Breaking the Cycle of SSDI and/or SSI Benefits

advertisement

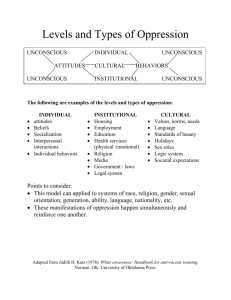

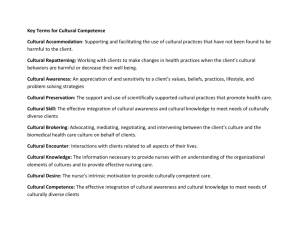

Breaking the Cycle of SSDI and SSI Benefits Molly Sullivan Griffin-Hammis Associates 1 The Facts Approximately 14.2 million people under 65 receiving SSDI and/or SSI 7.9 million SSDI only 4.6 million SSI only 1.6 million both Less than ½ of 1% of those receiving benefits earn so much the benefits stop Why are people choosing not to work? Combination of several factors, must explore the barrier(s) for each person 2 Contributing Factors Benefits Barrier Must demonstrate you can’t work to be found eligible Work rules confusing, letters from agency scary, some work rules not supportive to working How to address: provide encouragement that it’s possible and refer to the Work Incentive Planning and Assistance Program for expert advice to cut through unfounded fears http://ftw.sd-ccd.org/media/ftwsdccdorg/WIPAbrochure01072009.pdf 3 Contributing Factors Transportation Barrier Rural communities have limited transportation options Some people can drive but can’t afford a vehicle Some people can’t drive How to address: No simple/single solution – explore all possibilities (i.e., SSA Plan to Achieve Self-Support to purchase a car, carpooling, SSA IRWE to offset cost of paying someone) 4 Contributing Factors Accommodation Barrier Disabilities can pose a barrier to accessing a physical building (or parts of it) Disabilities can pose a barrier to completing some or all the job duties for a given job How to address: Physical barriers: brainstorm as a team, Job Accommodation Network (JAN) (www.askjan.org) Job duty barriers: use customized employment strategies (DOL/ODEP (fact sheets and videos): http://www.dol.gov/odep/topics/CustomizedEmployment.htm) 5 Contributing Factors Behavioral Economics - unconscious beliefs and behaviors (we all experience!) Unconscious beliefs we have about money and work affect our decisions about work (i.e. no employer will hire me, it’s easier to not work and just live with what I’ve got—no net gain possible) Unconscious behaviors about money (behavior economics) affect our decisions about work How to address: talk about beliefs and unconscious behaviors about money during career planning (new concept) 6 How Relevant Is This Concept to Breaking the Cycle of Poverty? Example: Budgets If beliefs and unconscious behaviors are the basis of financial decisions—that means bringing them to light is essential to breaking the cycle of poverty 7 Behavior and Money Traditional economic theory viewed people as: Rational in their thoughts and actions about money Able to weigh the costs and benefits of items and situations and choose the best financial option Not influenced by other people’s behaviors, their own experiences or belief Sounds more like a robot than a person! 8 Behavioral Economics A different way of thinking: Behavioral Economics Merging of psychology and economics as related to human judgment, decision-making, and behavior Views people a different way: People’s choices are made because of other people, their experiences and their emotions Beliefs influence our behaviors People are irrational, but in predictable ways 9 Case Study: Joan Joan is 20 years old, lives with dad who gets SSDI and doesn’t work, receives $721 of SSI and is transitioning out of high school Joan wants to work, but only 10 hours a week Why would that be? 10 Behavioral Economics Concept #1: Representation People impose patterns where they do not exist based on stereotypes drawn from experiences with a few members of a group Joan’s dad hasn’t been able to work because of his disability, as a result Joan believes she can’t work because of her disability Joan’s friend at school went to work and ended up with a huge overpayment and got in trouble with their parents, as a result she thinks she should only work a small amount 11 Behavioral Economics Concept #2: Loss Aversion The level of unhappiness that people feel about something being taken away is higher than the happiness when it is first received. They are more likely to go out of their way to prevent loss than to achieve a gain Joan has been offered a job making $1,300/month. She and her dad found out her SSI would be reduced to $113.50 so they decided work wasn’t a good idea (even though her total income will be $1,413.50). 12 Behavioral Economics Concepts #3: Status Quo Bias People have a hard time overcoming the inertia of doing something the same way. They will keep going on autopilot rather than make a change (even one that they know is better for them). Joan has her routine of volunteering at the church daycare after school each day. When asking whether she’d want a paying job at a different day care she said no she is happy where she is. 13 Behavioral Economics Concept #4: Complexity Too many or too much of any product or service impedes a person’s ability to sort through choices rationally. Joan and her dad were given the details on how her SSI check would change when working ($20 GIE, $65 EIE, one-half disregard, potential IRWEs or PASS). They decided work wasn’t a good idea because it would mess up her benefits. 14 How to Use Behavior Economics in Breaking the Cycle Step 1: Recognize behaviors don’t change in a day Be careful of your expectations Introduce possibilities Help bring unconscious behaviors into the light Provide alternatives Be prepared to revisit this barrier throughout the employment process 15 How to Use Behavior Economics in Breaking the Cycle Step 2: Get the focus on the motivating factor money Ask about money goals: Go over handout “What would you do with a little more money?” Draft rough budget –a ballpark Use the Living Wage Calculator: http://livingwage.mit.edu/states/46/locations Identify Top Financial Concerns and goals 16 Joan’s Budget Not Working ($721 SSI only) Working 35 hr/week at a daycare ($220 SSI + $920 = $1,140) Room/Board $600 $700 Cell Phone $40 $40 Misc./Fun/Transpor tation $81 $200 Saving for Goal(s) $0 $200 $721 $1,140 17 Takes a Team Step 3: Referrals – You aren’t a financial planning expert. Be prepared to refer the person for financial education, services, supports Education: Identify local financial education classes and/or refer to Money Smart: http://www.fdic.gov/consumers/consumer/moneysmart/adult.html Budgeting support: Identify personal or local support (i.e. Center for Independent Living) Credit/Debt Management: Identify local services Asset Development: Learn about Individual Development Accounts, Family Self-Sufficiency Programs, EITC, other local tools 18 10-Minute Overview Step 4: Explain how our unconscious behaviors can work against us –take a few minutes to explain beliefs and behaviors about money affect our ability to reach our goals Go over the handout “Thinking About Money and Behavior”—Remember, Knowledge is POWER! Be careful not to impose your beliefs about money on the person – respect where they are and their beliefs 19 Final Thoughts We all come to this moment with our own life experiences (do not judge) Those experiences shape our beliefs and conscious behaviors Be prepared to address the usual barriers (benefits, transportation, accommodations, etc.) Also be prepared to address unconscious beliefs and behaviors that may be keeping a person in the cycle of poverty Help identify the money motivation “What would you do with a little extra money” Provide appropriate referrals Help bring those limiting unconscious beliefs and behaviors to light 20