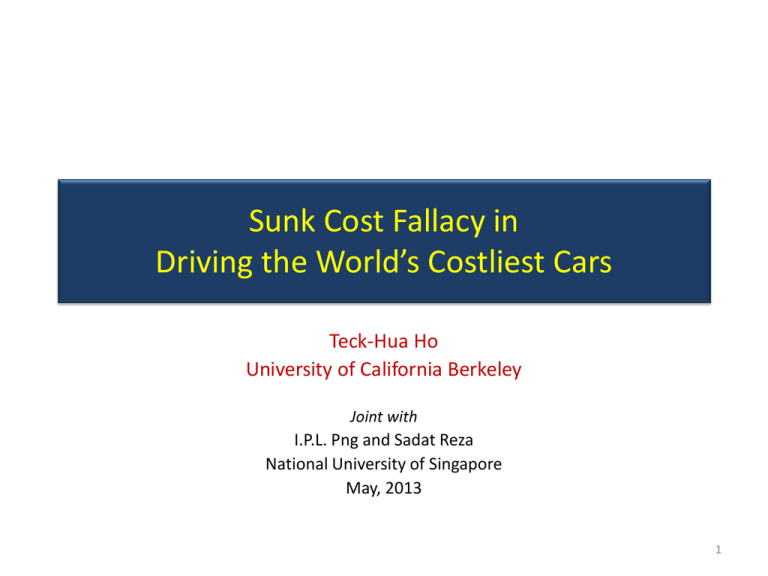

Sunk Cost Fallacy in Driving the World’s Costliest Cars Teck-Hua Ho

advertisement

Sunk Cost Fallacy in Driving the World’s Costliest Cars Teck-Hua Ho University of California Berkeley Joint with I.P.L. Png and Sadat Reza National University of Singapore May, 2013 1 Key Research question Driver A Mercedes-Benz CLS Class Purchase month: February 2009 Price = $300,000 Driver B Question: If both owners enjoy driving equally, would Driver B drive more as a result of higher sunk cost? US$242,000 Mercedes-Benz CLS Class Purchase month: February 2010 Price = $322,500 US$260,000 2 Sunk cost fallacy Behavioral tendency of an economic agent to consume/produce at a greater than optimal level Consumption: Desire not to appear wasteful Project investment: Do not wish to recognize losses To recover the sunk investment one has made (or close a mental account that carries the sunk cost of the product or project) 3 Sunk cost fallacy – Over-consumption Experiment by Arkes and Blumer (1985) Setting: Control: Bought a season theater ticket at full price Treatment: Bought a season theater ticket with unexpected discount Arkes and Blumer: Any difference in the attendance behaviour of the two (the number of shows attended)? Result: Buyers in the control condition attended more shows than those in the treatment condition (4.1 versus 3.3 out of 5 shows) Once the season ticket has been acquired, the actual price of the ticket paid should not affect decision to go to the show. Unless, there is a tendency to recover the initial investment – sunk cost fallacy 4 Sunk cost fallacy – Escalation of commitment Field studies by Staw and Hoang (1995) and Camerer and Weber (1999) Setting: National Basketball Association (NBA): Teams choose players in annual “draft”: higher rank = lower picks Lower draft players are expected to perform better and guaranteed higher salaries compared to the higher draft players Staw-Hoang and Camerer-Weber: Did teams deploy lower draft picks relatively (more minutes of play) because of the high salary commitment (after adjusting for performance)? Result: A minimal decrement in draft order increases playing time by 14 minutes in Year 2 to 2 minutes in Year 5 (Camerer and Weber, 1999). Performance should be the key driver of how many minutes a player plays and not the draft pick order. Escalation of commitment is another manifestation of sunk cost fallacy. 5 Positioning of research Low stakes Consumption Project Investment Arkes and Blumer (1985) Small monetary involvement High stakes This study High stakes consumption, free of agency problem Staw and Hoang (1995) and Camerer and Weber (1999) Agency problem 6 Singapore car market Singapore car market is heavily regulated to influence demand for cars High tariffs make the cars in Singapore the world’s costliest o ARF (Additional Registration Fee) o COE (Certificate of Entitlement) 7 Components of car price Car price on-the-road = Open market value (OMV) + Retail mark-up + Customs duty + GST + Registration fee + Certificate of entitlement (COE) premium + Additional registration fee (ARF) 8 