ninth edition Jeff Madura Florida Atlantic University THOIVISOINI

advertisement

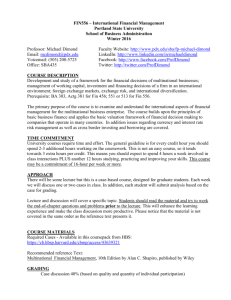

ninth edition Jeff Madura Florida Atlantic University THOIVISOINI * A u s t r a l i a • B r a z i l C a n a d a • M e x i c o •S i n g a p o r e • S p a i n • U n i t e d K i n g d o m • U n i t e d S t a t e s Contents Blades, Inc. Case: Decision to Expand Internationally, 19 Small Business Dilemma: Developing a Multinational Preface, xvii Sporting Goods Corporation, 20 Part 1: The International Financial Environment Internet/Excel Exercises, 21 1 Chapter 1: Multinational Financial Management: An Overview 2 Managing the MNC, 2 Facing Agency Problems, 3 Governance: How SOX Improved Corporate Governance of MNCs, 3 Management Structure of an MNC, 4 Why Firms Pursue International Business, 5 Theory of Comparative Advantage, 6 Imperfect Markets Theory, 6 Product Cycle Theory, 6 / How Firms Engageun International Business, 7 International Trade, 8 Licensing, 8 Franchising, 9 Joint Ventures, 9 Acquisitions of Existing Operations, 9 Establishing New Foreign Subsidiaries, 9 Summary of Methods, 10 Valuation Model for an MNC, 11 Domestic Model, 11 Valuing International Cash Flows, 12 Uncertainty Surrounding an MNCs Cash Flows, 14 Organization of the Text, 15 Summary, 16 Point Counter-Point: Should an MNC Reduce Its Ethical Standards to Compete Internationally?, 16 Self Test, 16 Questions and Applications, 17 Advanced Questions, 17 Discussion in the Boardroom, 19 Running Your Own MNC, 19 Chapter 2: International Flow of Funds 22 Balance of Payments, 22 Current Account, 22 Capital and Financial Accounts, 23 International Trade Flows, 25 Distribution of U.S. Exports and Imports, 26 U.S. Balance-of-Trade Trend, 26 International Trade Issues, 28 Events That Increased International Trade, 28 Trade Friction, 31 Governance: Should Managers Outsource to Satisfy Shareholders?, 32 Factors Affecting International Trade Flows, 34 Impact of Inflation, 34 Impact of National Income, 34 Impact of Government Policies, 35 Impact of Exchange Rates, 35 Interaction of Factors, 36 Correcting a Balance-of-Trade Deficit, 36 Why a Weak Home Currency Is Not a Perfect Solution, 37 International Capital Flows, 38 Distribution ofDFIby U.S. Firms, 38 Distribution of DEI in the United States, 39 Factors Affecting DFI, 40 Factors Affecting International Portfolio Investment, 41 Impact of International Capital Flows, 41 Agencies That Facilitate International Flows, 42 International Monetary Fund, 42 World Bank, 43 World Trade Organization, 44 International Financial Corporation, 44 vii viii Contents International Development Association, 45 Bank for International Settlements, 45 Organization for Economic Cooperation and Development, 45 Regional Development Agencies, 45 How International Trade Affects an MNCs Value, 45 Summary, 46 Point Counter-Point: Should Trade Restrictions Be Used to Influence Human Rights Issues?, 46 Self Test, 46 Questions and Applications, 47 Advanced Questions, 47 Discussion in the Boardroom, 47 Running Your Own MNC, 47 Blades, Inc. Case: Exposure to International Flow of Funds, 48 Small Business Dilemma: Identifying Factors That Will Affect the Foreign Demand at the Sports Exports Company, 48 Internet/Excel Exercises, 49 Chapter 3: International Financial Markets 50 Foreign Exchange Market, 50 History of Foreign Exchange, 50 Foreign Exchange Transactions, 51 Foreign Exchange Quotations, 54 Interpreting Foreign Exchange Quotations, 56 Forward, Futures, and Options Markets, 58 International Money Market, 59 Origins and Development, 60 Money Market Interest Rates among Currencies, 61 Standardizing Global Bank Regulations, 61 International Credit Market, 