CHAPTER ONE

advertisement

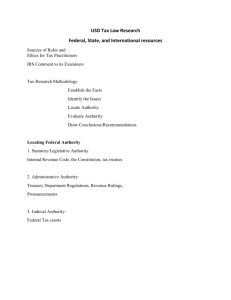

CHAPTER THREE TREASURY INTERPRETATIONS EXPECTED LEARNING OUTCOMES Understand the following about Treasury interpretations: • • • • • The different types Their level of authority How they are accessed How to determine their validity How they are cited TYPES OF TREASURY INTERPRETATIONS Regulations Revenue Rulings Revenue Procedures Letter Rulings Other Treasury Regulations and Their Authority Regulations provide clarity of IRC sections. Regs: Not issued for every section. Final Regs: Force and effect of law if reasonable & consistent interpretation of the law. (preamble – summarizes intended effect of the regulation. • Legislative v. Interpretive Regs??? Proposed: min. 30 days proposed before finalized. Solicit feedback (AICPA, ABA) – little authoritative value Temporary: authoritative guidance while being finalized (3 year expiration deadline) How to Access Regulations Treasury Decisions (Federal Register) – Law Library Internal Revenue Bulletin – published weekly. Cumulative Bulletin (compiled semi-annually. Organization and Citation of Regulations Organization • by Code Section Citation • Treas. Regs. 1.263-xxxxx • See pg. 125 Formats Available Print/Paper CD-ROM Modem Web Confirming the Reliability of a Regulation Danger of being obsolete Check for cautions Revenue Rulings Differ greatly from regulations Code’s application to specific set of facts Issued by IRS- National Office Issue/ Facts / Law& Analysis / Holding / Effect on other docs. Authority limited by its facts Discovering Relevant Revenue Rulings Through reference service IRS Bulletin Index-Digest System Accessing Revenue Rulings Internal Revenue Bulletin Cumulative Bulletin Print or electronic Discovering Relevant Revenue Rulings Through reference service IRS Bulletin Index-Digest System Citing a Revenue Ruling Rev. Rul. 83-14, 1983-1 CB 200 Rev. Rul. 99-89, IRB 1999-20, 30 Rev. Rul. 99-89, 1999-20 CB 30 Ensuring the Reliability of a Revenue Ruling Must check that Rev. ruling is still in effect. Old rulings are not removed Citator: indicates whether the IRS/Courts amended authority of ruling Use finding lists if using hard copy. See examples on page. 138/139. Revenue Procedures Procedural guidelines Authoritative if current Generally not fact specific If lengthy, have table of contents. Discovering Relevant Revenue Procedures Through reference service IRS Bulletin Index-Digest System Accessing Revenue Procedures Internal Revenue Bulletin Cumulative Bulletin Print or electronic Citing a Revenue Procedure Rev. Proc. 83-14, 1983-1 CB 200 Rev. Proc. 99-89, IRB 1999-20, 30 Rev. Proc. 99-89, 1999-20 CB 30 Ensuring the Reliability of a Revenue Procedure Citating- same procedure as for Rev. Rulings. Letter Rulings/Technical Advice Memoranda Similar to Revenue Rulings Generated through request or internal confusion Limited authority Discovering Relevant Letter Rulings Cannot depend on reference services Searching using electronic database Citing a Letter Ruling 9940300 • 99 year • 40 week • 300 number in that week Other Types of Treasury Interpretations Determination letters General Counsel Memos IRS News Releases IRS Publications Actions on Decisions Acquiescences/non Internal Revenue Manual Forms and Instructions Go Over p. 152-153