A popular model in our sample – Jun 2009 Car price on-the-road $ 129,000 = OMV: $34,952 + Retail mark-up: $37,141 + Customs duty: $6,990 + GST: $2,936 s Registration fee: $140 + COE Premium: $11,889 + ARF: $34,952 Ex-policy Price (P) Policy components 9 Three sources of sunk cost Ex-policy price ARF COE Premium 10 Source of sunk costs: Ex-policy price Value of ex-policy price declines as soon as the car is out on the road Sunk cost is therefore the difference between the amount paid and the amount available if re-sold the very next day 11 Sunk cost of ex-policy price COE Premium ARF 𝑠0 𝑃 Ex-policy price 0 5 10 Car age in years 12 Source of sunk costs: ARF Owners can purchase a new car by paying ARF at a preferential rate (PARF) if they dispose the car within 10 years If disposed within the first 5 years, a new car can be purchased by paying 25% of ARF (current policy) From the 6th year onward, the preferential rate increases by 5% per year (current policy) Therefore, 25% of ARF is sunk cost 13 Sunk cost of ARF COE Premium 𝑠1 𝐴𝑅𝐹 = 0.25 𝐴𝑅𝐹 ARF Ex-policy price 0 5 10 Car age in years 14 Source of sunk costs: COE premium COE is valid for 10 years If vehicle is disposed within 2 years of purchase, only 80% is refundable After 2 years the COE premium is depreciated on a monthly basis until the end of the 10th year. Therefore, 20% of COE premium is sunk cost 15 Sunk costs of COE Premium 𝑠2 𝐶𝑂𝐸 = 0.20 𝐶𝑂𝐸 COE Premium ARF Ex-policy price 0 2 5 10 Car age in years 16 Panel dataset of car usage Proprietary field data from a car dealer in Singapore • Jan 2001 – Dec 2011 • 33,457 observations on 6,474 cars • Engine capacity – 15 different sizes • LTA registration date • Servicing date • Cumulative mileage Other information (from Land Transport Authority, Dept of Statistics) • OMV • ARF rates • COE quota and premium - monthly • CPI Fuel - monthly • Car population per km - monthly 17 Key empirical regularity Noticeable phenomenon: Usage declines with time and price 2600 2400 2200 2003: $174,578 2004: $161,173 2000 2005: $151,607 2006: $145,347 1800 1600 1400 6 12 18 24 30 36 Vertical axis: average usage per month in km, horizontal axis: age of car in months (the most popular model in the sample) 18 Hypothesis 1: Novelty effect (H1.) Driver’s may drive more right after purchase of the car Novelty effect can be assumed to have non-negative contribution to utility of driving The effect diminishes over time Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 May-07 Jan-07 Sep-06 May-06 Jan-06 Sep-05 May-05 Jan-05 Sep-04 May-04 Jan-04 Sep-03 May-03 Jan-03 Sep-02 May-02 Jan-02 Sep-01 May-01 Jan-01 CPI Fuel Octane 98 Hypothesis 2: Increasing gasoline cost (H2.) Gasoline Cost 2001-2011 160 140 120 100 80 60 Jan-01 May-01 Sep-01 Jan-02 May-02 Sep-02 Jan-03 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 May-05 Sep-05 Jan-06 May-06 Sep-06 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Number of cars Hypothesis 3: Increasing congestion due to more cars on the road (H3.) Number of cars in Singapore 2001-2011 1000000 900000 800000 700000 600000 Hypothesis 4: Reduction in sunk cost (H4.) Decreasing prices resulted in decreasing sunk cost Average ARF and COE Quota Premium also declined 22 Hypothesis 4: Reduction in sunk cost (H4.) Decreasing prices resulted in decreasing sunk cost Average ARF and COE Quota Premium also declined 200000 180000 160000 140000 Retail price 120000 ARF 100000 COE premium 80000 Policy-related sunk cost 60000 40000 20000 Jun-01 Sep-01 Dec-01 Mar-02 Jun-02 Sep-02 Dec-02 Mar-03 Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Mar-06 Jun-06 Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 0 23 Hypothesis 5: Reduction in price – selection effect (H5.) Average price of two most popular models in our sample: Year of Purchase Model A Model C 2003 $174,578 $212,140 2007 $145,347 $171,920 24 Model of driving behavior Assumptions : Individual buys a car Plans to use for 120 months Scrap value at the end of the 120th month – 50% of ARF 25 Model of driving behavior −𝐷(𝑡) Usage value Gasoline cost Congestion cost Depreciation cost 26 Model of driving behavior 𝑈 𝑞𝑡 = 𝑉 𝑞𝑡 Usage value 𝜃0 + (𝜃1 +𝑒 −𝜃2𝑡 )𝑞𝑡 − 𝜃3 𝑞𝑡2 − 𝐺(𝑞𝑡 , 𝑡) −𝐶(𝑞𝑡 , 𝑡) −𝐷(𝑡) Gasoline cost 𝛽1 𝑔𝑡 𝑞𝑡 Congestion cost 𝛽2 𝑐𝑡 𝑞𝑡 Depreciation cost 𝐷(𝑡) 27 Model of driving behavior 𝑈 𝑞𝑡 = 𝑉 𝑞𝑡 − 𝐺(𝑞𝑡 , 𝑡) −𝐶(𝑞𝑡 , 𝑡) −𝐷(𝑡) = 𝜃0 + (𝜃1 + 𝑒 −𝜃2𝑡 )𝑞𝑡 − 𝜃3 𝑞𝑡2 Usage value Novelty effect Gasoline cost = 𝛽1 𝑔𝑡 𝑞𝑡 Congestion cost = 𝛽2 𝑐𝑡 𝑞𝑡 28 Optimal usage – standard model 𝑞𝑡∗ = 1 𝜃1 + 𝑒 −𝜃2𝑡 − 𝛽1 𝑔𝑡 − 𝛽2 𝑐𝑡 2𝜃3 29 Incorporating sunk-cost fallacy Psychological Sunk Cost 𝑈 𝑞𝑡 = 𝑉 𝑞𝑡 − 𝐺(𝑞𝑡 , 𝑡) −𝐶(𝑞𝑡 , 𝑡) −𝐷(𝑡) Consumer amortizes sunk cost S by the actual cumulative usage 𝑄𝑡 = relative to some target cumulative usage 𝑄 This nests the standard model (𝜆 = 0) Sunk cost gets smaller over time as usage accumulates 𝑡 𝜏=1 𝑞𝜏 30 Optimal usage with sunk costs 𝑞𝑡∗ = 1 𝜆𝑆 𝜃1 + 𝑒 −𝜃2𝑡 − 𝛽1 𝑔𝑡 − 𝛽2 𝑐𝑡 + [𝑇 − 𝑡 + 1] 2𝜃3 𝑄 H1. H2. H3. H4. ( confounded by H5.) 31 Diminishing effect of sunk-cost fallacy Car Usage (km/month) Optimal usage with sunk cost S2 Optimal usage with sunk cost S1 S1 < S2 Optimal usage without sunk cost fallacy Assumptions: 10 years Constant gasoline prices over time Constant level of congestion over time Zero novelty effect Time 32 Selection effect and identification of sunk-cost fallacy It is possible that heavy users are willing to pay higher price, thus higher sunk cost Since sunk-cost is assumed to be a function of price, sunk-cost effect is not identified using the optimal usage function However, it may be plausible to assume that selection effect has no time-varying effect In other words, heavy users may pay higher price, but their change in usage over time may have little to do with paying higher price On the other hand, our model suggests that sunk-cost effect diminishes over time (Arkes and Blumer find similar diminishing effect) Change in usage equation can be used to estimate the sunk-cost parameter 𝜆. 33 Sunk cost definition Total sunk cost is the sum of the sunk costs associated with the three components of car price • Ex-policy price (P) • ARF • COE Premium 𝑆 = 𝑠0 𝑃 + 𝑠1 𝐴𝑅𝐹 + 𝑠2 𝐶𝑂𝐸 𝑠0 , 𝑠1 , 𝑠2 ∈ (0,1) 34 Estimating sunk-cost fallacy Estimation equation: ∗ Δ𝑞𝑖𝑡 = Δ𝑒 −𝜃2𝑡 − 𝛽1 Δ𝑔𝑡 − 𝛽2 Δ𝑐𝑡 − 𝜆[ 0.25 × 𝐴𝑅𝐹𝑖 + 0.2 × 𝐶𝑂𝐸𝑖 + 𝑠0 𝑃𝑖 ] 𝑄𝑖 + 𝜖′𝑖𝑡 𝜆 > 0 would indicate presence of sunk-cost fallacy 35 Target usage Target usage 𝑄 is unobserved 𝑄 is assumed to be log-normally distributed with mean equaling sample average Maximum simulated likelihood method is applied to estimate the parameters of interest 36 Alternative specifications for robustness check The following specifications are estimated : Specification a: Conventional model (without sunk cost) Specification b: Main specification (previous slide) Specification c: Allowing marginal benefit to be dependent on price Specification d: Alternative definition of sunk cost Specification e: Main specification – smaller cars only Specification f: Main specification – larger cars only Specification g: Main specification – heterogeneous distribution of target usage for smaller and larger cars 37 Robustness check specifications Marginal benefit dependent on price (specification c): Usage value = exp 𝜇. 𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑖𝑐𝑒 . (𝜃0 + 𝜃1 𝑞𝑡 + 𝑒 −𝜃2 𝑡 𝑞𝑡 − 𝜃3 𝑞𝑡2 ) Alternative definition of sunk cost (specification d): Sunk cost, 𝑆 = 𝛼. 𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑖𝑐𝑒, 𝛼 ∈ (0,1) Separate estimation for small and large cars (specifications e, f) • Target usage drawn from distributions with corresponding sample average as mean Heterogeneous target usage (specification g): • Target usage drawn from two distributions with means corresponding to small and large cars 38 Estimates: With and Without Sunk Cost Variable Gasoline cost, 𝛽1 Congestion cost, 𝛽2 Age, 𝜃2 (a) Conventional rationality -0.0001 (0.000) 0.027*** (0.002) 0.010*** (0.000) Sunk cost, 𝜆 Sunk cost part of ex-policy price, 𝛼 Sunk cost, 𝜆𝜌 No. of observations Mean log likelihood Log likelihood Elasticity (b) Mental accounting for sunk cost -0.0003 (0.000) 0.010*** (0.002) 0.004*** (0.000) 0.094*** (0.012) 0.125*** (0.038) (c) Scaled marginal benefit -0.0006* (0.000) 0.009** (0.003) 0.000 (0.000) 0.237*** (0.031) 0.208*** (0.039) (d) (e) Sunk cost Smaller cars proportional to retail price -0.0003 (0.000) 0.010*** (0.002) 0.005*** (0.000) (f) Larger cars (g) Heterogeneous target usage -0.0006* (0.000) 0.011*** (0.003) 0.003** (0.001) 0.074*** (0.011) 0.233*** (0.080) -0.0001 (0.000) 0.003 (0.003) 0.003** (0.001) 0.060** (0.022) 0.326* (0.186) -0.0003 (0.000) 0.011*** (0.002) 0.004*** (0.001) 0.095*** (0.008) 0.094*** (0.023) 3581 -2.693 -9643.3 0.53*** (0.079) 2893 -2.819 -8155.7 0.73*** (0.269) 6474 -2.752 -17819.2 0.51*** (0.043) 0.024*** (0.002) 6474 -2.77204 -17946.2 n.a. 6474 -2.752 -17815.1 0.56*** (0.072) 6474 -2.748 -17788.7 0.64*** (0.190) 6474 -2.755 -17833.8 0.85*** (0.071) 39 Estimates: Controlling for Self-selection Variable Gasoline cost, 𝛽1 Congestion cost, 𝛽2 Age, 𝜃2 (a) Conventional rationality -0.0001 (0.000) 0.027*** (0.002) 0.010*** (0.000) Sunk cost, 𝜆 Sunk cost part of ex-policy price, 𝛼 Sunk cost, 𝜆𝜌 No. of observations Mean log likelihood Log likelihood Elasticity (b) Mental accounting for sunk cost -0.0003 (0.000) 0.010*** (0.002) 0.004*** (0.000) 0.094*** (0.012) 