63 Syndicated Loans, 63 International Bond Market, 64 Eurobond Market, 64 Development of Other Bond Markets, 65 International Stock Markets, 66 Issuance of Stock in Foreign Markets, 66 Issuance of Foreign Stock in the United States, 66 Listing of Stock by Non-U.S. Firms on U.S. Stock Exchanges, 67 Governance: Effect of Sarbanes-Oxley Act on Foreign Stock Offerings, 67 Investing in Foreign Stock Markets, 67 How Stock Market Characteristics Vary among Countries, 70 How Financial Markets Facilitate MNC Functions, 70 Summary, 71 Point Counter-Point: Should Firms That Go Public Engage in International Offerings?, 72 Self Test, 72 Questions and Applications, 72 Advanced Questions, 73 Discussion in the Boardroom, 74 Running Your Own MNC, 74 Blades, Inc. Case: Decisions to Use International Financial Markets, 74 Small Business Dilemma: Use of the Foreign Exchange Markets by the Sports Exports Company, 75 Internet/Excel Exercises, 75 Appendix 3: Investing in International Financial Markets, 76 Chapter 4: Exchange Rate Determination 85 Measuring Exchange Rate Movements, 85 Exchange Rate Equilibrium, 86 Demand for a Currency, 87 Supply of a Currency for Sale, 87 Equilibrium, 88 Factors That Influence Exchange Rates, 89 Relative Inflation Rates, 89 Relative Interest Rates, 90 Relative Income Levels, 92 Government Controls, 92 Expectations, 93 Interaction of Factors, 93 Speculating on Anticipated Exchange Rates, 95 Summary, 97 Point Counter-Point: How Can Persistently Weak Currencies Be Stabilized?, 97 Self Test, 98 Questions and Applications, 98 Advanced Questions, 99 Discussion in the Boardroom, 100 Running Your Own MNC, 100 Blades, Inc. Case: Assessment of Future Exchange Rate Movements, 101 Small Business Dilemma: Assessment by the Sports Exports Company of Factors That Affect the British Pound's Value, 101 Internet/Excel Exercises, 102 Chapter 5: Currency Derivatives Forward Market, 103 How MNCs Use Forward Contracts, 104 Non-Deliverable Forward Contracts, 107 Currency Futures Market, 108 Contract Specifications, 108 Trading Futures, 108 103 Contents Comparison of Currency Futures and Forward Contracts, 110 Pricing Currency Futures, 110 Credit Risk of Currency Futures Contracts, 111 Speculation with Currency Futures, 111 How Firms Use Currency Futures, 112 Closing Out a Futures Position, 113 Trading Platforms for Currency Futures, 114 Currency Options Market, 114 Option Exchanges, 114 Over-the-Counter Market, 114 Currency Call Options, 115 Factors Affecting Currency Call Option Premiums, 115 How Firms Use Currency Call Options, 116 Speculating with Currency Call Options, 117 Currency Put Options, 119 Factors Affecting Currency Put Option Premiums, 119 \ Hedging with Currency Put Options, 120 Speculating with Currency Put Options, 120 Contingency Graphs for Currency Options, 122 Contingency Graph for a Purchaser of a Call Option, 122 Contingency Graph for a Seller ofa Call Option, 123 Contingency Graph for a Buyer of a Put Option, 124 Contingency Graph for a Seller of a Put Option, 124 Governance: Should an MNCs Managers Use Currency Derivatives to Speculate?, 124 • Conditional Currency Options,,124 European Currency Options, 126 Summary, 126 V Point Counter-Point: Should Speculators Use Currency Futures or Options?, 126 Self Test, 127 Questions and Applications, 127 Advanced Questions, 130 Discussion in the Boardroom, 132 Running Your Own MNC, 132 Blades, Inc. Case: Use of Currency Derivative Instruments, 133 Small Business Dilemma: Use of Currency Futures and Options by the Sports Exports Company, 134 Internet/Excel Exercises, 134 Appendix 5A: Currency Option Pricing, 135 Part 2: Exchange Rate Behavior IX 153 Chapter 6: Government Influence on Exchange