Minnesota State University, Mankato Financial Planning Certificate Program

advertisement

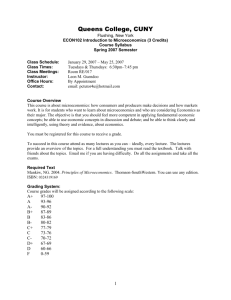

Minnesota State University, Mankato Financial Planning Certificate Program Retirement Planning – CF 204 – Classroom Instructor: Dan Hiebert, CFP®, MSFS E-mail: dnhiebert@gmail.com (612)978-8937 COURSE DESCRIPTION: This course is designed to cover retirement needs planning, including social security, IRAs, and numerous qualified and non-qualified plans. PREREQUISITIES: Knowledge of Time Value of Money and your Calculator CLASS OPENS: March 2, 3, 9, 10, 23, 24, 30 March 30, Final Exam OFFICE HOURS: I will be available anytime via email or phone. Feel free to call me or email during these times. Email is the best. TEACHING METHOD: Teaching methods used are PowerPoints, quizzes, case studies, and topical reading. The class agenda will be roughly as follows: 1. Review of quiz for past week 2. Learning activity done in pairs 3. Review of PowerPoint slides to re-enforce concepts of topic 4. Quiz and learning activity to solidify understanding of material Student preparation between classes will involve reading assigned chapters, followed by completion of a quiz to check for understanding at the end of each chapter. We will have a mid-term part way through to check for understanding of material covered to that point. There will be class time devoted to preparation for this and the final exam. TEXT: Text’s needed for course 1. Retirement Planning and Employee Benefits, 7th edition Michael Dalton CALCULATOR/CALCULATIONS: You are expected to know how to use your calculator and the basic Time Value of Money (TVM) concepts and calculations prior to taking this course. If you do not feel you are skilled in TVM, or wish a review; send me an email and I will help you through it. We will cover the retirement funding concepts and calculations which are the inflation adjusted serial funding calculations. Retirement Planning calculations are approximately 5-10% of this course. GRADING: CLASS PART. : QUIZZES FINAL EXAM 20% 30% 50% 85% to 100% A 70% to 84% B 60% to 69% C 50% to 59% D Below 50% F Note: Students need to maintain at least a B average to receive the MSU-Mankato’s completion certificate. ACADEMIC INTEGRITY: The university’s policy on cheating and plagiarism is adhered to. Students should realize that the material taught is essential for passing the CFP® Examination. STUDENT EXPECTATIONS: 1. Read the assigned material in the Text and for that week. 2. Complete multiple choice questions at the end of chapter of Text Quizzes: Will cover material assigned up through date of the class schedule. FINAL: Will cover the course comprehensively. ATTENDANCE: The students are expected to keep pace with the classes, if there are times your health or business conflict with completing the material in the assigned timeframe, contact me beforehand. Limited exceptions may be made to extend the cutoff. Minnesota State University, Mankato Financial Planning Certificate Program Retirement Planning – CF 204 – Classroom Instructor: Dan Hiebert, CFP® (612-978-8937) E-mail: dnhiebert@gmail.com Session Topic(s) Dalton Chapter/CFP Topic Mar 2 Intro to Retirement Planning Retirement Accumulations and Distributions Chap. 1-2 Mar 3 Qualified Plan Overview Qualified Pension Plans Chap. 3 Chap. 4 46,49,50 46,49 Profit Sharing Plans Chap. 5 46 44 Quiz #1 Mar 9 Stock Bonus Plans and ESOP’s Distributions from Qualified Plans Chap. 6 Chap. 7 46 52 Mar 10 Plan Installation, Admin., Termination IRA’s and SEPs Quiz #2 Chap. 8 Chap. 9 47,49,51,50,51 48 Chap. 10 46 Mar 23 Mar 24 Mar 30 Simple, 403(b), and 457 Plans Social Security Deferred Compensation and nonqualified Course review Quiz #3 Final Exam - Comprehensive Chap. 11 Chap. 12 45 48