Taxes and the Poor

advertisement

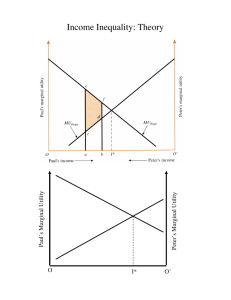

January 24, 2008 Reading Assignment for Tuesday, January 29 • Rich Williams (SOC) and Judy Fox (LAW)/Foreclosed and Abandoned Houses in SB/ Changing Face of Inequality, available at: – https://www3.nd.edu/~rwilliam/ndonly/rwpubs/Soci alProblems2005.pdf; or – http://www.nd.edu/~jwarlick/courses/html Extra Credit Event William Julius Wilson Lecture: Poverty and Inequality in Urban America Sunday, Jan. 27th, 7:00 pm, 101 Debartolo Hall!! Outline for today • Turn in papers – Observations about our public opinion poll? • A quick quiz • Questions about Professor Betson’s lecture • A few more comments about Measuring poverty • Ch. 1, What’s the point? • Taxes and the poor, featuring the EITC Turn in your papers now! • Pass to someone on the aisle. Quick Quiz 1. Indicate whether the following statement is true or false: – “The U.S. is the only country to adopt an official (government authorized) poverty measure.” A. True B. False Questions about Betson Lecture? • Mollie Orshansky’s obituary is posted on my web site http://www.nd.edu/~jwarlick • Also see http://www.ssa.gov/history/orshansky.html • Economists contribution: development of equivalence scales – “a means to allow for the comparison of the poverty status of families of various sizes and compositions” – See: http://www.irp.wisc.edu/research/method/oakvos.htm • Betson’s methods -- microsimulation with cross-sectional surveys of American households A bit more about Measuring Poverty • International Poverty Line, $1-per-day http://earthtrends.wri.org/images/pop_fea_dimofpov_fig4.jpg • Alternatives to income-poverty: multidimensional indexes of poverty focused on capabilities – Amartya Sen, Nobel Prize winner, 1999 Capability Deprivation • . . . In analyzing social justice, there is a strong case for judging individual advantage in terms of the capabilities that a person has, that is the substantive freedoms he or she has to lead the kind of life he or she has reason to value. In this perspective, poverty must be seem as the deprivation of basic capabilities rather than merely as lowness of incomes. . . – Amartya Sen, “Poverty as Capability Deprivation,” Development as Freedom (New York: Anchor Books, 1999). World Bank definition of the dimensions of poverty • • • • Income poverty--material deprivation Health and education Vunerability--exposure to risks Voicelessness and powerlessness-exclusion from political processes • http://web.worldbank.org/WBSITE/EXTERNAL/TOPICS/EXTPO VERTY/0,,contentMDK:20194762~pagePK:148956~piPK:21661 8~theSitePK:336992,00.html Implications for Development Policies • Development should not focus solely on raising incomes/consumption to reduce material deprivation, but also on enlarging people’s choices. • Progress should not be measured in economic terms alone. Is it feasible to measure poverty using Sen’s definition? • Human Development Index – http://hdr.undp.org/en/ – http://en.wikipedia.org/wiki/Human_Devel opment_Index#Top_thirty_countries What’s the point of Chapter 1? “Money and Its Opposite” 2. Which of the following best expresses your answer to the question above: A. B. C. D. To show adults in working poor families behave unwisely To show that the choices available to the working poor are constrained relative to those with greater economic resources To emphasis that the working poor face higher prices in financial markets and that these higher prices make it difficult for them to obtain basic necessities None of the above Your thoughts Taxes and the Working Poor Presentation 5 January 24, 2008 Do the working poor pay taxes? • Payroll taxes • Income taxes: Federal, State County, and local • Sales taxes: – State and Local – 6% in Indiana • Property taxes – collected by the local county treasurers, – based on assessments that are provided by the township and county assessors – Range from 2 to 3% in South Bend Payroll Tax • Tax Base: Earnings (wages and salaries) • Tax individually paid by both employer and employee: – OASI Portion: 6.2% of first $94,200 of Earnings – HI Portion: 1.45% of Earnings Payroll Taxes Tax ($) OASI + HI OASI HI $94,200 Earnings Income Tax • Income – Income Preferences -- Special Treatment of Certain Types of Income – Adjustments