Rates 154 Exchange Rate Systems, 154 Filled Exchange Rate System, 154 Freely Floating Exchange Rate System, 156 Managed Float Exchange Rate System, 158 Pegged Exchange Rate System, 158 Currency Boards Used to Peg Currency Values, 161 Dollarization, 163 Classification of Exchange Rate Arrangements, 163 A Single European Currency, 164 Membership, 165 Impact on European Monetary Policy, 165 Impact on Business within Europe, 165 Impact on the Valuation of Businesses in Europe, 166 Impact on Financial Flows, 166 Impact on Exchange Rate Risk, 167 Status Report on the Euro, 167 Government Intervention, 167 Reasons for Government Intervention, 167 Direct Intervention, 168 Indirect Intervention, 171 Intervention as a Policy Tool, 172 Influence of a Weak Home Currency on the Economy, 172 Influence of a Strong Home Currency on the Economy, 172 Summary, 174 Point Counter-Point: Should China Be Forced to Alter the Value of Its Currency?, 174 Self Test, 175 Questions and Applications, 175 Advanced Questions, 176 Discussion in the Boardroom, 176 Running Your Own MNC, 176 Blades, Inc. Case: Assessment of Government Influence on Exchange Rates, 177 Small Business Dilemma: Assessment of Central Bank Intervention by the Sports Exports Company, 178 Internet/Excel Exercises, 178 Appendix 6: Government Intervention during the Asian Crisis, 179 Appendix 5B: Currency Option Combinations, 139 Chapter 7: International Arbitrage and Interest Rate Parity Part 1 Integrative Problem: The International Financial Environment, 152 International Arbitrage, 188 Locational Arbitrage, 188 188 Contents Triangular Arbitrage, 191 Covered Interest Arbitrage, 194 Comparison ofArbitrage Effects, 197 Interest Rate Parity (IRP), 198 Derivation of Interest Rate Parity, 198 Determining the Forward Premium, 199 Graphic Analysis of Interest Rate Parity, 200 How to Test Whether Interest Rate Parity Exists, 202 Interpretation of Interest Rate Parity, 202 Does Interest Rate Parity Hold?, 203 Considerations When Assessing Interest Rate Parity, 204 Forward Premiums across Maturity Markets, 205 Changes in Forward Premiums, 206 Governance: How Arbitrage Reduces the Need to Monitor Transaction Costs, 207 Summary, 207 Point Counter-Point: Does Arbitrage Destabilize Foreign Exchange Markets?, 208 Self Test, 208 Questions and Applications, 209 Advanced Questions, 210 Discussion in the Boardroom, 211 Running Your Own MNC, 211 Blades, Inc. Case: Assessment of Potential Arbitrage Opportunities, 211 Small Business Dilemma: Assessment of Prevailing Spot and Forward Rates by the Sports Exports Company, 213 Internet/Excel Exercises, 213 Chapter 8: Relationships among Inflation, Interest Rates, and Exchange Rates 214 Purchasing Power Parity (PPP), 214 Interpretations of Purchasing Power Parity, 214 Rationale behind Purchasing Power Parity Theory, 215 Derivation of Purchasing Power Parity, 216 Using PPP to Estimate Exchange Rate Effects, 217 Graphic Analysis ofPurchasing Power Parity, 218 Testing the Purchasing Power Parity Theory, 219 Why Purchasing Power Parity Does Not Occur, 222 Purchasing Power Parity in the Long Run, 223 International Fisher Effect (IFE), 223 Relationship with Purchasing Power Parity, 223 Implications of the IFE for Foreign Investors, 224 Derivation of the International Fisher Effect, 225 Graphic Analysis of the International Fisher Effect, 227 Tests of the International Fisher Effect, 229 Why the International Fisher Effect Does Not Occur, 231 Comparison of the IRP, PPP, and IFE Theories, 231 Summary, 232 Point Counter-Point: Does PPP Eliminate Concerns about Long-Term Exchange Rate Risk?, 233 Self Test, 233 Questions and Applications, 234 Advanced Questions, 235 Discussion in the Boardroom, 237 