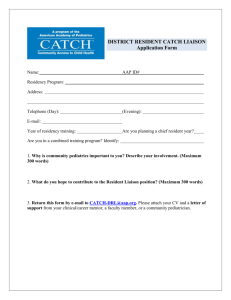

Application to MIL

advertisement