Customer Guideline 3 - Registration

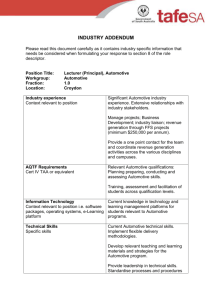

advertisement