BT Wholesale & Retail Consumer Service Review March 2012

advertisement

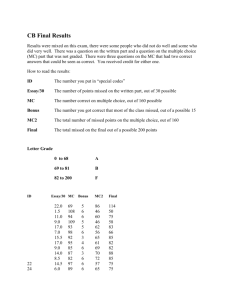

Customer Service Forum 3rd December 2012 Legal Notice The information contained in this document is confidential information as per your terms and conditions with British Telecommunications plc (“BT”). Please do not forward, republish or permit unauthorised access. BT has used its reasonable efforts to ensure that the content is accurate at the time of issue but it is subject to change. Details of any developments contained within this document are for information purposes only and do not constitute any contractual or other obligation. 1 Agenda 1. Introduction 2. Ethernet 3. Broadband – Trouble to Resolve 4. Broadband – Lead to Cash 5. High Level Escalations 6. Q&A 2 Ethernet 3 Executive Summary Progress continues on recovery actions • • • • National Fibre Planning and PST cross skilling continues; good progress on PNR backlog / dwell INS training required to enable “quick win” (CAT1 orders) improvement, although improving trend evident Resource re balancing with regions being reviewed with final resourcing decision due New Year Contingency staircase delivered additional 35 skilled resources w/e 18 November from wider field and planning teams Day 8/14 improvement continues week ending 18 November, although lag original recovery glide path • • • • • Original glide path targeted reduction to 10% by 4 November , 8% by 9 December D14 currently 12.3% failure, confidence high we will enter Dec c10% and reach 8% (BAU) by Christmas D8 currently 22.7% failure, expect to enter December c.15% and get below 10% by Christmas. Regional variances are still evident and are impacting recovery. Renewed focus with new regional senior operations managers to increase day 8 focus and ensure return to 90% success rate by end December. Delivery performance maintained with CDD at 96% Continued support from CP’s required around • • 4 Improved order quality to ensure work flows end to end in a fluid way incl full site and contact details Avoiding and/or forecasting known regional high order volumes Regional variation Heat Maps Day 8 Actual vs Regional Glide path Day 14 Actual vs Regional Glide path National result 77% National result 88% 81.7% achieved 88.8% achieved 76.2% achieved 92.6% achieved 82.7% achieved 63.8% achieved 96.4% achieved 84.0% achieved 66.2% achieved RAG status (snapshot 18/11) Red > 5% below regional glidepath target Amber < 5% below target & Green – at regional glidepath target or above 5 64.3% achieved 88.5% achieved 95.0% achieved 82.6% achieved 76.1% achieved RAG status (snapshot 81/11 Red > 5% below regional glidepath target Amber < 5% below target & Green – at regional glidepath target or above Ethernet - Provision Performance (Fibre) • OTD improving following lows in summer period • Movement of dates - manually tracking deemed consent with trial customers. Ofcom review 4th Dec • Percentage Calls Answered (PCA) remains strong PCA Performance 6 • Cycle times up since April - we are instigating a further jeopardy check at delivery date minus 10 days to ensure the order is still on track • If your order is business critical to meet CCD / brand damaging, this can be escalated to High Level Escalations (HLE). Ethernet - Provision Performance (Fibre) KCI3 Performance • OR KCI3 failure improving, 9.5% 4 week average • Openreach now moving planning design work around the UK, smoothing regional variations • More regular updates following Openreach reinstating their updates every 5 days post KCI3 KCI2 Performance 7 • OR KCI2 failure improving, 9.4% w/e 23/11 – lowest since June. Customer delays rising • Delays responding to emails - we are working hard to address this. • Aim to reply to all emails within 24 hours (Mon-Fri) and update KCI’s on the due day Ethernet - Repair Performance 100 98 96 94 92 90 88 86 84 82 On Time Repair Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 On Time Repair Tgt 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% PCA PCA 30 Calls Target PCA 30 Calls Actual 8 On Time Repair Act • OTR 8% up on April, last 5 months >95% • PCA holding above 80% following issues prior to August • Fault rate continues to fall, as self-serve fault reporting now at 86% (53% May) and use of diagnostic tool rises • Faults proved off BT Network still high at 70% Broadband - Repair 3 December 2012 9 Broadband T2R – contact handling performance Performance summary: • Challenging period for service due to the prolonged effects of the weather • Propensity to contact and contact volumes have significantly increased due to extended lead times on repair and missed appointments • Average handling time has grown in line with the need to contact Openreach as lead times have extended. 10 Enabler When RAG Maintaining key service levels (PCA) during busy period December & Q4 G Contact reduction by KBD fault type and additional guidance on certain outcomes, e.g. RAD24 (automated port flex) Through Q4 G BTW queue dwell management December & Q4 G Broadband T2R – on time repair and fault performance Performance Summary: • As a result of the weather, Openreach performance has resulted in an average repair time on the SFI product between 1-3 days but typically toward the higher end. • Increased volumes through July and August due to lightning storms also caused increased queue dwells due to increased levels of customer domain faults • We are working with Openreach who are increasing their engineering resource, to ensure as swift a recovery as possible. 