0.125*** (0.038) (c) Scaled marginal benefit -0.0006* (0.000) 0.009** (0.003) 0.000 (0.000) 0.237*** (0.031) 0.208*** (0.039) (d) (e) Sunk cost Smaller cars proportional to retail price -0.0003 (0.000) 0.010*** (0.002) 0.005*** (0.000) (f) Larger cars (g) Heterogeneous target usage -0.0006* (0.000) 0.011*** (0.003) 0.003** (0.001) 0.074*** (0.011) 0.233*** (0.080) -0.0001 (0.000) 0.003 (0.003) 0.003** (0.001) 0.060** (0.022) 0.326* (0.186) -0.0003 (0.000) 0.011*** (0.002) 0.004*** (0.001) 0.095*** (0.008) 0.094*** (0.023) 3581 -2.693 -9643.3 0.53*** (0.079) 2893 -2.819 -8155.7 0.73*** (0.269) 6474 -2.752 -17819.2 0.51*** (0.043) 0.024*** (0.002) 6474 -2.77204 -17946.2 n.a. 6474 -2.752 -17815.1 0.56*** (0.072) 6474 -2.748 -17788.7 0.64*** (0.190) 6474 -2.755 -17833.8 0.85*** (0.071) 40 Estimates: Alternative Specification of Sunk Cost Variable Gasoline cost, 𝛽1 Congestion cost, 𝛽2 Age, 𝜃2 (a) Conventional rationality -0.0001 (0.000) 0.027*** (0.002) 0.010*** (0.000) Sunk cost, 𝜆 Sunk cost part of ex-policy price, 𝛼 Sunk cost, 𝜆𝜌 No. of observations Mean log likelihood Log likelihood Elasticity (b) Mental accounting for sunk cost -0.0003 (0.000) 0.010*** (0.002) 0.004*** (0.000) 0.094*** (0.012) 0.125*** (0.038) (c) Scaled marginal benefit -0.0006* (0.000) 0.009** (0.003) 0.000 (0.000) 0.237*** (0.031) 0.208*** (0.039) (d) (e) Sunk cost Smaller cars proportional to retail price -0.0003 (0.000) 0.010*** (0.002) 0.005*** (0.000) (f) Larger cars (g) Heterogeneous target usage -0.0006* (0.000) 0.011*** (0.003) 0.003** (0.001) 0.074*** (0.011) 0.233*** (0.080) -0.0001 (0.000) 0.003 (0.003) 0.003** (0.001) 0.060** (0.022) 0.326* (0.186) -0.0003 (0.000) 0.011*** (0.002) 0.004*** (0.001) 0.095*** (0.008) 0.094*** (0.023) 3581 -2.693 -9643.3 0.53*** (0.079) 2893 -2.819 -8155.7 0.73*** (0.269) 6474 -2.752 -17819.2 0.51*** (0.043) 0.024*** (0.002) 6474 -2.77204 -17946.2 n.a. 6474 -2.752 -17815.1 0.56*** (0.072) 6474 -2.748 -17788.7 0.64*** (0.190) 6474 -2.755 -17833.8 0.85*** (0.071) 41 Estimates: Small versus Large Cars Variable Gasoline cost, 𝛽1 Congestion cost, 𝛽2 Age, 𝜃2 (a) Conventional rationality -0.0001 (0.000) 0.027*** (0.002) 0.010*** (0.000) Sunk cost, 𝜆 Sunk cost part of ex-policy price, 𝛼 Sunk cost, 𝜆𝜌 No. of observations Mean log likelihood Log likelihood Elasticity (b) Mental accounting for sunk cost -0.0003 (0.000) 0.010*** (0.002) 0.004*** (0.000) 0.094*** (0.012) 0.125*** (0.038) (c) Scaled marginal benefit -0.0006* (0.000) 0.009** (0.003) 0.000 (0.000) 0.237*** (0.031) 0.208*** (0.039) (d) (e) Sunk cost Smaller cars proportional to retail price -0.0003 (0.000) 0.010*** (0.002) 0.005*** (0.000) (f) Larger cars (g) Heterogeneous target usage -0.0006* (0.000) 0.011*** (0.003) 0.003** (0.001) 0.074*** (0.011) 0.233*** (0.080) -0.0001 (0.000) 0.003 (0.003) 0.003** (0.001) 0.060** (0.022) 0.326* (0.186) -0.0003 (0.000) 0.011*** (0.002) 0.004*** (0.001) 0.095*** (0.008) 0.094*** (0.023) 3581 -2.693 -9643.3 0.53*** (0.079) 2893 -2.819 -8155.7 0.73*** (0.269) 6474 -2.752 -17819.2 0.51*** (0.043) 0.024*** (0.002) 6474 -2.77204 -17946.2 n.a. 6474 -2.752 -17815.1 0.56*** (0.072) 