Running Your Own MNC, 237 Blades, Inc. Case: Assessment of Purchasing Power Parity, 238 Small Business Dilemma: Assessment of the IFE by the Sports Exports Company, 239 Internet/Excel Exercises, 239 Part 2 Integrative Problem: Exchange Rate Behavior, 24O Midterm Self Exam, 241 Part 3: Exchange Rate Risk Management 249 Chapter 9: Forecasting Exchange Rates 250 Why Firms Forecast Exchange Rates, 250 Forecasting Techniques, 252 Technical Forecasting, 253 Fundamental Forecasting, 254 Market-Based Forecasting, 258 Mixed Forecasting, 261 Forecasting Services, 262 Reliance on Forecasting Services, 262 Forecast Error, 263 Potential Impact of Forecast Errors, 263 Measurement of Forecast Error, 263 Forecast Accuracy over Time, 264 Forecast Accuracy among Currencies, 264 Forecast Bias, 265 Graphic Evaluation of Forecast Performance, 266 Comparison of Forecasting Methods, 269 Forecasting under Market Efficiency, 269 Governance: Governance of Managerial Forecasting, 270 Using Interval Forecasts, 270 Methods of Forecasting Exchange Rate Volatility, 271 Summary, 272 Point Counter-Point: Which Exchange Rate Forecast Technique Should MNCs Use?, 272 Contents Self Test, 273 Questions and Applications, 273 Advanced Questions, 275 Discussion in the Boardroom, 277 Running Your Own MNC, 277 Blades, Inc. Case: Forecasting Exchange Rates, 277 Small Business Dilemma: Exchange Rate Forecasting by the Sports Exports Company, 278 Internet/Excel Exercises, 278 Chapter 1O: Measuring Exposure to Exchange Rate Fluctuations Is Exchange Rate Risk Relevant?, 280 Purchasing Power Parity Argument, 280 The Investor Hedge Argument, 280 Currency Diversification Argument, 281 Stakeholder Diversification Argument, 281 Response from MNCs, 281 Types of Exposure, 281 Transaction Exposure, 282 Estimating "Net" Cash Flows in Each Currency, 282 Measuring the Potential Impact of the Currency Exposure, 284 Assessing Transaction Exposure Based on Value at Risk, 286 Economic Exposure, 289 Economic Exposure to Local Currency Appreciation, 291 Economic Exposure to Local Currency Depreciation, ir291 Economic Exposure of Domestic Firms, 292 Measuring Economic Exposure, 292 Translation Exposure, 295 Does Translation Exposure Matter?, 295 Determinants of Translation Exposure, 296 Examples of Translation Exposure, 297 Summary, 297 Point Counter-Point: Should Investors Care about an MNCs Translation Exposure?, 298 Self Test, 298 Questions and Applications, 299 Advanced Questions, 300 Discussion in the Boardroom, 304 Running Your Own MNC, 304 Blades, Inc. Case: Assessment of Exchange Rate Exposure, 304 Small Business Dilemma: Assessment of Exchange Rate Exposure by the Sports Exports Company, 305 Internet/Excel Exercises, 306 280 Chapter 11: Managing Transaction Exposure Transaction Exposure, 307 Identifying Net Transaction Exposure, 307 Adjusting the Invoice Policy to Manage Exposure, 308 Governance: Aligning Manager Compensation with Hedging'Goals, 308 Hedging Exposure to Payables, 308 Forward or Futures Hedge on Payables, 309 Money Market Hedge on Payables, 309 Call Option Hedge, 310 r Summary of Techniques Used to Hedge Payables, 313 Selecting the Optimal Technique for Hedging Payables, 313 OptimalfHedge versus No Hedge, 316 Evaluating the Hedge Decision, 316 Hedging Exposure To Receivables, 317 Forward or Futures Hedge on Receivables, 317 Money Market Hedge on Receivables, 317 Put Option Hedge, 318 Selecting the Optimal Technique for Hedging Receivables, 320 Optimal Hedge versus No Hedge, 323 Evaluating the Hedge Decision, 323 Comparison of Hedging Techniques, 324 Hedging Policies of MNCs, 325 Limitations of Hedging, 326 Limitation of Hedging an Uncertain Amount, 326 Limitation of Repeated Short-Term Hedging, 