to Income • Adjusted Gross Income – Deductions from Income Standard (single) $5,150 or (married) $10,300) Itemized Deductions: – – – – – Medical and Dental Spending Taxes Paid to other levels of Government Interest Paid (Homes and Investments) Gifts to Charity Job Expenses, Thief Losses, Other – Personal Exemptions ($3,300 per member) • • • • Taxable Income Gross Tax Liability + Tax Credits (EITC$$$$) Net Tax Liability Tax Credits • Different kinds of tax credits – Child- and dependent-care credit – Credit for the elderly or disabled – Retirement savings contributions credit – Adoption expenses credit – Hope and Lifetime Learning education credits Tax Credits, cont. • Even better than deductions?!? – Deductions reduce your amount of taxable income – credits cut your actual tax bill, dollarfor-dollar Tax Credits, cont. • Non-refundable vs. Refundable credits – Nonrefundable credits can take your tax down to nothing, but you can't get money back from the government – Refundable credits may eliminate any tax you owe and provide you with a refund$$$ • Earned Income Tax Credit is a refundable tax credit targeted at the working poor!!!!! Tax Rates Terms • Marginal Tax Rate -- if you earn one more dollar, what percent of that additional dollar do you pay in taxes? Marginal Federal Tax Rates Lower Income Limit on Taxable Income: MRT Single Married 10% 15% 25% 28% 33% 35% 0 $7,550 $30,650 $74,200 $154,800 $336,500 0 $15,100 $61,300 $123,700 $188,450 $336,500 Tax Terms, cont. • Average Tax Rate -- what percent of your income do you pay in taxes? Average Federal Tax Rates of U.S. Households, 2001 and 2004 Lowest 20% Second 20% Middle 20% Fourth 20% Highest 20% Top 1% 2001 2004 5.4 11.6 15.2 19.3 26.8 30.1 5.2 11.1 14.6 18.5 23.8 25.6 Upper income limit 2004 $18,486 $34,675 $55,230 $88,002 LL: $150,499 Sources for Previous Slides • Congressional Budget Office, Effective Federal Tax Rates under Current Law, 2001 to 2014 (Washington, D.C.: Congressional Budget Office, August 2004), table 2. • U.S. Census Bureau, Income: Historical Income Tables--Households, Table H-1: Income Limits for Each Fifth and Top 5 Percent of Households, All R aces, 1967 to 2006. Available at http://www.census.gov/hhes/www/income/histinc/h01 ar.html Tax Equity Terms Based on Average Tax Rates • Regressive -- Falling Average Tax Rate – Examples: OASI payroll tax – Sales taxes: As income rises, you spend less • Proportional -- Constant Average Tax Rate – Example: HI payroll tax, property tax • Progressive -- Rising Average Tax Rate – Example: Income Tax • All taxes considered, the US Tax system is progressive!!! What means-tested welfare programs are available for poor people in the U.S.? • Federal and State governments funded 85 welfare programs in FY 2002 at a total cost of $522 billion. – Federal Share: 71% – State and Local Share: 29% • The means-tested programs fall into 8 different categories. (Source for this and the next 2 slides : House Ways and Means Committee 2004 Green Book, http://www.gpoaccess.gov/wmprints/green/2004.html ) Understanding the EITC Eight Categories of Welfare Programs and Total Costs, 2002 – Medical Aid: $282 billion, 54% – Cash Aid: $102 billion, 20% – Food Aid: $39 billion, 7% – Housing Aid: $36 billion, 7% – Education Aid: $30 billion, 6% – Other Services: $22 billion, 5% – Jobs and Training Aid: $8 billion, 2% – Energy Aid: $2 billion, 0.3% 7 largest programs by amount spent • • • • • Medicaid ($258 billion) SSI ($39 billion) EITC ($28 billion) Food Stamps ($24 billion) TANF cash, ,services, child care, and work activities ($24 billion) • Section 8 low-income housing assistance ($18 billion) • Pell Grants ($11) Learn more about the EITC • Greenstein, “The Earned Income Tax Credit: Boosting Employment, Aiding the Working Poor,” http://www.cbpp.org/7-19-05eic.htm • Jason A. Levitis and Nicholas Johnson, “Together, State Minimum Wages and State Earned Income Tax Credits Make Work Pay,” http://www.cbpp.org/7-1206sfp.pdf • DeParle, Ch. 17: Money: Milwaukee, Summer 1999 Additional Sources • A. Nagle and N. Johnson, “A Hand Up: How State Income Tax Credits Help Working Families Escape Poverty In 2006,” Center for Budget and Policy Priorities, www.cbpp.org • S. Holt, “The Earned Income Tax Credit at Age 30: What We Know,” The