11 Enabler When RAG 1k additional recruits trained and on the park in Openreach Q3 G Contact reduction by KBD fault type and additional guidance on certain outcomes, e.g. RAD24 (automated port flex) Through Q4 G BTW queue dwell management December & Q4 G Broadband T2R – improvement roadmap FY2013/14 FY2012/13 Q4 Q3 Q2 Q1 Contact reduction (including supplier quality of notes) Incremental Fault Reduction Incident Management overhaul Programmes to evolve into FY13/14 roadmap Slow speed and throughput fault improvement KBD Accuracy Uplift & Enhancements Transformational Dwell management KBD Overhaul – development and trial Self-Serve - pilot Business Zone – improved online journeys 12 Full new deployment Self-Serve – capability development Phase one capabilities exposed Business Zone deployment / enhancement Broadband - Provision 3 December 2012 13 Broadband Provision – on time delivery and cycle times Cycle Time 25.00 On Time Delivery 100% 99% 98% 97% 96% 95% 94% 93% 92% 91% 20.00 15.00 10.00 5.00 0.00 CT 20c Actual CT 21c Actual Performance summary: • • • Cycle times increased through the summer and autumn months as Provision lead times were extended by our suppliers as a result of the bad weather experienced across the country and MBORC. Particularly affected were Sim provides due to extended lead times on WLR3 and FFTC because a managed install is required On time delivery to the Customer promised date has been impacted primarily by increased tail volumes ; the tail has begun to close out in recent weeks as the work stack has reduced. November has seen performance stabilise ; lead times have started to recover and on time delivery was moving up until last weeks severe weather hit. 14 OTD 20c Actual CT Fibre Actual OTD 21c Actual OTD Fibre Actual Enabler When RAG Openreach lead time reduction Through Q4 G BTW jeopardy management December &Q4 G Openreach Planning review Through Q4 G FTTC – Missed Appointments Volume of Customer Missed Appointments Volume of Supplier Missed Appointments 800 700 600 Total Missed 350 300 100 250 Total Supplier 200 Missed Total 150 Customer Missed 100 Total 50 Missed 0 0 500 400 300 200 Performance summary: • Supplier missed appointment volumes have increased primarily due to the impact of bad weather. • Customer missed appointments shows a recent increasing trend. • Openreach introduced a Copper pair quality test in October and this has resulted in more delayed provisions. The customers equipment was installed but the copper pair required faulting and this delayed completion. 15 565 No Access 5480 Customer Readiness Total Customer Missed Enabler When RAG Openreach recovery plan Now- early December G Review and revise FTTC tentative appointment process December & early Q4 G Missed Appts prioritisation December & early Q4 G Lead to Cash – improvement programmes for Broadband FY2013/14 FY2012/13 Q4 Q3 Q1 Q2 Incremental FTTC process review Cancellations reduction programme ELFs Programmes to evolve into FY13/14 roadmap Proactive Jeopardy Management Transformational Sim provide process review KCI // quality initiatives Customer Self Serve 16 Business Zone deployment / enhancement High Level Escalations 17 High Level Escalations Incoming volumes – change in mix Top 5 Drivers for HLE 100 Provision Delays 80 60 Total Missed Appointments 40 20 4/13/2012 4/27/2012 5/11/2012 5/25/2012 6/8/2012 6/22/2012 7/6/2012 7/20/2012 8/3/2012 8/17/2012 8/31/2012 9/14/2012 9/28/2012 10/12/2012 10/26/2012 11/9/2012 0 Ethernet Root Cause Analysis Governance Weekly analysis and feedback to BAU on Trends & Exceptions End-to-end Complex Case Reviews with our suppliers Escalations of policy requirements to Director forums 18 Drop in Connection Issues Slow Speed Failed installations Over half of our volumes are provision delay related (planning & missed appointments). Our incoming HLE volumes have increased – the mix has changed – we are now getting more Ethernet provision cases that have a longer cycle time Our response times have been impacted by a number of factors, especially Openreach DSO response times. We are working closely with Openreach and their glide path for improvement is over the next few days We have also recruited additional gatekeeping resources for support. KCI – flexed as per needs of case Glide path for reducing HLE Volumes 500 450 Escalations Sprint 400 Ethernet & Jeopardy Mgt. 350 300 HLE Accepted 250 Target Process improvements 200 Forecast 150 100 Openreach Recovery 50 0 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Key areas being addressed in Q3: • HLE team training – structured HLE training programme in Q2; product knowledge interventions in Q3 • Pan-product processes – focus on improving end-to-end processes when something fails on an Ethernet order (with BTO and Openreach) • REIN improvement Programme - trial to identify REIN in first visit in place; further improvement workshops taking place now • Missed Appointments – review taking place with suppliers to address (focus on multiple missed appointments) • Systems - a number of key tactical system changes and training interventions to aid BAU escalation being delivered now 19 A reminder of our criteria and escalation paths Operational BAU Teams (CSP) Operational BAU Escalations (CSP) High Level Customer Resolution Team In order to ensure that we are able to prioritise and provide the best level of service to real issues and escalations, we will be gatekeeping the cases that arrive in our in box Please help us by sending us only those cases where you believe the criteria are being met 20 Our Criteria – raise it with us when: • There’s a Blue light issue (loss of emergency services) • There’s a Clinical Risk (impacting public health) • There are severe financial implications, reputation or brand damage • When the available products (e.g. Expedite) have been used • The BAU escalation path has been exhausted Contact via pro forma on btwholesale.com or Email btw.hle@bt.com Please send us all the details (circuits, addresses, contact names and numbers) up-front so that we do not lose any time. Please quote our HLE reference number (once issued) in the subject line at all times