326 Hedging Long-Term Transaction Exposure, 328 Long-Term Forward Contract, 328 Parallel Loan, 328 Alternative Hedging Techniques, 329 Leading and Lagging, 329 Cross-Hedging, 329 Currency Diversification, 329 Summary, 330 Point Counter-Point: Should an MNC Risk Overhedging?, 330 Self Test, 331 Questions and Applications, 331 Advanced Questions, 334 Discussion in the Boardroom, 338 Running Your Own MNC, 338 Blades, Inc. Case: Management of Transaction Exposure, 338 xi 307 xii Contents Small Business Dilemma: Hedging Decisions by the Sports Exports Company, 340 Internet/Excel Exercises, 340 Appendix 11: Nontraditional Hedging Techniques, 341 Chapter 12: Managing Economic Exposure and Translation Exposure 369 Chapter 13: Direct Foreign Investment 346 Economic Exposure, 346 Use of Projected Cash Flows to Assess Economic Exposure, 347 How Restructuring Can Reduce Economic Exposure, 348 Issues Involved in the Restructuring Decision, 351 A Case Study in Hedging Economic Exposure, 352 Savor Co.'s Dilemma, 352 Assessment of Economic Exposure, 352 Assessment of Each Unit's Exposure, 353 Identifying the Source of the Unit's Exposure, 353 Possible Strategies to Hedge Economic Exposure, 354 Savor's Hedging Solution, 356 Limitations of Savor's Optimal Hedging Strategy, 356 Hedging Exposure to Fixed Assets, 356 Managing Translation Exposure, 357 Use of Forward Contracts to Hedge Translation Exposure, 357 Limitations of Hedging Translation Exposure, 358 Governance: Governing the Hedge of Translation Exposure, 359 Summary, 359 /' Point Counter-Point: Can an MNC Reduce the Impact of Translation Exposure by Communicating, 360 Self Test, 360 Questions and Applications, 361 Advanced Questions, 361 Discussion in the Boardroom, 362 Running Your Own MNC, 362 Blades, Inc. Case: Assessment of Economic Exposure, 363 Small Business Dilemma: Hedging the Sports Exports Company's Economic Exposure to Exchange Rate Risk, 364 Internet/Excel Exercises, 364 Part 3 Integrative Problem: Exchange Rate Risk Management, 366 Part 4: Long-Term Asset and Liability Management 370 Motives for Direct Foreign Investment, 370 Revenue-Related Motives, 370 Cost-Related Motives, 371 Governance: Selfish Managerial Motives for DFI, 373 Comparing Benefits of DFI among Countries, 373 Comparing Benefits of DFI over Time, 374 Benefits of International Diversification, 375 Diversification Analysis of International Projects, 377 Diversification^ among Countries, 379 Decisions Subsequent to DFI, 380 Host Government Views of DFI, 380 Incentives to Encourage DFI, 380 Barriers to DFI, 381 Government-Imposed Conditions to Engage in DFI, 382 Summary, 382 Point Counter-Point: Should MNCs Avoid DFI in Countries with Liberal Child Labor Laws?, 382 Self Test, 383 Questions and Applications, 383 Advanced Questions, 384 Discussion in the Boardroom, 384 Running Your Own MNC, 384 Blades, Inc. Case: Consideration of Direct Foreign Investment, 385 Small Business Dilemma: Direct Foreign Investment Decision by the Sports Exports Company, 386 Internet/Excel Exercises, 386 Chapter 14: Multinational Capital Budgeting Subsidiary versus Parent Perspective, 387 Tax Differentials, 387 Restricted Remittances, 388 Excessive Remittances, 388 Exchange Rate Movements, 388 Summary of Factors, 388 Input for Multinational Capital Budgeting, 389 Multinational Capital Budgeting Example, 391 Background, 391 Analysis, 392 Factors to Consider in Multinational Capital Budgeting, 395 Exchange Rate Fluctuations, 395 387 Contents Inflation, 396 Financing Arrangement, 397 Blocked Funds, 400 Uncertain Salvage Value, 401 Impact of Project on Prevailing Cash Flows, 402 Host Government Incentives, 403 Real Options, 403 Adjusting Project Assessment for