Brookings Institution, February, 2006 http://www.brookings.edu/metro/pubs/20060209_Holt.pdf • Citizens for Tax Justice, “The Hidden Entitlements,” 1996 http://www.ctj.org/hid_ent/part-3/part3-3.htm • Ifie Okwuje and Nicholas Johnson, “A RISING NUMBER OF STATE EARNED INCOME TAX CREDITS ARE HELPING WORKING FAMILIES ESCAPE POVERTY,” Center for Budget and Policy Priorities, October 20, 2006 http://www.cbpp.org/1012-06sfp.pdf EITC Questions • • • • • • What is the EITC and how does it work? Who receives the EITC? How large are the credits? Which States supplement the credit? Why is the EITC politically popular? Will this popularity last?-- problems with the EITC What is the EITC and how does it work? • A tax reduction and wage supplement for low- and moderateincome families • Available to both single parent, two parent families, and childless low-income workers • Must work to be eligible • A refundable credit, which means that if the credit amount is larger than a family’s income tax bill, the family receives a refund check equal to the difference. • Usually claimed when the income tax return is filed. Can opt for equal monthly payments. Source: Tax Policy Center, Joint effort of the Urban Institute and Brookings Institution http://www.taxpolicycenter.org/TaxFacts/TFDB/Content/PDF/eitc_parameters.pd f •Source: Together,State Minimum Wages and State Earned Income Tax Credits Make Work Pay” Center for Budget and Policy Priorities, http://www.cbpp.org/7-12-06sfp.pdf Example • A single parent with two children working nearly full-time--52 weeks per year at 38 hours per week--at the minimum wage of $5.15 per hour has an annual income of about $10,712. After subtracting $819 in federal payroll taxes and adding the $4,285 federal EITC for which the family qualifies, the family’s cash income totals $14,178, or $2,064 below the 2006 poverty line for a family of three ($16,242). • Source: Nagle and Johnson, 2006. Who Receives the EITC? • 5.4 million poor families with able-bodied parents – 3.3 million or 66 percent had at least one parent in the labor force – Among poor families with children in which one or both parents worked anytime during the year, the parents worked at combined 44 weeks. – About 75 percent of the families on welfare (TANF, SSI, or GA) had a parent working in 2004 Who Receives the EITC? Source: Holt, 2006 Who Receives the EITC? Source: Holt, 2006 Who Receives the EITC? Source: Holt, 2006 How large are the credits? Source: Nagle and Johnson, 2006 Source: Levitis and Johnson, 2006 Which States supplement the federal credit? • Nineteen States (counting the District of Columbia as a State) supplement with Federal EITC. • A campaign is being waged to convince the remaining States to do likewise. Source: Okwuje and Johnson, 2006 Notes for previous table Source: Nagle and Johnson, 2006 Why is the EITC politically popular? • Encourages work – More people enter the labor force – Workers work more hours • Reduces welfare costs – Grogger concluded that the EITC “may be the single most important policy for explaining recent increases in work and earnings and declines in receipt of cash welfare assistance among female-headed families.” Source: Greenstein, 2005 Why is the EITC politically popular?, Cont. • Reduces poverty – By 4.4 million in 2003 – The poverty rate among children would be 1/4 higher without EITC – Lifts more children out of poverty than any other program Will this popularity last?-problems with the EITC • Fraud – Overpayments to eligibles – Fraudulent claims from ineligibles • Nonparticipation • Marriage penalty encourages cohabitation – A two earner, two-child couple making $35,000 (with a 60/40% earnings split) can save $3,923 a year in federal income taxes by avoiding marriage (EITC: $4,400 vs. $476). Will this popularity last?-problems with the EITC, cont. • High cumulative marginal tax rates – When earnings are in the phase-out range, the combined marginal tax rates for the may create a substantial work disincentive • Federal income taxes • Payroll tax • EITC phase-out 15% 7% 21% – Add a State income tax (3 to 6%) to this 43% marginal tax rate if relevant. – Add 24% phase-out rate for Food Stamps. – Cumulatively the marginal tax rate face by low-income Americans is in the range of 43- 73% !