6474 -2.748 -17788.7 0.64*** (0.190) 6474 -2.755 -17833.8 0.85*** (0.071) 42 Estimates: Allowing for Different Means of Target Usage for Different Engine Sizes Variable Gasoline cost, 𝛽1 Congestion cost, 𝛽2 Age, 𝜃2 (a) Conventional rationality -0.0001 (0.000) 0.027*** (0.002) 0.010*** (0.000) Sunk cost, 𝜆 Sunk cost part of ex-policy price, 𝛼 Sunk cost, 𝜆𝜌 No. of observations Mean log likelihood Log likelihood Elasticity (b) Mental accounting for sunk cost -0.0003 (0.000) 0.010*** (0.002) 0.004*** (0.000) 0.094*** (0.012) 0.125*** (0.038) (c) Scaled marginal benefit -0.0006* (0.000) 0.009** (0.003) 0.000 (0.000) 0.237*** (0.031) 0.208*** (0.039) (d) (e) Sunk cost Smaller cars proportional to retail price -0.0003 (0.000) 0.010*** (0.002) 0.005*** (0.000) (f) Larger cars (g) Heterogeneous target usage -0.0006* (0.000) 0.011*** (0.003) 0.003** (0.001) 0.074*** (0.011) 0.233*** (0.080) -0.0001 (0.000) 0.003 (0.003) 0.003** (0.001) 0.060** (0.022) 0.326* (0.186) -0.0003 (0.000) 0.011*** (0.002) 0.004*** (0.001) 0.095*** (0.008) 0.094*** (0.023) 3581 -2.693 -9643.3 0.53*** (0.079) 2893 -2.819 -8155.7 0.73*** (0.269) 6474 -2.752 -17819.2 0.51*** (0.043) 0.024*** (0.002) 6474 -2.77204 -17946.2 n.a. 6474 -2.752 -17815.1 0.56*** (0.072) 6474 -2.748 -17788.7 0.64*** (0.190) 6474 -2.755 -17833.8 0.85*** (0.071) 43 Results Significant improvement in log-likelihood with specifications including sunk-cost Sunk-cost effect is significant in all specifications Elasticity wrt sunk-cost is similar (statistically not different) in all specifications Novelty effect is generally positive and significant Effect of gasoline cost is not significant (plausible since the sample is of premium cars) Congestion cost is generally positive and significant 44 Policy effect COE premium increased by $22,491 from February 2009 to February 2010 Specification b: Estimated increase in sunk cost $4,500 and increase in average monthly usage is 147 km (8.8% increase) Specification d: Estimated increase in average monthly usage due to increase in sunk cost is 164 km (9.9%) 45 Policy/Managerial implications Policy: - Making cars expensive has countervailing effect - Better to directly price congestion Managerial: - Countervailing argument against ‘razor/razorblade strategy’ - Underpricing the razor would reduce consumption of razor blade? 46 Back to the question that we posed in the beginning…. Driver A Mercedes-Benz CLS Class Purchase month: February 2009 Estimated price=$300,000 • Owner of the second car pays $22,500 more for the same model, due to increase in the COE premium. Driver B • Structural estimation suggests that Driver B will drive 147-164 km per month more than Driver A US$242,000 Mercedes-Benz CLS Class Purchase month: February 2010 Estimated price=$322,500 US$260,000 47 Conclusion Developed a behavioral model of car usage that incorporated mental accounting for sunk cost, where the standard model is a special case. Tested the model on a proprietary data set of 6,474 cars in Singapore, the world’s most expensive car market Found compelling evidence of sunk cost fallacy in car usage in Singapore 48