Risk, 404 Risk-Adjusted Discount Rate, 404 Sensitivity Analysis, 404 Simulation, 405 Governance: Controls over International Project Proposals, 406 Summary, 406 Point Counter-Point: Should MNCs Use Forward Rates to Estimate Dollar Cash Flows of Foreign Projects?, 406 Self Test, 407 Questions and Applications, 407 Advanced Questions, 410 Discussion in the Boardroom, 412 Running Your Own MNC, 412 Blades, Inc. Case: Decision by Blades, Inc., to Invest in Thailand, 412 Exchange Rate Effects on the Funds Remitted, 434 Required Return of Acquirer, 434 Other Types of Multinational Restructuring, 434 International Partial Acquisitions, 434 International Acquisitions of Privatized Businesses, 435 International Alliances, 435 International Divestitures, 436 Restructuring Decisions as Real Options, 437 Call Option on Real Assets, 437 Put Option on Real Assets, 438 ,Summary, 438 Point Counter-Point: Can a Foreign Target Be Assessed Like Any Other Asset?, 439 Self Test, 439 Questions and Applications, 439 Advanced Questions, 440 Discussion in the Boardroom, 443 Running Your Own MNC, 443 Blades, Inc. Case: Assessment of an Acquisition in Thailand, 443 Small Business Dilemma: Multinational Restructuring by the Sports Exports Company, 445 Small Business Dilemma: Multinational Capital Budgeting by the Sports Exports Company, 414 Internet/Excel Exercises, 414 Appendix 14: Incorporating International Tax Laws in Multinational Capital Budgeting, 415 Chapter 15: International Acquisitions ;» xiii 422 Background on International Acquisitions, 422 Trends in International Acquisitions, 423 Model for Valuing a Foreign Target, 423 Market Assessment of International Acquisitions, 424 Assessing Potential Acquisitions after the Asian Crisis, 424 Assessing Potential Acquisitions in Europe, 425 Governance: Impact of the Sarbanes-Oxley Act on the Pursuit of Targets, 425 Factors That Affect the Expected Cash Flows of the Foreign Target, 425 Target-Specific Factors, 425 Country-Specific Factors, 426 Example of the Valuation Process, 427 International Screening Process, 427 Estimating the Target's Value, 428 Changes in Valuation over Time, 431 Why Valuations of a Target May Vary among MNCs, 433 Estimated Cash Flows of the Foreign Target, 433 Internet/Excel Exercises, 445 Chapter 16: Country Risk Analysis 446 Why Country Risk Analysis Is Important, 446 Political Risk Factors, 447 Attitude of Consumers in the Host Country, 447 Actions of Host Government, 447 Blockage of Fund Transfers, 448 Currency Inconvertibility, 448 War, 449 Bureaucracy, 449 Corruption, 449 Financial Risk Factors, 450 Indicators of Economic Growth, 450 Types of Country Risk Assessment, 451 Macroassessment of Country Risk, 451 Microassessment of Country Risk, 452 Techniques to Assess Country Risk, 453 Checklist Approach, 453 Delphi Technique, 453 Quantitative Analysis, 454 Inspection Visits, 454 Combination of Techniques, 454 Measuring Country Risk, 454 Variation in Methods of Measuring Country Risk, 457 Using the Country Risk Rating for Decision Making, 457 xiv Contents Comparing Risk Ratings among Countries, 457 Actual Country Risk Ratings across Countries, 457 Incorporating Country Risk in Capital Budgeting, 459 Adjustment of the Discount Rate, 459 Adjustment of the Estimated Cash Flows, 459 How Country Risk Affects Financial Decisions, 462 Governance: Governance over the Assessment of Country Risk, 462 Reducing Exposure to Host Government Takeovers, 463 Use a Short-Term Horizon, 463 Rely on Unique Supplies or Technology, 463 Hire Local Labor, 463 Borrow Local Funds, 463 Purchase Insurance, 464 Use Project Finance, 464 Summary, 465 Point Counter-Point: Does Country Risk Matter for U.S. Projects?, 465 Self Test, 465 