Money Lives: Improving financial capability using behavioural

advertisement

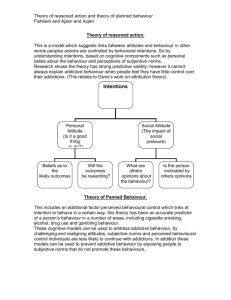

1 Money Lives Improving financial capability using behavioural science and ethnography Refining the definition of ‘financial capability’ 2 This research intended to help the Money Advice Service understand how context, environment, culture, seasonal changes and aspirations influence and change peoples’ financial capability and behaviour. Rational model Behavioural model Specifically, we were aiming to: 1. Understand financial behaviours 2. Refine the definition of financial capability 3. Develop interventions targeting gaps in capability Why ethnographic research? 3 Ethnography is the description of specific human cultures and is the foundation of anthropological knowledge. •The key difference between ethnography and other qualitative approaches is its emphasis on observation. • Analysis yields patterns of actual behaviour rather than reported behaviour •Ethnographic studies are characterized by immersion into the lives of subjects, from hours to weeks to years at a time. Longitudinal research with 72 households 4 • 48 families took part in the study • Each family was visited 4 times in 9 months. • Half of these families were filmed, half were not. • Each visit lasted between 3-6 hours, amounting to over 1100 hours of interviewing and observation • Included England, Wales, Scotland and Northern Ireland Longitudinal research with 48 participants 5 Number of Families Socio-economic Class Age Technological usage Financial vulnerability 12 45-64 Upper Middle class Very confident Least financially vulnerable 10 Older group (more retirees) Non-working Not confident Financially comfortable 8 25-44 Lower Middle class Confident Financially 8 Slightly older Working class 8 Young Working class 6 Young Skilled Working class Not very confident Relatively confident Somewhat confident 33 interviews in England 9 interviews in Scotland 5 interviews in Wales 5 interviews in Northern Ireland Risk averse Vulnerable and not in control of finances Not worried about finances What factors make up financial capability? 6 Making Ends Meet Keeping Track Planning Ahead Financial Capability: Beyond Skills & Knowledge 7 Skills The emotional, cognitive and/or behavioural skills and capacity to engage in the necessary thought processes for financial management. Knowledge The level of knowledge and awareness needed to find, understand and evaluate information in order to make financial decisions. Attitudes Motivation Opportunity An expression of the underlying beliefs that may influence behavioural intention and may also be influenced by social norms. The brain processes that direct behaviour, including automatic (unconscious) and reflective (conscious and considered) mechanisms. Factors that lie outside of an individual that may influence their financial behaviour. It includes both social opportunity (i.e. the networks they have) and physical opportunities (e.g. the area they live in or technology they have access to). What were we looking for? 8 Capability Motivation Opportunity Behaviour Fishbein et al. “Factors influencing behaviour and behaviour change” (Handbook of Health Psychology, 2001) Determinants of Behaviour 9 Susan Michie et (2011) The Behaviour Change Wheel Implementation Science Anatomy of Motivation 10 Reflective System • Controlled Automatic System • Uncontrolled • Effortful • Effortless • Rule-based • Associative • Slow • Fast • Conscious • Unconscious • Rational • Affective Anatomy of Automatic Motivation 11 12 Framework coded for financial capability outcomes Behavioural Determinants Conditions Ability Psychological defined as the individual’s psychological and physical capacity to engage in the activity concerned Physical Mechanisms Level of knowledge, awareness, appropriate (emotional, cognitive and/or behavioural) skills and capacity to engage in the necessary thought processes such as comprehension, reasoning etc Making ends meet What to look for Enabler This is about ability to perform - do they find it difficult or not? Using tools to aid budgeting - online or using a spreadsheet/ book Self- efficacy is also important do they believe they can't do things? Earmarking money for different outgoings mentally or physically separating them into piles Are they being Physical skill limited by their development which is the body because focus of training they are disabled in some way? Barrier Not aware that tools are available or not knowing how much they have at any given time. No experience or confidence in being able to create own budget Relates mostly to the old and infirm - do they have difficulty online or getting to banks in a rural location. 13 Framework coded for financial capability outcomes Behavioural Determinants Conditions Opportunity Social defined as all the factors, social and physical, that lie outside the individual that make the behaviour possible or prompt it Physical Mechanisms Afforded by the cultural milieu that dictates the way that people think, including the set of shared values and practices that characterize institutions and groups Making ends meet What to look for Awareness being raised by people they know - this is about receiving information NOT action Enabler Someone telling them about ways of budgeting or tools available Barrier Groups of friends / peers that encourage you to spend beyond your means - on going out, buying gadgets they can't afford High levels of choice The infrastructure or and competition in local Lack of choice over technology available area. Are people where to buy products for people, which can Level of access to 'living off the land' - e.g. guarantee services or products Buying / selling things Transport costs to