Memorandum D19-12-1 Importation of Vehicles In Brief ISSN 2369-2391

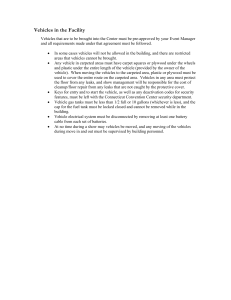

advertisement