Questions and Applications, 466 Advanced Questions, 467 Discussion in the Boardroom, 469 Running Your Own MNC, 469 Blades, Inc. Case: Country Risk Assessment, 469 Small Business Dilemma: Country Risk Analysis at the Sports Exports Company, 471 Internet/Excel Exercises, 471 Revising the Capital Structure in Response to Changing Conditions, 488 Interaction between Subsidiary and Parent Financing Decisions, 489 Impact of Increased Debt Financing by the Subsidiary, 490 Impact of Reduced Debt Financing by the Subsidiary,^491 Summary of Interaction between Subsidiary and Parent Financing Decisions, 491 Local versus Global Target Capital Structure, 492 Offsetting a Subsidiary's High Degree of Financial :Leverage, 492 Offsetting a Subsidiary's Low Degree of Financial Leverage, 492 Limitations in Offsetting a Subsidiary's Abnormal Degree of Financial Leverage, 492 Summary, 493 ? Point Counter-Point: Should the Reduced Tax Rate on Dividends Affect an MNCs Capital Structure?, 493 Self Test, 494 Questions and Applications, 494 Advanced Questions, 495 Discussion in the Boardroom, 497 Running Your Own MNC, 497 Blades, Inc. Case: Assessment of Cost of Capital, 497 Small Business Dilemma: Multinational Capital Structure Decision at the Sports Exports Company, 499 Internet/Excel Exercises, 499 Chapter 17: Multinational Cost of Capital and Capital Structure 472 Chapter 18: Long-Term Financing Background on Cost of Capital, 472 Comparing the Costs of'/Equity and Debt, 472 Cost of Capital for MNCs, 473 Cost-of-Equity Comparison Using the CAPM, 475 Implications ofth'e CAPM for an MNCs Risk, 476 Costs of Capital across Countries, 477 Country Differences in the Cost of Debt, 477 Country Differences in the Cost of Equity, 478 Combining the Costs of Debt and Equity, 480 Estimating the Cost of Debt and Equity, 480 Using the Cost of Capital for Assessing Foreign Projects, 481 Derive Net Present Values Based on the Weighted Average Cost of Capital, 481 Adjust the Weighted Average Cost of Capital for the Risk Differential, 482 Derive the Net Present Value of the Equity Investment, 482 The MNCs Capital Structure Decision, 486 Influence of Corporate Characteristics, 486 Influence of Country Characteristics, 487 Long-Term Financing Decision, 500 Sources of Equity, 500 500 Sources of Debt, 501 Governance: Stockholder versus Creditor Conflict, 501 Cost of Debt Financing, 501 Measuring the Cost of Financing, 502 Actual Effects of Exchange Rate Movements on Financing Costs, 504 Assessing the Exchange Rate Risk of Debt Financing, 506 Use of Exchange Rate Probabilities, 506 Use of Simulation, 506 Reducing Exchange Rate Risk, 507 Offsetting Cash Inflows, 507 Forward Contracts, 508 Currency Swaps, 508 Parallel Loans, 510 Diversifying among Currencies, 514 Interest Rate Risk from Debt Financing, 515 The Debt Maturity Decision, 515 Contents The Fixed versus Floating Rate Decision, 517 Hedging with Interest Rate Swaps, 517 Plain Vanilla Swap, 517 Summary, 521 Point Counter-Point: Will Currency Swaps Result in Low Financing Costs?, 521 Self Test, 521 Questions and Applications, 522 Advanced Questions, 523 Discussion in the Boardroom, 524 Running Your Own MNC, 524 Blades, Inc. Case: Use of Long-Term Financing, 524 Small Business Dilemma: Long-Term Financing Decision by the Sports Exports Company, 525 Internet/Excel Exercises, 526 Part 4 Integrative Problem: Long-Term Asset and Liability Management, 527 Part 5: Short-Term Asset and Liability Management 529 Chapter 19: Financing International Trade 530 Payment Methods for International Trade, 530 Prepayment, 531 Letters of Credit (L/Cs), 531 Drafts, 532 Consignment, 532 Open Account, 532 Trade Finance Method's, 533 Accounts Receivable Financing, 