sustainability of the that they find, growing shops/ banks target behaviours food, etc. 14 Behavioural Determinants Conditions Mechanisms Evaluation – usually based on information provision and incentives Reflective -usually targeted in interventions Goal setting - including abstract longMotivation based on cognitive term goals and short-term goals defined as all those brain processes behavioural therapy or that energize and direct behaviour, public policies that which includes reflective and include information automatic mechanisms provision and economic Planning - specifying where, when, incentives and how to execute an action What to look for WHY? - weighing up the pros and cons of something WHAT? - thinking about the outcome you want to achieve HOW? - creating an action plan to achieve an outcome 15 Behavioural Determinants Conditions Mechanisms What to look for Messenger - we are heavily This is about their decision to listen to or influenced by who communicates ignore something purely because of who information to us has said it. Incentives - our responses to incentives are shaped by predictable In the moment decisions based on mental shortcuts such as strongly perceptions of getting a 'good deal' avoiding losses, hyperbolic discounting, and mental accounting Norms - we are strongly influenced by Desire to be like those around you what others do Defaults are the options that are preDefaults - we ‘go with the flow’ of preselected if an individual does not make set options Motivation an active choice defined as all those brain processes Automatic People are more that energize and direct behaviour, predominantly influenced likely to register stimuli that are novel which includes reflective and by the context - we do Salience - our attention is drawn to (messages in flashing lights), accessible what is novel automatic mechanisms not think about these (items on sale next to checkouts) and simple (a snappy slogan). Priming - our acts are often influenced Sounds, sights and smells that draw us in by sub-conscious cues or repel us. People can respond emotional to words, Affect - our emotional associations images and events and their mood can can powerfully shape our actions impact decision making Commitments - we seek to be If you say you will do something you are consistent with our public promises, more likely to do it. and reciprocate acts We tend to behave in a way that supports Ego - we act in ways that make us feel the impression of a positive and better about ourselves consistent self-image. Keeping Track 16 Analysis: --> 'Observations' (interview responses plus observational notes by the team) --> 'Themes' (thematic analysis) --> 'Framework' (COMB) --> 'Barriers' (stats) Observation: "AOMMF51: Never keeps track and doesn't remember all the things that she spends money on - though says that she remembers" Keeping Track 17 Making Ends Meet Keeping Track Knowing how much money you have available at any one time. Planning Ahead What did we find? 18 Keeping Track http://vimeo.com/85435718 What were the key barriers? 19 High confidence use of mental accounting Abilities Organisational skills Financial illiteracy Keeping Track Sense of control Default behaviour Motivations Checking can have a negative emotional impact Social Norms Email Reminders Opportunity No access to Internet banking No access to smartphone banking apps What were the key barriers? 20 (Frequency = 23) Ability p = .144 (Frequency = 15) Psychological Ability Mental Accounting Financial literacy p = .047 (Frequency = 8) Physical Ability Lack basic literacy and numeracy skills Mobility issues Opportunity (Frequency = 9) Physical Opportunity Social Opportunity Default behaviour Motivation (Frequency = 18) Automatic Reflective Checking can have a negative emotional impact Social Norms What were the key enablers? 21 (Frequency = 28) Ability (Frequency = 25) Psychological Ability Organisational skills Technological skills p = .093 Physical Ability Opportunity (Frequency = 15) Physical Opportunity Social Opportunity Default behaviour Motivation (Frequency = 28) (Frequency = 22) Automatic Reflective Social Norms Sense of control Checking: what do I have? 22 An intervention designed to increase participants’ knowledge and awareness of their balances. • Participants were defeated by complexity of monitoring finances. • Finding opportunity • Planning and memorizing information • Retaining the information until next time. • Reliant on mental accounting errors • Those who did monitor had great organizational skills • Used habit formation theory • Given a planning sheet & credit-card sized record card • Linked this process this to a pleasant activity. 4. Checking: The Intervention 23 Those who did not complete the task: • felt have enough of a buffer in accounts • felt negative emotional impact Those who completed the task: • made them more aware of their position • better able to live within their means by no longer ending the month in overdraft • accessed new checking services such as online banking or banking apps A credit card sized piece of paper to fit into a wallet / purse Making Ends Meet 24 Making Ends Meet Keeping Track Planning Ahead Living within your means and not running out of money or exceeding your income. What did we find? 25 Making Ends Meet http://vimeo.com/85435717 What were the key barriers? 26 Unaware of budgeting techniques and tools Not keeping track Share offers Abilities Making Ends Meet Emotional hit Anchoring Motivations Social Rank Social Norms Opportunity Use friends and families Share offers Ego Seasonal impacts – work and events What were the key barriers? 