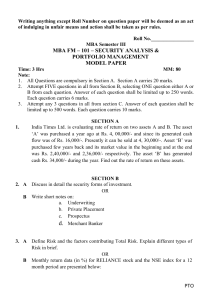

Return, Risk and the Security Market Line

advertisement

Return, Risk and the Security Market Line Expected Return and Variance • Expected return—the weighted average of the distribution of possible returns in the future. • Variance of returns—a measure of the dispersion of the distribution of possible returns. • Rational investors like return and dislike risk. Example—Calculating Expected Return St at e o f Eco no my Boo m No rma l Recessio n Expected return Pi Pro ba bilit y o f St at e i 0.25 0.50 0.25 Ri Ret urn in St at e i 35% 15% –5% 0.25 35% 0.50 15% 0.25 5% 15% Example—Calculating Variance State of Economy Boom Normal Recession (Ri – R) (Ri – R)2 Pi x (Ri – R)2 0.20 0 – 0.20 0.04 0 0.04 2= 0.01 0 0.01 0.02 0.02 0.1414 or 14.14% Example—Expected Return and Variance State of Economy Boom Bust Pi 0.40 0.60 Return on Asset A 30% –10% Return on Asset B –5% 25% Expected Returns: E RA 0.40 0.30 0.60 0.10 0.06 6% E RB 0.40 0.05 0.60 0.25 0.13 13% Example—Expected Return and Variance Variances: Var RA 0.40 0.30 0.06 0.60 0.10 0.06 2 2 0.0384 Var RB 0.40 0.05 0.13 0.60 0.25 0.13 2 0.0216 Standard deviations: σ RA 0.0384 0.196 19.6% σ RB 0.0216 0.147 14.7% 2 Portfolios • A portfolio is a collection of assets. • An asset’s risk and return is important in how it affects the risk and return of the portfolio. • The risk–return trade-off for a portfolio is measured by the portfolio’s expected return and standard deviation, just as with individual assets. Portfolio Expected Returns • The expected return of a portfolio is the weighted average of the expected returns for each asset in the portfolio. m E(Rp) = ∑ wjE (Rj) j =1 • You can also find the expected return by finding the portfolio return in each possible state and computing the expected value as we did with individual securities. Example—Portfolio Return and Variance Assume 50 per cent of portfolio in asset A and 50 per cent in asset B. State of Economy Boom Bust Pi RA RB 0.40 0.60 30% –10% –5% 25% E R p 0.40 0.125 0.60 0.075 0.095 or 9.5% R 12. 7.5 Example—Portfolio Return and Variance • • Var(Rp) (0.50 x Var(RA)) + (0.50 x Var(RB)). By combining assets in a portfolio, the risks faced by the investor can significantly change. Var R p 0.40 0.125 0.095 0.60 0.075 0.095 2 0.0006 R p 0.0006 0.0245 or 2.45% 2 Announcements, Surprises and Expected Returns • Key Issues – What are the components of the total return? – What are the different types of risk? • Expected and Unexpected Returns – Total return (R) = expected return (E(R))+ unexpected return (U) • Announcements and News – Announcement = expected part + surprise – It is the surprise component that affects a stock’s price and, therefore, its return. Risk • • Systematic risk: that component of total risk which is due to economy-wide factors. Non-systematic risk: that component of total risk which is unique to an asset or firm. Total return Expected return Unexpected return R E R U E R systematicportion non - systematicportion Standard Deviations of Monthly Portfolio Returns Number of Shares 1 5 10 15 20 25 30 35 40 45 Average Standard Deviation 11.49% 7.91% 6.61% 6.08% 5.71% 5.60% 5.50% 5.50% 5.26% 5.12% Ratio of Standard Deviations 1.00 0.69 0.58 0.53 0.50 0.49 0.48 0.48 0.46 0.45 Diversification • The process of spreading investments across different assets, industries and countries to reduce risk. • Total risk = systematic risk + non-systematic risk • Non-systematic risk can be eliminated by diversification; systematic risk affects all assets and cannot be diversified away. The Principle of Diversification • Diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns. • This reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another. • However, there is a minimum level of risk that cannot be diversified away and that is the systematic portion. Portfolio Diversification Systematic Risk • • The systematic risk principle states that the expected return on a risky asset depends only on the asset’s systematic risk. The amount of systematic risk in an asset relative to an average risky asset is measured by the beta coefficient. Security A Security B • Std Deviation 30% 10% Beta 0.60 1.20 Security A has greater total risk but less systematic risk (more non-systematic risk) than Security B. Measuring Systemic Risk • What does beta tell us? - - A beta of 1 implies the asset has the same