533 Factoring, 533 Letters of Credit (L/Cs), 534 Banker's Acceptance, 538 Working Capital Financing, 540 Medium-Term Capital Goods Financing (Forfaiting), 541 Countertrade, 541 Agencies That Motivate International Trade, 542 Export-Import Bank of the United States, 542 Private Export Funding Corporation (PEFCO), 544 Overseas Private Investment Corporation (OPIC), 544 ' xv Discussion in the Boardroom, 546 Running Your Own MNC, 546 Blades, Inc. Case: Assessment of International Trade Financing in Thailand, 546 Small Business Dilemma: Ensuring Payment for Products Exported by the Sports Exports Company, 548 Internet/Excel Exercise, 548 Chapter 2O: Short-Term Financing 549 Sources of Short-Term Financing, 549 Short-Term Notes, 549 Commercial Paper, 549 Bank Loans, 549 Internal Financing by MNCs, 550 Governance: Governance over Subsidiary Short-Term Financing,550 Why MNCs Consider Foreign Financing, 550 Foreign Financing to Offset Foreign Currency Inflows, 550 Foreign Financing to Reduce Costs, 551 Determining the Effective Financing Rate, 552 Criteria Considered for Foreign Financing, 553 Interest Rate Parity, 553 The Forward Rate as a Forecast, 554 Exchange Rate Forecasts, 555 Actual Results from Foreign Financing, 558 Financing with a Portfolio of Currencies, 558 Portfolio Diversification Effects, 561 Repeated Financing with a Currency Portfolio, 562 Summary, 564 Point Counter-Point: Do MNCs Increase Their Risk When Borrowing Foreign Currencies?, 564 Self Test, 564 Questions and Applications, 565 Advanced Questions, 566 Discussion in the Boardroom, 567 Running Your Own MNC, 567 Blades, Inc. Case: Use of Foreign Short-Term Financing, 567 Small Business Dilemma: Short-Term Financing by the Sports Exports Company, 568 Internet/Excel Exercises, 568 Summary, 545 Chapter 21: International Cash Management Point Counter-PointrDo Agencies That Facilitate International Trade Prevent Free Trade?, 545 Self Test, 545 Questions and Applications, 545 Advanced Questions, 546 Multinational Management of Working Capital, 569 Subsidiary Expenses, 569 Subsidiary Revenue, 570 Subsidiary Dividend Payments, 570 Subsidiary Liquidity Management, 570 569 xvi Contents Centralized Cash Management, 571 Self Test, 587 Governance: Monitoring of MNC Cash Positions, 571 Questions and Applications, 587 Advanced Questions, 588 Discussion in the Boardroom, 589 Running Your Own MNC, 589 Blades, Inc. Case: International Cash Management, 589 Small Business Dilemma: Cash Management at the Sports Exports Comp'any, 590 Internet/Excel Exercises, 590 Techniques to Optimize Cash Flows, 572 Accelerating Cash Inflows, 572 Minimizing Currency Conversion Costs, 573 Managing Blocked Funds, 575 Managing Intersubsidiary Cash Transfers, 575 Complications in Optimizing Cash Flow, 576 Company-Related Characteristics, 576 Government Restrictions, 576 Characteristics of Banking Systems, 576 Investing Excess Cash, 576 How to Invest Excess Cash, 577 Centralized Cash Management, 577 Determining the Effective Yield, 579 Implications of Interest Rate Parity, 581 Use of the Forward Rate as a Forecast, 581 Use of Exchange Rate Forecasts, 582 Diversifying Cash across Currencies, 585 Dynamic Hedging, 586 Summary, 586 Point Counter-Point: Should Interest Rate Parity Prevent MNCs from Investing in Foreign Currencies?, 587 Appendix 21: Investing in a Portfolio of Currencies, 592 Part,5 Integrative Problem: Short-Term Asset and Liability Management, 596 Final Self Exam, 598 Appendix A: Answers to Self Test Questions, 606 Appendix B: Supplemental Cases, 618 Appendix C: Using Excel to Conduct Analysis, 640 Appendix D: International Investing Project, 647 Appendix E: Discussion in the Boardroom, 650 Glossary, 658 Index, 665