27 (Frequency = 27) Ability (Frequency = 15) Psychological Ability Mental Accounting Financial literacy Physical Ability Lack basic literacy and numeracy skills Opportunity (Frequency = 25) Mobility issues Physical Opportunity Social Opportunity Affect p = .000 Motivation (Frequency = 64) (Frequency = 55) Automatic p = .000 Reflective Ego Social Norms Social Rank What were the key enablers? 28 (Frequency = 28) Ability (Frequency = 21) Psychological Ability Numeracy skills Physical Ability Opportunity (Frequency = 35) Physical Opportunity (Frequency = 26) Social Opportunity Share offers with friends p = .002 Default behaviour Motivation (Frequency = 57) (Frequency = 22) Automatic p = .508 Reflective Social Norms Checking: what do I have? 29 An intervention designed to increase participants’ knowledge and awareness of their balances. • Participants overweight social rank • Seek to increase social rank by spending • Receive emotional gratification • Reinforces spending behaviour • Permit ego and affective mechanisms • Substitute the associated costs • Participants give blank card sleeve • Wrote down things to avoid buying on side • Wrote down substitutes for those things on the other side. Substitution – what could I have instead? 30 An intervention to encourage participants to curb areas of expenditure they found difficult to control by substituting them with similar, but less costly, purchases. Substitution: The Intervention 31 Most used the tool and took pleasure in recording their progress Encouraged participants to take control of their expenditure: • begun to transfer the principles to other areas of spending • feeling of empowerment and in control of their money Depended on suitability of the alternative chosen and timeframe substituted • chosen alternative must give equivalent instant gratification A personalised sleeve that folds around debit/credit card Planning Ahead 32 Making Ends Meet Keeping Track Planning Ahead Thinking about the future and putting appropriate plans in place to help you realise your goals or cover the costs of future events. What did we find? 33 Planning ahead http://vimeo.com/85435716 What were the key barriers? 34 Making goals without plans Abilities Do not understanding financial products such as pensions Financial knowledge Temporal Discounting Risk averse Planning Ahead Account ‘buffers’ Investments in children Optimistic about the future Motivations Opportunity Sporadic employment Reliance on parents Use of friends within financial services Tangible future What were the key barriers? 35 (Frequency = 18) Ability (Frequency = 13) Psychological Ability Mental Accounting Financial literacy Physical Ability Opportunity Physical Opportunity (Frequency = 15) Social Opportunity (Frequency = 10) Financial network p = .000 Motivation (Frequency = 43) Incentives Temporal Discounting Automatic p = .170 Goal-setting Reflective Evaluative What were the key enablers? 36 (Frequency = 29) Ability (Frequency = 21) Psychological Ability Numeracy skills Physical Ability Physical Opportunity Opportunity (Frequency = 19) p = .000 Motivation (Frequency = 68) (Frequency = 26) Social Opportunity (Frequency = 20) Automatic p = .001 Share offers with friends Default behaviour Social Norms Goal-setting (Frequency = 48) Reflective Evaluative (Frequency = 18) Checking: what do I have? 37 An intervention designed to increase participants’ knowledge and awareness of their balances. • Motivational factors (automatic and reflective) were greatest barriers • Reflective motivation were the greatest enablers • Participants asked to set a financial goal • Participants given a planner sheet to monitor financial goals. • Asked to monitor on weekly basis • Intervention promoted goal-setting and planning mechanisms • Affective mechanisms encouraged participants – picture to represent their goal. • Picture was linked to goal • The budgeting tool was visually salient Planning - what’s my potential to save? 38 An intervention designed to encourage participants to work towards a financial goal with the help of a budgeting tool Planning: The Intervention 39 A spreadsheet that enables people to plan their expenditure and save Empowered them and given them a sense of control over their finances Understood benefits of aggregating spending in different areas Became very conscious of spending Visual features and use of colour was appealing More effective for working towards a savings goal (as easier to visualise) rather paying off debt Reframing - how should I think about my money? 40 An intervention aimed at encouraging participants to think about their incomings over different periods of time in order to prompt richer levels of evaluation and planning around spending, debt and saving. Reframing: The Intervention 41 Participants who relied solely on benefits seemed to take the most from the exercise Prompted discussions about the possibilities of returning to work Made them feel more in control of finances The longer-term figures were much higher than expected and this encouraged thinking how small weekly savings could add up A poster to go on the fridge 3. Methodology for developing behavioural interventions 42 1. Identify desired outcome e.g. budgeting or savings 2. Identify the important features leading to different levels of financial capability e.g. skills, knowledge, opportunity, attitude and motivation 3. Use behavioural framework as a checklist tool to evaluate potential interventions 4. Develop hierarchy of intervention combinations to be tested in specific context 5. Testing to identify effectiveness of intervention 6. Adjust design of intervention for specific population group if required 7. Implement intervention and monitor behaviour change effects 43 44 Thank you! ivo.vlaev@wbs.ac.uk antony.elliott@fairbanking.org.uk katrina.leary@ipsos.com ella.fryer-smith@ipsos.com oliver.sweet@ipsos.com suzanne.hall@ipsos.com