systematic risk as the overall market. A beta < 1 implies the asset has less systematic risk than the overall market. A beta > 1 implies the asset has more systematic risk than the overall market. Beta Coefficients for Selected Companies Company Amcor BHP Boral Caltex Australia CSR Coles Myer Mayne Nickless NAB Beta Coefficent 0.78 1.33 0.85 1.38 0.96 0.45 0.68 1.27 Example—Portfolio Beta Calculations Amount Invested Portfolio Weights Beta (2) (3) (4) (3) (4) ABC Company $6 000 50% 0.90 0.450 LMN Company 4 000 33% 1.10 0.367 XYZ Company 2 000 17% 1.30 0.217 $12 000 100% Share (1) Portfolio 1.034 Example—Portfolio Expected Returns and Betas • Assume you wish to hold a portfolio consisting of asset A and a riskless asset. Given the following information, calculate portfolio expected returns and portfolio betas, letting the proportion of funds invested in asset A range from 0 to 125 per cent. • Asset A has a beta of 1.2 and an expected return of 18 per cent. The risk-free rate is 7 per cent. Asset A weights: 0 per cent, 25 per cent, 50 per cent, 75 per cent, 100 per cent and 125 per cent. • • Example—Portfolio Expected Returns and Betas Proportion Invested in Asset A (%) Proportion Invested in Risk-free Asset (%) Portfolio Expected Return (%) Portfolio Beta 0 100 7.00 0.00 25 75 9.75 0.30 50 50 12.50 0.60 75 25 15.25 0.90 100 0 18.00 1.20 125 –25 20.75 1.50 Return, Risk and Equilibrium • Key issues: – What is the relationship between risk and return? – What does security market equilibrium look like? • The ratio of the risk premium to beta is the same for every asset. In other words, the reward-to-risk ratio for the market is constant and equal to: Reward/ris k ratio E Ri R f i Example—Asset Pricing • Asset A has an expected return of 12 per cent and a beta of 1.40. Asset B has an expected return of 8 per cent and a beta of 0.80. Are these two assets valued correctly relative to each other if the risk-free rate is 5 per cent? 0.12 0.05 A: 0.05 1.40 0.08 0.05 B: 0.0375 0.80 • Asset B offers insufficient return for its level of risk, relative to A. B’s price is too high; therefore, it is overvalued (or A is undervalued). Security Market Line • The security market line (SML) is the representation of market equilibrium. • The slope of the SML is the reward-to-risk ratio: (E(RM) – Rf)/ßM • But since the beta for the market is ALWAYS equal to one, the slope can be rewritten. • Slope = E(RM) – Rf = market risk premium Security Market Line (SML) Asset expected return (E (Ri)) = E (RM) – Rf E (RM) Rf M = 1.0 Asset beta (i) The Capital Asset Pricing Model (CAPM) • • An equilibrium model of the relationship between risk and return. What determines an asset’s expected return? – The risk-free rate—the pure time value of money. – The market risk premium—the reward for bearing systematic risk. – The beta coefficient—a measure of the amount of systematic risk present in a particular asset. CAPM E Ri R f E RM R f i 11-27 Calculation of Systematic Risk ~ ~ i Cov Ri , RM /M Where: Cov = covariance ~ Ri = random distribution of return for asset i ~ R M = random distribution of return for the market M = standard deviation of market return Covariance and Correlation • • • The covariance term measures how returns change together—measured in absolute terms. The correlation coefficient measures how returns change together—measured in relative terms. Correlation coefficient ranges between –1.0 and +1.0. ~ ~ ρiM Cov Ri , RM /σi σ M • Where i = standard deviation of the return on asset i. Security Market Line versus Capital Market Line E R β CML E R p R f E RM R f / M p SML E Ri R f M Rf i * SML explains the expected return for all assets. * CML explains the expected return for efficient portfolios. Risk of a Portfolio Variance of a two-asset portfolio is calculated as: weighted variance of the expected return for each asset in the portfolio + twice the weighted covariance of the expected return on the first asset with the expected return on the second Example—Risk of a Portfolio Weighting 0.3 0.7 Asset A Asset B Std Deviation 0.26 0.13 The covariance of the expected returns between A and B is 0.017. Variance 0.3 0.26 0.7 0.13 2 0.3 0.7 0.017 2 2 0.006084 0.008281 0.00714 0.0215 Std dev 0.1466 Problems with CAPM • Difficulties in estimating beta - thin trading - non-constant beta • Using CAPM - adding explanatory variables - measure of market return