Business Cycle

advertisement

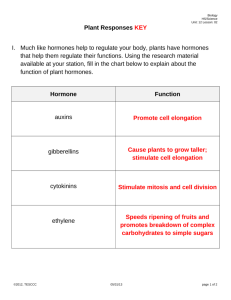

Business Cycle Changes in Business Activity © 2012, TESCCC Economics Unit 7, Lesson 2 Learning Targets 1. Describe phases of business cycle 2. Identify and explain the factors that cause business cycles 3. Analyze how economists use business cycle theory to predict what is going to happen 4. Analyze how the government uses predictions to make public policy © 2012, TESCCC Business Cycle Theory A free market economy does not grow at a constant rate. It goes through a series of expansions and contractions. These fluctuations are called business cycles. Business cycles are a pattern to the general level of economic activity or the level of production of goods and services (GDP). Since this is a pattern it keeps repeating itself.You can see the business cycle activity from 1914 to 1992 below in the graph. © 2012, TESCCC Business Cycle Theory Four Phases of business cycle are: –Expansion –Peak –Contraction-recession –Trough © 2012, TESCCC Contraction or Recession For a contraction to be a true recession, you must see 2 consecutive quarters or six months of declining real GDP. © 2012, TESCCC Business Cycle Theory Peak Stages Expansion Trough Recession Expansion Phase 1. 2. 3. 4. 5. 6. 7. © 2012, TESCCC GDP Durable goods Factory order Raw materials orders Unemployment Consumer confidence problem -inflation Contraction or Recession 1. Demand 2. GDP 3. Durable goods 4. Factory orders 5. Unemployment 6.Consumer confidence 7. problem- unemployment. © 2012, TESCCC Causes • There are several things that may lead to fluctuations in the economy. Some are within the economy and we call them internal factors. Some are outside the economy and we call them external factors. © 2012, TESCCC Internal factors (within the economic system) 1. Business Investment In an expanding economy firms invest in new capital goods. This investment spending creates new jobs and growth. If firms decide to halt investment, this slows the economy down and can cause unemployment. © 2012, TESCCC 2. Interest Rates and Credit When interest rates go up, consumers will not make big ticket purchases. Lower demand slows down economy. When interest rates go down we see more purchases being made – causing growth. © 2012, TESCCC 3. Consumer Expectations Fears of the economy slowing down can cause consumers to stop spending. This will then actually slow down the economy. If consumers feel confident about the economy, they spend more. Spending more can cause growth. © 2012, TESCCC External factors (outside the economic system) External Shocks These are factors outside the economic system, but they can cause fluctuations in business activities. Examples include: wars natural disasters foreign economies 9/11 © 2012, TESCCC