UMOE Schat Harding Key figures

advertisement

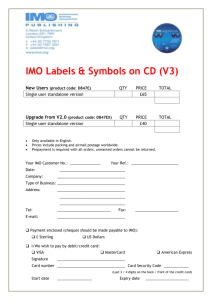

Information package – August 2006 Schat-Harding The world’s largest manufacturer of maritime life saving systems/lifeboats, davits and winches • • • Dates back to 1928, when Schat Davits patented the first skates to launch a lifeboat from a listing ship. Since then developed to be the worlds largest manufacturer of maritime life saving systems/lifeboats, davits and winches Unique installed base – • • More than 10,000 ships and oil rigs relay on Schat-Harding for emergency evacuation This family of trusted brands has made Schat-Harding the first supplier to offer fully integrated packages of lifeboats, davits, hooks, winches, cruise tenders, and rescue boats, backed up by global service and after-sales Hundred of years of accumulated experience in maritime safety schat-harding 30.8.01 pkt. 1 Page 1 Schat-Harding Geograpic presence America: 2 agents Asia: 22 agents Europe: 15 agents S. KOREA Norway Canada USA Germany United Kingdom Czech Republic The Netherlands SPAIN S-H OFFICES: JAPAN Osaka China GREECE PORTUGAL MEXICO GIBRALTA R SERVICE PARTNERS: Singapore UAE / BAHRAIN INDIA AUSTRALIA Perth Active 40 employees 372 employees 96 employees Melbourne Sydney Schat-Harding Company structure Production Americas Asia Pacific After Sales & Service Rosendal Rosendal UK UK Netherlands Netherlands Germany Germany US US US Qingdao Singapore Singapore Ølve Europe Sales& Marketing Slany Schat-Harding Organizational Chart Schat-Harding Legal Chart Umoe Schat-Harding AS Norway 100% 100% 100% 100% Umoe Schat-Harding BV Netherlands Umoe Schat-Harding Boatbuilding Qingdao Co Ltd China Umoe Schat-Harding FE Singapore Umoe Schat-Harding GmbH Germany Umoe Schat-Harding Inc. US 100% Umoe Schat-Harding LTD UK 100% Umoe Schat-Harding s.r.o Ccech Republic Schat-Harding Product range Schat-Harding has one of the most extensive product ranges in the industry, and is currently in process of developing new products and services that will provide further revenue growth opportunities for Schat-Harding Schat-Harding Market segments Cruise World leader. Delivers complete systems, including Cruise Tenders and Partially Enclosed Lifeboats (PELB) Approximate market share*: Life boats: +50% Davits: +40% Merchant Offers totally enclosed lifeboats and davits, conventional lifeboat systems and freefall lifeboats Approximate market share*: 67% *Source: Schat-Harding estimates Offshore Totally enclosed lifeboats and davits for platforms, as well as freefall and conventional systems Approximate market share*: 25% After Sales Global leader in the high- margin AS & S market Estimated 3x larger revenues than no. 2 in the market USH has the largest and most extensive service network within its product niche Schat-Harding Market drivers Cruise D R I V E R S Merchant Offshore After Sales •Newbuilding activity •Sailing fleet/offshore units in production •Demolition rate. High rate increases the newbuilding activity •The world economy •Economic development in America •Increased time for vacation •Focus on safety in the industry •Freight markets •Oil price •New safety and environmental regulations •Ageing fleet •Oil price •USD level •Demand for rigs •New investments •New safety and environmental regulations •Sailing vessels with USH equip. •New safety and environmental regulations •Ageing fleet •Freight markets •Oil price •Change of flag Schat-Harding Extensive product and services range for the important after market Products installed on more than 10,000 oil rigs and vessels should give strong after sales customer base for this business Solas/IMO regulations • New regulation in IMO* to prevent accidents with LSA systems – New Amendments to Sola’s Chapt. III Adopted in MSC.78 for training, servicing and maintenance of LSA – All inspections (ex. Weekly and monthly inspections), servicing and repairs should be conducted by the OEM*’s representative, or a person appropriately trained and certified by the OEM for the work to be done – Compulsory annual and five-yearly inspections, servicing and testing will require trained and authorised personnel by the OEM – Entered into force 1st July 2006 New Solas/IMO regulations will increase demand strongly for OEM’s products and services *IMO: International Maritime Organisation. OEM: Original Equipment Manufacture Schat-Harding Profit & Loss* NOK 1000 Total operating income Raw materials and consumable used Other operating costs EBITDA Write down of bad debt Depreciation & amortisation Operating profit Financial income Financial expense Profit/loss before tax Tax Net profit/loss for the period 2004 2005 Per 1Q06 Per 2Q06 430 727 319 774 97 180 13 773 2 000 11 336 437 9 021 4 966 4 493 2 226 2 266 391 540 254 304 100 660 36 576 7 880 28 696 7 114 11 437 24 373 -4 231 28 604 116 659 72 892 25 758 18 009 1 987 16 021 1 336 942 16 415 3 103 13 313 236 153 147 553 51 282 37 317 4 013 33 304 3 409 4 060 32 653 10 363 22 290 *Consolidated, unaudited Umoe Schat-Harding Group figures. 2004 and 2005 figures are based on audited accounts for the respective Schat-Harding companies. Schat-Harding Balance Sheet* Balance sheet (NOK 1000) 2004 2005 Per 1Q06 Per 2Q06 16 731 48 453 1 348 66 532 15 617 53 060 1 140 69 817 14 381 48 473 1 030 63 884 12 838 47 913 1 027 61 778 Inventories Other debitors Total debitors Bank deposits/cash Total current assets 128 876 71 597 200 473 31 028 231 500 125 341 146 200 271 541 31 854 303 395 101 475 108 475 209 950 27 464 237 413 136 495 123 206 259 701 27 177 286 878 Total assets 298 033 373 212 301 297 348 656 47 782 46 803 94 585 51 150 80 653 131 803 47 777 91 706 139 483 47 778 100 693 148 471 Provisions Other long-terms liabilities Long term liabilities Current liabilities Total liabilities 16 114 52 738 68 852 134 596 203 448 12 573 70 584 83 157 158 251 241 409 12 459 44 314 56 773 105 040 161 814 12 419 55 188 67 607 132 578 200 185 Total equity and liabilities 298 033 373 212 301 297 348 656 Intangible assets Tangible assets Financial assets Total fixed assets Share capital Retained earnings Total equity Comments Schat-Harding balance sheet – will be refinanced after completion of acquisition, and debt to Umoe Industrier repaid (NOK 39 million) Schat-Harding has no undrawn committed or uncommitted credit facilities from any financial institutions Bank guaranties of approximately NOK 63.5 million outstanding as per 30.06.06 *Consolidated, unaudited Umoe Schat-Harding Group figures. 2004 and 2005 figures are based on audited accounts for the respective Schat-Harding companies. Schat-Harding Strong order backlog (excluding options*) 600 NOK Mill 500 400 300 200 100 0 1Q 05 2Q 05 3Q 05 4Q 05 1Q 06 2Q 06 3Q 06 *Options related to existing orders sums up to approximately 14 million euro. Contracts will become effective if end customers exercises its options with the yards. www.schat-harding.com Address: Head Office: Seimsfoss 5450, Rosendal, Norway. Org. number:Umoe Schat-Harding AS: 937989202: